About the Company

Sansera Engineering Ltd is an engineering-led manufacturer of complex and critical precision engineered components across automotive and non – automotive sectors. The company manufactures and supplies a wide range of precision forged and machined components for the automotive sector and for non – automotive sector it manufactures and supplies a wide range of precision components for aerospace, off-road, agriculture, and other segments.

Q4FY23 Updates

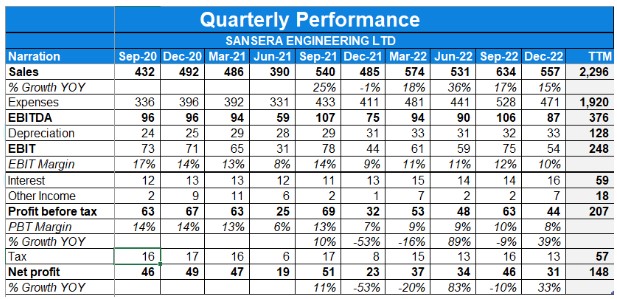

Financial Results & Highlights

Detailed Results:

- The company registered a 78% increase in their auto-tech agnostic and xEV products.

- The non-automotive segment grew by 50% in the quarter. This segment contributed to 14% of our sales.

- Aerospace and defense business contributed about 4.9% of the company’s sales, registering a strong 76% year-on-year growth in the quarter.

- The company had an annual peak revenue of INR13.3 billion with auto ICE contributing to INR5.5 billion, which is about 41% of the total order book. Auto tech agnostic and xEV adding to 4.3 billion, which is about 33% of the total order book.

- During Q4 FY ‘23, the company’s total income stood at INR6,230 million, representing a 7% growth on a year-on-year basis and 10% increase sequentially.

- The Q4 gross margins at 39%, had an impact of approximately 100 basis points by one-time year-end adjustments, including the inventory provisions and some customer-related costs.

- Employee expenses saw an increase of about 9% on a year-on-year basis, which represents the annual increments and volume increases during the quarter as against previous year, in the same period.

- Other expenses at INR 583 million were in line with the last quarter and represent our run rate.

- EBITDA margin for Q4 FY ‘23 stood at about 16.2% versus 17.2% during Q4 FY ’22.

- Finance costs for the quarter increased to INR 173 million as compared to INR 147 million in the corresponding quarter in FY ‘22.

- Cash profit after tax of INR 701 million in Q4 FY ‘23 was stable against the same for last year at INR701 million.

- EBITDA stood at INR3,948 million with a margin of 16.8%.

- Net profit was INR1,483 million as compared to INR1,319 million in the previous year.

- Cash profit after tax of INR2,784 million versus INR2,516 million in the last year

- Net cash from operating activities at INR2,558 million, which is 79% of the EBITDA for FY ‘23 as against 73% during FY ‘22.

- The Board of Directors has recommended a dividend of 125% of the face value at INR2.5 per share for the financial year 2023.

- Capex for this year stood at INR2,440 million.

- In the current quarter (Q4), the company added approximately INR 2 billion worth of new orders, resulting in an overall order book of INR 13.3 billion.

Investor Conference Call Highlights

- The company made an investment in MMRFIC, which is a research, design, and manufacturing entity, building subsystems for next-generation radars by leveraging machine learning with artificial intelligence and millimeter wave sensors with hybrid beam forming capabilities. The strategic investment in MMRFIC will help Sansera enter into high-technology space and have access to a strong R&D engineering team.

- The management stated that EV two-wheeler demand is rising. Tech agnostic products performing well, strong order flow for aluminum forged components. All three press lines which they had commissioned were fully booked.

- The company is adding another 2,500 ton plus for the aluminum components.

- With the upcoming change in BS norms, the company’s ICE sales registered a marginal decline of 3% during the quarter. This decline was seen across two-wheelers, three-wheelers, and passenger vehicles.

- Performance for motorcycles was flat whereas xEV registered a growth. This segment contributed to about 75% of sales of which 33% sales came from the motorcycle segment.

- Scooters accounted for 6% of the top line. Passenger vehicles accounted for 22% of the top line. Commercial vehicles, which accounted for 13% of the top line.

- The management stated that a significant portion of sales has come from our Swedish subsidiary in this segment.

