About the Company

Tata Consumer Products Limited (formerly Tata Global Beverages) is an Indian multinational non-alcoholic beverage company headquartered in Kolkata, West Bengal, India, and a subsidiary of the Tata Group. It is the world’s second-largest manufacturer and distributor of tea and a major producer of coffee.

The company markets tea under the major brands Tata Tea, Tetley, Good Earth Teas, and others. Tata Tea is the biggest-selling tea brand in India, Tetley is the biggest-selling tea brand in Canada and the second-biggest-selling in the United Kingdom and the United States.

In 2012, the company ventured into the Indian cafe market in a 50/50 joint venture with Starbucks Coffee Company. The coffee shops branded as “Starbucks Coffee – A Tata Alliance” source coffee beans from Tata Coffee, a subsidiary company of TataConsumer Products.

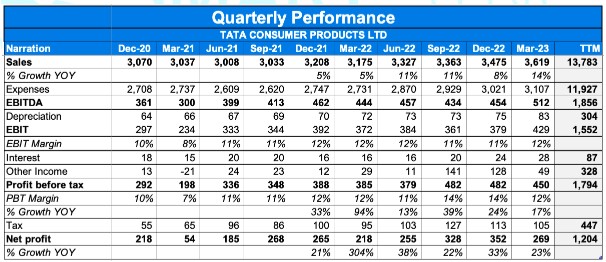

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The consolidated performance was great at 14% YoY growth in revenue while EBITDA grew majorly by 15% YoY.

- PAT was up 23% YoY.

- The consolidated EBITDA margin was at 14.3% which was down by 50 bps YoY.

- Q4 performance for the respective segments stood as followed-

- FY23 performance for the respective segments stood as followed-

- The company has a net cash balance of Rs 2945 Cr as of March 2023.

- Tata Tea saw a market share loss of 50 & 113 bps YoY on volume & value basis respectively while Tata Salt saw a market share gain of 76 bps YoY.

- Growth biz grew by 53% & now contributes to 15% of branded biz.

- Rebranded Tata Q to Tata Sampann Yumside for domestic markets and Tata Raasa for international markets.

- NourishCo scaled to a net sales of INR 621 Cr in FY23, up from 180 Cr. In FY20.

- Tata Starbucks saw net sales of 1087 Cr in FY23 with 333 total stores in 41 cities with 71 net new stores opened this year .

- In the international biz-

- UK revenues grew 8% YoY with value-market share for Everyday black being 19.1%.

- USA saw coffee revenue grow by -4% while tea grew by 5% YoY.

- Canada saw 5% revenue growth with a -12% growth in the specialty tea biz.

- The total revenue & profit distribution for TCPL was:

- India Business: 70% & 71%

- Intl Business: 30% & 29%

- The share of new modes of distribution stood as followed-

Investor Conference Call Highlights

- The management states that beverage volume growth was good at 3%, despite all the price increases.

- India Growth business now accounts for 15% of revenues from 6% when the management took over. They have grown 53% overall.

- The company is on track to hit the target of 4 million outlets by Sep’23. It is current at 3.8 mn.

- Alternate channels have given good growth with contribution from modern trade at 14% and E-Commerce at 9% with each growing 21% & 32% respectively.

- The digital functioning of the company is completely on cloud and not on servers. The entire front-end has now been digitized.

- The boards focus is to leverage the pipelines that are laid and the data that is gathered to move into the next phase of data-driven NPD, into things like web crawling, social listening to drive NPD, leveraging AI/ML to drive procurement, to take revenue growth management to the next level and sharpen spends on marketing.

- The management has made significant process on its global simplification goal, and expect to complete a NCLT process in Q2 to thereby start the process of collapsing international entities.

- The company has terminated their JV in Bangladesh to venture out on its own. In South Africa, they have upped their stake to take majority control.

- NourishCo is a 600 Cr brand now, while Soulfull doubled in revenue last year while reaching 300k+ outlets.

- In macro environment, there is slight downtrend in tea prices while coffee is stable.

- The profitability of the international business is in line with the previous year, without any decline due to the price increases.

- The company has changed its reporting disclosures by going to a statutory reporting of advertising or sales promotion.

- The company took a 15% price increase in UK in Feb, which expected to result in Q1 and Q2.

- Eight O’clock sales have been down 20% due to packaging strategy of smaller packs at the same price.

- Salt margins for the company have back overall to the normative 32%-37% gross margins range.

- The management has given a guidance of mid-single digits growth in volumes for the tea and salt business.

- The management is mainly focusing in the North and West for NourishCo, with presence over 80% of the country. They have targeted to be close to a 4 digit number for valuations in FY24.

- The INR 56 Cr losses from share of JV and associate is one-time for the current quarter only.

- In the areas of currency, crude and inflation, the management expects a stable operating environment.

- Starbucks JV is EBITDA positive and EBIT positive according to Ind AS reporting, but is PAT negative due to rapid expansion leading to interest and depreciation impact.

- The company has started moving into higher double-digit market shares in specific modern trade accounts where it had placed Masala Oats Plus.

- NourishCo’s manufacturing footprint has expanded by 2x-2.5x YoY, and expansion for additional lines is also currently in place.

- In the India Coffee business, the company has expanded to the distribution of entry level Rs2 packs.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. It also completed the acquisition of Tata SmartFoodz which would add Tata Q to the company’s roster. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and premium flagship brands like Tetley. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded-to-branded transition for food and beverage products in India. It remains to be seen how the company will be able to weather the rising inflation concerns and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

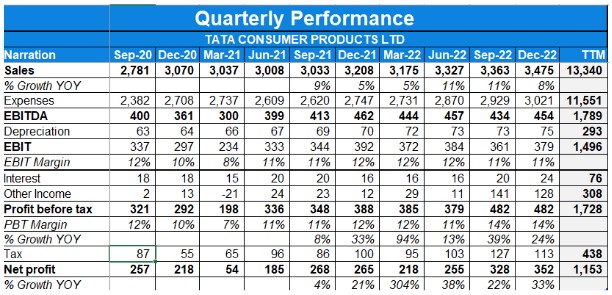

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The consolidated performance was mediocre at 8% YoY growth in revenue while EBITDA declined by 2% YoY.

- PAT was up 33% YoY.

- The consolidated EBITDA margin was at 13.2% which was down by 140 bps YoY.

- Q3 performance for the respective segments stood as followed-

- The company has a net cash balance of Rs 2099 Cr as of December 2022.

- Tata Tea saw a market share loss of 46 & 113 bps YoY on volume & value basis respectively while Tata Salt saw a market share gain of 90 bps YoY.

- Growth biz grew by 53% & now contributes to 13% of branded biz.

- Tata Starbucks saw 11 net new stores opening taking the total count to 311 stores across 38 cities.

- In the international biz-

- UK revenues grew 1% YoY

- USA saw coffee revenue grow by 1% while tea degrow by 8% YoY.

- Canada saw 5% revenue growth with a 1% growth in the specialty tea biz.

- The total revenue & profit distribution for TCPL was:

- India Business: 70% & 77%

- Intl Business: 30% & 23%

- The share of new modes of distribution stood as followed-

Investor Conference Call Highlights

- The management explains that the primary reason for the softness in the Indian business was continued stress in rural and especially in tea, where there is a very high factor of seasonality.

- The company expects significant movement from sub-distributors to distributors in the next 2 or 3 months as it seeks to improve direct coverage in semi-urban areas.

- The company launched a full coffee variant,e iodized Rock salt variant for the value seeker, and relaunched Tata Soulfull Ragi Bites with extra creamy fill.

- The management explains that since 40% of the spice market is concentrated in the South, it is taking steps to penetrate that market & entered the Karnataka market recently.

- The company has witnessed lower growth in volumes across the portfolio owing to price hikes.

- The effective tax rate is slightly lower because of the fact that the Joekels transaction is not liable to tax.

- On the distribution side, the company is 10-12% behind its largest competitor in the Tea biz.

- The strategy in the tea biz remains to focus on the gaps in the value side in rural Tamil Nadu & Eastern UP & some parts of Maharashtra on the volume side.

