Star Health & Allied Insurance Ltd (Star) is India’s first Standalone Health Insurance provider and is the largest private health insurer in India with a market share of 15.8% in the Indian health insurance market in FY21 with leadership in the attractive retail health segment.

Q4FY23 Updates

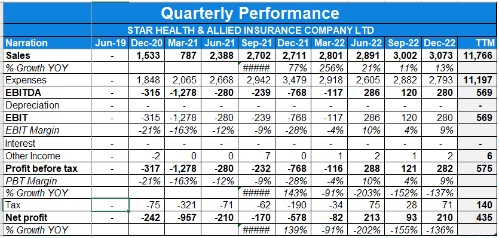

Financial Results & Highlights

Detailed Results:

- The company had a decent quarter with revenue rising by 12% while the company turned healthy profits Vs losses YoY.

- The combined ratio for the quarter improved to 91.3% Vs 98.4%.

- Opex/GWP stood at 14.5% Vs 14.8%.

- Quarterly Investment income improved from 1.8 Bn to 2.2 Bn YoY.

Investor Conference Call Highlights

- Premium growth for April stood at 27%.

- In Q4 ’23, the health insurance industry, including PA, has grown by 25.4% driven largely by 28% growth in group health and 16% growth in retail health.

- For 12M FY23The company’s retail health has grown by close to 18% versus the industry’s retail health growth of 15.3%, while for Q4, the segment grew by 16% vs the industry’s 15.2% leading to a market share of 35%.

- Star Health has registered close to 40% retail health acquisition market share in FY ’23.

- Agency business continues to contribute around 82% of the overall business with agency strength having increased to 6,25,860 agents, with a net addition of 16,165 agents in the Q4 of FY ’23. For the full year FY ’23, it added approximately 76,000 new agents over the previous year.

- The company’s app downloads have reached 2 million downloads while the Organic traffic to the website has grown by 95% in Q4 ’23 over the same period last year, and 39% growth sequentially over Q3 of FY ’23.

- The average sum assured of new policies has increased by 13% on a year-on-year basis to INR9 lakh per policy. INR5 lakh sum insured and above now constitute 70% of the health insurance portfolio, which was 64% in the last financial year.

- The premium from benefit products has grown by 53% in FY ’23 over FY ’22. The share of such products within the overall GWP has increased by 61 bps to 2.3% in FY ’23 from 1.7% in FY ’22.

- The company launched two new products in quarter four, which is Star Special Care Gold ( a product tailored specifically for individuals with disabilities and those who are HIV-positive) and Star Group Health Benefit Plus (critical illness covers up to 54 critical illnesses, to personal accident cover, hospital cash cover, and EMI protect due to hospitalization).

- The company is working on a four-pronged approach to effectively manage claims outgrowth -1)prudent claims settlement, based on its rich medical expertise and insurance system, 2) well-negotiated volume-based pricing arrangement with network hospitals, which gives it operating leverage in terms of lower average per claim, 3) technology-enabled fraud detection and mitigation And 4) risk-based pricing through micro-segmentation of the portfolio.

- 73% of the number of paid claims in the financial year ’23 are through cashless versus 63% in the previous financial year. In terms of the amount paid through cashless, it is 80% in FY ’23 compared to 71% in FY ’22.

- The share of hospitals with proper pricing arrangement,i.e. the cashless claims is 67% versus 64% in FY ’22.

- There is a 1.3% incremental benefit of anti-fraud digital initiatives in terms of lower claims ratio in FY ’23 versus FY ’22 and the SaaS platform has assisted in 55% of those cases.

- The expense ratio has fallen in FY ’23 to 30.3% versus 30.8% for FY ’22 on account of efficient cost control and management. For Q4 FY ’23, the expense ratio has reduced to 29.4% from 30.3% in Q4 FY ’22.

- The investment assets have grown to INR13,392 crores in FY ’23 versus INR11,373 crores in FY ’22.

- Solvency as on 31st March 2023 is 2.14 times compared to the regulatory requirement of 1.50 times.

- The company is confident about beating the industry growth rate in the retail segment in the coming period.

- The new ESOP’s will be issued at market price leading to no impact on P&L.

- Specialized products contribution came down due to certain underwriting costs however it is continuous to remain a key focus area for the company.

- Retail growth was split equally between value & volume growth.

- The company expects 55% to 60% value growth and 40% to 45% volume growth.

- Around 2.5% of policies are coming from long term plans & the company plans to improve on that front.

- The company’s ROE stood at 12.4% due to a one time ESOP expense, otherwise, the company is confident of reporting ROE of 16-18% for the coming year, especially since it has recently taken price hikes.

- The implementation of IFRS will lead to deferment of costs as well leading to a ROE increase by 300-400 points.

- The investment in equities through ETF stood at 4.1% & it plans to increase this to 7% in the coming period.

- The company believes that due to change in product & business mix coupled with new reforms regarding increasing the maximum number of tie-ups for corporate agents and Insurance Marketing Firms (IMF) to 9 (earlier 3) and 6 insurers (earlier 2 insurers) each, the combined ratio/ profitability is expected to improve.

- Unexpired risk reserve (URR) was higher owing to higher growth.

- The company signed up three banks in the last quarter, which includes India Post Payments Bank, Standard Chartered bank and ESAF Small Finance Bank & it strives to add more and more banks.

- Company added 18,000 exclusive agents in the quarter.

Analyst’s View

The company is the largest standalone health insurance company with strong operating metrics Vs its peers. The company saw a decent quarter & expects to clock ROE of 16-18% in the coming financial year. It remains to be seen how the company will be able to keep growing at a rate faster than industry given its products are priced at a premium to its competitors, coupled with high competition from other health insurance companies due to better partnerships with banks & other channels. However, given its strong market presence & good growth prospects in the industry, Star health remains an interesting stock to keep on one’s watchlist.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a decent quarter with revenue rising by 13% while the company turned healthy profits Vs losses YoY.