- The management stated that the increase in finance cost was due largely due to an increase in the rate of interest that they have seen over this year and the higher working capital borrowings that they had to do for business expansion.

- In terms of geographic sales mix for Q4 FY ‘23, it stood as follows: India 68.4%, Europe 18.5%, USA 9.2% and other foreign regions 3.9%, as a percentage of total revenues.

- The company has initiated the construction of a new aluminum machining parts facility at an existing plant.

- The management stated that the ramp-up of these orders typically takes two to three years for full maturity. The first year sees around 30% to 40% ramp-up, with 70% to 75% achieved in the second year. The third year is typically when full maturity is reached.

- The company’s MMRFIC technology, primarily focused on millimeter-wave radars, has been developed in-house.

- The management expected meaningful revenues from MMRFIC technology to be between 18 to 24 months from now.

- The company aims to collaborate with its existing aerospace clients to leverage their customer base and management capabilities for the commercialization of MMRFIC technology.

- The estimated capex for the next financial year (FY24) is expected to be around INR 250 crores. This investment will primarily support projects related to delivering the new order book, focusing on non-auto and auto non-ICE categories.

- The management mentioned that there was a slight impact of approximately 1% on the EBITDA margin for the current quarter due to certain costs. However, when added back, the full-year EBITDA margin would be slightly over 17%.

- The company stated that more than 75% of their capex is focused on new sectors, including aerospace, tech agnostic, and xEV components. They have also initiated the construction of a new facility for aluminum forged and machined components. Additionally, a new 4,000-ton press line is being procured, with 50% of the capacity allocated for heavy engines and the remaining 50% for larger aluminum components.

- The company has plans to establish a facility in North America by 2025 on a lease basis. The goal is to cater to specific customer requests and focus on final operations, assembly, and inspection in North America while sourcing majority forging and machining operations from India.

- The company anticipates significant revenue generation from aerospace in FY24 and FY25, with a fully utilized new facility contributing revenue in the range of INR 350 crores to INR 400 crores.

- The company’s exports accounted for 28.4% of product sales in FY23, with a significant portion coming from India and international sales from the Sweden plant.

Analyst’s View

Sansera Engineering Ltd is an engineering-led manufacturer of complex and critical precision engineered components across automotive and non – automotive sectors. The Co. has 17 manufacturing facilities, out of which 16, are in India located across the states of Karnataka, Haryana, Maharashtra, Uttarakhand, and Gujarat while one facility is set up in Sweden.

In the long term, Sansera Engineering aims to have its auto internal combustion engine (ICE) segment contribute to 60% of its top line, while non-auto and xEV (electric vehicle) segments each contribute 20%. This diversified portfolio strategy positions the company for sustained growth and adaptation to changing market trends. The company’s resilient business model has proven successful in navigating challenging market conditions. Despite a weak domestic market in FY22, Sansera Engineering leveraged its strong performance in the export segment to achieve growth. However, in FY23, the company faced additional obstacles such as the Ukraine war, energy crisis, and chip shortage, resulting in a decrease in export contributions to revenue. Nonetheless, the company still achieved a commendable growth rate of approximately 17%.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had consolidated revenue growth of 16% YoY and profits grew by 31% YoY on a consolidated basis.

- EBITDA margins stood at 16.6% Vs 15.6% YoY.

- As of Dec-22, the order book with annual peak revenues stood at Rs 15.0 bn with auto ICE contributing Rs 7.34bn (49%), auto tech-agnostic adding Rs 4.52bn (30%), and non-auto accounting for Rs 3.16bn (21%).

- Net debt stood at Rs. 6,787 Mln.

- The company completed the construction of its new Aerospace and defense plant in Bengaluru. This plant will be fully operational by Mar-23 and has the potential to achieve a topline of up to Rs. 3,500 Mln, at a full capacity utilization level.

- The auto segment contributed around 79% of order book in Q3 FY23, 12% of sales came from tech agnostic and xEV products contributed 18%.

