About the Company

Zydus Wellness is an Ahmedabad based company that manufactures and sells a big range of health and wellness products all across India. They have a number of recognizable brands like Everyuth, Sugar free, Nutralite and Actilife. They have three manufacturing facilities in Gujarat and two in Sikkim.

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company’s net sales grew by 11.8% to INR 7,099 million during the quarter on — year on-year basis, of which 4% is volume-led.

- For the financial year 2023, the company achieved a growth of 12.8% year-on-year on net sales.

- The gross margin for quarter 4 stood at 50.6% on net sales.

- Total income from operations grew by 11.4% to INR 7,130 million.

- EBITDA grew by 2.2% year-on-year to INR1,446 million.

- The company continued to witness high inflation in alternative fuel and labour costs as a result of which other expenses grew by 36%.

- Reported net profit was up by 9.0% year-on-year at INR1,453 million. Adjusting for exceptional items, the net profit was up by 14.4% year-on-year to INR1,525 million.

- Annual consolidated financial highlights

Total income from operations increased by 12.8% year-on-year to INR22,426 million during the year.

EBITDA was down by 2.2% year-on-year to INR3,372 million.

EBITDA margin as a percentage to total income from operations stood at 15.0%.

Reported net profit was up by 0.5% to INR3,104 million.

Adjusting for exceptional items, the net profit was up by 3.7%.

Consolidated cash position stood at INR 1,081 million, including investments made in the liquid funds.

Consolidated capex for the year was INR 489 million.

- The Glucose powder category has grown by 10.7% at the MAT level.

- The Health Food Drink category has degrown by 1.1 percent at MAT level.

- Complan market share stood at 4.5% in the category as per the MAT March 2023 report Nielsen.

- The peel off category has registered a growth of 4.5% at MAT level.

- The Prickly heat powder category has grown by 13.4% at MAT level.

- The absolute quantum of one-off expenses during the quarter was almost half of the increase in expenses.

Investor Conference Call Highlights

- The management stated that the company has successfully increased prices and stabilized inflation for most imports, leading to improved gross margins in the fourth quarter compared to the previous year.

- The management stated that the decision to temporarily outsource the manufacturing of Glucon-D to third parties added to the overall expense burden.

- The management expressed confidence that the changes made to the manufacturing footprint, along with ongoing cost optimization initiatives, would lead to expense reductions in the upcoming quarters.

- The management stated that during the quarter, the company focused on marketing initiatives to drive category growth and expand market share for its brands. Specifically, for Glucon-D, the brand’s strong momentum throughout the financial year was maintained through consistent marketing efforts aimed at driving growth and attracting new consumers.

- Glucon-D brand continues to maintain its number one position with a market share of 60.1% as per MAT March 2023 report of Nielsen, which is an increase of 159 basis points over the same period last year.

- The management stated that Complan, within the health food drinks category, experienced a slowdown in line with the overall trend during the financial year.

- The management stated that Sugar Free continues to maintain its leadership with a market share of 96% as per MAT March ’23 report of IQVIA.

- The face scrub category has registered a growth of 9.1% at MAT level. Everyuth Scrub continues to maintain its leadership position with market share of 41.9% in the facial scrub category which is an increase of 68 basis points over the same period last year as per MAT March 2023 report of Nielsen.

- Everyuth peel off has maintained its number one position with a market share of 78.4% in the peel off, which is an increase of 7 basis points over the same period last year as per the MAT March 2023 report of Nielsen.

- The management informed that Nycil has maintained its number one position with market share of 35.4% in the Prickly heat powder category, which is an increase of 157 basis points over the same period last year as per the MAT March 2023 report of Nielsen.

- The management stated that Nutralite brand has delivered a robust growth for the financial year gone by, backed by well-planned digital and on-ground activations.

- The international business of the company operates in about 25 countries, with the top 5 countries contributing more than 75% of the business. The brands Sugar-free and Complan account for about 75-80% of the international business. Supply issues in New Zealand and local economic issues in Nigeria affected growth in the past, but the management expects continued good growth momentum.

- The management believes that sugar substitutes like stevia, sucralose, or aspartame offer lower calorie content than sugar, and they will work with regulators to ensure the best for consumers.

- The management stated that new products launched in recent years constitute about 3.5% of the company’s sales.

- The management stated that Everyuth has been experiencing consistent double-digit growth, primarily driven by strong performance in segments such as scrubs and peel-off masks. The brand has expanded into tan removal and other skin benefits, with potential for strong double-digit growth in the future.

