About the Company

SJS Enterprises Ltd. (SJS) is one of the leading players in the Indian decorative aesthetics industry in terms of revenue. It offers a “design-to-delivery” aesthetics solutions provider with the ability to design, develop and manufacture a diverse product portfolio for a wide range of customers primarily in the automotive and consumer appliance industries.

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

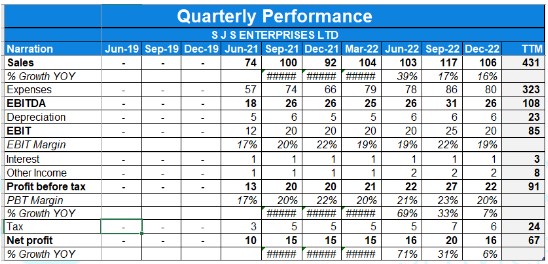

- SJS margin of EBITDA for the current quarter was 24.8%, impacted by product mix and export sales and the EBITDA stood at 27.18 Cr.

- Overall, SJS achieved a consolidated revenue growth of 2.4% YoY in Q4 FY23 and 18.3% YoY for the full year FY23.

- SJS maintained strong cash flow generation of INR 609.5 million for the year and has cash and cash equivalents of INR 1,648.2 million.

- Net Profit stood at Rs 15.39 Cr, with a margin of 14.4% in Q4FY23.

- In FY23, the company clocked its revenue at 433.05 Cr, a growth of 18.3% YoY

- In FY23, EBITDA stood at Rs 1,167.8 Mn with EBITDA margins at 26.4%, an improvement of 75 bps and a growth of 25.2% YoY

- In FY23, Net Profit stood at Rs 672.5 Mn, with a margin of 15.5%, an improvement of 127 bps YoY and a growth of 28.8% YoY.

- Revenue contribution is as follows

- 2W- 44.8%

- PV- 32.5%

- Consumer durables- 15.4%

- Others- 7.3%

- Strong Cash & cash equivalents position (including Investments) of ~Rs 1,648.2 Mn as on 31st Mar 2023

- SJS delivered a strong performance for FY23, with 23.1% YoY growth in the 2-wheeler segment and 27.8% YoY growth in the passenger vehicle segment

- Debt free company on net debt basis.

Investor Conference Call Highlights:

- SJS Enterprises made an acquisition of Walter Pack India to reinforce its market leadership in the decorative aesthetics business.

- The acquisition of Walter Pack India brings complementary and adjacent technologies of IMF, IMD, and IME, which have high growth potential and margin potential.

- A 3-year service and technology support agreement has been signed with Walter Pack Spain for ongoing exchange of know-how.

- The acquisition provides cross-selling opportunities and diversifies the end industry revenue split.

- Walter Pack India had interim revenue of INR 1,200 million with healthy EBITDA margins of around 30% for FY23.

- The acquisition is valued at approximately 7x FY23 EBITDA, with a total cash consideration of INR 2,393 million for a 90.1% stake.

- SJS aims to close the acquisition in the next 3 to 4 weeks and expects it to be EPS accretive in the current year.

- SJS plans to grow consolidated revenue by over 50% in FY24, with EBITDA and PAT expected to grow around 40%.

- SJS won new businesses and customers, including Mahindra, Maruti Suzuki, TVS, Royal Enfield, Honda, Uno Minda, Atomberg, Godrej, Litemed, Samsung, Altigreen, and Hop.

- SJS was certified as a Great Place to Work for the third time in a row among mid-sized organizations.

- SJS aims for future growth in the PV segment, especially after the Walter Pack acquisition.

- The company’s medium-term goals include building mega customer accounts, expanding share of wallet, and delivering new technology products across end segments.

- Key points from the investors conference call:

- Consumer durables witnessed a declining revenue share of 15.4% due to macroeconomic headwinds and rising inflation impacting demand in Europe and North American markets.

- Adverse geopolitical issues and macroeconomic challenges led to a decline in export business and impacted the sale of new generation products.

- The overall contribution of new generation products to revenue is 9% to 10% for FY23.

- Despite near-term challenges, the company remains confident in achieving medium-term growth targets in the consumer segment and maintaining a strong focus on exports.

- The acquisition of WPI is expected to significantly increase the share of revenue from passenger vehicles and the consumer segment.

- The acquisition also brings new technologies, such as 2K injection molding, laser decoration, and in-mold forming (IMF), which will provide a competitive advantage from a global perspective.

- SJS aims to become a significant player in the automotive interior space, offering decorative trims and high-quality IP prints for dashboards.

- The company’s medium-term growth strategy includes winning new businesses, increasing wallet share with existing customers, expanding into new geographies, and adding premium products to the portfolio.

- The guidance for revenue growth is 50%+ on a consolidated basis, including SJS, Exotech, and Walter Pack. The organic growth for SJS and Exotech together is expected to be around 20-25% for the next year.

- The 2-wheeler industry, which was impacted by government regulations, has recovered, and there are no major challenges expected in the upcoming quarter.