- The company plans to add 35-40% of the total DSR base.

- The management is confident about the long runway for growth in its Sampann category due to the lower penetration of pulses despite the potential rise in competition. This category is a lower-margin one.

- The company’s total selling points are 3.6 million which involves- 2.7 Mn for individual categories of tea & salt, Soulfull is about300,000 outlets & NourishCo is about 600,000 outlets.

- The management states that in the growth category, Sampann is the biggest opportunity followed by NourishCo followed by Soulfull.

- The company is targeting overall global simplification, which is already in place, where it aims to reduce from 43 to about 23- 25 operating entities.

- The management expects mid-single-digit growth in its legacy salt & tea biz whereas a high growth in its food & beverage biz will help the company become a strong multi-category food and beverage company.

- The Currency impacts us both in terms of a transaction as well as a translation where- it buys tea out of Kenya, which is priced in U.S. dollars. The drop in British Pounds and its inability to take quick pricing in that market meant that it had a transaction impact. And on top of that, the drop in the British Pound versus the Indian Rupee meant that there was a translation impact.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. It also completed the acquisition of Tata SmartFoodz which would add Tata Q to the company’s roster. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and premium flagship brands like Tetley. The current quarter was mediocre with lower volume growth owing to higher pricing coupled with margins eroding from 14.6% to 13.2% YoY. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded-to-branded transition for food and beverage products in India. It remains to be seen how the company will be able to weather the rising inflation concerns and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

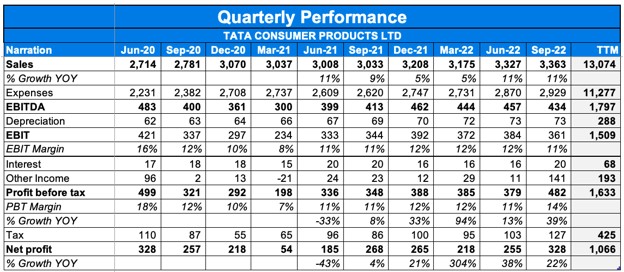

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- The consolidated performance was good at 11% YoY growth in revenue while PAT was up 22% YoY.

- EBITDA margin was at 13% which was down 100 bps YoY. EBITDA for the quarter grew 4%.

- Overall, India’s business grew 9% YoY with a business growth of -2% in beverages & 29% in foods.

- The company has a net cash balance of Rs 2013 Cr as of Sep 2022.

- Tata Tea saw market share gain of 46 bps YoY and Tata Salt saw market share gain of 128 bps YoY.

- The India Beverages business showed revenue growth of 1% YoY & volume growth of 0% YoY in Q2.

- The India Foods business showed revenue growth of 24% YoY & volume growth of -1% YoY in Q2. Salt revenues grew by 27% in Q2 with Rock salt delivering growth of 43%. Tata Sampann portfolio also grew 37% in volumes.

- NourishCo had revenue of Rs 138 Cr and saw 64% YoY revenue growth in Q2. Tata Water Plus (now rebranded to Tata Copper Water) sold 1.9x volumes in Q2.

- The Tata Coffee division saw 39% revenue growth YoY in Q2. Plantation revenue grew by 73% and Extraction revenue grew 26% YoY in Q2. Vietnam plant operated with 99% capacity utilisation.

- In the Starbucks JV, the company had 99% of stores operational. The company increased its store count to 300 stores with 25 new stores and 6 cities added during the year.

- The UK tea business saw revenue growth of -7% YoY in Q2. It maintained a market share of 19.2% in the everyday black tea segment. Teapigs revenue grew -16% YoY in Q2.

- The USA coffee business saw a 16% YoY revenue growth in Q2. The tea business saw revenue growth of 9% YoY in Q2.

- In Canada, the company saw revenue growth of 16% YoY in Q2. It maintained a market share of 27.3%.

- The total revenue distribution for TCPL was:

- India Business: 72%

- Intl Business: 28%

- The company launched new innovations like Tata Sampann spices in the south, Tata ORS and Tata Cold brew iced tea in the US.

- The company expanded in the protein foods category during the quarter, with plant-based meat market expected to reach USD 25 billion globally by 2030.

Investor Conference Call Highlights

- The management is positive about the company’s volume market share gains in both tea and salt.

- For tea, the volume share is up while value share is down because the company has given up some pricing to make sure the volume momentum does not stop.

- The company’s growth businesses like Ready-to-drink, Sampann and Soulfull are on a very good trajectory growing 50% consistently since the last few quarters.

- In Ready-to-eat, the company is relaunching and revamping the entire business including the entire marketing mix.

- Relaunched Ready-to-eat in india under the brand name, Tata Sampann Yumside and internationally as Tata Raasa.

- Group net profit is up 36% mainly because of a one-time gain on a disputed litigated land sale of Tata Coffee.

- The company is on-route to hit its target of 1.5 million outlets by March 23 beforehand as the company has already reached 1.4 million direct outlets.

- Modern Trade continues to go from strength-to-strength up by 18%. E-commerce which was at 7.5% of sales in FY22 is at 9.2% currently growing 40%. NPD contribution was at 11%.

- The management states that it will continue to put money behind its brands. The A&P spends for the first half increased to 6.4% of sales from 6.1% the previous year.

- Premiumization continues to be a focus, Tata Tea Gold Care, launched 24 months back is at 5% of total sales.

- The company entered another category of Hing through Sampann. Sampann spices is planned to be launched into the south which is 40% of India’s market for spices.

- This quarter the company got into the health supplement space with GoFit.

- The pound depreciating against the dollar is creating a currency issue for the company.

- The management states that Tea prices have been on a secular downtrend and are expected to continue trending downwards for the short term. Coffee prices are stable on an overall level.

- The company has taken price increases in International markets, but it is coming with a lag upto the next quarter.

- Tata Q was mainly relaunched to reflect consumer feedback on product and branding and bring it under the Tata Sampann brand name which will help sales.

- The ready-to-eat category has different branding for India and International due to a copyright issue on the brand Tata Raasa in India.

- The management is very positive about the ready-to-eat category as it is a nice profitable business with good margins having a market of 1500 crores, growing double digits every year.

- In the US markets, the company has taken a price increase of 22% from September onwards, while in the UK it was 7%.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and in premium flagship brands like Tetley. The margins in the tea business are normalizing which is resulting in a good revenue rise despite modest volume growth. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded-to-branded transition for food and beverage products in India. It remains to be seen how the company will be able to weather the rising inflation concerns and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

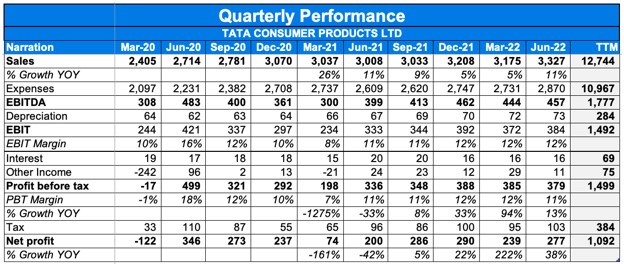

Q1FY23 Updates

Financial Results & Highlights

Detailed Results:

- The consolidated performance was good at 11% YoY growth in revenue while PAT was up 38% YoY.

- EBITDA margin was at 13.8% which was up 40 bps YoY. EBITDA for the quarter grew 14%.

- Overall, India’s business grew 9% YoY with a business growth of 3% in beverages & 19% in foods.

- India business A&P was up 48% YoY.

- The company has a net cash balance of Rs 1896 Cr as of Jun 2022.

- Tata Tea saw market share gain of 40 bps YoY and Tata Salt saw market share gain of 400 bps YoY.

- The India Beverages business showed revenue growth of 3% YoY & volume growth of 1% YoY in Q1.

- The India Foods business showed revenue growth of 19% YoY & volume growth of -3% YoY in Q1. Salt revenues grew by 20% in Q1 with Rock salt delivering growth of 75%. Tata Sampann portfolio also grew 6% in volumes.

