Established in 1947, SIL is engaged in providing building material products for interior and exterior building systems and roofing solutions. SIL got listed on the stock exchange in year 2006-07. It operates through five manufacturing plants located across four states ‘ Maharashtra, Gujarat, Tamil Nadu and Andhra Pradesh, and sells its products under the brand names – Swastik, Cemply and Ecopro through a network comprising over 3,000 distributors. The company also operates nine windmills in Maharashtra and Rajasthan.

Q4FY23 Updates

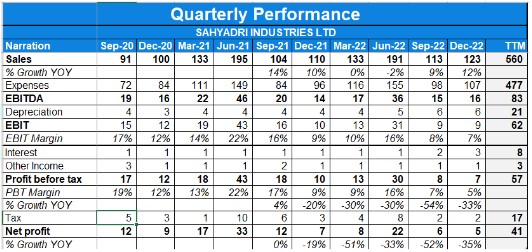

Financial Highlights & Results

Detailed Results:

- The company saw average revenue numbers in Q4 at Rs. 167 Cr with growth of 26% YoY due to there being subdued demand on-ground for the roofing business in rural areas.

- PAT numbers in Q4 were at Rs. 5 Cr going down by -47% on a YoY basis.

- EBITDA margins went down by 479 bps to 8.74% in Q4.

- PAT margins stood at 2.83% in Q4.

- The Board has recommended a final dividend of Rs 1.5 per equity share of the face value of Rs 10/- that leads to a cumulative dividend of Rs 4 each for the financial year ending 31st March, 2023.

- The stabilization of operations at the Perundurai plant resulted in higher expenditure that has also impacted EBITDA negatively.

- The capacity utilization for FY23 stood at 71%. The management envisages improvement in the capacity utilization levels in FY24 along with favourable industry scenario which will lead to an uptick in the topline and bottom-line going forward.

- FY23 performance highlights were as follows :-

- Total Income – Rs. 597.2 Cr vs Rs 546.3 Cr the previous year

- EBITDA – Rs. 84.4 Cr vs Rs. 104 Cr the previous year

- PAT – Rs. 37.1 Cr vs Rs. 61.8 Cr the previous year

- The capex update as on 31st March, 2023 is as follows :-

Investor Conference Call Highlights:

- The management states that the raw material prices continues to be at elevated levels due to inflationary pressure across the globe.

- The management states that the overall demand for roofing product remains sluggish across the country largely due to an uptick in the inflation prevailing in the rural economy.

- The management states that were able to pass on prices partially. However, the industry still remains under margin pressure with it hampering the overall performance.

- In Q4 FY23 the capacity utilization was 80% whereas it was 71% for the full year FY23.

- The management states that capacity expansion in Maharashtra for non-asbestos cement board plant having capacity of 72,000 metric ton have been initiated. Land has been identified and land acquisition is in process.

- The company is also in the process of setting up a new unit in Orissa state for manufacturing asbestos corrugated sheet of 1,20,000 metric ton per annum.

- The shares of Sahyadri Industries listed on the National Stock Exchange on 6th April 23.

- The management states that growth in revenues in Q4 is contributed by the volume in the NFS from Perundurai plant which is now getting stabilized.

- The management states that the company has taken around 2% to 2.5% in price hikes in Q4.

- The management is not seeing good enough first quarter demand despite first quarter being the best quarter for the company and the industry.

- The management is hopeful that the subdued demand till April and May should get compensated in June and July due to delayed monsoons.

- On PBT margins, the management states that considering the present circumstances of the market it is expected to be in line of the current margins for the next few quarters.

- The ratio for the non-asbestos division for the quarter is 21:79 and 22:78 for the year.

- The management states that inventory days were high due to the geopolitical situation which resulted in carrying of fiber. The inventory days are slowly expected to come down moving ahead.

- In the non-asbestos part of the business the company is selling flat sheets from the new plant while in the old two plants they are selling the value-added products.

