About the Company

Syngene International Limited is a contract research and manufacturing company which provides drug discovery and development services in India and internationally. The company serves start-up companies, pharma/biotech, agrochemical, chemical, nutrition, and animal health companies. It has partnerships with Bristol-Myers Squibb Co.; Baxter International Inc.; Amgen Inc.; Zoetis Inc.; GSK; Merck KGaA; Artelo Biosciences, Inc.; PharmAust Limited; HiMedia Laboratories; and Zumutor Biologics. The company was incorporated in 1993 and is based in Bengaluru, India. Syngene International Limited is a subsidiary of Biocon Limited.

Q4FY23 Updates

Financial Results & Highlights

Detailed results

- Syngene’s fourth-quarter revenue from operations grew by 15% over the corresponding quarter last year.

- The total revenue in quarter 4, crossed 100 million US dollars.

- The company’s EBITDA for the quarter was up 13%, Rs.365 Crores

- The company’s profit before tax is in the mid-teens translated to a profit after tax growth of 10% year-over-year

- The reported EBITDA margin for the quarter was 34.3%, broadly at the same level as compared to the previous year of 34.5%.

- The full-year EBITDA was at Rs.849 Crores versus Rs.736 Crores in the previous year an increase of 15%. Depreciation for the year increased by 13% in line with fixed asset addition.

Conference call highlights

- The company stated that development services had a particularly strong quarter as it caught up on projects that were deferred from the previous quarter due to supply chain delays and other COVID-related disruptions in addition to underlying organic growth.

- The company stated that total investment during the year was Rs.621 Crores, approximately $80 million

- The company stated profit growth was depressed a little by a higher effective tax rate in the quarter compared to last year.

- The company feels that there is a good demand in the marketplace for chemistry and biology as many of its Western clients came out of the pandemic and are getting back into their offices.

- The company stated that there are some elements of seasonality to its quarterly performance and the fourth quarter is often the largest of the year. Later the CP added, “The growth is nicely balanced, driven by solid delivery across all four.”

- The company stated that in manufacturing services, biologics manufacturing continues to make progress.

- The company will keep manufacturing Remdesivir till the pandemic persists.

- The company stated that it had concluded phase three of the expansion for our Hyderabad facility with a lab capacity to employ 200 scientists which brings the total number in Hyderabad to around 600.

- The company stated that In developmental services, it expects the “injectable fill-finish facility” to be completed in the first quarter of FY2023 and that will bring a new capability to the formulation business.

- The company stated that it had expanded its biologics manufacturing capacity. The growing demands for biologic manufacturing have encouraged the company to continue to build capacity year-on-year.

- When asked about future predictions, the company said that they are no longer counting on Remdesivir and it expects to deliver revenue growth in the mid-teens with an EBITDA margin of around 30% single-digit PAT growth

- The company stated that in a challenging year, it grew its revenues by 19%, maintained margins above 30%, increased its net cash position, and ended up with a strong balance sheet

- The company stated that revenue from operations for the fourth quarter grew by 15% versus the same quarter in the previous year.

- The company stated that there was a particularly strong performance from the development services division. The company is looking forward to seeing sustained growth in the research business as it has upgraded its technology capabilities across platforms and therapeutic areas.

- The company claimed that the manufacturing plant in Mangaluru is expected to be in a position to have key market regulatory approvals in the next 12 to 18 months. The company also stated that it considers this plant as a long-term asset that will provide a full return on investment once it has a proven regulatory track record and can attract a wider scope of projects.

- The company stated that the expenditure on raw materials increased by 390 basis points.

- The company stated that employment cost was reduced by 5% year-on-year due to a special bonus position that it made in Q4 last year to reward the staff for their efforts during the peak pandemic period.

- The company stated that general overheads are up by 24% from Rs.89 Crores in Q4 FY2021 to Rs.111 Crores in the current quarter.

- The company also made hedge gains, the hedge rate for 12 months was Rs.77 per US dollar against the spot rate of Rs.75.5 per US dollar and this delivered an improvement in margin by 50 basis points.

- The company stated that the effective tax rate of FY2021 to 12% because of a favorable court order. The effective tax rate for FY2022 was around 18% and this increase in the effective tax rate provided a headwind for the PAT growth.

- The company claimed it has a well-established position in the contract research market and a strong emerging presence in contract development and manufacturing services.

- The business portfolio, a decade ago, 80% of the company’s revenue came from the research business. Despite the strong and consistent growth in research services, the share of research business now is 66% of revenue indicating a visible shift in Syngene’s revenue mix towards development and manufacturing.

- The renewal for five years of the contract with Amgen together with the 10-year contract extension signed with BMS in FY2021 provides good visibility on the future of these facilities.

- The increase in raw material cost was offset by other cost elements, which increased less than the revenue growth.