- NourishCo had revenue of Rs 183 Cr and saw 110% YoY revenue growth in Q1. Tata Water Plus (now rebranded to Tata Copper Water) sold 2.9x volumes in Q1.

- The Tata Coffee division saw 25% revenue growth YoY in Q1. Plantation revenue grew by 31% and Extraction revenue grew 26% YoY in Q1. Vietnam plant operated with 99% capacity utilisation.

- In the Starbucks JV, the company had 99% of stores operational. Sales have been rising each month since the opening-up post 3rd wave of COVID-19. The company increased its store count to 275 stores with 7 new stores and 4 cities added during the year.

- The UK tea business saw revenue growth of 3% YoY in Q1. It maintained a market share of 19.1% in the everyday black tea segment. Teapigs revenue grew 16% YoY in Q1.

- The USA coffee business saw a 15% YoY revenue growth in Q1. The tea business saw revenue decline -11% YoY in Q1.

- In Canada, the company saw revenue growth of 14% YoY in Q1. It maintained a market share of 27.3%.

- The total revenue distribution for TCPL was:

- India Business: 72%

- Intl Business: 28%

- The company launched new innovations like Tata Sampann spices in the south, Tata ORS and Tata Cold brew iced tea in the US.

- The company entered the protein foods category during the quarter, with plant-based meat market expected to reach USD 25 billion globally by 2030.

Investor Conference Call Highlights

- The company has achieved a direct reach of 1.3 million outlets and wholesale coverage has gone up from 18,000 to 38,000.

- The company has expanded the portfolio of NourishCo and has launched Tata ORS on a pilot basis in specific markets.

- The management plans to make Soulfull as a base brand for breakfast cereals, mini meals and snacking.

- The company has expanded the Himalayan brand into becoming a provenance brand. They have rolled out jams, preserves and honey.

- The company has also entered the protein food products business seeing its huge potential in the country.

- For alternative meat, the company has launched Tata Simply Better and the management sees huge potential in this brand.

- The company has taken a price hike for Tata base Salt from 25 to 28 and expects margins to be back on track soon.

- In Tata Sampann, 25% of spices mix comes from online and for pulses and spices it is 40% from online.

- The total addressable market for Tata Sampann is 15500 crores in pulses and 60000 crores in spices.

- In the salt business, salt prices were mainly taken up because of increase in and coal prices while brine remained stable.

- The company had launched dry fruits six months ago under Tata Sampann and the products have performed extremely well giving a tough competition to competitors.

- The inflationary situation in Europe continues to affect the international business of the company.

- Teapigs continues to drive category growth in the USA and maintained momentum with its cold brew range. It emerged as the fastest growing specialty tea brand during the quarter.

- Tata Salt Immuno with its category-first unique proposition of added Zinc is being rolled out Nation-wide post encouraging results in the pilot phase.

- Tata Starbucks opened 7 new stores during Q1 and entered four new cities – Jalandhar, Anand, Nagpur, and Calicut. This brought the total number of stores to 275 across 30 cities.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. It also completed the acquisition of Tata SmartFoodz which would add Tata Q to the company’s roster. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and in premium flagship brands like Tetley. The margins in the tea business are normalizing which is resulting in a good revenue rise despite modest volume growth. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded to branded transition for food and beverage products in India. It remains to be seen how the company will be able to weather the rising inflation concerns and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1986 | 1878 | 5.7% | 2054 | -3.3% | 8171 | 7287 | 12.1% |

| PBT | 272 | 115 | 136.5% | 252 | 7.9% | 1151 | 836 | 37.6% |

| PAT | 206 | 81 | 154.3% | 187 | 10.1% | 885 | 619 | 42.9% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 3222 | 3080 | 4.6% | 3233 | -0.3% | 12565 | 11723 | 7.1% |

| PBT | 384 | 197 | 94.9% | 387 | -0.7% | 1455 | 1311 | 10.9% |

| PAT | 289 | 133 | 117.2% | 287 | 0.6% | 1078 | 993 | 8.5% |

Detailed Results:

- The consolidated performance was good at 4.6% YoY growth in revenue while PAT was up 117% YoY.

- FY22 performance was good with 7% YoY revenue growth and 8.5% YoY growth in PAT.

- EBITDA margin was at 14.4% which was down 20 bps QoQ and was up 400 bps YoY.

- Overall, India’s business grew 13% YoY with a business growth of 10% in beverages & 19% in foods. The company has a cash position of Rs 2486 Cr.

- India business A&P was up 29% YoY.

- TCPL has acquired Tata SmartFoodz Ltd. (TSFL), owner of the brand Tata Q which marks their expansion into new higher margin Ready-to-eat categories.

- The company has a net cash balance of Rs 2486 Cr as of Mar 2022.

- Tata Tea saw market share gain of 100 bps YoY and Tata Salt saw market share gain of 400 bps YoY.

- The India Beverages business showed revenue growth of 6% YoY & volume growth of 3% YoY in Q4.

- The India Foods business showed revenue growth of 19% YoY & volume growth of 8% YoY in Q4. Salt revenues grew by 15% in Q4 with Rock salt delivering growth of 82%. Tata Sampann portfolio also grew 30% in volumes.

- NourishCo had revenue of Rs 344 Cr and saw 83% YoY revenue growth in Q4. Tata Water Plus (now rebranded to Tata Copper Water) sold 3.2x volumes in Q4.

- The Tata Coffee division saw 11% revenue growth YoY in FY22. Plantation revenue grew and Extraction revenue grew 19% YoY in FY22. Vietnam plant operated with 98% capacity utilisation.

- In the Starbucks JV, the company had 96% of stores operational. Sales have been rising each month since the opening-up post 3rd wave of COVID-19. The company increased its store count to 268 stores with 50 stores added during the year.

- The UK tea business saw revenue growth of -2% YoY in FY22. It maintained a market share of 19.4% in the everyday black tea segment. Teapigs revenue grew 7% YoY in FY22.

- The USA coffee business saw a flat YoY revenue growth in FY22. The tea business saw revenue decline 8% YoY in FY22.

- In Canada, the company saw revenue decline of -7% YoY in FY22. It maintained a market share of 27.8%.

- The total revenue distribution for TCPL was:

- India Business: 69%

- Intl Business: 31%

Investor Conference Call Highlights

- India beverages business saw better margins due to tea inflation tapering off.

- The company is sitting with 2486 Crores of cash which incidentally despite the investment in Tata SmartFoodz, the recapitalization of APPL, investment into taking control of the TRIL JV and Starbucks investment is still higher than last year.

- The company has seen great progress in alternate channels, with modern trade growing 30% YoY and e-commerce contributing 7.3% of sales.

- Premiumization has started showing results for the company with Sampann up 28% and value-added salt up 26%.

- The company is focused on innovation and currently spends 2.7% of sales from 0.9% previously.

- The company has 11000 drop-off points in India to 38 centers. Supply chain integration has yielded great results with a 25% reduction in secondary trade.

- 24% of the company’s energy needs for its supply chain come from renewable sources.

- The company has announced its plans for merger of Tata Coffee and simplification of the international business which will yield higher operational efficiencies.

- Tata Starbucks reported 18% same store sales growth vs pre-covid levels and opened a record 23 stores in a single quarter.

- Commodities like tea, coffee and salt are range bound currently which is positive for the company.

- The company had been taking rapid price increases in the international business in line with the inflation levels.

- The company’s e-commerce market share in tea is 41.9% on platforms including Amazon, BigBasket etc.

- The management sees tea prices remaining range bound with a slight downtrend for the upcoming quarters as they expect a decent monsoon. The company has not been affected by the problems in Russia and Sri Lanka.

- The management states that the gross margins for beverages are at a comfortable level and will remain sustainable going forward.

- The management believes that it has fairly good numeric reach in Tier 1 and 2 towns and sees opportunities in rest of urban and rural. This year it plans to increase the multiplier of wholesales.

- The management expects a double-digit growth in the India food business with margins continuing to improve for the long term.

- Secondary freight per kilometer for the company is down 25% because of combining of salt and tea.