- Exotech is currently running at 80-90% capacity utilization, while Walter Pack and SJS are at around 60-65%.

- The company’s passenger vehicle growth exceeded the industry production volumes, and overall automotive 2-wheeler and 4-wheeler business grew by 3.6% YoY compared to a flat industry performance.

- The company focuses on strategic customers that have the potential for 2x to 3x growth over the last 3 years.

- EBITDA expected to grow at around 40%.

- The company is an important supplier to Mahindra but does not provide specific details about supplying all Mahindra EV and passenger vehicle segments.

Analyst’s View:

SJS is one of the leading players in the Indian decorative aesthetics industry. The company saw a mediocre quarter with revenue growth of 18.3% YoY. The company has been in the business for more than 25 years. It remains to be seen whether the company will be able to match the management growth guidance and how will its export business pan out in the future. Given the company’s strong position in its industry, SJS is an interesting small-cap stock to watch out for.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The revenue & adjusted PAT growth for Q3FY23 was 16% YoY & 29% each.

- The company outperformed the industry growth rate across all segments.

- EBIDTA margins stood at 26.1% while NPM stood at 14.8%.

- The company’s business highlights for the quarter include:

– added new marquee customers like Foxconn and IFB

– won many new businesses from its customers like Mahindra, Tata Motors, Toyota, Whirlpool, Electrolux, Royal Enfield

Investor Conference Call Highlights:

- The automotive segment grew by about 4% Y-o-Y, whereas SJS revenues in the Automotive segment grew 25%, surpassing the overall combined industry growth.

- The company added sales representatives in Columbia which will help strengthen its presence in Latin America.

- Exotech achieved FY22 full-year revenues in just 9M of FY23, with EBITDA margin improvement to 14% from 12.8% in FY22.

- ROCE for 9M stands at 33% Vs 27% for FY22.

- The two-wheeler and passenger vehicle shares of revenue have improved to 47% and 31%, while consumer durables witnessed a decline in revenue share to around 15% due to macroeconomic headwinds, and rising inflation that led to subdued demand in Europe and North American markets.

- The decline in exports impacted the sale of new-generation products and hence, the overall contribution of the new-generation products to revenues is around 11% to 12% for 9M FY23.

- The company’s free cash flow to EBITDA for 9M FY23 stands at a healthy rate of 53.4%.

- For passenger vehicles, the company is working on products that will increase its kit value from a current INR 1,200 to INR 1,500 by almost 3 to 4 times.

- For the two-wheeler industry, the company targets to increase the kit value from the current INR 300 to INR 500 by around 2 times with highly futuristic products.

- For the consumer appliances, it targets to increase the kit value from the current INR 50 to INR 150 by around 3 to 4x with the addition of futuristic products.

- The Board has passed an enabling resolution for fundraising, for an amount not exceeding INR 300 crores for future acquisitions.

- As per management, the company’s competitive edge is that it has a seamless design for manufacturing and delivery company coupled with very strong labor arbitrage in the export market.

- The management believes that the company’s involvement in early-stage product development also helps secure customers. Further, it competes on its capability to differentiate products and add value to the customers’ product Vs price.

- The product of Foxconn is already under development i.e. an optical plastic part for the 2-wheeler EV, and the company expects to see volume within the next year & further localization of contents in the future..

- Although export sales have been weak, the company hasn’t lost any clients.

- The other expenses rose sharply owing to one-time provisions made in Exotech due to a rate amendment request from the customer.

- The PE fund Everstone will look to exit at some point in the future but the Promoter(who has a 15% stake) will continue to work with the company & in fact his son has also joined the biz.

- Geographical revenue distribution for the export market stands at 30-35% in Europe & Asia each, 8-10% in USA & balance from other countries. While the exports’ contribution to overall revenues stands at around 7-8% Vs 12-13% in the previous year.

Analyst’s View:

SJS is one of the leading players in the Indian decorative aesthetics industry. The company saw a mediocre quarter with revenue growth of 16% YoY owing to poor performance in exports market. The company is gearing up for a CAPEX of Rs 100 Cr to expand its chrome plating division to meet the additional demand & is passing a resolution to potentially raise up to INR300 crs for further acquisition.. The management guides for an organic topline growth of 25% for the next 3 years. It remains to be seen whether the company will be able to match the management growth guidance and how will its export business pan out in the future. Given the company’s strong position in its industry, SJS is an interesting small-cap stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- The revenue & PAT growth for Q2FY23 was 17.3% YoY & 30.7% each.

- EBIDTA margins stood at 28% while NPM stood at 17.1%.

- The company’s business highlights for the quarter include:

-added leading customers like Skoda Auto Volkswagen India for chrome plating parts in the PV segment and Atomberg Technologies for IML parts of consumer appliances segment

– entered a new FMCG premium segment by adding John Distilleries as a customer for speciality decals.

– .added BuymyEV and TI India in Q2,( SJS now supplies to 12 leading EV manufacturers in the country)

-won new businesses with customers like TVS, Bajaj Auto, Royal Enfield, Mahindra & Mahindra, etc

– working with OEMs for futuristic products, such as illuminated logos & cover glass technology for the automotive center stack displays.

