Brief Introduction

Syrma is a technology-focused engineering and design company engaged in turnkey electronics manufacturing services (“EMS”), specializing in precision manufacturing for diverse end-use industries. They are leaders in high-mix low volume product management and are present in most industrial verticals

Its clientele includes TVS Motor Company Ltd., A. O. Smith India Water Products Pvt. Ltd., Robert Bosch Engineering and Business Solution Pvt Ltd., Eureka Forbes Ltd Limited, CyanConnode Ltd., Atomberg Technologies Pvt. Ltd., Hindustan Unilever Ltd., Total Power Europe B.V.

Q4FY23 Updates

Financial Highlights & Results

Detailed Results:

- The net profit before tax (PBT) by about 61% in the same year.

- The company repoeted profit after tax (PAT) increase by 61%

- The order book as of March 31, 2023, stands at INR 3,000 crores, a significant increase from the previous year.

- In terms of financials, total income grew by 63% to INR 2,092 crores in FY23.

- The company reported that EBITDA showed a strong performance with INR 232 crores with 61.1% growth.

- The company reported a tremendous increase in the Finance cost i.e. 170.3%

- Total revenue for the last quarter was reported at 7,012 Million- increase of 33.7% QoQ & 84.8% YoY

- Total EBITDA for the last quarter was reported at 808 Million- increase of 36% QoQ & 142% YoY

- Total PBT for the last quarter was reported at 681 Million- increase of 51% QoQ & 180% YoY

- Total PAT for the last quarter was reported at 429 Million- increase of 25% QoQ & 153% YoY.

- Industry wise revenue divisions are as follows-

- Auto- 4,029 Crs an increase of 60.2% YoY

- Consumer- 6,597 Crs an increase of 156% YoY

- Healthcare- 1,633 Crs an increase of 0.9% YoY

- Industrials- 6,422 Crs an increase of 45.6% YoY

- IT & Railways- 1,802 Crs an increase of 16.7% YoY

- Industry wise material margins are as follows-

- Auto- Margin stood at 22.1% at the end of FY23.

- Consumer- Margin stood at 17.1% at the end of FY23.

- Healthcare- Margin stood at 53.9% at the end of FY23.

- Industrials- Margin stood at 29.9% at the end of FY23.

- IT & Railways- Margin stood at 19.8% at the end of FY23.

- EBITDA margin at the end of the FY23 stood at 11.1%

- PAT margin at the end of the FY23 stood at 8.5%

- ROCE stood at 15% in FY23 vs 16.8% in FY22.

Investor Conference Call Highlights

- The company plans to focus on building a sustainable and profitable organization and has set up a subsidiary for design and development services.

- The company expects revenue to grow by about 35% to 40% in the coming years and aims to sustain a doubledigit EBITDA.

- The company maintained a net cash position of approximately INR 537 crores as of March 31, 2023.

- They plan to deploy INR 200 crores to INR 260 crores for capital expenditures in FY24.

- Syrma SGS aims to reduce net working capital by 5 to 10 days by the end of FY24.

- The company has a diversified customer base in sectors such as automotive (both combustion and electric vehicles), refrigeration and air conditioning, industrial parks, electric charging infrastructure, and infrastructure electronics.

- The company’s consumer business, although with relatively lower margins, benefits from high volumes and efficiency on the production lines.

- Working capital control in the quarter was impressive, with a target of reducing inventories to below 80 days. However, there is still progress to be made in reducing inventories.

- The tax rate increase in the quarter was due to short provisioning in the previous nine months. On a fullyear basis, the tax rate is expected to be evenly distributed.

- The IT business constituted around 7% of the revenue and is expected to benefit from the recently announced favorable IT policy. The margins in the IT business are in line with other products in the consumer space, and the value addition is higher due to the high unit value.

- The company’s focus is on delivering doubledigit EBITDA on a sustainable basis, and while gross margins may fluctuate quarteronquarter, there is no significant downside expected in the margins on a sustained basis.

- Healthcare and industrial segments are expected to have robust growth, with industrial growing around 46% and healthcare growing in the early teens.

- Margin differential between ODM (Original Design Manufacturer) and contract manufacturing business is expected to be around 2% to 5% on a longterm sustainable basis, leading to better EBITDA with improved material margin.