- The company stated that the other cost which consists of selling expenses, IT cost, maintenance expenditure, and other general overheads, declined from 12.7% of the revenue in FY2021 to 12.5% in FY2022 driven by effective management of discretionary cost despite inflationary pressure.

- The company recorded an exchange gain of Rs.55 Crores for the full year versus a gain of Rs.17 Crores in the last year.

- Total assets capitalized during the year were around Rs.512 Crores approximately $68 million.

- Out of the total $80 million, the company invested approximately 70% in the research business, around 10% was invested in development services, another 10% was invested in the manufacturing business and the remaining investments were in common assets including added power grid capacity which is commonly used by all divisions

- The company stated that its inventory levels have increased to Rs.179 Crores from Rs.60 Crores at the beginning of the financial year, this was by design to ensure that there is no disruption in client deliveries due to the supply chain delays and to compensate for the increased lead-time for materials in case of biologics. The company expects to continue higher levels of inventory.

- With an improved growth trajectory, the company expects better operating leverage from FY2024.

- The company is assuming an increased tax rate of 25% in future years.

- The company stated that the level of business the company got from Remdesivir in Q1 last year is not expected to repeat again in Q1 of this year. Hence we may see a year-on-year decline in revenue in Q1. This will also likely depress the profit line for Q1.

- The company stated that it expects FY2023 to be good for topline growth, and its margin structure looks very well compared to many of its competitors around the world.

Analyst’s View

Syngene is an integrated research, development, and manufacturing organization providing scientific services from early discovery to commercial supply. The company’s services cater to a wide range of industrial sectors, including pharmaceutical, biotechnology, nutrition, animal health, consumer goods, and specialty chemical companies. Its culture of scientific innovation is driven by the expertise of our highly qualified team of 5,200+ scientists and supported by state-of-the-art infrastructure and market-leading technology. The company has been in the business for more than 25 years now. It remains to be seen how the company’s near-term performance will pan out given the steady rise in inflation. Given the company’s strong working, SyngeneLTD is a good Pharmaceutical stock to watch out for.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

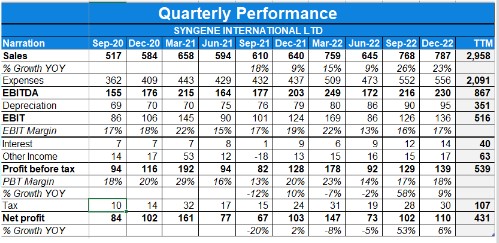

- Consolidated revenues were up 23% YoY in Q3. PBT grew by 9% & PAT by 6%.

- EBITDA margin decreased by 220 bps to 30.9%.

Investor Conference Call Highlights

- During the quarter, the company received regulatory approval for its commercial biologics operations from the USFDA, European Union’s EMA, and the UK’s MHRA.

- In the discovery services, the number of scientists has increased to around 800 and the company expects the completion of an additional 24,000 square feet of lab space and a new compound management facility in the current quarter.

- In the development services, the company completed the construction of a state-of-the-art, sterile fill-finish facility for small-scale clinical manufacturing & expects to start GMP production this quarter. This facility offers the ability to offer end-to-end solutions in drug product development and manufacturing for clinical supplies of small and large molecules.

- The company successfully completed the USFDA, EMA, and MHRA regulatory audits for the commercial-scale biologics manufacturing facility.

- The hedge rate revenue growth was in the high teens this quarter while Hedge losses during the quarter were INR16 crores.

- The EBITDA growth was lower than the revenue growth, primarily due to fixed-cost manufacturing, which currently has lower margins because of lower scale and capacity utilization. In addition, there are inflationary pressures on other operating expenses.

- During the quarter, staff costs increased by 12% year-on-year while other OpEx has seen a 33% increase YoY due to cost inflation as well as a step-up in business travel, sales promotion, and other overhead.

- The Finance cost increased from INR9.4 crores to INR13.7 crores due to the recognition of the interest component on newly leased assets following lease accounting as per accounting standard IAS under 16 coupled with addition to the rising interest rate on borrowings.

- The management believes that the slowdown in Biotech funding will be offset by the company’s value proposition.

- The fill-finish unit will be located in Bangalore & will have a clinical scale.

- The total capex for the Mangalore unit stands at $85 million.

Analyst’s View:

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen, and others. The Company had a decent Q3 with a revenue increase (excluding the contribution from Remedsvir) of 23% YoY The company expects the Mangalore API facility to get USFDA approval in the next 2 years. It remains to be seen whether the company will be able to maintain its growth momentum, how long will the elevated raw materials prices prevail, and what challenges it will face when expanding into the API industry. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- Consolidated revenues were up 26% YoY in Q2. Profit before exceptional items grew by 11% YoY in the same quarter due to higher tax rates & lower contributions from Remedisvir.

