Do you think Domino’s is in the Pizza-making business?

Do you think Zomato is just a new-age tech platform business?

Do you think Amazon is all about online buying and selling?

My answer to all of the above questions would be a resounding ‘NO”.

SUBSCRIBE to our mailing list

Here’s a slide from our 12th MissioN SMILE Webinar (Feb 2022) on the QSR industry.

Domino’s is more into a logistics business than a pizza-making business. And due to superior logistic strategy and execution, it went past its biggest competitor, Pizza Hut, in India. Not by the quality of the pizza or the dine-in experience.

Similarly, Zomato/Swiggy is more about delivering food to your home conveniently & fast. And much less about the brand or chain from where you ordered your food. Quality of food matters. But if you carefully analyze your own behaviour you will know this. The one thing that occupies most of your mind space when you order from Zomato/Swiggy is ETA. Estimated Time of Arrival. Period.

Same with Amazon. The online app or tech stack is like that top part of the iceberg visible to you. And the one that is beneath the water, not visible but substantially larger is the logistics part.

Blinkit, is one of the largest & arguably the fastest-growing e-grocery companies in India. Let’s put the cash burn aside for the moment.

If you study its business model, you will realize that Blinkit operates on a marketplace model. It has no personal warehouses or grocery stores. Instead, the company collaborates with various local grocery stores and merchants in the city, and the delivery boys go there to pick up the ordered items. The orders are then delivered to the customers by the delivery boys.

In a nutshell, Blinkit is a grocery delivery platform.

You get the importance of logistics now. Right?

I started with Domino’s, Zomato, Swiggy, Amazon, & Blinkit only because you and I are more connected and involved with these businesses. And hence relate to them much better.

But the underlying theme that I want to cover today is the importance of logistics in the growing large economy of India.

Logistics is an integral activity for economic growth as it involves the management of the flow of goods from the place of origination to the place of consumption. Businesses need logistics services for reaching out to their customers within tight timelines and delivering products.

The sector broadly comprises the following:

- Shipping

- Port operation

- Warehousing

- Rail

- Road

- Air freight

- Express Cargo

- Other value-added services

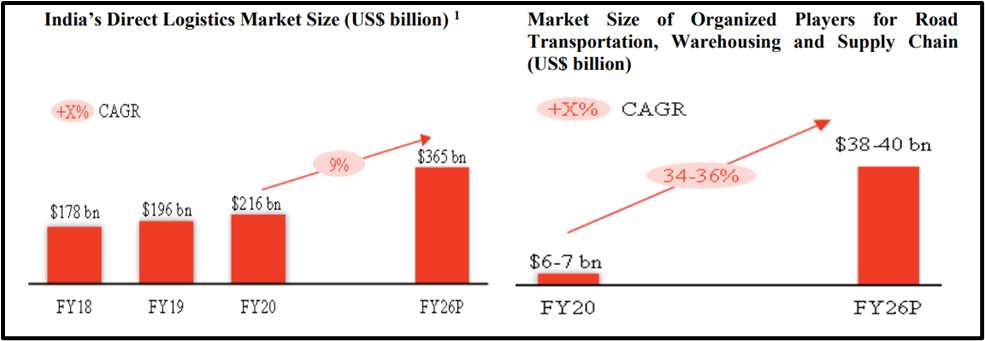

India’s Direct Logistics Market Size (US$ billion)

Based on a research report on the Indian Express Logistics Industry (2022) by Aviral Consulting OPC Pvt Ltd, the logistics market, pegged at ~$250 bn, is expected to grow at 10- 12% CAGR, to $380 bn by FY25.

Industry Growth Drivers

- Strong underlying economic growth

- Favourable regulatory environment in logistics, resulting in the evolution of efficient supply chain formats

- Improvement in India’s transportation infrastructure, especially highway connectivity

- Growth of the domestic manufacturing sector, driven by favorable policy support and increased domestic and foreign investments.