- Fuji, one of the machine suppliers, is not setting up a PCB capacity according to the Managing Director. The company specializes in equipment and is expected to continue in that field.

- The entry of Chinese companies into India is seen as an opportunity rather than a threat. It opens up possibilities for partnerships and manufacturing specialized products in India. The company believes it can benefit from this and expand its presence in verticals where it is currently not present.

- The impact of EU’s retaliatory tariffs on exports is not expected to have a significant adverse effect on the company. There is positive interest in sourcing from India, and major multinationals have shown interest in partnerships. The entry of companies like Apple into India changes the perception and can benefit the industry.

- Apple’s ecosystem shift to India may not directly impact the EMS (Electronics Manufacturing Services) industry, as Apple may continue working with Foxconn or Wistron for EMS. However, Tier two and Tier three companies entering India due to the positive perception created by Apple’s entry can provide business opportunities for companies like the one in the conference call.

- Manpower availability is seen as a challenge in the industry, but the company believes it can address it through attraction, engagement, and resolving attrition issues. Manpower availability will be a key factor going forward, as the electronics industry is expected to grow at a significant rate.

- The dividend recommendation is seen as a way to reward shareholders who have invested in the company. The company has made profits and has adequate cash reserves to support the dividend payment. It aims to involve shareholders in the growth journey without compromising longterm objectives.

- The company’s vision is to be a designled engineering and electronics manufacturing company, maintaining doubledigit EBITDA growth, and being a responsible corporate citizen. It is focused on organic growth, diversifying its customer base, and spreading across industry verticals. The company is investing in building organizational structure to support the accelerated growth.

- The company has received the ProductionLinked Incentive (PLI) for telecom and airconditioning, and expects positive impact from the recently announced IT PLI. It anticipates an exciting growth trajectory for the next few years with profitability, while acknowledging the challenges that come with rapid expansion.

Analyst’s View

The company reported a strong quarter with revenue growing by 70% despite exports remaining subdued due to global economic issues. The company has a strong biz model with exposure to different industries. It is also doing major capex which will further give impetus to growth.However, it remains to be seen how the company will be able to grow sustainably at this rate given the high valuations which seems to have baked in this underyling growth expectations, coupled with weak global demand scenario owing to war & semiconductor issues looming. However, given its strong growth prospects, it remains an interesting stock to keep track off.

Q3FY23 Updates

Financial Highlights & Results

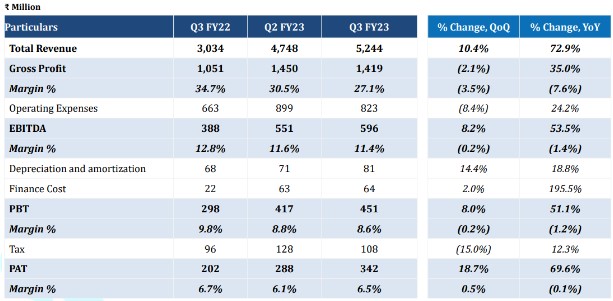

Detailed Results:

- Sales grew by 73% YoY while PAT increased by 70% YoY.

- GPM dropped significantly from 34.7% to 27.1% YoY.

- EBITDA margins stood at 11.4% Vs 12.8% YoY.

- Export Revenue stood at 26% of Revenue from Operations.

- Net debt stood at (559.6) Crs.

- Net working capital days improved from 96 days to 80 days YoY while ROCE pre & post adjustment for Unutilised IPO proceeds & Goodwill stood at 13.4% & 22.5%.

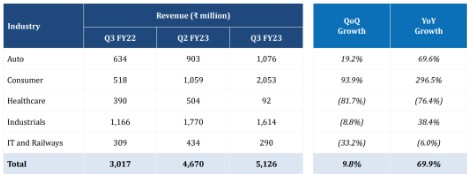

- Revenue growth for the segments stood as:-

- Margins for the reported segments stood as-

Investor Conference Call Highlights

- The company is building more ODM-type development with current and new customers.

- As of December 31, 2022, the company has an order book of Rs.2100 Crores, which would be executed during CY2023 spilling over to CY2024.