- EBITDA margin for the period was at 29.6% with EBITDA growing 22% YoY.

Investor Conference Call Highlights

- The company incurred an exceptional item involving a one-time downward adjustment of Rs.25 crores in the second quarter of last year on account of the government’s decision during that quarter to cap the Services Export Incentive Scheme (SEIS) Scheme for research and development services at Rs.5 crores cap for the financial year.

- The management states that the company’s proprietary integrated drug discovery platform, SynVent continued to gain traction & that portfolio currently stands at 18 integrated programs.

- The company anticipates manufacturing of the drug substance for Zoetis to begin in the fourth quarter of this financial year.

- The company’s small molecule manufacturing facility in Mangalore is on track to obtain the key regulatory approvals around the mid of the next financial year.

- The company invested close to US$30 million out of the US$100 million budget for the current FY. Half of that CAPEX went into research services, 30% into biologics, and the remainder into common infrastructure, safety-related improvements, replacement of old equipment, etc.

- Revenue growth excluding Remdesivir stood at 31% YoY.

- The depreciation of the rupee versus the US dollar strengthened the top line without commensurate benefit on the bottom line because the company booked hedge losses as a part of expenses.

- The material cost As a percentage of revenue from operations stood at 25.9% compared to 27.5% last year(which was high due to raw materials for Remdesivir). The current material cost is below the 27% guidance, and this will move up to the guidance level with the increasing share of manufacturing in its revenue.

- Staff cost increased by 15% YoY, and was at 28.4% of revenue from operations as compared to 31% in the second quarter of last year. The YoY increase is due to an increase in headcount, salary increases, and changes in the mix of the employee base.

- The direct cost which primarily includes power and utility costs increased 39% YoY and is now at 3.7% of the revenue from operations for the quarter compared to 3.4% for the corresponding period in the previous year. The increase is mainly on account of higher fuel prices for natural gas used for steam generation and high-speed diesel used for power backup.

- Other expenses which include travel, conveyance, repairs, maintenance, digitization, automation, and selling expenses increased by 32% YoY.

- Hedge losses during the quarter were Rs.19 crores reflecting the difference between the average spot rate during the quarter to the hedge rate.

- Other income for the period increased from Rs.12.9 crores to Rs.15.4 crores, an increase of 20% on the back of increasing yield on investments and fixed deposits.

- Profit before tax increased by 15% YoY, the lower growth as compared to EBITDA and EBIT is on account of higher interest rates and currency translation losses.

- The effective tax rate for the quarter was around 21.5% compared to 18.5% during the same period last year due to an increasing share of biz coming from non-SEZ locations.

- The management states that the entry of international innovators in India like Baxter won’t affect the company’s business as they will work together given the company’s scale of operations & expertise in the local market.

- The management expects to benefit from funding dry-out in the Biotech space in the US since the startups will look to partner with Syngene to get the benefit of cost arbitrage & still maintain the quality Vs global peers & help reduce the cash burn.

- The company’s Synvent platform is an integrated value chain offering to the clients on demand & the management defines it as a “fully integrated drug hunting, drug discovery, drug development platform & series of interlinked interconnected services”.

- The management believes that the company’s strong relationships with leading universities help in sourcing talent & innovation.

- The effective tax rate will move from 21.5% to 25% by FY25-26.

Analyst’s View:

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. The Company had a decent Q2 with a revenue increase (excluding the contribution from Remedsvir) of 26% YoY The company expects the Mangalore API facility to get USFDA approval in the next 2 years. The management increased its guidance from mid-teen to high-teen revenue growth. It remains to be seen whether the company will be able to maintain its growth momentum, how long will the elevated raw materials prices prevail, and what challenges it will face when expanding into the API industry. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q1FY23 Updates

Financial Results & Highlights

Detailed Results:

- Consolidated revenues were up 9% YoY in Q1. Profit has fallen by 2% YoY in the same quarter due to higher tax rate & lower contribution from Remedisvir.

- EBITDA margin for the period was at 28.5% with EBITDA growing 6% YoY.

- The company signed a 10-year manufacturing deal with Zoetis worth up to $500Mn.

Investor Conference Call Highlights

- The company’s revenue growth for the quarter was muted due to a higher base in the previous year due to sales of Remedisvir.

- The company’s revenue & PAT growth (excluding Remedisvir) stood at 30% & 31% YoY.

- The management states that due to a healthy demand environment, supported by rupee depreciation, it is raising guidance for the year from mid-teens to high teens.

- The agreement with Zoetis to manufacture the drug substance for Librela will take Syngene into commercial manufacturing of large molecules, which is in line with its strategy to offer an end-to-end discovery development and manufacturing platform.

- The company’s overall investment in biologics has been about 550 million, and an asset turnover of around 1x is expected as it scales up the manufacturing.

- The company plans to invest $30 million in the current year, taking the cumulative biologics investment to $80 million by end of this financial year.