- The company is currently seeing EBITDA margins between 15% and 20% currently for Tata Starbucks and plans to ramp it up going forward.

- The company’s other expenses are higher in Q4 as the company is investing into sales and digital infrastructure.

- The company’s target for numeric reach is 4 million outlets and the company is at 2.7 million outlets currently.

- In Tata Sampann, the company has entered the dry fruits category which is a high margin category.

- The management expect Tata Sampann to outpace TCPL’s growth numbers significantly going forward.

- The company is keeping 2400 crores cash ready to deploy, in case good opportunities arise.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen a mixed performance in Q4FY22 with the revenues rising only 5% YoY while PAT increased more than 117% YoY due to rise in margins. It also completed the acquisition of Tata SmartFoodz which would add Tata Q to the company’s roster. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and in premium flagship brands like Tetley. The margins in the tea business are normalizing which is resulting in a good revenue rise despite modest volume growth. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded to branded transition for food and beverage products in India. It remains to be seen how the company will be able to weather the rising inflation concerns and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 2054 | 1987 | 3.3% | 2018 | 1.7% | 6184 | 5408 | 14.3% |

| PBT | 252 | 176 | 43.1% | 248 | 1.6% | 878 | 721 | 21.7% |

| PAT | 187 | 136 | 37.5% | 188 | -0.5% | 679 | 537 | 26.4% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 3233 | 3089 | 4.6% | 3072 | 5.2% | 9342 | 8643 | 8% |

| PBT | 387 | 292 | 32.5% | 347 | 11.5% | 1071 | 1113 | -3.7% |

| PAT | 287 | 237 | 21% | 285 | 0.5% | 789 | 860 | -8.2% |

Detailed Results:

- The consolidated performance was decent at 4.6% YoY growth in revenue while PAT was up 21% YoY.

- 9M performance was mixed with 8% YoY revenue growth and -8.2% YoY decline in PAT.

- EBITDA margin was at 14.6% which was up 70 bps QoQ and was up 270 bps YoY.

- Overall, India’s business grew 6% YoY with a business growth of 1% in beverages & 16% in foods. The company has a cash position of Rs 1891 Cr.

- India business A&P was up 19% YoY.

- TCPL has acquired Tata SmartFoodz Ltd. (TSFL), owner of the brand Tata Q which marks their expansion into new higher margin categories.

- The company has a net cash balance of Rs 1891 Cr as of Dec 2021.

- Tata Tea saw market share gain of 89 bps YoY and Tata Salt saw market share gain of 476 bps YoY.

- The India Beverages business showed revenue growth of -1% YoY & volume growth of 6% YoY in Q3.

- The India Foods business showed revenue growth of 16% YoY & volume growth of 4% YoY in Q3. Salt revenues grew by double digits in Q3 with the premium salt portfolio growing 29% YoY in Q3. Tata Sampann portfolio also grew in double digits.

- NourishCo had revenue of Rs 72 Cr and saw 91% YoY revenue growth in Q3. Tata Water Plus (now rebranded to Tata Copper Water) sold 2.8x volumes in Q3.

- The Tata Coffee division saw 33% revenue growth YoY in Q3. Plantation revenue grew and Extraction revenue grew 36% YoY in Q3. Vietnam plant operated with 98% capacity utilisation. Vietnam sales grew 17% YoY.

- In the Starbucks JV, the company had 94% of stores operational. Sales have been rising each month since the opening-up post 2nd wave of COVID-19. The company added 13 new stores and entered Trivandrum and Siliguri in Q3.

- The UK tea business saw revenue growth of -4% YoY in Q3. It maintained a market share of 19.4% in the everyday black tea segment. Teapigs revenue declined 3% YoY in Q3 due to a high base last year.

- The USA coffee business saw a 6% YoY revenue growth in Q3. The tea business saw revenue remain flat YoY in Q2.

- In Canada, the company saw revenue decline of -2% YoY in Q3. It maintained a market share of 28.2%.

- The total revenue distribution for TCPL was:

- India Beverages: 44%

- India Foods: 25%

- Intl Beverages: 31%

Investor Conference Call Highlights

- International business’ growth was average to flat due to an elevated base in Q3 last year.

- With tea inflation tapering off, the company has seen a strong improvement in India Beverages gross margins resulting in EBIT margins jumping up 1100 bps YoY.

- India foods margins were impacted by inflation across the portfolio and investments into new businesses.

- The company continues to invest in new businesses and acquire new brands. It has recently acquired Soulfull and Tata Q which add new categories to the company.

- Tata SmartFoodz Limited is the recent acquisition by the company which owns the brand Tata Q. This brand will enable the company to enter the ready-to-eat market cater to the growing consumer need for convenient food offerings.

- The company has transitioned its Australian business from direct distribution to distribution-led which will expand reach and give cost efficiencies.

- The company took price increases this quarter for coffee products due to the unprecedented cost inflation on coffee.

- The management has defined six strategic priorities – strengthening and accelerating core business, driving digital and innovation, unlocking synergies and focusing on costs, making sure the company has talent and capabilities and building a future-ready organization, exploring organic and inorganic new opportunities, and embedding sustainability in everything the company does.

- The company has started ATL on Agni to move the brand up the value chain. It partnered with the Indian Hockey Team for an ad that was extremely well received.

- The company took a 15% price increase in Tata Salt to mitigate various cost impacts.

- The company has started a pilot of online-only dry fruits which received a great response.

- The inflationary pressures the company is currently facing are freight, packaging, and energy.

- The company is focusing on premiumization and value-added products to improve margins.

- NourishCo is going from strength-to-strength delivering better performance each quarter and will be a big value add to the company in the future according to the management.

- Contributors to EBITDA in the consolidated performance were renegotiation of input cost with Keurig and price hikes in the coffee business.

- Exceptional items are higher because of the ongoing activity of restructuring and are expected to continue for a few more quarters.

- The tax rates this year are comparatively higher as the company had availed deferred tax benefits and one-time tax credits last year.

- The management states that it sees the India business as a portfolio and if it feels the need to invest in the foods business at the cost of the portfolio, it will go ahead with it.

- The management plans to build a master brand architecture with Tata Tea. Tata tea will be the mother brand in this with smaller brands like Gold, Premium, and Agni being on different price brands and positioning range.

- The company’s plan for the dry fruits business is to leverage the Tata brand and gain the trust of consumers while making sure the price value equations are right.

- The management expects the margins in the dry fruits business to be comparable to existing businesses.

- A&P expenses were at 150 crores and were 13% up QoQ.

- The management expects margin compression to remain for a few quarters till brine prices stabilize. They expect the brine prices to retrace down in the long term.

- 35% of the company’s overall revenues come from rural areas. The management states that the company is currently witnessing softness in rural demand and expects it to bounce back soon.

- The company is continuing to expand its distribution to rural areas. Currently, it has distribution to 1.2 million outlets.

- Current ready-to-eat market size in India is Rs 150 Cr but for exports, it is Rs 1700 Cr. The company is currently only present in the domestic segment in this business. The acquisition of Tata Q gives the company a huge export potential while domestic markets are expected to keep on expanding.

- For Tata Q, the company plans to leverage its distribution to scale and expand the portfolio. In the next 1 year, the company plans to be in all developed markets which will give higher revenues and have attractive margins.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen a mixed performance in Q3FY22 with the domestic beverages and foods businesses growing while international business was mostly flat YoY. It also completed the acquisition of Tata SmartFoodz which would add Tata Q to the company’s roster. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and in premium flagship brands like Tetley. The margins in the tea business are normalizing which is resulting in a good revenue rise despite modest volume growth. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded to branded transition for food and beverage products in India. It remains to be seen how the company will leverage its connection with BigBasket for the online grocery space and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 2018 | 1770 | 14.01% | 2112 | -4.45% | 4131 | 3421 | 20.75% |

| PBT | 249 | 231 | 7.79% | 378 | -34.13% | 626 | 545 | 14.9% |

| PAT | 188 | 169 | 11.24% | 304 | -38.16% | 492 | 402 | 22.39% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 3073 | 2808 | 9.44% | 3036 | 1.22% | 6109 | 5554 | 9.99% |

| PBT | 348 | 321 | 8.41% | 336 | 3.57% | 684 | 821 | -17% |

| PAT | 261 | 234 | 11.54% | 241 | 8.30% | 502 | 623 | -19.48% |

Detailed Results:

- The consolidated performance was average at 9.44% YoY growth in revenue and PAT was up 11.54% YoY.

