Brief Introduction

Salzer Electronics Limited is engaged in offering Total and Customised Electrical Solutions in switchgear, Wires & Cables, and the Energy Management business. It is also involved in manufacturing CAM Operated Rotary switches & Wire Ducts in India The Co’s Client base includes Alstom, BHEL, Indian Railways, Siemens, L&T, Schneider, Nuclear Power Corporation, GE Energy, etc. The Co is the largest manufacturer of Cam Operated Rotary Switches with a 25% share.

Q4 FY23 Updates

Financial results & highlights

Detailed Results:

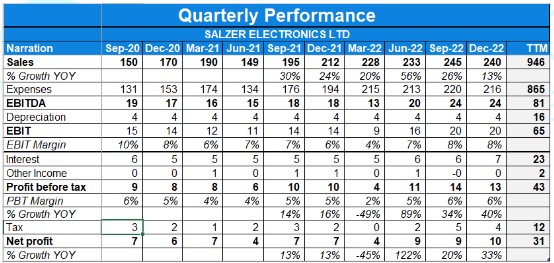

- The company had a decent quarter with revenue and profits increasing by 29% and 134% on a YoY basis respectively.

- EBITDA margins stood at 7.9% , thus rising by 224 Bps.

- Revenue break up stood as- Industrial Switchgear: 53.4% of net revenues with EBITDA margins at 10.5%, Wires & Cables: 41% of net revenues & 5.5% margins , Building Electrical Products: 6% of net revenues & 2.6% margins.

- Contribution from Exports stood at 27% while Exports revenue grew by 73% YoY in Q4FY23 driven by higher exports to Middle East Africa, and North & South America.

- The board recommended a final dividend of Rs2.2 per equity share.

Investor Conference Call Highlights

- The management stated that despite the headwinds, the company has crossed the 1000 Crs revenue milestone in FY23 owing to advanced engineering capabilities backed by a strong in-house manufacturing and R&D team, product innovation, strong technical collaboration, and long-standing customer relationships.

- On the switchgear front, growth was driven by high-margin products like toroidal transformers, three-phase transformers, wire harnesses, rotary cam switches, and isolators. & All these comprised approximately 65% of the switchgear division sales.

- To cater to the continuous demand, it has set up new manufacturing facilities strategically located at Hosur in Tamil Nadu.

- Kaycee (the company’s subsidiary) saw its top line grow 42% to Rs.42.3 crore from 29.8 crore last year while PAT grew 87% from 1.86 crore last year to 3.5 crore this year.

- The company achieved its internal target of 12% ROC in FY23.

- The EBITDA percentage for industrial switchgear for FY23 is at around 11.7%, wire, and cable is at 7% and the building segment is at 3%.

- The company is projecting 20% & 25% top line & bottom line growth respectively.

- The company expects its new products to generate around 1-2 Mn dollars in revenues in America in the first year & then scale to 20-25 Mn dollars of revenues.

- The company will be launching EV chargers in Q2FY24.

- The new funds raised are expected to be deployed in the new plant (12-15 Crs) & in its EV charging station JV (10-15 Crs).

- The company’s margins were reduced due to higher contribution from Wires & Harness business where it has lower margins.

- The company’s rationale for going into EV charging station is its aim to transform into a global electrical solutions provider, & since EV is going to be at the forefront in the coming 10-15 years & the company already has the inhouse products will be used in making the charger coupled with a JV partner, it is going forward with the charger plans.

- Around 30% of the value of EV charger will be in-house components.

- The company will not be doing any capex in the wire & harness division, however, it will incur some capex in dry-type transformers where asset turns are 4-4.5X currently.

- The company’s target product mix is 60% from the industrial switchgear business, 30% wire, and cable & 10% from building electrical.

- The Margins of switchgear have reduced in the recent year owing to higher contribution from transformers.

- The company has applied for some patents in technology rotary switch & cable ducts where it expects to get the same in 2-3 years.

- The company’s margins in wire business is lower Vs the peers owing to distribution through L&T along with high contribution from agri-segment which is more seasonal.

- The company expects certain sales in Europe in the coming years in the charging space through its JV collaborator, while it plans on selling its chargers to players who are installing & running the charging stations in India.

- The company expects the charging division to generate revenues of the 30-40 Crs in FY25 & scale this business to 500 Crs in the coming period owing to high adoption of EV.

- The company’s customer base in Toroidal transformer includes ABB, Schneider & Eaton.

- The company has existing capacity of 100 chargers per month with revenue potential of 120 Crs per year.

- The company has a 1.5 acre land available where it can do a capex in future.

- The management states that it is a “Type-II indirect supplier to solar renewables. Any solar inverter manufacturer, or a solar park that is coming up means there are inverters being used. And we supply components to those inverter manufacturers”.