- The management states that wild swings in forex market will have an impact on EBIDTA margins because rupee depreciation improves the revenue line without any corresponding improvement in EBITDA, thereby reducing the reported EBITDA margin.

- The company’s Material costs decreased from 32.1% of revenue in the first quarter of last year to 24.6% in the first quarter of this year due to high raw material costs from Remdesivir in the previous year.

- The company’s Power costs increased from 2.2% of revenue in Q1FY22 to 2.6% in Q1 FY23 while staff cost as a percentage of revenue was flat at 28.2%.

- Depreciation for the period was Rs.86 crores compared to Rs.75 crores in the same period last year & this increase of 15% on YoY basis is due to the new investments.

- The tax rate stood at 20% Vs 18% YoY in line with the company’s guidance of increased taxes due to removal of SEZ incentives.

- The company is guiding on maintaining 30% operating margin despite the inflationary environment.

- The management believes that the Zoetis deal marks an inflection point for its biologics business.

- The company’s capex distribution for FY23 stands at $50 million for research, $ 30 million for biologics & the remaining $20 million for others.

- The management states that as it moves towards manufacturing, the overall inventory levels and the raw material costs will rise.

- The management believes that the biologics division will grow bigger than the small molecules division in the coming 1-2 years.

Analyst’s View:

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. The Company had a decent Q1 with a revenue increase (excluding contribution from Remedsvir) of 31% YoY The company expects the Mangalore API facility to get USFDA approval in the next 2 years. The management increased its guidance from mid –teen to high-teen revenue growthoetis. It remains to be seen whether the company will be able to maintain its growth momentum, how long will the elevated raw materials prices prevail and what challenges it will face when expanding into the API industry. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q4FY22 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 773 | 676 | 14.3% | 652 | 18.6% | 2654 | 2244 | 18.3% |

| PBT | 178 | 192* | -7.3% | 127 | 40.2% | 482 | 467 | 3.2% |

| PAT | 147 | 160 | -8.1% | 103 | 42.7% | 394 | 404 | -2.5% |

| Consolidated financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 773 | 677 | 14.2% | 654 | 18.2% | 2657 | 2249 | 18.1% |

| PBT | 179 | 192* | -6.8% | 128 | 39.8% | 484 | 469 | 3.2% |

| PAT | 148 | 160 | -7.5% | 104 | 42.3% | 396 | 405 | -2.2% |

*Contains an exceptional item of Rs 35 Cr

Detailed Results:

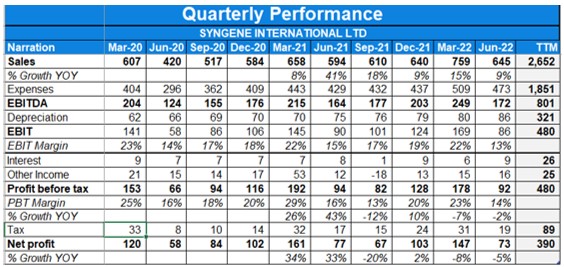

- Consolidated revenues were up 14% YoY in Q4. Profit has fell by 7% YoY in the same quarter while profit after tax before exceptional items was up 7% YOY.

- EBITDA margin for the period was at 34% with EBITDA growing 13% YoY.

- PAT margins stood at 19%.

- FY22 was decent for the company with revenue growth of 19% YoY and EBIDTA growth of 15%

- It also continued to manufacture remdesivir for COVID-19, under a voluntary licensing agreement from Gilead.

- The company is guiding for 30% EBIDTA margins due to higher investments & travel related expense, single digit PAT growth due to effective tax rate being higher by 200-300 Bps & revenue growth to be atleast in Mid-teens.

- The company is on track to receive huge regulatory approval for its Mangalore plant.

Investor Conference Call Highlights

- The company crossed the $100 million revenue mark in a quarter for the first time.

- The company’s expenditure on raw materials increased by 390 basis points due to the change in the mix with more early-stage manufacturing projects as well as input cost inflation.

- The Employment cost was reduced by 5% year-on-year due to a special bonus in Q4FY21.

- The hedge gains led to an improvement in the margin by 50 basis points

- The company’s effective tax rate stood at 18% Vs 12% YoY.

- The management states that supply chain challenges and long lead times constrained the growth of the biologics in FY2022, but it expects things to improve in FY2023 and expect biologics to contribute an increasing share of revenues.

- The company’s Investment during the year was Rs.621 Cr and this included capital projects under progress and capitalization of lease rentals from long-term lease arrangements.

- Out of the total investments in the current year, the company invested approximately 70% in the research business while it also added laboratory capacity in Hyderabad in two phases and expanded facilities in Bengaluru as part of the contractual commitment for dedicated centres.