- The growth in a few sectors like healthcare and exports has been muted because of the recessionary conditions and inflation in Europe, however, the management continues to be bullish on the long-term prospects.

- The gross material cost increased by 300 basis points to 73% quarter on quarter as a factor of softening of the export healthcare business coupled with higher growth & contribution of the consumer segment.

- The company has deployed around Rs.35 odd Crores of capex during this quarter and expects to incur another Rs.40 Crores to Rs.60 Crores in Q4 of this financial year.

- The. Inventory days have increased to 121 days from 108 days last quarter mainly on account of higher inventory built-up, as the company was expecting a Chinese New Year in the initial first two weeks of January. While On the receivables side, there is a saving of almost 12 days on a quarter-on-quarter basis & with trade payables stay flat.

- The management expects a rebound to happen in Q1 of FY24 on the export front.

- The consumer biz grew due to its entry into the fiber-to-home devices and the telecom PLI scheme. The management explains this growth is sustainable & that the industry is price sensitive leading to lower margins, but higher turnaround times ensure good returns on capital deployed.

- The company sees good opportunities in EV mobility as well as the charging station segment & is witnessing good inquiries.

- The margins in consumer materials have deteriorated due to a lower proportion of ODM (exports) from 26% to 11%.

- The company’s gross block currently stands at 400 Crs & expects to do a capex of 200-250 Crs in FY24.

- The Gurgaon facility has a utilization of 50% while the Chennai facility was commissioned recently.

- The company targets a ROCE of 25% internally.

- The current asset turns to stand at 5.6X times while they are expected to be at 6-8X for the new biz.

- Order book split involves 35-40% of exports. Industry-wise split involves 35%- 40% from the consumer sector, 20% plus from the auto sector,18% to 20% from the industrial and about 7% to 8% from the Healthcare sector.

- The company targeted ODM contribution is 25%+.

- The management expects to receive PLI benefits by Q3FY24.

- Out of the total raise of around Rs.800 Crores, the company is expecting to use around Rs.300 Crores in the next year towards capex, 100 to 150 Crs towards working capital, and the balance for general corporate purposes.

- The company doesn’t expects Q4 to be the biggest quarter always since this is the case only for companies more dependent on Govt. orders.

- The top 10 client concentration stands at 46-50%.

- The consumer business comprises fiber-to-home telecom, wearables for ‘Firebolt’, controllers for water purification & ODM businesses like controllers for energy-saving devices, brushless DC motors, etc.

- The major risk for the healthcare biz remains the recession in the West owing to its products being a discretionary spending types product coupled with possible dumping of products by China.

- The current box build as a percentage of total sales is hovering at about 14% to 15%.

- The management states that the stickiness of the customers is evident from their 20-30 years of relationships with the customers & the exports growing by 50% on a 9M basis despite a global slowdown is a testament to its superior biz model.

- PCBA contributes 70% of revenues.

- When new customers come in, it takes 12 to 18 months for high-volume production to start.

- The management explains that in the semiconductor space, The passive components pressures have eased out, but microcontrollers continue to be a challenging area because passive components have a wider manufacturing base whereas microcontrollers and active components have a smaller manufacturing base.

- The management is seeing freight costs easing YoY.

- The company is outsourcing the products for box-build from outside vendors since they have been in a relationship for 20 years & haven’t faced any problems due to this arrangement, further management believes doing backward integration is not a major issue however, the demand should offset the higher capex.

- In the Short term, margins are lower because of the capex cycle which has been set in because of front loading of the expenses to make the organization future-ready however, the management targets low double-digit margins in the long term.

- The company believes that Energy storage would be one of the biggest growth drivers for EV-related sectors & On the energy part energy conservation and energy efficiency are well placed with their own design on controllers for brushless DC motors for the fans and migrating it to other applications.

Analyst’s View

The company reported a strong quarter with revenue growing by 70% despite exports remaining subdued due to global economic issues. The company has a strong biz model with exposure to different industries. It is also doing major capex which will further give impetus to growth.However, it remains to be seen how the company will be able to grow sustainably at this rate given the high valuations which seems to have baked in this underyling growth expectations, coupled with weak global demand scenario owing to war & semiconductor issues looming. However, given its strong growth prospects, it remains an interesting stock to keep track off.