- The company implemented price hikes of around 6.5% in the last quarter, which helped cover the gross margin decline compared to the previous year. However, further price increases may be necessary to reach previous margin levels due to inflationary pressures.

- The management stated the increase in receivables was mainly due to year-end credit passed on to distributors and customers. The increase in inventory was a result of stock accumulation at the Uttarakhand factory, pending legal approval, and strategic backup for manufacturing.

- The management stated that there is ongoing legal action regarding the Sugarlite brand rights, and the company expects the issue to be resolved as they progress through the higher court.

- The company has already recovered the 200 basis points lost in FY ’22. They expect a mix of cost reductions, including material price improvements and price increases, to contribute to gross margin recovery.

- The management stated that the increase in other expenditure, specifically related to third-party manufacturing of Glucon-D, was driven by seasonal demand and the shutdown of the Sitarganj plant. The company tied up additional quantities to have a backup plan.

- The company aims to maintain ad and sales promotion spend in the range of 12.5% to 13% of sales.

- The management informed that the supply chain issues in New Zealand and the economic unrest in Nigeria had limited impact on the Complan business.

- The company faced some inclement weather in March and April, impacting their summer product portfolio.

- The management stated that rural consumers are showing a preference for lower-priced packs, including lower SKU packs. There is traction towards higher access packs, which are lower-priced packs.

Analyst’s View

Zydus Wellness operates as an integrated consumer Company with business encompassing the entire value chain in the development, production, marketing and distribution of health and wellness products. The product portfolio of the Company includes brands like Sugar free, Everyuth and Nutralite. The company had net sales growth of 11.8% YoY in Q4 FY2023, with 4% volume-led. It achieved a growth of 12.8% YoY on net sales for the financial year 2023. Complan will be the most challenged product segment in terms of reaching previous gross margin levels.

The volume growth in the current quarter showed a positive trend, reaching approximately 4%. The demand environment has seen a slight improvement, giving the management confidence in the potential for further volume growth. However, due to factors such as weather fluctuations and other variables, it is challenging to provide precise predictions for future growth. During discussions, feedback was received regarding the absence of certain variants, specifically apricot and coffee, in the Everyuth brand. The management acknowledged this feedback and expressed a willingness to consider and expand the product portfolio to address customer preferences. To enhance control and efficiency, the company has successfully achieved 100% digitization of its field force. This digitization effort allows for targeted selling, improved SKU management, and better overall control. Furthermore, ongoing digitization initiatives in operations planning aim to optimize inventory planning and drive operational efficiency throughout the company.

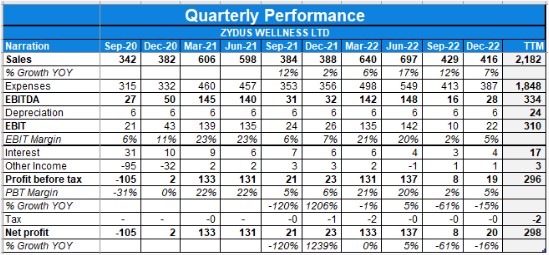

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- Net sales growth of 7.3% on a consolidated basis during Q3.

- Gross margins up by 60 basis points sequentially.

- Volume growth at a YTD level is 13.3%, with a 6%+ volume growth and market shares at a five-year high.

- Net debt as of December 2022 is 250 Crores.

- Total income from operations grew by 7.1% to Rs.4156 million.

- EBITDA degrew by 12.7% year-on-year basis to Rs.282 million.

- PBT before exceptional items degrew by 15.0% year-on-year to Rs.193 million.

- Reported net profit was down by 16.1% year-on-year to Rs.186 million.

- Net debt as of December 2022 is 250 Crores

Investor Conference Call Highlights

- The management stated that the inflation has moderated across key imports except that of milk, which remained at an elevated level even during the flush season. To mitigate the impact of inflation the company has already taken appropriate price increases, which will fully get reflected in Q4 of this financial year.

- Price increases have absorbed most of the RM inflation while management believes the Long-term EBITDA margin target of plus 20%, 21%, or 22% will take at least a couple of years to achieve due to steep inflation.

- The gross margins for non-milk-based products go up over 200 basis points sequentially while there is a drop in gross margins of Complan due to milk inflation.

- Price increases have absorbed most of the RM inflation.

- The management stated that other expenses grew by 17.4%, which was largely due to increase in cost of fuel like coal and husk, and also the statutory revision in the wage rate in the Northeastern belt where some of their manufacturing facilities are located and increase in manufacturing activities and preparation for the season.