- The management states that for the upcoming board capacity next year, it will take 2.5 years to reach 85% capacity. As it starts it will touch 50% capacity.

- The management states that the gross margins on the three major product lines are the same.

- The management states that the contribution from the NFS out of the total revenue pie of Rs 580 crore is at 21% for FY23.

- The current long term borrowing for the company is Rs. 42 Cr, with the cost of funds linked to the MCLR.

- The utilization levels for the Perundurai plant last year was 41% which is expected to go to 60%-65%.

- The company has already spent 30 Cr in capex for the Wada project with 65 Cr left.

Analyst’s View

Sahyadri is the market leader in Maharashtra for AC sheets market. It reported an average quarter with revenue growth & PAT degrowth due to poor demand scenario & higher inflation costs coupled with forex fluctuations & finance, depreciation costs impacting the bottom-line severely.

It remains to be seen how the company will deal with shift from AC roofing to galvanised iron (GI) roofing sheets, Scaling up new capex, sluggish demand scenario & raw material inflation. However, given its strong market presence & relatively high capex for its size, the company remains an interesting small cap stock to keep in one’s watchlist.

Q3FY23 Updates

Financial Highlights & Results

Detailed Results:

- The company saw moderate revenue growth of 12% YoY due to subdued demand for the roofing business in rural areas.

- PAT degrew by 35% on a YoY basis.

- EBITDA margins degrew by 70 bps to 13.1%.

- PAT margins stood at 3.8%.

- The company declared an interim dividend of INR 2.5 per equity share of the face value of INR 10 each for FY ’23.

Investor Conference Call Highlights

- The raw material costs are at elevated levels on the back of the inflationary trend prevailing in the economy. However, it has been able to pass on the partial increase in cost to its customers.

- The stabilization of operations at the Perundurai plant resulted in increased expenditure, which impacted the bottom line.

- The 9M capacity utilization was 66% with flagship product having a high capacity utilization than roofing products.

- The capacity utilization will go to around 77% to 80% in Q4.

- The company is on track to do revenue of INR 575 crores to INR 600 crores.

- For capacity expansion in Maharashtra state for manufacturing of non-asbestos cement board, the plant having a capacity of 72,000 metric ton have been initiated & land has been identified and land acquisition is in process.

- The Company is also in the process of setting up new unit in Orrisa state for manufacturing asbestos corrugated sheets of 120,000 metric tons.

- The management states that utilisation levels for the current year were low due to low sales in Q1(their highest quarter) owing to unseasonal monsoon. The company in general gets hugely affected by monsoon due to its high concentration towards rural areas.

- Forex had a negative impact of 9% coupled with 6-7% impact on costs of raw material due to Ukraine war. The company however passed 60-70% of the cost increase to customer.

- The company doesnt hedge foreign currency imports.

- The finance costs increased due to commissioning of new capacity coupled with higher working capital by 100 Crs.

- The supplier of fibre has pricing power due to the duopoly market structure.

- The company is engaging on only FOB contracts Vs COF in exports to avoid profits burn due to fluctuation of sea freight.

- The Maharashtra capacity is expected to come live in Q4FY24.

- The pricing in exports & domestic market is similar.

- The revenue mix of asbestos and non asbestos for Q3 and 9M FY ’23 is 78:22.

- The company’s annual marketing budget will be Rs.5 Crs.

Analyst’s View

Sahyadri is the market leader in Maharashtra for AC sheets market. It reported a mediocre quarter with sluggish revenue growth & PAT degrowth due to poor demand scenario & higher inflation costs coupled with forex fluctuations & finance, depreciation costs impacting the bottomline severly.It remains to be seen how the company will deal with shift from AC roofing to galvanised iron (GI) roofing sheets, Scaling up new capex, sluggish demand scenario & raw material inflation. However, given its strong market presence & relatively high capex for its size, the company remains an interesting small cap stock to keep in one’s watchlist.