- Around 10% was invested in development services mainly in completing the clinical scale fill-finish facility of its formulation operating unit & another 10% was invested in the manufacturing business mainly for the capacity addition of its fourth reactor in biologics as well as completing the microbial development and manufacturing facilities. The remaining investments were in common assets including added power grid capacity which is commonly used by all divisions.

- The management expects Q1FY23 to be significantly lower due to the very high contribution from Remdesvir (covid medication) in Q1FY22 which is not expected in the current quarter.

- The company expects strong growth from its manufacturing side from FY23-24 onwards.

Analyst’s View:

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. The Company had a mediocre Q4 with a revenue increase of 14% YoY. The company expects the Mangalore API facility to get USFDA approval in the next 2 years. The management remains confident of the company’s revenue growth guidance of 13-15%. It remains to be seen whether the company will be able to maintain its growth momentum, how long will the elevated raw materials prices prevail and what challenges it will face when expanding into the API industry. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 622 | 531 | 17.1% | 606 | 2.6% | 1228 | 966 | 27.1% |

| PBT | 82* | 94 | -12.8% | 94 | -12.8% | 176* | 160 | 10.0% |

| PAT | 67 | 84 | -20.2% | 77 | -13.0% | 143 | 141 | 1.4% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 623 | 533 | 16.9% | 607 | 2.6% | 1230 | 970 | 26.8% |

| PBT | 82* | 94 | -12.8% | 95 | -13.7% | 177* | 161 | 9.9% |

| PAT | 67 | 84 | -20.2% | 77 | -13.0% | 144 | 142 | 1.4% |

*Contains an exceptional item of Rs 30.7 Cr

Detailed Results:

- Consolidated revenues were up 17% YoY in Q2. Profit has risen 20% YoY in the same quarter. PAT before exceptional items was up 9% YoY.

- EBITDA margin for the period was at 31% with EBITDA growing 12% YoY.

- H1 was very good for the company with revenue growth of 27% YoY and PAT before exceptional items growing 19% YoY.

- The exceptional item in Q2 was related to the reversal of service export incentives.

- The company made key appointments in executive and operating leadership during the quarter.

- Syngene’s client base in biologics manufacturing expanded during the quarter.

- It also continued to manufacture remdesivir for COVID-19, under a voluntary licensing agreement from Gilead.

Investor Conference Call Highlights

- The export incentive benefit was capped at INR 50 million by the govt of India.

- The management expects the Mangalore API facility to get USFDA approval in the next 2 years.

- Material costs have risen from 24% of revenues last year to 27% of revenues in Q2FY22.

- The company is making procurements in advance to prevent any risks arising from potential disruptions.

- Syngene continues to see a rising number of new clients in Discovery Services, particularly in the emerging biopharma segment.

- The capex during the quarter was around INR 1 billion, which comprised of Discovery Services expansion at Hyderabad and Mangalore, expansion of dedicated centers, and investment in the new Biologics facility.

- The capex guidance has sustained between INR 7.5 billion to INR 9 billion during the year, and this included about INR 2.5 billion rollover from the previous year. In the first 6 months, Syngene has invested around INR 1.8 billion and has already committed close to INR 5 billion for execution.

- The management maintains the guidance for 13-15% revenue growth in FY22.

- The management expects the demand for biologics to rise a lot in the near future.

- The drop in gross margins was mainly on account of manufacturing remdesivir and due to an increase in raw material costs.

- The company has preferred to carry a higher inventory than usual because of uncertainty regarding logistics and supply chain issues in the world.

- The capex guidance for the year includes the expansion of the biologics plant.

- The management is confident of maintaining margins near 30% at the bottom and expects the revenues and to triple in 5 years.

- The management has clarified that the Mangalore plant is not margin dilutive and it should deliver good performance once the necessary approvals are done.

- The company’s profits have gotten affected due to the rise in inventory as many of the raw materials stocked like solvents are expensed immediately according to the management.

- At this point, 1/3 of revenues comes from dedicated centers, 1/3 from Discovery, and 1/3 from Development and Manufacturing.

- The management FDA approval for Syngene’s Mangalore plant to be done by H1FY24.

- The company also has a biologics facility that is a mammalian manufacturing facility and it is looking to get regulatory approvals for it too. The microbial facility has just come online and will take more time to get the necessary approvals.