- Sales mix by geography:

- Sales mix by end-user segments:

- In terms of the 9MFY23 sales mix for the auto segment, covering both ICE as well as xEV and tech agnostic components:

- 37% of sales came from the motorcycle segment

- Scooters accounted for 14%

- Passenger vehicles accounted for 26%

- Commercial vehicles accounted for 11% of its top line

- Aerospace contributed to about 4% of sales

- The agriculture segment accounted for about 3%

- Off-road sector contributed 3%

- 37% of sales came from the motorcycle segment

The geographical sales of 9M FY23:

- India accounted for 73%

- Europe 17%

- US space customers 6%

- Other foreign countries overall 4%

Investor Conference Call Highlights

- The growth was largely driven by the domestic markets whereas international business was flat.

- The company’s r long-term target is to improve its contribution from the non-auto segment to 25%, and auto tech agnostic, xEV to 15%.

- The finance cost for the quarter increased to Rs. 161.8 million as compared to Rs. 134.5 million in the corresponding quarter of FY ’22, largely due to the increase in the interest rates coupled with a slight increase in the debt.

- The company’s quarterly sales mix split stood as India accounting for 69.2%. Europe for about 19%, the USA for 7.6%, and other foreign countries were 4.2% as a percentage of total sales.

- Exports were lower owing to chip shortage & Ukraine crisis leading to Exports as % of revenues being reduced to 30%. However, the management expects this to go back to 35-36% levels in the coming years.

- In the new facility, Two-thirds of the facility is meant for commercial Aerospace, and one-third is specifically kept for defense. The management has used only 4.5 acres out of the total land available for the current capex & can increase the capacity in the future by 120%.

- The capex for 9M stood at INR 185 Crs.

- The 37% contribution of motorcycles to total sales is split as 27% is domestic motorcycles and 8.2% or 8.3% is exports.

- The company saw a revenue loss of INR 66 Crs (25%) sequentially in its domestic 2-wheeler biz & doesn’t expect any recovery in Q4 on that front.

- There is a total of 58 components that are under PPAP and under development on aluminum, which includes both domestic and export and also both two-wheeler as well as a passenger vehicle.

- The company expects good revenue growth in TVS & Tata motors account considering the stabilization of their new relationship.

- The company has retraced back from its plan of starting a greenfield facility in North America & would rather look at acquiring land on lease.

- The impact of RM cost deflation on the quarter’s revenue would be 2-3%.

- The company expects PV & 2W industries to grow by 5 & 7% respectively while Sansera grows by at least 10%.

Analyst’s View

Sansera is a leading smallcap Auto ancillary provider in India. The company has seen a dismal quarter with declining margins. The company has done well by growing revenues by 16% & PAT by 31%. A weak global macro environment has kept the export volume down, which is expected to come back from Q4 onwards. It remains to be seen how the company will be able to increase its non-auto businesses, ramp up its new aerospace & defense plant, and whether it will be able to capture the rise in outsourcing in the auto sector manufacturing space in the future. Nonetheless, given its good innovation capabilities and its rising customer set, Sansera is interesting to smallcap auto ancillary stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 580 | 482 | 20.25% | 477 | 21.49% | 1,762 | 1,368 | 28.80% |

| PBT | 60 | 67 | -10.98% | 48 | 25.79% | 171 | 132 | 29.55% |

| PAT | 45 | 51 | -11.46% | 36 | 25.84% | 128 | 98 | 30.61% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 636 | 542 | 17.40% | 533 | 19.37% | 2,004 | 1,572 | 27.48% |

| PBT | 63 | 69 | -8.73% | 48 | 31.17% | 178 | 146 | 21.92% |

| PAT | 47 | 52 | -9.48% | 35 | 34.87% | 132 | 110 | 20.00% |

Detailed Results:

- The company had a revenue growth of 17% YoY and profits fall by 9% YoY on the consolidated basis.

- The company recorded highest-ever quarterly and half-yearly sales.

- This quarter close to 3% of total sales came from the xEV segment

- EBITDA margin for the second quarter stood at 17.1% against 20.1% in the second quarter.

- Sales of auto segment soared by 20% year-on-year largely driven by growth in domestic markets

- The auto segment contributed around 90% of sales in Q2 FY23, 10% of sales came from tech agnostic and xEV products versus 7% in the last Q2

- In terms of the Q2 FY23 sales mix for the auto segment, covering both ICE as well as xEV and tech agnostic components:

-

- 39% sales came from the motorcycle segment

-

-

- Scooters accounted for 15%

- Passenger vehicles accounted for 27%

- Commercial vehicles accounted for 9% of our top line even that a significant portion of the sales of CV comes from our Swedish subsidiary, the company witnessed a subdued performance in Europe in this sector in this quarter.

