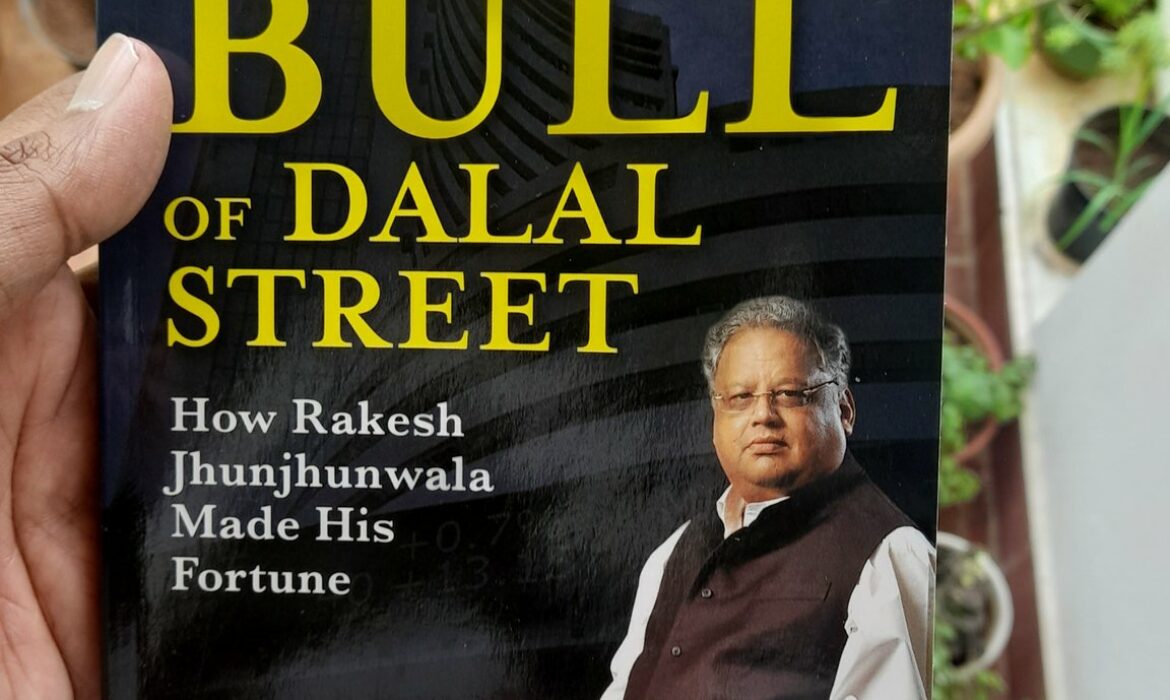

The Big Bull of Dalal Street, co-authored by Neil, Aditya & Aprajita, is an enjoyable read. More so for die-hard fans of Mr. Rakesh Jhunjhunwala, aka RJ. It took me 3 hours straight to cover about 80% of the book. And another hour the next day to cover the remaining. So, if you find reading books a daunting task, it is always good to start with a book like this. Easy to read. Simple words. Only 150 pages. And an interesting account of a larger-than-life figure.

On the cover page of the book, the famous investor, Shankar Sharma, aptly describes the aura and personality of RJ.

They don’t make investors like Rakesh anymore. He was special. A rare combination of chutzpah, skill, and luck.

Shankar Sharma

I think I can not write anything better to describe the Big Bull.

Now coming to the review. As the book’s authors have spent a lot of time and effort, I will try not to reveal much directly from the book. I would rather want you to read the book and find it yourself.

However, here are the top 10 learnings I picked up from the book which I believe most investors (both seasoned and newcomers) will probably agree upon.

- Independent thinking: In the early 1990s, Madhu Dandavate, then finance minister in the V.P. Singh government presented the Union budget. The consensus view before the budget was extremely bearish. RJ had a completely opposite view. And in one day he turned his net worth from 2 Cr to 20 Cr. Of course, there is a heavy dose of leverage, risk & luck in this. But as investors, the lesson we should take home is that of courage and conviction. As a rule, I would not recommend leveraging and taking high risks. But backing your conviction is a necessary condition to grow as an investor.

- Role of Luck: Fans of RJ, often forget to give luck its due. RJ, according to the book, came close to going bankrupt on his short trades during the fag end of the Harshad Mehta bull run. But the market collapse helped him immensely. While retail investors lost their years of savings in the crash, RJ made a killing. However, just as the stroke of luck was in his favour in 1992, for the next 7 years, (1992-1990), it tested his patience. Most of us do not have the tenacity to bear long stretches of underperformance or no activity in the market or in life in general. That is what separates the winners from the rest.

- Being out of a rally and watching it from the sidelines is fine: During the Y2K mania, RJ neither made money in tech stocks nor did he lose when the bubble burst. He, just like Waren Buffett, had a simple rule for internet stocks. If he didn’t know how much money they will make in the future and how to value them, he would stay away. Most of us, do not possess this uncanny ability to stay out of something when so many others are doing it. We have this tendency of throwing independent thinking out of the window when it matters the most and give into the temptation of social proof.

- Apna Time Ayega but can you wait for it: One common trait in all long-term investors who made big in the stock market is their bullishness. Cynicism raises eyeballs, but optimism makes money. Just as Buffett was always positive about the potential of the USA, RJ was always optimistic about the future prospects of India. During the worst of times in 2002-03, when almost all the stocks were trading cheap in India, RJ had the vision to believe that Apna Time Ayyega (India will do well in the future and the whole world will notice.). And he also had the patience and conviction to bet big and wait for a long time to witness that.