Analyst’s View:

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. The Company had a decent Q2 with a revenue increase of 17% YoY. Besides continuing progress across all our business divisions, growth for this quarter was strongly boosted by the manufacturing of COVID-19 treatment, Remdesivir despite pressure from raw material price increases which have seen margins come to 31%. The company expects the Mangalore API facility to get USFDA approval in the next 2 years. The management remains confident of the company’s revenue growth guidance of 13-15%. It remains to be seen whether the company will be able to maintain its growth momentum, how long will the elevated raw materials prices prevail and what challenges it will face when expanding into the API industry. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q1FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 606 | 436 | 38.99% | 677 | -10.49% |

| PBT | 94 | 66.0 | 42.42% | 192* | -51.04% |

| PAT | 77 | 58.0 | 32.76% | 161 | -52.17% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 607 | 437 | 38.90% | 677 | -10.34% |

| PBT | 95 | 66 | 43.94% | 192* | -50.52% |

| PAT | 77 | 58 | 32.76% | 161 | -52.17% |

*Contains an exceptional item of gain of Rs 35 Cr

Detailed Results:

- Consolidated revenues were up 39% YoY in Q1. Profit has risen 33% YoY in Q1FY22.

- EBITDA margin for the quarter was lower at 29% in Q1FY22 as compared to 32% last year.

- The EBITDA margin excluding other income and export incentives was lower by 170bps from 29.5% to 27.8% during the quarter. This was primarily driven by higher material costs mostly due to the high level of manufacturing activities.

- The company has completed the second phase of expansion in Hyderabad and currently 300 scientists working out of this facility.

- The company has signed a five-year agreement with IAVI, to develop and manufacture three recombinant, monoclonal antibodies (mAbs) for HIV. The mAbs will be used for phase I and II human clinical studies.

- The revenue performance in the first quarter was also boosted by the manufacturing of remdesivir to fulfill high demand for the drug from Indian healthcare providers.

Investor Conference Call Highlights

- The revenue from operations grew 41% YoY to Rs 594 Cr. It was boosted by two factors which were the low base last year and the high demand for Remdesivir.

- The management expects the Mangalore API facility to get USFDA approval in the next 2 years.

- The drop in EBITDA margin during the quarter was primarily driven by the high raw material cost of remdesivir.

- Staffing costs have increased 21.9% YoY due to the addition of almost 500 employees in the past 12 months.

- The company did a capex of Rs 77 Cr in Q1 and it approved projects to build around 200,000 square feet of additional capacity catering to Dedicated Center and Discovery Services.

- According to the management, the cost of raw materials as a percentage of revenue grew from 24 percent in FY21 to 34.2 percent in Q1 FY22, due to owing to Remdesivir as well as the purchasing of raw material in advance,

- The company’s depreciation is Rs.74.7Cr, up from Rs.66.1Cr in the same period last year. The YoY is mostly due to new investments made in the last year.

- As part of the expansion agreement, the company also began the process of establishing a new 50,000 square foot dedicated facility for BMS, which is expected to be operational by the fourth quarter.

- The company is starting the third phase of expansion in Hyderabad, which will expand capacity by 200 scientists, and it will be completed in the second half of this fiscal year. It will have a capacity of filling 2000 vials per hour

- Syngene already has a clinical and commercial supply capability for oral dosage formulations, with a yearly production capacity of up to 30 million tablets.

- The expansion of the company BMS is going well, and they intend to expand the number of scientists actively involved in cutting-edge discovery science by 25% of the total 40 percent increase projected under this contract.

- In the biologics business, the company has commissioned a microbial platform with a 500-liter capacity and is now in the process of adding a 2,000-liter bioreactor to their mammalian biologics facility.

- The Indian Drug Regulatory Authority has approved the Mangalore API facility.

- The management maintains its previous revenue growth guidance of around 15% growth in FY22.

- The management is expecting production in the Mangalore facility to go up to 20% by the time it gets USFDA approval.

- The contract with 3DC is mainly discovery focused while the IAVI contract is mainly focused on development and trials.

- The CAPEX in the biologics industry has been close to $50 million as of now and according to the management, Capex is expected to rise by another 15-20% this year.

- The biologics business is mainly about manufacturing and a very small part is in discovery.

- Albireo, a client of Syngene, has received FDA and EMA approval for Odevixibat. Syngene supplies the API for this drug.

- The management states that Syngene is involved in cell and gene therapy discovery for several years for biotech clients.

- The management mentions that Syngene has the capability to work on projects involving new technologies like CRISPR Cas9 and protein degradation.

Analyst’s View:

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. The Company made a strong start to the financial year with a revenue increase of 38% YoY. Besides continuing progress across all our business divisions, growth for this quarter was strongly boosted by the manufacturing of COVID-19 treatment, Remdesivir despite the seasonal pressure seen in the CRAMS industry. The company also get approval from the Indian Drug Regulatory Authority for the Mangalore API facility which is expected to get USFDA approval in the next 2 years. It remains to be seen whether the company will be able to maintain its growth momentum and what challenges it will face when expanding into the API industry. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 677 | 628 | 7.80% | 601 | 12.65% | 2244 | 2094 | 7.16% |

| PBT | 192* | 153 | 25.49% | 116 | 65.52% | 467* | 516** | -9.50% |

| PAT | 161 | 120 | 34.17% | 102 | 57.84% | 404 | 412 | -1.94% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 677 | 628 | 7.80% | 602 | 12.46% | 2249 | 2094 | 7.40% |

| PBT | 192* | 153 | 25% | 117 | 64.10% | 469* | 517** | -9.28% |

| PAT | 161 | 120 | 34% | 102 | 57.84% | 405 | 412 | -1.70% |

*Contains an exceptional item of gain of Rs 35 Cr

**Contains an exceptional item of gain of Rs 71.3 Cr

Detailed Results

- Consolidated revenues were up with 7.8% YoY in Q4. Profit has risen 34% YoY in Q4 and 15% YoY when not accounting for exceptional gains.