- On the Glucon-D front Q3 being a nonseasonal quarter for Glucon-D has limited contribution to the business.

- On the Complan front the health food drinks category continued to witness slowdown and has degrown in low single digits at MAT level.

- The management informed that Sugar Free Green continues to build on digital platforms with special campaigns during the T20 World Cup while Sugarlite looks to expand aggressively in its world space markets with TV plus multimedia approach of print both outdoor and digital.

- Sugar Free Green and Sugarlite contribute 13% of the total sweeteners portfolio.

- On the personal care front, Everyuth brand continued consistent performance delivering a double-digit growth on a three-year CAGR basis and building market share which was supported by TV and digital campaigns across its core portfolio of face scrub and body lotions range

- The management stated that Nutralite DoodhShakti Probiotic Butter Spread was supported with digital and print media to drive awareness.

- The management expects that better mix coupled with appropriate price increases will help them to mitigate the inflationary impact on business.

- The investment in Glucon-D has not seen substantial lift as the company expected and therefore Glucon-D numbers are muted and lower.

- The company’s international business this year especially in last couple of quarters has been impacted especially on Complan because of supply issues in New Zealand in particular and demonetization in Nigeria, which is their largest market.

- The management plans that, in the nine months, the 270 or 300 basis point loss in gross margin will be recouped with price increase.

- The management stated that the increase in other expenses is led by the wage revision at their plant in the Northern Eastern belt and also there are husk and other fuel cost increases in one of the facilities in Uttar Pradesh.

- The management states that inflation is extremely steep which affects not just the cost structures but also the demand and therefore even the operating leverage also becomes that much harder.

- The management stated that on a market cap to sales basis this is probably the lowest level that our stock is trading and since demand is also subdued and the margins are also under pressure and valuations also are on the lower side resultantly.

- The management states that they have seen a growth internally for the quarter on Complan while Nielsen continues to report negative growth for the category.

- The management thinks that the biggest challenge for them to deal with is that the category of Nielsen has been degrowing and the only source of growth for the category has been low unit price tax which they under participate given the profit pools being lower in that part of the market.

- The management stated that they have a B2B business on two fronts. One is food service which caters to the food operators. Sugar Free also participates in this business both from backend kitchen usage as well as for some of the café’s and QSRs buying the sachets around it.

- The company plans to remain B2C on Everyuth.

- The management stated there are two parts of digital. One is the digital communication brand building which is across multiple platforms like search, videos, etc., YouTube, programmatic work that they do as well as the fulfillment which is the sales part of e-commerce where they have a dedicated team who work very closely with some of these accounts.

Analyst’s View

Zydus Wellness has been steadily growing all its six brands with new launches, investing behind brands through effective communication & enhancing distribution network. The company has strong market share in some of the smaller subcategories and being the leader, ZWL would be driving the category growth. It remains to be seen how the company will tackle current inflationary environment coupled with slowdown in its categories. Nonetheless, given its strong market positioning & competitive advantages, it remains an interesting FMCG stock to keep track off.

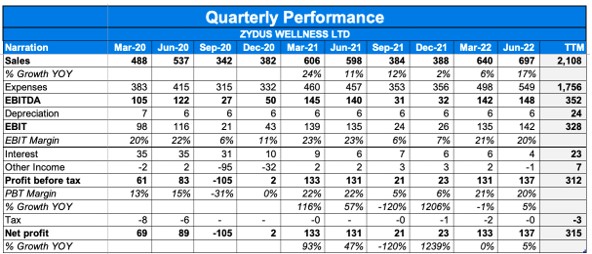

Q2 2023 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 70 | 56 | 24.51% | 66 | 7.02% | 232 | 181 | 28.25% |

| PBT | 14 | -2 | 808.42% | 8 | 80.00% | 5 | -188 | 102.77% |

| PAT | 15 | -2 | 831.68% | 8 | 85.91% | 13 | -182 | 106.97% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 431 | 387 | 11.32% | 699 | -38.34% | 2,020 | 1,876 | 7.67% |

| PBT | 8 | 21 | -60.95% | 137 | -93.98% | 306 | 112 | 172.72% |

| PAT | 8 | 21 | -60.55% | 137 | -93.82% | 309 | 119 | 160.14% |

Detailed Results:

- The company’s revenue grew by 11% YoY and profits fall by 60% YoY on the consolidated basis.

- The QoQ numbers are poor, revenue and profits falling by 38% and 94% respectively on the consolidated basis.