- H1 performance was mixed with 10% YoY revenue growth and 19% YoY decline in PAT.

- EBITDA margin was at 13.9% which was up 50 bps QoQ but was down 60 bps YoY.

- Overall, India’s business grew 17% YoY with a business growth of 14% in beverages & 23% in foods. The company has a cash position of Rs 2250 Cr.

- India business A&P was up 75% YoY.

- Tata Tea saw market share gain of 169 bps YoY and Tata Salt saw market share gain of 440 bps YoY.

- Ecommerce channel has grown 39% YoY and now accounts for 7% of sales. Institutional channel has also grown 117% YoY.

- The India Beverages business showed revenue growth of 14% YoY & volume growth of 2% YoY in Q2.

- The India Foods business showed revenue growth of 21% YoY & volume growth of 16% YoY in Q2. Salt revenues grew 20% in Q2 with the premium salt portfolio growing 42% YoY in Q2. Tata Sampann portfolio grew 29% YoY.

- NourishCo had revenue of Rs 84 Cr and saw 121% YoY revenue growth in Q2. Tata Water Plus (now rebranded to Tata Copper Water) sold 4x volumes in Q2.

- The Tata Coffee division saw flat growth YoY in Q2. Plantations revenue fell 24% YoY and Extractions revenue grew 16% YoY in Q2. Vietnam plant operated with 98% capacity utilisation.

- In the Starbucks JV, the company had 88% of stores operational. Sales have been rising each month since the opening-up post 2nd wave of COVID-19. The company added 14 new stores and entered Jaipur in Q2.

- The UK tea business saw revenue growth of 1% YoY in Q2. It maintained a market share of 19.8% in the everyday black tea segment. Teapigs revenue grew 17% YoY in Q2.

- The USA coffee business saw a 1% YoY revenue growth in Q2. The tea business saw revenue decline of 12% YoY in Q2.

- In Canada, the company saw revenue decline of 1% YoY in Q2. It maintained a market share of 28.5%.

- The total revenue distribution for TCPL was:

- India Beverages: 46%

- India Foods: 26%

- Intl Beverages: 28%

Investor Conference Call Highlights

- The tapering of tea cost inflation has led to improvements in gross margins for the 2nd consecutive quarter and the management expects further improvements in margins QoQ for at least the next 2 to 3 quarters.

- The company has reduced its working capital days by 16 days and has improved its free cash flow to EBITDA 1700 bps YoY.

- The management has surpassed the initial target of 1 million outlets at 1.1 million. The target has been revised to 1.3 million outlets by FY22.

- The management has initiated a premium DSR program to enhance focus beyond tea and base salt, with additional salespeople only focusing on premium portfolio and upcoming brands like Sampann, Tetley, Coffee, and Soulfull.

- The management is bullish on the company’s NourishCo business and has laid out plans to expand it geographically and portfolio-wise.

- The rural segment of the business seems like a bigger opportunity than urban and the management plans to reach 5000 rural distributors by March 2022.

- Fruski and Tata Gluco Plus, 2 new products launched have received strong initial success.

- The company has also launched 2 new products under Soulfull which are Soulfull 0% added sugar Muesli and Rs 10 Soulfull Ragi Bites.

- The management’s 3-brand strategy in UK to move from a black tea company to fruit and herbals, specialty, and premium spaces has paid off. As a result, TCPL has seen increased traction in its overall tea share in the UK.

- Consolidated EBITDA was at 13.9% against 14.4% last year due to investments in Soulfull, higher Advertising & Promotion expenses, fixed cost investment in infrastructure, and an increase in freight and inflation costs. The management reassured these are not reflective of subsequent quarters to come and they expect margins to improve from here.

- The management states that the company will focus its ad spend towards the premium end of the tea business and in the emerging brands of the foods business like premium salt and Sampann.

- The management remains confident of the market potential for branded food and beverage products in India.

- The volume growth momentum has slowed down due to the normalization of consumer behavior according to the management.

- The working capital improvement has come due to improvement in receivables management and the company moving away from booking inventory in tea due to its ability to easily procure tea due to its market strength.

- The management states that gross margins have mainly stayed flat while EBITDA margins have fallen due to increased A&P spending. This should yield a higher margin in the future based on brand strengths.

- The company is aiming to provide different selections of spices and spice mixes under Sampann in different geographies to maintain attractive margins and establish a national brand that is catering to regional tastes according to the management.

- The management reiterated that the biggest runway it sees for growth is in the food business. Although sitting with Rs. 2250 crore of cash, TCPL is focused on creating opportunities for both strategic and financial fits according to the management.

- The management expects the proportion of other expenses as a percentage to sales will improve as the business grows, as they don’t expect the element of inflation for long and have also taken initiatives on restructuring.

- The company’s urban presence is wider than its rural footprint and thus the management says that rural regions are a big opportunity for market capture for TCPL.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen a mixed performance in Q2FY21 with the domestic beverages and foods businesses growing 14% & 23% YoY respectively while international business was mostly flat YoY. The company is focused on expanding and enhancing the brand image for emerging brands like Tata Sampann, Soulfull, and Tata Coffee products, and in premium flagship brands like Tetley. The margins in the tea business are normalizing which is resulting in a good revenue rise despite modest volume growth. The management is committed to maintaining a high A&P spend to enhance the brands of the company and to capitalize on the unbranded to branded transition for food and beverage products in India. It remains to be seen how the company will leverage its connection with BigBasket for the online grocery space and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q1FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 2112 | 1651 | 27.92% | 1879 | 12.40% |

| PBT | 378 | 314 | 20.38% | 115 | 228.70% |

| PAT | 304 | 232 | 31.03% | 82 | 270.73% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 3036 | 2747 | 10.52% | 3080 | -1.43% |

| PBT | 336 | 499* | -33% | 198** | 69.70% |

| PAT | 241 | 389 | -38% | 133 | 81.20% |

*Contains exceptional item of loss of Rs 64 Cr

**Contains exceptional item of gain of Rs 63 Cr

Detailed Results:

- The consolidated performance was mixed at 10% YoY growth in revenue and PAT was at Rs 241 Cr vs Rs 389 Cr last year. Adjusted for exceptional items, PAT was down 27% YoY.

- EBITDA margin was at 13.4% which was up 300 bps QoQ but was down 452 bps YoY.

- Overall, India’s business grew 25% YoY with a business growth of 28% in beverages & 20% in foods. The company has a cash position of Rs 2169 Cr.

- India business A&P was up 53% YoY. Tata Tea saw market share gain of 170 bps YoY and tata Salt saw market share gain of 370 bps YoY.

- Ecommerce channel has grown 153% YoY and now accounts for 7.3% of sales. Institutional channel has also grown 144% YoY.

- The India Beverages business showed revenue growth of 24% YoY & volume growth of 3% YoY in Q1. Coffee revenue grew of 14% YoY in Q1.

- The India Foods business showed revenue growth of 20% YoY & volume growth of 17% YoY in Q1. Salt revenues grew 20% in Q1 with the premium salt portfolio growing 34% YoY in Q1. Tata Sampann grew 12% YoY.

- NourishCo had revenue of Rs 87 Cr and saw 91% YoY revenue growth in Q1. Tata Water Plus sold 4.8x volumes in Q1.

- The Tata Coffee division saw value growth of 5% YoY in Q1. Plantations revenue fell 23% YoY and Extractions revenue grew 21% YoY in Q1. Vietnam plant recorded its highest ever EBIT.

- In the Starbucks JV, the company had 84% of stores operational. Sales in Q1 were depressed due to localized lockdowns.