Investor Conference Call Highlights:

- The company’s superior growth in the two-wheeler segment compared to the industry volumes was on account of its new business wins and market share gains.

- For H1 FY23, SJS outperformed the market by growing at 38.9% on YoY basis in the automotive segment, whereas the two-wheeler plus four-wheeler combined industry production grew by 22.5%–Y-o-Y on the back of a strong recovery in the two-wheeler segment.

- EBIDTA margins improved by 134 Bps primarily on account of higher sales, operational efficiency, and softening in the raw material prices.

- The management maintains its FY23 outlook of around 25% revenue growth as well as its medium-term guidance over FY23 to FY25.

- The management states that company was able to counter softness in export market through robustness of domestic demand.It is cautiously optimistic about the exports market to revive.

- The company is looking at acquisition opportunities in Europe & US where due to current scenario, valuations are relatively cheaper.This will help the company to cater those products in the external market & help in margin expansion.

- The management is targeting contribution of new age products to increase to 35-40% of total sales in future.

- The management explains that it uses its relationships with other suppliers to get certain commodity products like optical plastics on which the company does further value addition & then supply to the end customers.

- The management states that Exotech division benefitted from softening of raw material prices leading to EBIDTA margins of 17% but it still guides to maintain 14-15% margin.

- The company has enough capacity to double its FY22 revenues.Further it has an option to do debottlenekcing exercise to increase capacity without major additional costs.

- The management believes the company still commands a strong positioning in new age products like 3D Vs its peers because of its capability to produce coupled with strong relationships with the existing customers.

- The management states that the new plant will take about 12 to 18 months to get on stream.

- The management comments that Technically, it can build another facility and double the volume at Bangalore without investing in land.

Analyst’s View:

SJS is one of the leading players in the Indian decorative aesthetics industry. The company saw a decent quarter with revenue growth of 17% YoY. The company is gearing up for a CAPEX of Rs 100 Cr to expand its chrome plating division to meet the additional demand. The management guides for an organic topline growth of 25% for the next 3 years. It remains to be seen whether the company will be able to match the management growth guidance and how will its export business pan out in the future. Given the company’s strong position in its industry, SJS is an interesting small-cap stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 74 | 74 | 0.0% | 67 | 10.4% | 271 | 255 | 6.3% |

| PBT | 19 | 15 | 26.7% | 19 | 0.0% | 69 | 64 | 7.8% |

| PAT | 14 | 11 | 27.3% | 14 | 0.0% | 52 | 48 | 8.3% |

Detailed Results:

- The revenue growth for Q4FY22 was flat YoY & increased by 10% on a QoQ basis.

- EBIDTA margins stood at 25.3% while NPM stood at 14.6%.

- The company’s new customer additions include Stellantis, MG, Honda, Hyundai & Continental.

- Revenue contribution from different segments for FY22 stood as follow: –

- 2W- 43.3%

- PV- 28.8%

- CD- 22.2%

- Others- 5.7%

Investor Conference Call Highlights:

- The management states that traditional versus the new age products, which were only 3% of its sales in FY2019 today constitute about 16% of its overall sales in FY2022.

- The management states that for Q4FY22, the two-wheeler industry production volume declined 21% YoY while SJS sales were down only 5%, similarly Passenger vehicle industry production volume growth was flat at 2% YoY while SJS passenger vehicle sales jumped to 52.3 YoY.

- The company’s acquisition of Exotech ltd has led to strong performance in FY22 with revenue growth of around 50% YoY & increase in EBITDA margins to 12.8% from 11.3% in FY2021 excluding the one-time gain on the sale of land.

- The company’s medium-term growth plan for FY2023 to FY2025 involves the aspiration to grow the top line at a CAGR of about 25% organically while maintaining margins.

- The company is expected to incur a capex of about 100 Crores over 18 to 24 months to service high demand for its chrome platings division which will generate revenue & ROCE of Rs.300 Cr & 20% respectively at full capacity.

- The management states that almost 85% – 90% of the sales that the company is expecting to do for FY2023 are already business awarded to the company.

- The company’s exports for FY2022 over FY2021 have grown by 15% and its consumer durable business grew by 24% during the same period.

- The management states that customers prefer SJS over others due to its strong financial profile, diversified product basket, lower employee costs in comparison to suppliers in Europe & North America & its services in the form of a styling studio.

- The company expects sustainable margins of 13-15% from its chrome plating division.

Analyst’s View:

SJS is one of the leading players in the Indian decorative aesthetics industry. The company saw a mixed quarter with revenues flat YoY while profit increased by 27% YoY. The company is gearing up for a capex of Rs 100 Cr to expand its chrome plating division to meet the additional demand. It has also added MG, Honda and Hyundai as customers in Q4. The management guides for an organic topline growth of 25% for the next 3 years. It remains to be seen whether the company will be able to match the management growth guidance and how will its export business pan out in the future. Given the company’s strong position in its industry, SJS is an interesting smallcap stock to watch out for.