- Non-automotive segment contributed 10%

- Aerospace contributed to about 4% of sales registering a strong growth of 41% year-on-year in the quarter

- The agriculture segment accounted for about 4%

- Off-road sector contributed 1% compared to 4% in last Q2

-

- The geographical sales of Q2 FY23:

- . India accounted for 77%

- Europe 16%

- US space customers 4%

- Other foreign countries overall 3%

- H1 FY23 highlights

- . Total revenue surged by 25% on a year-on-year basis to 11,691 million; This includes approximately 3.5% of the material inflation passed on within the customers in the domestic region

- For H1 FY23 EBITDA stood at Rs. 2,008 million with a margin of 17.2%.

- The net profit for H1 FY23 stood at 817 million and registered a growth of 16% as compared to 706 million in the corresponding period in the previous year.

- Cash from operations of about 1,299 million against Rs. 709 million last year

- Invested about 1,282 million against the purchase of property plant and equipment

- Net debt stood at Rs. 6,250 million the net debt to equity ratio was 0.56 against 0.57 for the year FY22.

Investor Conference Call Highlights

- The company has recently won an award from a global OEM with a peak annual revenue of Rs. 1,300 million, this contract would be for a time horizon of around 6 years starting from 2025. It can give around 700 crores of business, 130 crore annually.

- The company has also secured a 6- year order from a well-known American company with a peak annual revenue of 250 million orders. This is in the non-auto space

- EV Industry in India

- EV penetration in India as per various surveys is just about 2.6% of the total automotive market and our government of India is targeting between 30%-35% of EV penetration by 2030.

- Today Sansera has overall 12 xEV customers in all sectors including some marquee global names. The company’s wealth of experience in ICE provides it with a solid foundation to grow in EV space.

- In the two-wheeler scooter space today Sansera has six customers for tech-agnostic and xEV components vis-a-vis four customers in the traditional ICE components. Also, Sansera’s peak content per vehicle for auto tech agnostic and xEV components in an EV scooter is about 1,827 versus Rs. 1,467 in our traditional ICE scooter.

- The management stated production lines for two-wheeler xEV in hybrid PVs that are dedicated facilities for hybrid and electric components began mass production in Quarter 4 of FY22 and it is ramping up well.

- The management stated a couple of customers in the EV two-wheeler space are getting Sansera prepared for mass production and as a result, they are anticipating accelerated growth of components in the coming quarters

- The management expects momentum to continue and register a 35% to 40% growth in aerospace revenues this year.

- On the CAPEX front, the new aerospace and defense facility is almost ready and is expected to get into operation by the fourth quarter. The mass production post all the approvals are expected to start from the year FY24.

- The management stated on 30th September 22, the company’s order book of the new business with an annual peak revenue stood at Rs. 14.2 billion with auto ICE contributing 6.94 billion 49% and auto tech agnostic adding 4.41 billion amounting to 31%. Non-auto accounts for 2.84 billion and contributes 20% to the sales order pipeline.

- This order book continues to showcase the progress that the company is making towards a long-term vision of improving market share by participating in xEV opportunities and diversifying into technological agnostic components and focusing on non-auto sectors.

- The company’s aluminum forged and machine components continue to see very healthy traction. The management stated going forward growth will come in both auto and non-auto sectors.

- The management stated export may continue to be a drag for the industry this year. They expect domestic sales to register higher growth.

- The management stated the company’s growth will be driven by new products like xEV and hybrid components for which mass production has already started.

- On the non-auto side, the management expects a strong uptake in the aerospace and defense business next year. The last two or three years were rather dull for the sector, but now the demand has come back strongly.

- The management did not expect any growth in export in this year, but going forward expectation is as things normalize the company should be back to between 35% and 38% of international revenue on our overall gross sales. Quarter 4 should be relatively strong for exports.

- The management stated US continues to be a very focused market, they are adding a lot of business in US.

- The management stated in Q3 margins can improve because some cooling down of raw material prices is there already.