- Volume growth of 5% in Q2

- EBITDA degrew by 46.8% year-on-year to INR 163 million

- Glucon-D has maintained its number one position with a value market share of 60.0% in the glucose powder category at a MAT September level, which is an increase of 157 basis points over the same period last year

- The Sugar Free brand continues to maintain its leadership with a market share of 95% as per MAT September ’22 report of IQVIA.

- 25% of our annual sales comes from rural

Investor Conference Call Highlights

- Industry highlights consumer sentiments have gradually started to improve in urban areas, however, higher input costs have continued to impact the industry.

-

- Moreover, pick-up in rural demand has been slower than urban areas, which has resulted in down-trading.

- Rural demand which contributes 25% of the total net sales has been a subdued.

- The management expect revival in consumer demand on completion of normal monsoon and increased government spending. They also expect good demand led by festive season in the coming quarters. The company expects to improve margin on a sequential basis, the impact of which will be partially seen in the coming quarter with full impact being captured in the quarter 4 of the financial year.

- The management has seen some level of volatility and the increase in milk prices remains unabated and has hurt the gross margin of dairy-related products, which is what’s reflected in the company’s numbers as well.

- The management stated some key inputs continued to remain high and have worsened the impact due to weakening INR and negatively impacted gross margins.

- The company’s expenses has risen, which was largely driven by increase in the cost of fuel hike like coal and husk and also the statutory revision in wage rate in Northeastern belt where some of our manufacturing facilities are located.

- The company continued our investments on advertising and marketing

- Complan front, the management stated the health food drinks category continued to witness slowdown and similar trend was reflected for Complan as well. The category has been showing degrowth for last three quarters at an overall level as reported by Nielsen. However, with the company’s interventions in terms of sachets and pouches launched in key markets and some in the pipeline, which will help it participate in a larger buyer of HFD market.

- The management stated green shoots are already visible in terms of increasing market share of Complan, specifically in some channels like Modern Trade, E-commerce. Brand market share stood at 4.6% in HFD category as per MAT September 2022 report of Nielsen.

- On the sweeteners front, the management stated Sugar Free brand continued to face headwinds of higher base and registered a flattish growth during the second quarter; its direct distribution has doubled during the quarter on a sequential basis.

- The company’s new initiatives over the last three years on Sugar Free Green and Sugarlite contribute to now 14% of the sweeteners business, thus making zydus more future-ready.

- On the personal care front,

- . Everyuth brand registered another quarter with a double digit growth. The brand was supported by TV and digital campaigns across its sub-segments like face wash, scrubs and peel-offs.

- Everyuth Scrub continues to maintain its leadership position with market share of 41.8% in the facial scrub category, which is an increase of 269 basis points over the same period last year.

- Everyuth peel-off has maintained its number one position with a market share of 75.7% in the peel-off category.

- Everyuth brand is at a number five position with a market share of 6.5% at overall facial cleansing segment. This covers face wash, face scrub and peel-off, all the facial cleansing segments. We are taking the benefit of prolonged monsoon in some parts of the country.

- Nycil brand registered a strong double-digit sales growth supported by TV campaigns. Nycil has maintained its number one position with a market share of 35% in prickly heat powder category, which is an increase of 47 basis points over the same period last year.

- On the dairy and spreads category front,

- . The management stated Nutralite continued to build momentum in overall business and delivered a double-digit growth in quarter gone by.

- Nutralite DoodhShakti dairy portfolio, which includes butter, spreads and ghee has delivered a good performance backed by increased distribution drive, festival-specific digital activations and online recipe videos endorsed by celebrity Shilpa Shetty.

- The management stated top end of the market, both in direct distribution, even the organized state which typically ends up selling larger packs, have done better than sub stockist, super-stockist business, which caters to largely the lower pops strata in rural. And that confirms with the fact that there is being a muted offtakes across the board, which is what you were also saying. So clearly, the company sees a better offtake from the more affluent, more upper segments.

- The management stated largely, growth thesis is based on what we already have in the market. The innovation and renovation is the key and they will keep doing that.

- The company has target of increasing the outlets by 60%. The management stated there is a steady plan of taking it up and one new innovation or model which the company want to test, which will help the company expand our coverage without taking a relevant increase in cost to serve.

- The management stated key roles with new outlets will be, the growth, driving growth of NPDs, which otherwise do not go through the indirect channel.

- The sachets of Complan, which used to be about 12% to 15%, now occupy 27% of the whole category.

- The management stated that Nutralite will be amongst the top four, five brands and will be sizable enough.