- The rapid growth of the digital economy has led to the creation of digital-native business models such as e-commerce, direct-to-consumer, and social commerce

- Growth in offline commerce driven by increased offline consumption, industrial activity, and cross-border trade

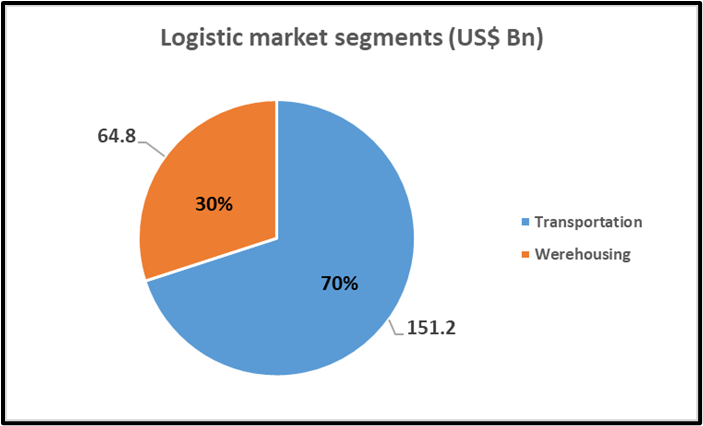

The logistics market primarily comprises transportation and warehousing, of which transportation accounted for 70% or US$151 billion in Fiscal 2020.

Organized players accounted for only ~3.5% of the logistics market (road transportation, warehousing & supply-chain services only) in Fiscal 2020.

Organized players are expected to grow at a CAGR of 35% between Fiscal 2020 and Fiscal 2026, taking their share to 12.5-15% by Fiscal 2026 of the logistics market (road transportation, warehousing & supply-chain services only).

This shift is expected to be driven by the ability of organized players to offer integrated services, network, and scale-driven efficiencies and larger investments in technology and engineering, resulting in a higher share of wallet with customers.

India’s logistic market spending is 14% of GDP in 2020, which is higher than emerging markets and the same as the developed markets.

Way Forward

India has achieved a major milestone of becoming the fifth largest economy in the world and efforts to propel growth across sectors are being undertaken continuously. To become globally competitive and reduce logistics costs in the country, Government’s focus has been on integrated infrastructure development for multimodal connectivity and improving the efficiency of logistics services. In the spirit of cooperative and competitive federalism, States/UTs have an integral role to play in devising ways and means for improving logistics infrastructure in the country, which in turn shall result in increased logistics efficiency and reduced logistics costs in domestic as well as EXIM trade. This Chapter encapsulates the key initiatives undertaken by the Government of India (GOI), which will provide guidance to the States and UTs for developing a resilient and sustainable logistics system.

India Logistics Industry Segmentation

Express Parcel: Fastest growing segment of Road Transportation

Express delivery refers to the delivery of parcels weighing less than 40 kilograms. These are typically e-commerce orders or business documents, with standard turnaround times of less than 3-4 days. The express parcel delivery market was estimated to be ~US$2.3 billion in size in Fiscal 2020 and is expected to reach ~US$10-12 billion by Fiscal 2026 at a CAGR of 28-32%.

This segment has been driven by the growth of e-commerce and rising customer expectations for delivery speed. The e-commerce industry in India grew by 31% from Fiscal 2018 to Fiscal 2020 and is estimated to further grow by 30-33% from Fiscal 2020 to Fiscal 2026. Total e-commerce volume was estimated to be 1.5 billion shipments in Fiscal 2020, which is expected to reach 8-9 billion by Fiscal 2026, at a CAGR of 32-35%.

The express parcel delivery market is mostly catered to by organized players, who are expected to maintain their share of the market. Major e-commerce marketplaces fulfilled 75%+ of their parcel deliveries through their in-house captive logistics arms. Further, ~59% of the total e-commerce shipments in the country in Fiscal 2021 were handled by captive logistics arms of various e-commerce companies. 3PL players handled 41% of e-commerce shipments in Fiscal 2021, which is expected to rise to ~46% by Fiscal 2026, as e-Commerce companies focus increasingly on core business operations and new-age logistics companies continue to build scale, expand the reach and improve delivery timelines.