- The management expects that in Q3 the operational leverage will not be substantial because Q3 quarter will not be as strong as Q2 in terms of domestic volumes. So they expect that margin will continue to be towards 17% – 17.5% in this Q3, but Q4 they expect a good improvement in margins definitely and the operational leverage will also kick in, and also there will be recovery from exports.

- The management stated the new orders that they are participating in are all orders which are going to be executed for the new platforms from calendar year 25-26-27.

- The company’s target of reaching 200 crores business in aerospace in next three years is intact

- The management expect that in the coming years the Sweden growth will be back to normal revenues of like the previous years. Though they do not expect too much of change in volumes, but operating efficiency by increasing automation and increasing engineering efforts from India, they expect that they will maintain healthy double-digit EBITDA from Swedish facility from next year.

- In H1, there is 1.9% is the margin deterioration. 1.3% is the optical impact of raw material about 0.4% was the effect of change in geographical mix

- Almost 20% of our order book we have xEV components specifically.

- The company now has 6 customers in Two-wheeler EVs, the volumes have started going up

- Almost 100 crores of orders have been booked, in aluminum components for two-wheelers.

- 18% of this order book is coming out of xEVs. 40% plus coming out of nonauto ICE I mean non-auto tech agnostic and EV.

- The management stated the company has added Tata Motors as customers, the production of that has started there. The company has added Force Motors the production has started for that, added Volvo Eicher the production again has started for that.

- The management expect that in the next two or three years none of customrs will be more than 10%. The biggest of the company’s customers could be very close to double digit not more than that

- The management stated the company should reach to 40% of revenue coming from nonauto and tech agnostic. It could be 25-15 or it could be 20-20 by next three to four years

- The management stated they should reach on a medium term about 10% of global share of business.

- Sansera belief is that it has three very clear principles:

- . One is it should be engineering centric,

- The second one is it should be scalable and

- The third one is the ROCE and EBITDA should be around 20%.

- The company work with both Boeing and Airbus through their Boeing directly and for Boeing and Airbus through their Tier-1 and Tier-2.

Analyst’s View

Sansera is a leading smallcap Auto ancillary provider in India. The company has seen a dismal quarter with declining margins. The company has done well to secure new 2 wheeler EV customers and also expects to onboard more in the future. The rising inflation posts a big challenge to Sansera as steel and other commodities are the main raw materials for the company. Weak global macro environment has keep the exports volume down, which is expected to come back Q4 onwards. It remains to be seen how the company will be able to increase its non-auto businesses and whether it will be able to capture the rise in outsourcing in the auto sector manufacturing space in the future. Nonetheless, given its good innovation capabilities and its rising customer set, Sansera is an interesting smallcap auto ancillary stock to watch out for.

Q1FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY21 | FY22 | YoY% | |

| Sales | 475 | 335 | 27% | 511 | -7% | 1351 | 1745 | 29.16% |

| PBT | 48 | 22 | 118% | 55 | -12.7% | 132 | 172 | 30% |

| PAT | 36 | 17 | 111% | 41 | -12% | 98 | 128 | 30.61% |

| Consolidated Financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY21 | FY22 | YoY% | |

| Sales | 533 | 39.5 | 35% | 574 | -7.14% | 1572 | 2004 | 27% |

| PBT | 47.8 | 25.2 | 89% | 53 | -9.81% | 146 | 178.3 | 22% |

| PAT | 34.8 | 18.9 | 84% | 37 | -5.95% | 109.8 | 131.8 | 20% |

Detailed Results:

- Sansera has reported a healthy set of numbers with a 35% year-on-year growth in top line of Rs. 5,329 million.

- With better capacity utilization, the company’s EBITDA margin improved from 16.3% (Q1FY22) to 17.3% (Q1FY23).

- PAT for the quarter increased by 84% to Rs. 347.8 Mln and margin increased from 4.8% to 6.5%.

- In Q1 FY 23, 89% of auto segments revenues included a 9% contribution from auto tech agnostic and xEV products was vis-a-vis 4% in Q1 FY22 and 6% in FY22.

- In terms of current auto segment sales mix – motorcycles contributed to 36% of top line, passenger vehicles accounted for 27% of the top line, commercial vehicle accounted for 11% of top line, aerospace and agriculture accounted for 3% of the topline, off-road accounted for 4% of the top line and remaining 1% of the top line came from other segments.