- Directly, indirectly, a large portfolio has a currency impact. Majorly the sweeteners, it has oils, flavors, fragrances. So there’s a wide range of products which get impacted at overall level. Sweeteners in particular is direct.

- The company has already initiated price increases more than 2% across portfolio to maintain gross margins. The gross margin contraction was largely from milk portfolio. Milk is majorly used in the Complan and Nutralite DoodhShakti.

- The management stated the milk is the largest in RM and palm oil will be about third or fourth of total RM for the company.

- Average realization per gram on HFD market is actually declining on the industry level.

- face wash may have grown decently, but peel-off and scrub has grown faster and that’s why growth for the entire personal care is higher of double-digit.

- The company has faced about 8% inflation in RM basket. Sequential basis, it is about 3.5%. About 200 basis points has happened because of COGS.

- The management stated by fourth quarter, they should certainly be able to fully catch up on margin front.

Analyst’s View

Zydus Wellness has long been a consistent wealth creator and have been at the forefront of the health and wellness industry in India for a long time. In their current product categories, they already have a significant standing in India and are also trying to expand their resident portfolio to overseas markets. Now with the acquisition of Heinz India, they have acquired a number of sector leading brands in other categories than their own, thus significantly expanding their product portfolio. This also signals the great ambition the firm and its management possess, and their willingness to take bold steps to go further ahead on their mission path. It remains to be seen whether the benefits from the acquisition will be as good as promised, but there is a high chance of a good integration given that both operate in different categories, thus reducing chances of market share cannibalization. All in all, Zydus Wellness looks like a good investment option given their soon to be expanded portfolio, especially to those investors seeking to invest in the theme of increasing consumption and in the health and well ness industry.

Q1 2023 Updates

Financial Results & Highlights

Detailed Results:

- The company had a good quarter with a 17% consolidated revenue growth YoY and a PAT rise of 5%.

- The Market shares for the company’s brands as on June 2022 were:

- Glucon-D – 60.4%

- Complan – 4.8%

- Sugar Free – 95.5%

- Nycil – 34.2%

- Everyuth (Facial Cleansing) – 6.6%

- Everyuth (Scrub) – 41.8%

- Everyuth (Peel-off) – 76%

- With the good onset of summer, Nycil brand witnessed a strong comeback and registered a double-digit growth.

- Glucon-D witnessed double-digit growth led by revival in the market demand, which was absent during last two consecutive summers due to the pandemic.

- Plan to enhance distribution infra to 3Mn+ reach and 1 Mn direct coverage over the next three years.

- E-commerce continued good growth, contributing to 6.5% of the sales.

- The company faced double digit inflation in most of its raw materials during the quarter.

Conference Call Highlights:

- Inflation on palm oil and packing materials eased out during the first quarter.

- The gross margin has improved 352 QoQ bps due to price increases, cost improvement measures and product mix. On YoY basis it fell by 70 bps due to inflation.

- The company has ceased the operations of the Sitarganj plant to have leaner operations which are closer to consumers. The company has accounted Rs.29 million one-off expenditures for the same.

- This quarter, the company saw products crossing 2.5 million stores with equal split between urban and rural.

- The company’s largest brand, Glucon-D crossed 60% market share for the first time in several years at an MAT level as reported by Nielson.

- Glucon-D market demand was supported by strong media coverage with Pankaj Tripathi as the endorser to drive daily relevance for energy drinks synergized with consumer activisions.

- On Complan front, health food drinks category saw a continued slowdown, which is further compounded by down trading to LUPs and lower-priced pouch packs.

- On sweeteners front, the company continued to promote Sugar Free Green through Katrina Kaif along with various social media digital initiatives for Sugar Free brand.

- Sugar Free brand did not see any growth during Q1 due to high base of Covid wave 2, which was led by high diabetic consumption.

- Sugar Free brand witnessed healthy growth in distribution expanding to 497,000 outlets, which is an increase of 26,000 YoY.

- Everyuth brand witnessed another strong double-digit quarter mainly due to TV and digital campaigns across its sub-segments.

- Distribution of Everyuth products increased to 6.8 lac outlets from 6 lac outlets the previous year.

- Nycil brand witnessed a strong comeback during the quarter and registered double digit growth. It maintained its No.1 position and improved availability by 16.5% 1.67 Mn outlets.

- Nutralite brand registered double-digit growth during the quarter with Nutralite DoodhShakti dairy portfolio gaining good traction. The brand is also expanding presence of ghee into institutional channels.