- FY21 saw revenue growth of 7.4% YoY while profits fell 1.7% YoY.

- EBITDA margin at 33% in the quarter and 31% in FY21.

- Syngene extended strategic collaboration with Bristol Myers Squibb until 2030.

- It also completed qualification for Mangalore API facility for GMP certification.

- Syngene received ISO/IEC 27001:2013 accreditation for the majority of its units.

- Syngene also commissioned HPAPI lab to support scale up for manufacturing.

Investor Conference Call Highlights

- The contract extension with BMS should provide for a 40% increase in the number of dedicated scientists as well as adding some additional lab space.

- Syngene has 10 clients now on IDD projects.

- In the last quarter, 10 of Syngene’s scientists were cited in globally renowned publications.

- Syngene’s investments in digitization and automation have helped improve the speed of delivery and reduce the turnaround time.

- Digitization initiatives now completed include a complete upgrade of the quality management system, a sophisticated document management system as well as the more widespread use of laboratory information management systems.

- Syngene is manufacturing remdesivir under a voluntary license agreement with Gilead. This is not expected to yield any significant profits.

- The company has added 40 new clients in FY21 taking the total to >400.

- The BMS dedicated center now has more than 600 scientists.

- The raw material cost for the quarter has marginally increased from 25% of revenues to 26% due to a shift of business mix towards manufacturing of biologics.

- The headcount has risen 11% YoY to 5400 employees.

- The company saw a forex gain of Rs 5 Cr in Q4 vs a forex loss of Rs 1 Cr last year.

- The exceptional gains in Q4 were due to returns from insurance.

- The company has added capacity to its Mamilion capabilities with 1 additional 2,000-liter reactor.

- Syngene is also looking to start investing in viral vector development and manufacturing capability that will cater to clinical and commercial supplies of viral vectors to be used for cell and gene therapy. The manufacturing facilities will have a scale of operations up to 200-liter bioreactors, which can be further scaled up based on business needs. This initiative is supported by Biotechnology Industry Research Assistance Council under the National Biopharma Mission.

- BIRAC has also provided Syngene a grant to part-fund this project. The first phase of this plant will require around INR 200 crores of investment, and the plant will be ready for operations in 2 years.

- The CapEx plan is expected to be between INR 750 crores and INR 900 crores for the financial year 2022, including unspent CapEx rollover from the previous year.

- EBITDA margins have historically been in the range of 30-33% and are expected to stay in the same range according to the management.

- The management states that the biggest learning from the pandemic was to reduce dependence on physical sales channels and to enhance digital initiatives.

- The management has warned that there might be some margin compression in the near future owing to the hiring of new scientific and sales people in USA, EU and client locations.

- The company is awaiting approval for Odevixibat which is to be used to treat PFIC for children. This is the only treatment for the disease right now. This program is a good example of Syngene’s core integrated end-to-end offering according to the management.

- The management has guided for revenue growth close to 15% in FY22.

- Sales growth in $ terms excluding other income has been 12% YoY.

- The management states that the inherent advantage of India as a research destination is the widespread availability of Masters and PhDs as compared to western economies.

- Around 10% of revenues come from the non-pharma segment.

- The management maintains that in looking for capex projects, Syngene always looks to maintain asset turnover of 1 or more for a period of 5 or more years while revenue generation period should be at least 15-20 years.

- The management remains confident of the IDD potential for Syngene and states that the company’s ability to construct an integrated value chain right from IDD to manufacturing will be what drives its growth in the medium term.

Analyst’s View

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. It has seen a good Q4 with the contract extension with Bristol Myers Squibb until 2030. The company has also been enhancing its digital side to reduce turnaround time and improve efficiencies. The management remains confident that the IDD research capability and the end-to-end value chain construction ability will be what drives growth for Syngene for the next 5 years. It remains to be seen how long will it take for the company’s foray into CMO to bear fruit and whether there are any surprises in store for Syngene from the 2nd wave of COVID-19. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 601 | 539 | 11.50% | 531 | 13.18% | 1568 | 1466 | 6.96% |

| PBT | 116 | 106 | 9.43% | 94 | 23.40% | 275 | 363* | -24.24% |

| PAT | 102 | 92 | 10.87% | 84 | 21.43% | 243 | 292 | -16.78% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 602 | 539 | 11.69% | 533 | 12.95% | 1572 | 1466 | 7.23% |

| PBT | 117 | 107 | 9% | 94 | 24.47% | 277 | 364* | -23.90% |

| PAT | 102 | 92 | 11% | 84 | 21.43% | 244 | 292 | -16.44% |

*Contains an exceptional item of gain of Rs 71.3 Cr

Detailed Results

- Consolidated revenues were up with 12% YoY growth. Profit has risen 11% YoY in Q3.