New-age, technology-enabled 3PL providers have scaled-up and flexible networks that can better handle multiple models, product types, and volume fluctuations, compared to networks that are designed for relatively limited internal use cases.

Partial Truck Load (PTL)

PTL freight refers to the delivery of consignments with weights of between 10-2,000 kgs. PTL providers operate a network of pick-up and delivery points and terminals where freight from different customers that are traveling in similar directions is consolidated. This consolidation leads to lower transportation costs for individual customers while providing faster delivery times and greater flexibility.

The PTL market, which was estimated to be US$13 billion in Fiscal 2020 is expected to double to US$26 billion in Fiscal 2026. There are two key segments in this market:

Express PTL: Turnaround times of 3-5 days, typically focused on smaller consignment sizes

Traditional PTL: Turnaround times are slower than Express PTL. Used by relatively time-insensitive shippers who are comfortable with waiting for carriers to consolidate freight loads. Typically focused on heavier consignments.

New-age technology-enabled logistics players are rapidly expanding PTL operations, especially in the Express PTL segment.

Truckload Freight (TL)

Truckload Freight (TL) refers to the delivery of a full truck/trailer load of freight, moving directly from the shipper or origin point to the consignee or point of destination. This is the largest segment of road transportation, with a market size of US$109 billion in Fiscal 2020 that is expected to reach U$163 billion by Fiscal 2026. Some of the largest end users of TL freight include the FMCG, agriculture, raw materials, automotive and spare parts, manufacturing, retail, and pharmaceutical industries.

Domestic Air Express Transportation: Niche segment with limited growth

The domestic air-express transportation market was estimated to be US$0.8 billion in Fiscal 2020 and is expected to touch US$1.2 billion in Fiscal 2026. Air-express is a niche service suitable for highly time-sensitive shipments requiring reliable, mid to long-distance transportation.

Cross-border Logistics: Nascent segment with large growth potential

Cross-border transportation is done primarily through air and ocean shipping. The cross-border air transport market stood at ~US$5.4 billion in Fiscal 2020 and is expected to reach US$8.2 billion by Fiscal 2026. Airports Authority of India handled ~2 million MT of international freight movements (import + export) in Fiscal 2021. The international air freight market is driven by growth in trade, especially cross-border e-commerce (import as well as Indian sellers selling in global markets). Ocean freight is significantly more cost-efficient than air freight and suited for larger, less time-sensitive freight movements. Ocean freight forms 25-30% of the total cross-border transportation market.

Supply Chain Services: Key enabler for rapidly changing commerce

Supply chain services refer to integrated warehousing, transportation, and technology solutions created for industry-specific and customer-specific requirements. The Indian supply chain services market (including warehousing) was estimated to be US$65 billion in Fiscal 2020 and is expected to reach US$109 billion by Fiscal 2026. The share of organized players is expected to increase from US$1.6 billion in Fiscal 2020 to US$13-15 billion in Fiscal 2026 at a CAGR of 42-45%.