- In Q1 FY23, Auto-Tech Agnostic & xEV products contributed 9% of the topline vs 4% in Q1FY22 and 6% in FY22.

- As on 31-Jul-22, our orderbook with annual peak revenues stood at Rs 11.1 bn, with auto ICE contributing Rs 5.3 bn/ 48%, auto tech-agnostic adding Rs 3.4 bn/ 31% and nonauto accounting for Rs 2.4 bn/ 22%.

Investor Conference Call Highlights

- In line with the company’s long term strategy, share of auto tech agnostic, xEV and non auto revenue improved by 4% to reach 20% of total revenue.

- Company has added Tata Motors and Force Motors to its client list and this opens up opportunities to participate in various programs across PVs as well as CVs both in ICE and electric vehicle space.

- Management expects exports to be weak primarily as a result of the war, the commodity price increase, energy cost increases, continued semiconductor challenges and also rising fear of inflation as well as recession.

- Scooters accounted for 14% of the top line with a positive trend of increasing share of business of scooters in overall two-wheeler markets especially the EV scooter.

- In terms of geographical sales mix for Q1 FY23 stands as follows India contributed 71%, sales to customers in Europe about 17% and USA 9%, other foreign countries contributed to 3% of total revenues.

- Management believes growth will come on both auto and non-auto side.

- Management expects to close about 30% to 40% growth in revenues in the aerospace sector this year.

- Management expects technology agnostic and non-auto components to grow by around 50% in FY23, with their new facility coming on stream, aerospace & defense would be a major contributor to this growth.

- Company has recently received order confirmations for xEV components from two two-wheeler manufacturers namely Ultraviolet and Hero Motors.

- The main spoilsport in taking the sequential revenue down was, approximately about 17 crores worth of finished goods couldn’t be dispatched although it was ready and cleared by export customers due to a logistic disagreement.

- Though price increase was not part of the standard contract, the company was able to get some price increase and since sequentially if seen the volumes have slightly come down so that is a give and take impact between the gross margin and the overall cost structure.

- In the company’s line of business it is not very usual, but it is not uncommon also that the customers for various reasons can cancel a project.

- 276 LOIs/Purchase Orders from 74 customers in the auto and 34 customers in the non-auto sector.

- Sales Mix- India- 71% and international- 29%.

- The critical applications of Sansera’s products and stringent quality requirements, act as a strong competitive advantage for the company.

- Largest supplier of connecting rods, rocker arms and gear shifter forks in two wheelers.

- Largest supplier of connecting rods and rocker arms in light vehicles.

- Most of the products are sold directly to OEMs in finished (forged and machined) condition, resulting in significant value addition by the company.

- Over the years, the company leveraged its existing capabilities to manufacture precision components for several nonautomotive sectors and established its presence in the aerospace, off-road and agriculture sectors.

- Top 5 customers constitute 54% of the total sales mix.

- Company has improved capital and operating efficiency, reduced reliance on third party suppliers and high responsiveness to customer needs.

- Company has automated facilities by installing 170 Robots across all facilities.

- Sansera has 16 plants under operation across India, 1 in Sweden and 1 under construction in India All its facilities are located in close proximity to the client production facilities.

- Company plans to deploy the automation capabilities across other manufacturing lines.

- Management believes that Sansera focuses on providing high value-added and technology-driven components to capture shifts in customer preferences as well as evolving regulatory requirements, such as heightened emissions control standards. Further, this would increase opportunities for company to become a preferred supplier to their customers and consolidate position.

- Management is not expecting any negative movement on margins. Even though their exports are not going to register significant growth.