- EBITDA grew 11% YoY in Q3 with EBITDA margin at 32% in the quarter.

- Syngene collaborated with Deerfield Discovery and Development (3DC) to advance integrated drug discovery projects, from early target validation through to preclinical evaluation. 3DC has awarded four new Integrated Drug Discovery (IDD) projects.

- Syngene has also expanded its research facility in Genome Valley, Hyderabad, India and added capacity for additional 90 scientists.

- Syngene has also set up a new RT-PCR testing facility that is approved by NABL and ICMR and has test >1 Lac samples.

- In the Discovery Services division, the Company has received NABL (National Accreditation Board for Testing and Calibration Laboratories) accreditation to provide safety assessment services for testing medical devices from its facility in Bangalore.

Investor Conference Call Highlights

- The 4 IDD projects from 3DC are in Oncology and Autoimmune segments.

- Syngene has currently close to 175 scientists operating out of the Hyderabad facility.

- The company saw EBITDA margin appreciation of 150 bps on improvement in direct cost with raw materials and power cost which has gone down from 28.5% last year to 27% currently.

- Staff costs increased by 16% to INR 176 Cr. Other expenses have risen 13% YoY due to new ways of doing business during the COVID-19 times and an increase in cost associated with maintaining necessary health and safety protocol.

- Depreciation rose 22% YoY to Rs 70 Cr owing to the investments in the Hyderabad facility, expansion at the main Bangalore campus and the commencement of the Mangalore commercial API plant at the end of the last financial year.

- Syngene recorded an exchange gain of INR 8 crores in the quarter. The effective tax rate was at 12.3% vs 13.9% last year. Forex gain in the 9M period was at Rs 12 Cr vs Rs 15 Cr last year.

- Capex in 9M was at $53 million. Of this, $8 million pertains to the commercial API manufacturing facility, another USD 16 million was invested in Discovery Services, USD 15 million was invested in dedicated centers, USD 7 million in the biologics manufacturing facility and a balance of USD 7 million in Development Services and other assets.

- The company maintains its guidance of spending USD 550 million by end of March 2021. Some part of this may spill over into Q1FY22.

- The company continued to work at near 100% operational levels in Q2 and Q3.

- Mangalore OpEx is diluting Syngene’s margin by close to 2%. The company has spent $75 million here and will be depreciating this number over 18 years.

- The management maintains that the company’s successful track record and its scientific capability are what led 3DC to choose it as its collaborator.

- Headcount numbers and people costs will continue to grow in absolute terms as people are a direct revenue generator in terms of how that business model works for Syngene.

- There is a general slowness around the whole of the industry globally on starting new clinical trials as all hospitals around the world are running close to full capacity due to COVID.

- The management has stated that most of the work Syngene does with BMS is under a research discovery relationship. It is working on the science today that will probably become new product approvals in about 8 years.

- The management has stated that it has expanded on the Mangalore facility to be able to win more integrated projects and expand upon the CMO opportunities in the future. The startup period for this venture is expected to be till the next 5 years.

- Although the company faces tough competition in the biologics space from global giants like Lonza and Samsung, the management is confident of the company’s value proposition and the space for agile, modestly scaled, and competent Biologics manufacturers in the industry.

- Constant currency growth in Q3 is above 10% YoY.

- The gestation period for the Mangalore expansion will be around 3-5 years before it starts showing a strong return on capital employed in that investment.

Analyst’s View

Syngene is a fast-rising player in the CRMO space and has established itself well with its associations with industry leaders in the pharma space like Bristol-Myers Squibb, Amgen and others. It has seen a good Q3 with revenues rising 12% YoY and EBITDA margins improving to 32%. The company has seen a good response to its CRO capability and this has resulted in its association with 3DC for its Integrated Drug Discovery platform. The management remains cautiously optimistic on its foray into contract manufacturing with the setup of the Mangalore facility. It remains to be seen how long will it take for the company’s foray into CMO to bear fruit and whether the company can continue its robust growth momentum on its current CRO capabilities. Nonetheless, given its scientific capabilities, its associations with industry leaders for drug discovery, and its expanding reach in the global pharma space, Syngene is a pivotal midcap pharma stock to keep in mind for all investors.

Disclaimer

This is not investment advice. Please read our terms and conditions.