- The UK tea business saw revenue decline of 13% YoY in Q1. It maintained a market share of 19.9% in the everyday black tea segment. Teapigs revenue grew 14% YoY in Q1.

- The USA coffee business saw a 15% YoY revenue Decline in Q1. The tea business saw revenue decline of 8% YoY in Q1.

- In Canada, the company saw revenue decline of 25% YoY in Q1. It maintained a market share of 29%.

Investor Conference Call Highlights

- The exceptional item in Q1FY21 was the gain from the NourishCo transaction.

- The company is on track to complete the Soulfull integration within 100 days of the acquisition.

- The company has already launched Tata Coffee Sonnets, 1868 tea, and is planning to launch Eight O’Clock coffee as well in India soon.

- There was an uptick in tea margins due to a drought scare in Assam and limited operating capacity due to the 2nd wave of COVID-19 which resulted in a rise in tea prices due to a drop in supply. The prices should normalize going forward.

- Coffee prices are also on an uptrend due to drought in Brazil which is positive for Tata Coffee and Eight O’Clock.

- The biggest traction in Smapann products is coming in poha, followed by pulses, and lastly in spices.

- The management expects margins in tea to expand going forward.

- The Indian coffee market size is at Rs 2500 Cr. Tata Coffee has a very small share of it but given the vast distribution system of TCPL, the company can scale up this business very fast.

- Both Sonnets and Eight O’Clock will be targeting premium customers and the company has gone with the online model for them.

- The A&P spending will remain at current elevated levels because the company is looking to do long-term brand strengthening.

- The management has stated that pricing action in the tea segment is not uniform for everywhere and it is tailored on a market-by-market basis. The overall price rise or fall is taken keeping in mind to preserve margins and deliveries.

- The company is collecting data at each level to use analytics to drive efficiency within the organization.

- The opportunities in Sampann are based mainly on pricing and product quality while the opportunities in NourishCo are based on scaling and expanding in geographies and its portfolio.

- The major issue for India Beverages in May and June was last-mile delivery and closure of out-of-home consumption like in tea stalls, all of which were hampered due to localized lockdowns.

- The major focus for Sampann will remain to increase the level of synergies that can be derived and to maintain the product portfolio to ensure customer stickiness.

- The company will be working with BigBasket which is now a Tata Sons company to explore areas for cooperation and synergy.

Analyst’s View:

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen mixed growth with good growth in India business and decline in international business due to a large base in Q1FY21 from pantry stocking in western countries. The company is focused on expanding and enhancing the brand image for both Tata Sampann and Tata Coffee products. The margins in the tea business are expected to normalize going forward. It remains to be seen how the company will leverage its connection with BigBasket for the online grocery space and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1879 | 1352 | 38.98% | 1988 | -5.48% | 7287 | 5808 | 25.46% |

| PBT | 115 | 96 | 19.79% | 176 | -34.66% | 836 | 729 | 14.68% |

| PAT | 82 | 71 | 15.49% | 136 | -39.71% | 620 | 524 | 18.32% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 3080 | 2427 | 26.91% | 3089 | -0.29% | 11723 | 9749 | 20.25% |

| PBT | 198 | -17 | 1265% | 292 | -32.19% | 1311 | 809 | 62.05% |

| PAT | 133 | -50 | 366% | 237 | -43.88% | 930 | 460 | 102.17% |

Detailed Results

- The consolidated performance was good at 27% YoY growth in revenue and PAT was at Rs 133 Cr vs loss of Rs 50 Cr last year.

- During FY21, Consolidated Revenue grew 20% YoY with consolidated Net Profit growth of 102% YoY.

- The company saw growth in consolidated EBITDA of 20% YoY in FY21. EBITDA margins fell 260 bps YoY to 10.4%.

- Overall, India’s business grew 29% YoY with a volume growth of 12% in beverages & 11% in foods. The company has a cash position of Rs 2421 Cr.

- Distribution points for tea rose 15% YoY and salt rose 11% YoY. TCPL is on track to reach 1 million direct outlets by Sep ’21. E-commerce contribution has risen to 5.2% of sales vs 2.5% last year.

- The India Beverages business showed revenue growth of 53% YoY & volume growth of 23% YoY in Q4. The business saw 32% YoY revenue growth in FY21 and a market share gain of 100 bps. Coffee Volume grew 19% YoY with revenue growth of 36% during FY21.

- The India Foods business showed revenue growth of 22% YoY & volume growth of 21% YoY in Q4. Salt revenues grew 26% in Q4 with a market share gain of 180 bps in FY21. The value-added salt portfolio has grown 75% in FY21. Pulses grew 26% in FY21. Launched 5 products under Tata Sampann Ready to Cook (RTC) portfolio in Q4.

- NourishCo had revenue of Rs 188 Cr in FY21 and saw 86% YoY revenue growth in Q4. Tata Water Plus sold 1.3 x volumes in FY21.

- The Tata Coffee division saw value growth of 14% YoY in FY21 & 30% YoY in Q4. Plantations revenue grew 24% YoY and Extractions revenue grew 12% YoY in FY21. Vietnam plant now operating at near peak capacity.

- In the Starbucks JV, the company saw a 14% YoY revenue growth in Q4 and a 33% revenue decline in FY21. Around 94% of stores are operational. 39 new stores and 7 new cities are added in FY21.

- The UK tea business saw revenue growth of 2% YoY in FY21 & a revenue decline of 10% YoY in Q4. It maintained a market share of 20% in the everyday black tea segment. Teapigs revenue grew 18% YoY in FY21.

- The USA coffee business saw a 9% & 3% YoY revenue growth in FY21 & Q4 respectively. The tea business saw revenue growth of 16% YoY in FY21.

- In Canada, the company saw revenue growth of 15% & 6% YoY in FY21 & Q4 respectively. Tt maintained a market share of 29.3%.

- The Board recommended a final dividend of Rs 4.05 per share for FY21.

Investor Conference Call Highlights

- TCPL added about INR 2,000 crores to the top line in FY21.

- Consolidated EBITDA for the year is also up 20%, with strong margin expansion in International and India Foods. India Beverages faced margin pressure due to inflation in raw tea prices.

- TCPL is now at 2.4 million outlets in terms of total reach.

- The company has added 2000 rural distributors in FY21.

- Kanan Devan had a relaunch during the quarter. A&P spend in Q4 was up 18% YoY.

- Q4 saw the relaunch of Tetley with Vitamin C & the pilot of Tata Tea Gold Care in some cities in the South.

- TCPL also launched Tata Coffee Sonnets, its direct-to-consumer coffee product, & Tata Tea 1868, a range of gourmet tea, in Q4.

- 100% of distributors are now online on the sales force and distributor management system.

- TCPL has also gone live with its ERP system.

- The company also launched thin poha & haldi doodh in Q4.

- It launched a new brand called Fruski under NourishCo in Q4 which got good response in pilot cities of Hyderabad and Vijaywada.

- TCPL is now realizing between INR 5 crores and INR 7 crores of monthly run-rate cost synergies alone.

- The Soulfull integration should be done in the next 3 months.

- The management states that TCPL has completed internal S&D integration and is now focused on adding outlets.

- The major market share capture taking place across all segments is from the unorganized sector.

- Although Sampann growth has tapered in H2, the management has stated that it has been finetuning this business and the segment should come back to high growth soon.

- The company has still not passed on the entire price increase in tea to the consumers and it will do so on steps going forward if tea prices do not come down.

- Although there is a capacity constraint for salt from Tata Chemicals, the company is increasing its capacity to align with the growth expectations of TCPL.

- The management expects tea prices to moderate as the hyperinflation last year was mainly on account of lockdown and bad weather in July.

- Despite the drought-like condition in April in Assam, the management is confident of prices normalizing for tea going forward.

- The opportunity size of the pulses market is Rs 1.5 lac Cr.

- The BigBasket acquisition by Tata Sons should provide the opportunity to leverage synergies and work closely for TCPL.

- The pulses business is seen as a very high-volume opportunity at a decent margin today by the management. The management hopes to convert the decent margin to a high margin over the years with its enhanced brand value to be able to weather RM price volatility.