- Titan- The best investing ideas take birth during tough times: RJ bought his first 5 lacs shares of Titan in 2001 when a broker was offering him a price of 32 against the prevailing market price of 34. RJ didn’t know anything about Titan at that time. The extreme pessimism in the market was enough for him to find value in it. Interestingly, he soon raised his stake and ended up owning 12.5 lac shares despite a stern warning from his friend that Morgan Stanley was expected to sell 90 lac shares of Titan. Only when the price went up to 43-44, RJ met the management of Titan. Often we wait for more clarity while investing but miss the fact that good prices and good news often do not come together for an investor.

- Due Diligence: The often ignored part of investing, especially during the roaring bull markets, is due diligence. While investing with limited or incomplete information is a necessity. Investing without due diligence is a cardinal sin. RJ paid a heavy price for the same in the DHFL fiasco. Here’s our tweet on the same.

- Don’t care about being wrong or right. Care about making money: One of RJ’s employees narrates this beautifully: “For example, if he was playing with INR 10,000 crore, and he lost 200-300 Cr, he wouldn’t care about his outlook on the stock. He would first sell and think about the next move later.” The incident was narrated while keeping his trading rules in mind, investors can also learn a great deal from it. We keep holding on to our losers and book profit early on our winners while we are supposed to do the opposite.

- Pyramiding, the art of stock trading: This particular trick is for the traders and not the investors. Even though I don’t trade, I found it extremely insightful as to how traders should look at their bets. A good trader, according to RJ, should have his highest position outstanding at the highest price. If you can’t bet on your stocks at higher prices, you are not going to make money in trading. I believe a part of it is even true for investing. If you are not comfortable buying or owning stocks at prices far higher than your original purchase price, the odds are high that you won’t be able to make substantial wealth in investing.

- Roughly right is better than precisely wrong: Precision hardly rewards you in trading and investing. You need to broadly recognize the trend correctly and then bet when the odds are in your favour. But if you keep looking for precision in your decisions in the market, you are going to miss the big picture. Whether you are a trader or an investor, this is an important style one shall always strive to follow.

- Lower Expectations: The book talks about an incident where Rj explains the process of a retail investor buying insurance. RJ tells that an agent comes to you, and sells you a dream where you give INR 5000 every month and after many years you get a lumpsum amount back. If you do the math, the returns on those investments are less than FD. But we never look at equity investments that way. Here, we all want to be a millionaire in a one-night stand. Nobody has the patience to wait for 15 or 20 years in equities before it really starts showing you the real magic of compounding. All everyone is looking for is a hot tip that can help you double the money in six months. Ironically, the same guy has the patience to wait for 20 years when it is an insurance product. Lowering expectations and taking the long-term view is always our best bet to earn from equities, but we invariably do the reverse. Almost always.

Now that I have covered the top 10 learnings from the book, here’s a bonus one that I saved for the last. And this is about how RJ summed up his life with 6 major challenges about a decade ago.

- Health: Authors have written extensively on RJ’s bad habits and poor health in the last chapter. And I believe RJ grappled with it right till his last breath.

- Spending time with family: He improved a lot on this challenge over the last few years. However, someone who has lived in the market for so long can only change so much.

- Institutionalizing Rare Enterprise: For the first 15-20 years, Rare Enterprise meant only RJ but later on he worked on delegating the decision-making responsibilities to his team. That ensured that Rare Enterprises is living despite RJ being no more. RJ always dreamt of a perpetual life for Rare Enterprises.

- Taking breaks from work: RJ planned for taking a break one weekend a month, one week a quarter, and one month a year to travel around the world. The book remains silent if the dream was fulfilled or not. However, my sense is that he might have made some progress here but it wasn’t fulfilled.

- Kindness: RJ was extremely happy with what he received from life. So he wished to be kind to others and not belittle anyone. I suppose he did really well on this front.

- Charity: RJ believed in not considering himself as the owner of his wealth but as a trustee. And of all the 6 challenges, probably this is one challenge he actually managed to overcome substantially if not completely.

Chapter 14: Risk Management in Trading was my most-favourite chapter from the book. Even though I have no knowledge of or inclination toward trading, I learned a lot. Of the ten learnings I shared above, 4 were from this chapter only.

While being an RJ fan, I enjoyed reading the book and have already mentioned what I liked about the book, I would also want to mention what I missed in the book.

I was hoping for some long discussions between RJ and Mr. Utpal Sheth on a few businesses and sectors and how they both debated and finally arrived at the decision of buying or rejecting a few stocks. That would have been a treasure trove for ardent RJ fans and students of investing in India. Maybe I am asking a lot. 🙂

But that aside, the book is an enjoyable read for all. And I hope this blog motivates you to get a copy and read it soon.

I would like to dedicate this blog to Mr. Rakesh Jhunjhunwala for inspiring millions of investors in India to explore investing in the market. And let’s end with my favourite quote from RJ:

There are no Kings in the market. The market is the King.

Rakesh Jhunjhunwala

Thank you for reading.

Happy Investing 😊

P.S.: I am Ankit Kanodia, co-founder & partner of Smart Sync Services, a SEBI-registered investment advisory firm. We also have a stock market learning platform, MissioN SMILE. To know more about MissioN SMILE, you may download our MissioN SMILE app on your Android phone. (iOS App coming soon ). Lots of free & premium sessions on investing for you to explore and learn. Subscribe to our free weekly newsletter here.🙂