Analyst’s View:

Sansera manufactures and supplies a wide range of precision forged and machined components that are critical for engine, transmission and other systems for 2Ws, PVs and CVs. It also supplies components to the aerospace sector and for off-road vehicles. Company has created a unique value proposition for their customers. As a result, the company has added new customers and their existing customers are expanding their product basket. The domestic auto industry has been doing better thanks to rising demand, consumer confidence in rural areas easing semiconductor supply issues and declining commodity prices. The Indian auto-ancillary manufacturers are well positioned and appreciated for their work in the areas of robust component development, consistent quality and clear-cut price advantage. Besides, China Plus one strategy has also been helpful in acquiring more and more businesses. Sansera is well equipped to capture these growth opportunities with a long history of operational excellence. With the possibility of recession in Europe, the company may face few headwinds as it derives 17% of its revenue from Europe. Overall, seeing the company and the way it’s positioned. It would be recommended to keep a watch on it. Any development on the electric vehicle, aerospace, defense sector can be immensely beneficial to the company as it has technology and it’s not easy for a new player to settle here.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 519 | 430 | 20.7% | 421 | 23.3% | 1762 | 1368 | 28.8% |

| PBT | 55 | 58 | -5.2% | 27 | 103.7% | 171 | 132 | 29.5% |

| PAT | 41 | 42 | -2.4% | 20 | 105.0% | 128 | 98 | 30.6% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 581 | 496 | 17.1% | 487 | 19.3% | 2004 | 1572 | 27.5% |

| PBT | 52 | 63 | -17.5% | 32 | 62.5% | 178 | 146 | 21.9% |

| PAT | 37 | 47 | -21.3% | 24 | 54.2% | 132 | 110 | 20.0% |

Detailed Results:

- The company recorded highest ever quarterly revenue with revenue growth of 17% YoY.

- EBIDTA decreased by 4% while EBIDTA margins decreased by 17.2% Vs 21.1% YoY.

- PAT decreased by 21% YoY while NPM stood at 6.4%.

- Revenue mix product wise stood at:

- Non-auto – 16%

- Auto-Tech Agnostic & xEV – 22%

- Auto-ICE- 62%

- International to Domestic mix stood at 59% & 41%.

- Item wise mix stood at

- Motorcycles – 36%

- Scooters – 12%

- Passenger vehicles – 29%

- Commercial vehicles – 13%

- Aerospace – 3%

- Off-road – 3%

- Agriculture – 3%

- Others – 1%

- Net Debt/ Equity stood at 0.57 while ROCE & ROE stood 13.7%.

Investor Conference Call Details:

-

- The company recently won a very big order of Rs.30 billion from a leading North American OEM for connecting rods for their upcoming project.

- The company also bagged orders for two packages consisting of 26 aluminium forged and machined parts from BMW Motorrad amounting to approximately Rs.3 billion over the next 10 years.

- The company incurred a capex of Rs.255 Cr in FY22.

- The company currently has about 255 components under various stages of development including auto and non-auto excluding aerospace & another 300 components on various stages of RFQ.

- The geographical sales mix for FY2022 stood as follows: India 63%, Europe 24%, USA 9%, and other foreign countries about 5%.

- The management expects at least a CAGR growth of about 25% to 30% in aerospace for the next three years.

- The management expects peak capex for its North America division to be Rs.30-35 Cr & peak revenue generation of Rs.75 Cr.

- The management believes that the trend of a newer set of engines, platforms & outsourcing will lead to an increase in its global market share from 3-3.5% to 10% in the coming years.

- The company expects the margins from the USA manufacturing plant to be either stable or increase Vs the Indian plant due to lower cost of capital & higher automation.

- The company currently have 5 two-wheeler EV manufacturers on board and expects to work with at least 7-8 manufacturers in the long term.

- The management expects a drop in EBIDTA margins of its Sweden biz from current levels of 7% to a lower no. In the current FY due to high energy prices. However, the company is working on developing alternative sources of energy whose benefits will come from FY24 onwards.

- The company is planning to keep the debt levels constant in FY23.

- The management expects that technology agnostic and non-auto components which stand currently at 17% this year would at least 22% to 22.5% next year signifying 50% growth in this segment and which is in line with what the company has projected in terms of its roadmap to reach about 40% of this segment in the next three years.

Analyst’s View:

Sansera is a leading smallcap Auto ancillary provider in India. The company has seen a dismal quarter with declining margins. The company has done well to secure new 2 wheeler EV customers and also expects to onboard more in the future. The rising inflation posts a big challenge to Sansera as steel and other commodities are the main raw materials for the company. It remains to be seen how the company will be able to increase its non-auto businesses and whether it will be able to capture the rise in outsourcing in the auto sector manufacturing space in the future. Nonetheless, given its good innovation capabilities and its rising customer set, Sansera is an interesting smallcap auto ancillary stock to watch out for.