- The concept behind Fruski is Indianized juice variants or street drinks for ready consumption.

- The dividend in FY21 is at 405% vs 270% last year.

- The company has been able to reduce days of sales from 59 to 42 with the digitization of the supply chain.

- According to the management, Sampann, both pulses, spices, and nutrimixes are significantly underleveraged in the overall GT distribution system and thus there is big room for market capture & distribution expansion here for these products.

- The short-term slowdown in the modern trade channel is being mitigated by the growth in the e-commerce channel for TCPL.

Analyst’s View

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen good growth in both value and volume terms across all segments, especially in the tea and salt businesses in both Q4 & FY21. It has also been able to complete almost all of the internal integration and is now focussing on expanding the reach. The long-term growth runway for both Sampann and nutrimixes remains intact, especially given its underrepresentation in the general trade channel. The margins in the tea business have remained subdued due to high RM costs but the management expects it to come down going forward. It remains to be seen how the company’s tea prices affect TCPL’s margins going forward and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 1988 | 1488 | 33.60% | 1770 | 12.32% | 5409 | 4456 | 21.39% |

| PBT | 176 | 194 | -9.28% | 231 | -23.81% | 721 | 634 | 13.72% |

| PAT | 136 | 143 | -4.90% | 169 | -19.53% | 538 | 453 | 18.76% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 3089 | 2522 | 22.48% | 2808 | 10.01% | 8643 | 7322 | 18.04% |

| PBT | 292 | 264 | 11% | 321 | -9.03% | 1113 | 826 | 34.75% |

| PAT | 237 | 189 | 25% | 234 | 1.28% | 860 | 585 | 47.01% |

Detailed Results

- The consolidated performance was good at 22.5% YoY growth in revenue and 25% YoY PAT growth for Q3.

- The company saw growth in consolidated EBITDA of 12% YoY. EBITDA margins fell 120 bps YoY to 11.9%.

- Overall India business grew 36% YoY. The company has a cash position of Rs 1550 Cr.

- TCPL acquired 100% equity stake in Kottaram Agro Foods Pvt Limited (Soulfull). Operational integration to be completed by Q2FY22.

- Integration expected to be substantially completed by Q4 FY21.

- 100% of all channel partners have been digitised and dedicated sales reps have risen 30% in 9M.

- The India Packaged Beverages business showed revenue growth of 19% YoY & volume growth of 12% YoY in Q3. India tea business saw 43% YoY revenue growth, 10% YoY volume growth and 94 bps market share gain.

- The India Foods business showed a revenue growth of 19% YoY & volume growth of 12% YoY in Q3. Salt revenues grew 19% in Q3 with market share gains. The value-added salt portfolio has grown 2.7 times. Pulses grew 35%. Launched new products Poha and nutria-mixes in Q2.

- NourishCo had revenue of Rs 33 Cr and saw 9% QoQ revenue growth. Tata Water Plus sold 1.6 x volumes in Q3.

- The Tata Coffee division saw value growth of 1% YoY. Plantations revenue grew 6% YoY and Extractions Volume fell 3% YoY. Vietnam plant now operating at ~93% capacity. Extractions business was impacted by global shortage of shipping containers and further lockdowns in Europe.

- In the Starbucks JV, the company saw a 90% YoY revenue recovery in Q3. Around 92% of stores are operational and 13 new stores and 3 new cities are added in Q3.

- The UK tea business saw revenue growth of 1% YoY with volume growth of 5% YoY. It maintained a market share of 20.3% in the everyday black tea segment.

- The USA coffee business saw a 7% YoY rise in volumes and 6% YoY revenue growth. The tea business saw revenue growth of 18% YoY & volume growth of 22% YoY.

- In Canada, the company saw revenue growth of 24% YoY in Q3 and it maintained a market share at 29.5%. The volume growth in the quarter was 19% YoY.

Investor Conference Call Highlights

- TCPL exited the Map Coffee business in Australia for the sake of portfolio rebalancing.

- The company has trimmed down the number of distributors by about 63% and all distributors are now 100% food and beverage.

- Unique outlets built for 3 months are up by 65%.

- The SoulFull portfolio straddles multiple consumer occasions, breakfast, snacking, mini-meals, convenience, healthy, clean label, no maida offerings targeted for millennial families. It also has a reach of 15,000 outlets.

- The acquisition was done for Rs 156 Cr for 100% equity stake.

- The founders and key management will remain with the company at their normal posts.

- The estimated market size for TCPL’s health and wellness offerings portfolio is at Rs 20,000 Cr and is expected to grow to Rs 40,000 Cr in next 5-6 years.

- In the U.K., after growth in Q2, black tea has started to get into declining territories, but we continue to see strong growth in Fruit & Herbals.

- In USA, TCPL saw a decline in regular black tea after strong growth in Q1 and decent growth in Q2. Coffee continues to grow at 7-9% rate.

- Canada saw growth both in black tea and in speciality tea.

- The company’s super premium brand Teapigs grew 32% YoY in Q3.

- Tea inflation in India remains a challenge in the near term according to the management.

- The management maintains that there is ample room for growth in the Salt business both on the mass and value added end.

- The management has stated that Soulfull already has a good product portfolio and it will be currently looking for distribution expansion for Soulfull and then look to expand the product portfolio.

- The biggest permanent impact from COVID-19 was the increased consumption of beverages in home and the rise of tea here.

- Pantry loading is indeed expected to continue but it will be declining going forward.

- Soulfull had revenues of Rs 39 Cr in FY20.

- The tea prices are expected to soften once the new crop comes in by the end of April.

- The management sees geographic expansion, capacity expansion and portfolio expansion as the key for NourishCo in the near future.

- Although the company has very little presence in the retail coffee space in India, the management believes that this business can expand fast through the company’s brand strength and distribution reach.

- The Sampann business has seen 5x growth in the Poha portfolio and is also introducing thin poha to expand the portfolio.

Analyst’s View

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen good growth in both value and volume terms across all segments, especially in the tea and salt businesses. The company has a good opportunity for growth in the health and wellness segment with the recent acquisition of Soulfull. This increases TCPL’s health portfolio to a massive addressable market of Rs 20,000 Cr which is expected to double in 5-6 years. It was also able to pass on the increase in tea and salt prices directly to consumers and also gain market YoY. It remains to be seen how the company’s wholesale businesses which was the worst hit from COVID-19 fare going forward and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution-reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1770 | 1462 | 21.07% | 1651 | 7.21% | 3421 | 2967 | 15.30% |

| PBT | 231 | 205 | 12.68% | 314 | -26.43% | 545 | 439 | 24.15% |

| PAT | 169 | 155 | 9.03% | 232 | -27.16% | 402 | 310 | 29.68% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 2808 | 2375 | 18.23% | 2747 | 2.22% | 5554 | 4801 | 15.68% |

| PBT | 321 | 262 | 22.52% | 500 | -35.80% | 821 | 562 | 46.09% |

| PAT | 273 | 208 | 31.25% | 346 | -21.10% | 619 | 398 | 55.53% |

Detailed Results

- The consolidated performance was good at 18% YoY growth in revenue and 22.5% YoY PBT growth for Q2.

- The company saw growth in consolidated EBITDA of 26% YoY for Q2. EBITDA margins expanded 90 bps YoY to 14.4%.

- Overall India business grew 25% YoY. The company has a cash position of Rs 1439 Cr.

- Realisation of benefits from synergies to start from Q3 onwards. Outlets reach expanded by ~12% till Sep’20.

- The India Packaged Beverages business showed revenue growth of 29% YoY & volume growth of 12% YoY in Q2. Margins stable YoY despite unprecedented inflation in raw tea prices.

- The India Foods business showed a revenue growth of 13% YoY & volume growth of 6% YoY in Q2. Salt revenues grew 10% in Q2 with market share gains. The value-added salt portfolio has grown by ~100%. Pulses grew 35%. Launched new products Poha and nutria-mixes in Q2.