Analyst’s View

Salzer electronics saw a decent quarter with revenue growth of 29% due to good performance of industrial switch gears, wires & cables , & its newer products like dry transformers. . The company is venturing into the production of EV chargers through the JV route with a 26% stake. It remains to be seen how the company will counter wild fluctuation in prices of commodities like copper, scale up the biz to get operational leverage, develop & commercialize its new products & reduce its working capital cycle to improve returns on capitals. Nonetheless, given its strong positioning, Strong tailwinds, and Promoter pedigree coupled with their renewed investments in biz through preferential allotment of shares at a higher price Vs market rates, Salzer seems like a good stock to keep on one’s watchlist.

Q3 FY23 Updates

Financial results & highlights

Detailed Results:

- The company had a decent quarter with revenue and profits increasing by 13% and 33% on a YoY basis respectively.

- EBITDA margins stood at 9.9% Vs 8.35% YoY.

- Revenue break up stood as- Industrial Switchgear: 57.86% of net revenues, Wires & Cables: 34.60% of net revenues, Building Electrical Products: 7.54% of net revenues.

- Contribution from Exports stood at 28.34% while Exports revenue grew by 45.6% YoY in Q3 FY23 driven by higher exports to Middle East Africa, and North & South America.

Investor Conference Call Highlights

- The margins rose mainly on account of an increase in sales from higher-margin industrial switchgear products.

- The 3 Phase Dry-Type Transformer grew about 174% year-on-year in the quarter and about 138% in the 9 months, while Wire Harness grew 8% year-on-year during the quarter to INR 16.16 crores and 5.8% year-on-year in the 9 months ended FY ’23.

- The Wire & Cable division revenue declined close to 10% year-on-year in the quarter, mainly on account of a slowdown in the agri segment, leading to lower sales volumes where High inflation led to lower spending in rural markets that resulted in degrowth in this segment.

- The Raw material prices have begun to stabilize because of this, the company is seeing the benefits of price hikes in the form of better margins quarter-on-quarter and year-on-year.

- The company recently set up a new manufacturing facility in a rented space in Hosur, Tamil Nadu to manufacture wire harnesses and transformers with an initial investment of INR 15 crores. The new facility is spread over 30,000 square feet out of which, 15000 will be utilized in Phase 1 & full commercial production will start from March-April.

- The company expects its India-built fast chargers for Indian EV markets to be ready for testing, approval, and also for sales by June-July 2023.

- The company’s subsidiary Kaycee Industries saw revenues increase by 24% year-on-year to INR 10 crores with margins of 11.4% EBITDA and 8.4% PAT level. The management expects Kaycee to continue to grow at a 30% to 35% level over the coming quarters.

- The company continues to target achieving a consolidated revenue of INR 1,000 crores and an INR 40 crores PAT for FY ’23.

- Margins in the cable & wires division reduced by around 100 Bps in Q3 sequentially owing to copper price fluctuations.

- The commercialization of electric chargers (which are in the prototype stage) is getting delayed from march to July owing to the difficulty in the absorption of technology and sourcing of various components for the product since the components are not available in India.

- The company is going slow on the auto conversion kits since it doesn’t see any bright scope for the same.

- The management explains that operating leverage for the building products division will kick in post turnover of 100-120 Crs where EBITDA margins will rise to 8-10% from current levels of 2.5% with an expected turnover of 70 Crs for FY23.

- The company plans to make 50-100 chargers a month in the first year with 8 lakhs ASP, but the management believes that this could be scaled up to 700-800 Crs in the future.

- The government’s thrust on capex in the budget should bode well for the company as per the management.

- The Hosure capex will incrementally add to 25% of revenue growth in the future.

- Working capital days stood at 130 where Inventory is at around 95 days, while the debtor is around 75 days.

- The current capacity utilization segment-wise is between 65% and 80%.

- The company’s existing capacity for Wire Harnesses and Toroidal Transformers was fully utilized owing to the company being a preferred supplier with various customers across the world including various OEMs which is translating to higher demand.

- The company’s gross margins have reduced in the past several years owing to higher contributions from the Wires & Cables division.

- The company’s share in EV charger JV stands at 26% with rights to go up to 50%.

- The company is guiding for a 20% growth in FY24 with the majority coming from industrial switchgear products.

- The company believes that the working capital days can reduce to 105-110 days within the next 3 quarters.

- The company has a benchmark of working capital debt to be not more than 20-25% of revenues.

- The company EV charges have an import components share of 60% & will be solely used for 4-wheelers.

- The company’s internal ROCE target stands at 18% & it strives to achieve it in the next 2 years.

- The company’s wire harness biz couldn’t grow as per expectations owing to its customers facing a lot of chip shortage issues where they scaled down their production to a large extent.

Analyst’s View

Salzer electronics saw a decent quarter with revenue growth of 14% primarily due to industrial switch gears whereas its Wire & cables biz perform poorly. The company is venturing into the production of EV chargers through the JV route with a 26% stake. It remains to be seen how the company will counter wild fluctuation in prices of commodities like copper, scale up the biz to get operational leverage, develop & commercialize its new products & reduce its working capital cycle to improve returns on capitals. Nonetheless, given its strong positioning, Strong tailwinds, and Promoter pedigree coupled with their renewed investments in biz through preferential allotment of shares at a higher price Vs market rates, Salzer seems like a good stock to keep on one’s watchlist.