Kaushal works in a private firm and earns a decent salary. A week back he received an email from his employer asking him to declare his tax savings in the company’s finance portal.

This being a regular yearly ritual, Kaushal was well aware of it. However, he was left surprised on logging in the finance portal, as he could not declare his investments in PPF. Neither could he claim the deductions for his housing rent. The options were disabled!

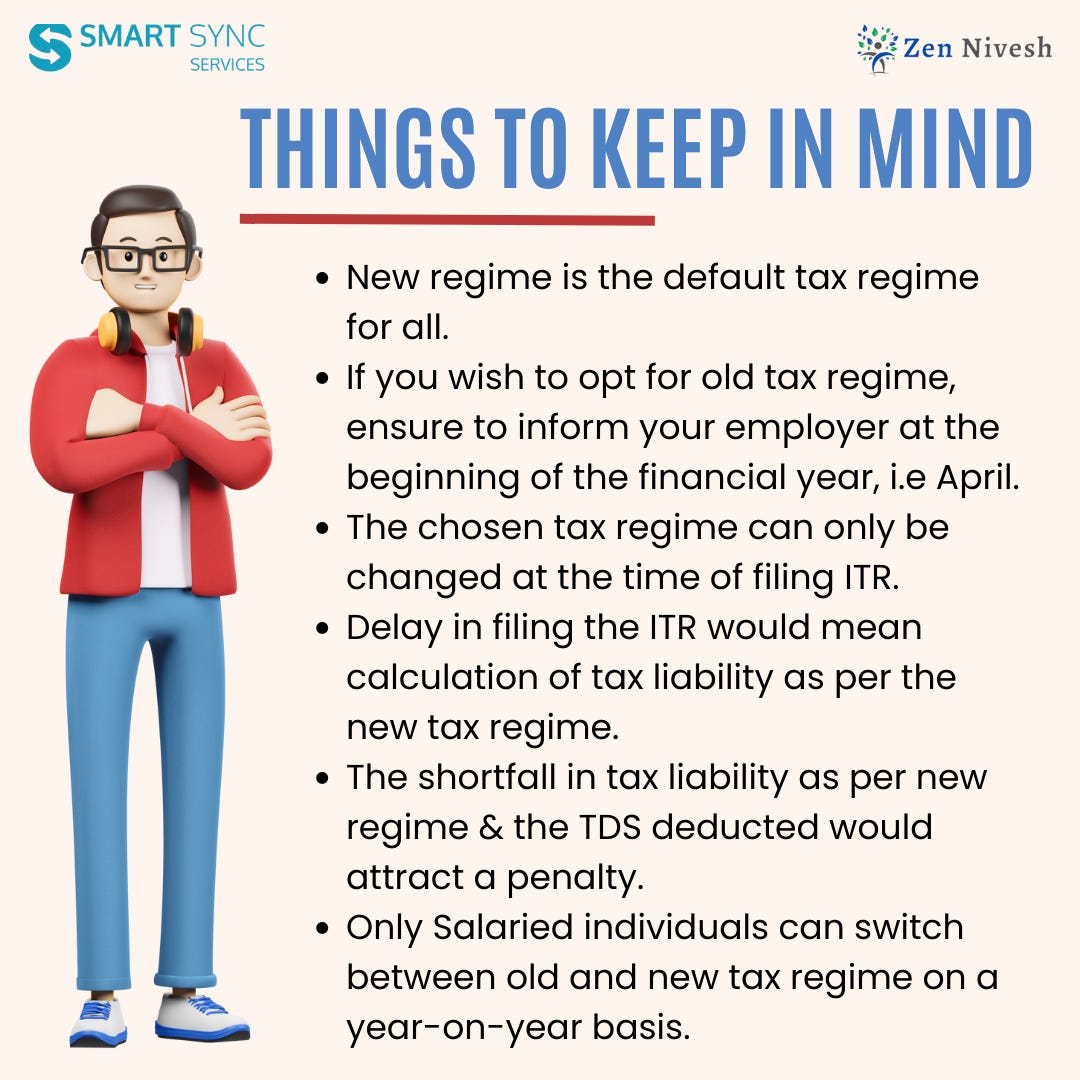

Well, this can happen with many of us. As per Budget 2022, which is applicable for FY 23-24 the default tax regime for all is the new tax regime. For the uninitiated the new tax regime allows a limited number of tax saving deductions & exemptions. Unless you don’t tell your employer your choice of the tax regime, the employer will deduct the TDS (Tax deducted at source) as per the new tax regime. So, in the case of Kaushal his company portal had by default calculated his tax liability based on the new tax regime. He soon found out that there was an option to choose the old tax regime in the portal. By doing this, he could declare his tax saving investments popularly known as 80C deductions. He could also claim HRA (Housing Rent Allowance) & LTA (Leave Travel Allowance) deductions.