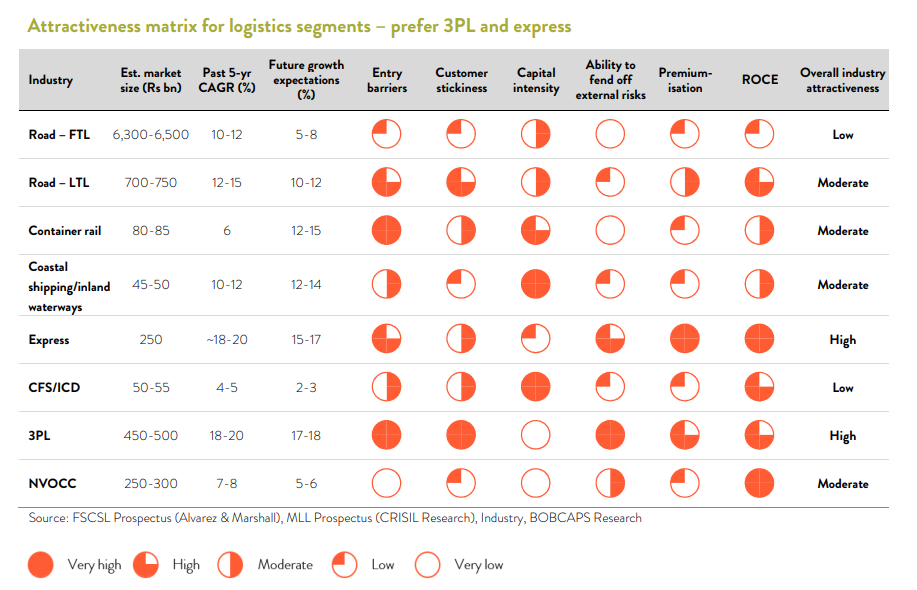

Attractiveness matrix for logistics segments: prefer 3PL & express

To summarize

- Express delivery is a high margin + high entry barrier business

- E-commerce penetration is a huge driver of the Express delivery business

- PTL and TL businesses are asset-heavy and high entry barrier business

- 3PL and supply chain management services are emerging businesses

- The logistics industry is a highly fragmented industry, and we may expect a shift from the unorganized to the organized sector in the coming years.

- If we see companies in the industry from the segmentation part, there are very few overlaps on the companies’ part. That means every company has specialization in its own segment. This conveys that companies are segment focused, and they have not tried to diversify much.

- Efficiency is a key to success in the logistics industry

Challenges & Forces of Disruption

As is the case with most industries, logistics industry is also undergoing a big change or disruption. It poses a host of challenges, especially for the incumbents. They cannot ignore the following seemingly irreversible trends in the sector:

First, the customers’ obsession with speed of delivery and convenience. No one has said this better than Jeff Bezos.

You snooze, you lose. You have to be on your toes as both individuals and businesses expect to get goods faster, more flexibly, and – in the case of consumers – at low or no delivery cost.

Second, the industry needs to be digitally fit. Most of the incumbents are still working with traditional methods. They still don’t get that being digital does not only mean having a platform where your customers can book online and track. There is a lot more to it. To become digitally fit, you need to think afresh and have the DNA of a digital organization. That is missing with almost all the incumbents. While it’s a big challenge for traditional players in the industry, this also is the biggest opportunity for the new-age tech-oriented players.

Third, the fast-changing landscape sometimes becomes difficult to cope up with. For example. A few years ago, Amazon was predominantly dependent on players like Blue Dart. But today, Amazon has a gigantic size logistic business of its own. That changes the demand-supply equation completely. And it is only fair to assume that this kind of disruption will only accelerate going forward. For logistics players, it’s either prepare or perish.

Fourth & last, how to adapt to the sharing economy. One of the biggest challenges for the players in the sector is not how to compete with other players but how to collaborate effectively to get the best out of the sharing economy we are living in. “Sharing” is a big story for logistics

now – from Uber-style approaches to last-mile delivery to more formal JVs and partnerships at the corporate level, the whole sector is redefining

collaboration. But there are inconsistencies in shipment sizes, IT infra & system, and processes. This makes collaboration and sharing very challenging.

We at SSS strongly believe in Don’t Predict, Prepare!

Rather than wasting our time and resources in projecting future trends, we are closely monitoring the current trends and preparing for the brave new world of the logistics sector in India. Are you prepared?

Thank you for reading.

Happy Investing 😊

P.S.: We will deep dive into one business from this sector in our 24th MissioN SMILE webinar this month. If you like what you read above, you may like to know more about MissioN SMILE. You may download our MissioN SMILE app on your Android phone. (iOS App coming soon ). Lots of free & premium sessions on investing for you to explore and learn. 🙂