- For Complan, management is focused on growing and regaining market share through the nutrition route rather than competing in the pricing.

- The management believes that for inflation pressures, the worst times have passed away with prices easing a bit.

- The management gives a guidance of 20% operating margins for the year.

- The management does not currently have any plans for inorganic growth and is focused on the growth opportunity that its brands have.

Analyst’s View:

Zydus Wellness has long been a consistent wealth creator and has been at the forefront of the health and wellness industry in India for a long time. In their current product categories, they already have a significant standing in India and are also trying to expand their brands in international markets. The company has solid brands in categories with huge potential in both Global and International markets. All in all, Zydus Wellness looks like a good investment option given that they are leaders in most of their markets, especially to those investors seeking to invest in the theme of increasing consumption and in the health and wellness industry.

Q3 2019 Updates

Financial Results & Highlights

|

Standalone Financials (In Lacs) |

||||||||

| Q3FY19 | Q3FY18 | YoY % | Q2FY19 | QoQ % | 9M FY19 | 9M FY18 | 9M% Change | |

| Sales | 9159 | 7510 | 21.96% | 8503 | 7.71% | 25047 | 21524 | 16.37% |

| PBT | 4040 | 3529 | 14.48% | 4103 | -1.54% | 10698 | 9651 | 10.85% |

| PAT | 3959 | 3612 | 9.61% | 4110 | -3.67% | 10640 | 9752 | 9.11% |

|

Consolidated Financials (In Lacs) |

||||||||

| Q3FY19 | Q3FY18 | YoY % | Q2FY19 | QoQ % | 9M FY19 | 9M FY18 | 9M% Change | |

| Sales | 15583 | 14123 | 10.34% | 14841 | 5.00% | 45706 | 41508 | 10.11% |

| PBT | 4558 | 3926 | 16.10% | 4617 | -1.28% | 12115 | 10994 | 10.20% |

Detailed Results

- Zydus Wellness along with Cadila Healthcare will acquire Heinz India for Rs 4595 Cr.

- They stand to gain many category leading brands like Glucon D, Complan, Nycil and Sampriti through the above acquisition.

- The transaction is expected to be completed by Q4FY19 subject to regulatory approvals.

- The company is being aggressive in pursuing their goal of becoming India’s leading consumer wellness company.

- The acquisition target Heinz is almost double the size of Zydus wellness in terms of revenue and profits. Thus the acquisition shall be completed as a mixture of equity and debt.

- This shall see debt levels rise in the company balance sheet which has been debt free for some time now.

- The Sugar Free brand maintains its market leader position in its segment with more than 94% market share currently. New products Sugar Green and Sugar Lite launched under this brand are expected to reinforce its position.

- The Nutralite brand is expanding into the mayonnaise market which has been growing above 20% per year and is currently estimated to be at Rs 700 Cr.

- The Everyuth brand is outpacing the segment market growth and is growing at more than 10%. Growth is mainly driven by dominant market share in the peel-offs and scrubs sub-segments in the facial cleansing category.

Investor Conference Call Highlights

- The company has successfully completed Heinz acquisition

- UAE, Behrain, Qatar and Oman have been new market where Everyuth brand products have been introduced.

- Both Heinz and Zydus are profitable businesses so they would not require further capital for further running of the combined entity. The company expects a lot of synergistic benefits arising from the acquisition.

- The company will be issuing Rs 1500 cr NCD, interest payable is 9%, for buying Heinz business. The rest of the transaction will be completed through cash and internal accruals.

- Management guides that the acquisition would be margin accretive, however the company’s presentation shows data which suggest that initially margins may go down.

Analyst’s View

Zydus Wellness has long been a consistent wealth creator and have been at the forefront of the health and wellness industry in India for a long time. In their current product categories, they already have a significant standing in India and are also trying to expand their resident portfolio to overseas markets. Now with the acquisition of Heinz India, they have acquired a number of sector leading brands in other categories than their own, thus significantly expanding their product portfolio. This also signals the great ambition the firm and its management possess, and their willingness to take bold steps to go further ahead on their mission path. It remains to be seen whether the benefits from the acquisition will be as good as promised, but there is a high chance of a good integration given that both operate in different categories, thus reducing chances of market share cannibalization. All in all, Zydus Wellness looks like a good investment option given their soon to be expanded portfolio, especially to those investors seeking to invest in the theme of increasing consumption and in the health and well ness industry. However, extremely high valuation (more than 50 times P/E) creates a dilemma.

Disclaimer

This is not an investment advice. Please read our terms and conditions.