What if Kaushal decides to not declare his regime now and decide at the year’s end? Yes, a few have been doing that. Those who don’t plan their tax saving investments at the beginning of the financial year, often find it convenient to choose the tax regime at the time of filing the ITR. They calculate the amount they could invest in tax saving instruments over the year. Then, they choose that regime which yields a lower tax liability & file the ITR.

Well, we at Zen Nivesh strictly don’t advise the above approach. First of all, tax saving is never the purpose of investment, it’s a byproduct. Secondly, one must always plan investments at the beginning of the year, rather at the end. This builds a savings habit & automatically helps keep your expenses in check.

Also, if you need some help on which tax regime to choose, just click on the image and it will take you to our guide:

Now let’s get back to the topic. If Kaushal does not inform the choice of tax regime now, the employer will deduct TDS as per the new tax regime. This clarity is important for the employer as they have to finalise the payrolls of all the employees. Once a particular regime is selected by an employee it cannot be changed. Imagine the hassle for the organisation, if the tax regime is changed in the year. Now let’s suppose that Kaushal has selected new tax regime. He will receive the salary from him employer after deduction of tax liability accordingly. If Kaushal wishes to change the regime he can only, do it at the time of filing the Income tax return (ITR) for the year. While filing ITR, he can claim the 80C & 80D deductions by selecting the old tax regime. However, there is a catch. He cannot claim LTA deduction as employer has not considered them. LTA deduction can only be claimed through the employer. This is one reason why it’s important to declare your choice of regime at the start.

Let’s take another scenario. Suppose, Kaushal informs his choice of old tax regime to the employer at the beginning of the financial year. However, he fails to file the ITR on time. In that case, his tax liability will be automatically calculated according to the new tax regime. If the TDS deducted by the employer over the year (as per the old tax regime declared by Kaushal) is less than the tax liability as per new tax regime, then the difference will be charged a penalty. The penalty is actually the interest charged on the unpaid tax.

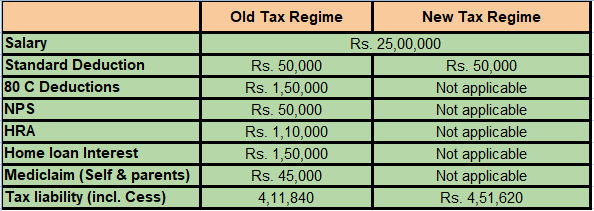

Let us consider this scenario with an example as given in below table.

If Kaushal earns a salary of 25 Lakh per year and avails deduction for 80C, NPS, health insurance premiums & home loan interest then the tax liability is roughly Rs. 40,000 lesser in old regime than that in the new regime.

But, a delay in filing the ITR would mean a tax liability of about 4.5 Lakh with an additional penalty on the Rs. 40,000.

Dear reader, the tax regime you choose will directly impact your take-home monthly salary. So, it is prudent that you choose the same wisely. Moreover, the regime you choose will be applicable for that particular financial year & can only be changed at the time of filing ITR, for that financial year. Moreover, individual taxpayers without any business income can switch between regimes at the beginning of the financial year. However, those with business income need to be careful. As per current provisions, the tax payers who derive income from their business or profession & have selected the new tax regime, can never switch back to the old regime.

So, as we said earlier, organisations are already in the process of finalising payrolls for their employees. Many have already rolled out the necessary formalities to ask for the choice of regime from their employees. If your organisation hasn’t it’s time you initiate the discussion. Do note, the deadline to inform your employer about the choice of regime is April 30th.

To conclude:

Hope you have found this post useful, but we are sure you are still unsure which regime suits you. We will let you into a secret. But if you have not subscribed here, please do subscribe to get updated as we release it!

We are in the process of rolling out a Tax Calculation Tool, specifically for you to calculate your tax liability. You can input your exact details such as salary, deductions, rent etc & find out which regime would be beneficial for you. Stay tuned for it!

If you like our content, then please do like and share with your friends and family. The idea is to help as many people as possible. Thanks.