- NourishCo had revenue of Rs 38 Cr and was at 87% of pre-Covid levels in Q2 and 101% in Sep. Highest ever volumes achieved for Tata Water Plus in Sep’20.

- The Tata Coffee division saw volume and value growth of 17% YoY. Plantations volumes grew 6% YoY and Extractions Volume grew 11% YoY. Vietnam plant now operating at ~90% capacity.

- In the Starbucks JV, the company saw a 70% YoY revenue recovery in Q2. Around 86% of stores are operational and 11 new stores and 1 new city added.

- The UK tea business saw revenue growth of 4% YoY with volume growth of 7% YoY. It maintained a market share of 20.5% in the everyday black tea segment.

- The USA coffee business saw a 1% YoY decline in volumes and 4% YoY revenue growth. The tea business saw revenue growth of 11% YoY & volume growth of 8% YoY.

- In Canada, the company saw revenue growth of 1% YoY in Q2 and it maintained a market share at 29.5%. The volume decline in the quarter was 7% YoY.

Investor Conference Call Highlights

- The reworking of the Sales & Distribution system has seen the completion of 2 out of 3 phases.

- Operating profit grew by 24% YoY. There were exceptional items of Rs 19 Cr in standalone and Rs 24 Cr in consolidated terms which were primarily representing integration costs and redundancies arising out of the restructuring of the business.

- The company is looking to maintain a cautious outlook due to the second wave phenomenon in most major western economies.

- Tea inflation in India remains a headwind in the short term for the company.

- The company expects a shortfall in tea production for the full year which should put pressure on the inventory.

- For the new product segment of Nutri-mixes, the company is focussing largely on e-commerce.

- The management expects the branded side of this new business to be growing at a pace of 25-30% per year going forward.

- The rise in margins in international tea businesses is mainly due to a slight fall in commodity prices and better product mix as the company moves towards the premiumization of its portfolio.

- The projected synergies of 2-3% margin appreciation are expected to come half from the revenue side and a half from the cost side. At present, the company is focussing on cost synergies and as time goes on, the company expects acceleration on these synergies flowing in.

- The company takes price increases in Tata Salt based on input cost increases. This was the main reason behind the price increase of 5% in Tata Salt in Oct.

- The company is looking to not only dominate the market share and volumes in the salt business, it is also looking to expand its market portfolio and help in premiumization of category.

- The objective in Sampann’s business is to increase penetration as it is still at a nascent stage.

- The company has multiple products launched lined up for Tea and Coffee including a reformulation and a relaunch of the entire Tata Coffee range in the South.

- The company has gone on in a very analytical manner in designating integrated distributors for every city and is considering all distributors regardless of category for investment and expansion.

- Roughly half of the tea industry is still unbranded and the shift to branded has slightly accelerated in the year.

- Similarly, in pulses, the majority of the industry is unorganized which should provide good growth opportunity for Sampann which is the only branded in the category at present.

- The company is indeed on the lookout for inorganic opportunities and is also maintaining a large cash position to stand ready to take any arising opportunities in fast-rising segments like Sampann.

- Although there some established players in the ready-to-eat segment, the category is still small and has a big potential for growth and thus competitive pressure is not as high as it seems.

Analyst’s View

Tata Consumer Products has a very good product portfolio in diverse F&B segments and strong brands like Tata Tea under its umbrella. The company has seen good growth in both value and volume terms across all segments, especially in the tea and salt businesses. The company has a good opportunity for growth in the staples segment with Tata Sampann which saw good traction in the quarter. It was also able to pass on the increase in tea and salt prices directly to consumers without losing any market share thus highlighting the brand’s strength. It remains to be seen how the company’s wholesale businesses which was the worst hit from COVID-19 fare going forward and how the company will fare against other branded players like ITC in the fast-rising branded staples category. Nonetheless, given the company’s leadership position in its top brand segments, its enhanced distribution-reach after the merger, and the incoming synergies and benefits from integration, Tata Consumer Products remains a good FMCG stock to watch out for.

Q1FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 1651 | 1505 | 9.70% | 1352 | 22.12% |

| PBT | 314 | 235 | 33.62% | 96 | 227.08% |

| PAT | 232 | 155 | 49.68% | 71 | 226.76% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 2747 | 2425 | 13.28% | 2427 | 13.19% |

| PBT | 499* | 300 | 66.33% | -17** | 3035.29% |

| PAT | 389 | 198 | 96.46% | -50 | 878.00% |

*Includes a one-time gain of Rs 84 Cr from the conversion of NourishCo JV into 100% subsidiary and integration costs of Rs 21 Cr for the foods business.

*Contains exceptional item of Rs 264 Cr which mainly consists of impairment of goodwill related to business in Australia and tea business in USA. It also contains some business integration and reorganization costs after the merger with the consumer products division of Tata Chemicals.

Detailed Results

-

- The consolidated performance was good 13% YoY growth in revenue and 42% YoY PBT (before exceptional items) growth for Q1.

- The company saw growth in consolidated EBITDA of 37% YoY for Q1. EBITDA margins expanded 310 bps YoY to 17.9%.

- The India Beverages business showed a growth of 11% YoY in Q1 while the India Foods business grew 19% YoY in value terms and 8% YoY in volume terms.

- International beverages saw 23% YoY value growth for Q1 with volume growth of 27% YoY in Coffee and 4% YoY in Tea.

- Completed acquisition of the entire stake of PepsiCo in NourishCo in May 2020.

- There was a sharp increase in North India Tea prices during Q1FY21 owing to production impacted by lockdown and excessive rains in Assam.

- Tata Tea Gold showed >10% growth.

- The India Foods division saw Salt revenues grew 11% and record volumes sold in May & June for Tata Salt. Pulse & spices grew >50% YoY.

- The Tata Coffee division saw volume and value growth of 18% YoY and 12% YoY respectively with highest-ever quarterly sales in volumes. This Vietnam plant is now running at greater than 87% utilization and has turned EBIT positive.

- In the Starbucks JV, the company saw an 87% YoY revenue decline in Q1. Around 60% of stores are operational and 82% of orders are for delivery.

- The UK tea business saw revenue growth of 12% YoY with a volume growth of 7% YoY. It maintained a market share of 20.5% in the everyday black tea segment.

- The USA coffee business saw a 27% YoY growth in volumes and 26% YoY revenue growth. Tea business saw revenue growth of 25% YoY & volume growth of 26% YoY.

- In Canada, the company saw revenue growth of 32% YoY in Q1 and it maintained a market share at 29.2%. Volume growth in the quarter was at 28% YoY.

Investor Conference Call Highlights

- Tea prices continue to rise and it may affect margins in the short term.

- The company is in the process of implementing end-to-end digitization across both the sales & distribution side and the supply chain side, providing end-to-end visibility.

- The management states that the company is broadly on track to realize the estimated synergies announced at the time of the merger.

- The company is looking to double its direct reach in the next 12 months and double the total reach in the next 3 years.

- The company has a concentrated supply agreement for 5 years and R&D support for 3 years from PepsiCo for NourishCo.

- The management expects some problems to come up with coffee as TCPL’s primary customers facing issues on on-premise and out-of-home consumption because most of the coffee is consumed out-of-home.

- Starbucks launched India’s first Starbucks Drive Through at Zirakpur near Chandigarh.

- The company launched the Good Earth brand (which operates in the USA) in the UK in Q1.

- The main reasons for the revenue growth in foods business being greater than volume growth are:

- Increase in selling prices.

- Improvement in product mix.

- Reduced promotions.

- The company was able to gain market share in India Tea business despite passing on the increase in RM costs.

- The company’s immediate focus is to complete the merger integration by December and then it will look to explore new businesses or categories.

- The management has reassured that it will not be blindly chasing volume growth for tea. The management will also ensure that as inventory costs go up, this translates to an increase in pricing.

- The company will focus on setting up its distribution structure in urban areas before going to rural areas.

- The management states that Tata Sampann has good potential going forward and the company is looking to increase distribution reach for this division.

- The company is looking to flatten the distribution structure by implementing the salesforce applications with the front end connected with DMS and the distributors.