- The combined ratio for the quarter improved to 94.8% Vs 135% YoY.

- Opex/GWP stood at 16.5%.

Investor Conference Call Highlights

- In Q3, the health insurance industry including personal accidents has grown by 24.6% driven by 32% growth in group health and 17% growth in retail health.

- For nine months in 2023, the company’s retail health growth is 19.4% versus the industry retail health growth of 14.9%.

- In Q3 FY ’23 Star Health registered a 34% market share in retail health, which is 3x the second-largest player in the industry.

- Star Health has registered a 42% retail health acquisition market share in nine months of FY ’23 with Agency business contributing around 82% of the overall business for the company.

- The company’s agency strength has increased to 609,695 with an addition of approximately 23,700 agents in Q3 FY23. It is on course to add 80,000 to 100,000 agents in the current financial year.

- The premium from corporate channels like banks has grown by 49%.

- The company is focusing on the premiumization of its policies and the average sum assured of new policies has increased by 13% yearly to 8.8 lakhs per policy.

- The company implemented a hike in its flagship product, the Family Health Optima to combat the structural rise in medical inflation post-COVID of approximately 25% premium increase effective from 1st February.

- The premium from benefit products has grown by 70% in 9M on a YoY basis. The share of such products within overall GWP has increased by 79 bps to 2.3% in nine-month FY ’23 from 1.6% in nine-month FY ’22.

- The Rural business has grown by 48% during the quarter on a YoY basis. The number of rural agents has also grown by 69% to 3,861 agents in this particular quarter.

- The app downloads stood at 1.85 million downloads with The Star Power customer-facing app now available both on the Android and iOS platforms.

- The premium collected directly from the website, as well as through third-party web aggregators and online brokers has grown by 27% Y-o-Y and now accounts for close to 10% of overall GWP in nine months FY ’23. The Organic traffic to the website has grown by 44% in Q3 FY ’23 of the same period last year and 14% sequentially over Q2 FY ’23.

- The management explained its 4-prolonged claims settlement strategy as “ Number one, prudent claims settlement based on rich medical wisdom and insurance expertise. Well-negotiated volume-based pricing arrangement with network hospitals, which gives us operating leverage in terms of lower average claim size. The technology enabled fraud detection and mitigation. The fourth one is risk-based pricing through micro-segmentation of the portfolio.”

- 80% of the amount in these nine months of FY ’23 is settled in claims through cashless where Cashless turnaround time remains around 90% within two hours.”

- The share of hospitals with pricing arrangements stood at 76% Vs 64% YoY.

- The company’s anti-fraud digital initiative led to a 1.2% incremental benefit in terms of lower claims ratio in Q3 of FY ’23 compared to Q3 of FY ’22.

- The claims ratio in quarter three of FY ’23 has improved to 63.7% versus 104.6% in quarter three of FY ’22 and this was 68.2% for quarter two of FY ’23.

- The Solvency as on December 31, 2022, is 2.17 times compared to the regulatory requirement of 1.50 times.

- The share of Family Health Optima (FHO) to the total book stood at 46%.

- The company is seeing strong growth in the bancassurance biz & expects its network to increase due to a new rule where banks are allowed to have tie-ups with nine insurance companies each.

- The company’s current year growth will look muted due to its strategic decision of reducing the share of the group biz coupled with Q1 degrowth(in line with industry performance due to higher base effect). However, in the retail segment, it is comprehensively beating the industry in FY22 & expects to grow in the coming year by 20%.

- The management doesn’t expect to lose a high number of agents due to the composite license scheme since it has a very strong presence in the market.

- The company aspires to increase the share of benefits plans from the current level of 2% to 10%.

- The management while explaining the seasonality of the biz said “loss ratio of 62.4% is only for the month of Jan. For quarter three it is 63.7%. So there is seasonality and cyclicity also in the business. So monthly ratio cannot be a guiding factor for decision making”

- The company takes a price revision, not in anticipation but based on experience to achieve sustainable ICR for each and every product. And the price increases are taken considering that they will be sustained for three years.

- The management states that the price hike is being well accepted by the market and that’s being reflected in the initial results since it is seeing significant positive growth in new business for the third quarter.

- The company’s price hike of 25% is not uniform across the country & varies based on geography.

- The company’s strategy is to do quality growth of 18-20% while maintaining a combined ratio of 93-95%.

- The management while answering an analyst said that the combined ratio of Care health(92% of H1FY23) is not a correct comparison due to different accounting policies wherein they follow the 50% accounting method Vs the company’s 1/365 days.

- The company’s Opex is equally split between fixed & variable costs.

- The management explains that by giving additional services to the customer, it offers more than just reimbursing a claim.

- The company expects the share of the bancassurance biz to grow to 20% from current levels of 10%.

- The management states that health insurance is the toughest biz to crack, & since it has done that, it gives them the confidence to do well in life insurance as well in the future as & when they venture.

- The management believes that since health insurance is an engagement product Vs a commodity product, a price hike won’t have a major effect on its market share as having the best servicing is it’s USP Vs having the lowest cost.

Analyst’s View

The company is the largest standalone health insurance company with strong operating metrics Vs its peers. The company saw a decent quarter & expects to grow by 20% in the coming financial year. It remains to be seen how the market will absorb its price hike in FHO products, coupled with high competition from other health insurance companies due to either their lower pricing or better partnerships with banks & other channels. However given its strong market presence & good growth prospects in the industry, Star health remains an interesting stock to keep on one’s watchlist.