About the company

Rallis India, a Tata Group company Group Co., has a history of over 150 years. The company is into manufacturing of Agrochemicals and is present across the value chain of agriculture inputs – from seeds to organic plant growth nutrients. Rallis is also in the business of contract manufacturing for global corporations.

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

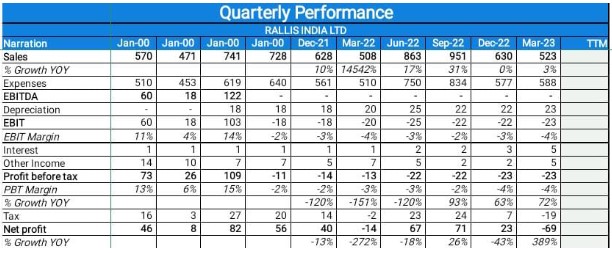

- The company’s revenues for the quarter stood at Rs.523 crore as against Rs.508 crore generated during Q4 of FY ’22, a growth of 3%.

- The company’s domestic revenues were flat. International revenue business reported a growth of 7%, driven by volume growth of 10% plus.

- The company’s seeds business generated revenue worth Rs.25 crore during the quarter, largely in line with the previous year

- The company’s EBITDA loss for the quarter stood at Rs.65 crore as against a loss of Rs.3 crore generated during the corresponding period last year. Loss for the quarter stood at Rs.69 crore as against a loss of Rs.14 crore garnered during Q4 of FY ’22.

Investor Conference Call Highlights

- The company stated that the industry demand was relatively less due to higher carryover inventory from the Kharif season and higher returns in insecticides.

- The company stated Low pest pressure and erratic rainfall resulted in lower liquidation.

- The company stated that the Rabi season has ended with 3% higher crop acreage YoY, but adverse weather conditions could impact yields.

- IMD forecast a normal monsoon at around 96% of the LPA, but Skymet’s forecast is below normal at around 94% of the LPA, raising concerns about monsoon rains.

- Talking about business, the company stated that domestic market growth is soft due to high inventory levels, but international businesses reported growth.

- The company stated that margins were low due to high stock levels globally and pricing pressure, resulting in an EBITDA loss of Rs. 65 crore for the quarter.

- The company stated that gross margins remained lower due to high-cost volatility.

- The company launched new products under the 9(3) and 9(4) categories and Crop Nutrition portfolio.

- The company stated that it has expanded its distribution network to 60,000 retail footprints for the Crop Care business.

- The company stated that it has once again started shipments of PEKK in the Contract Manufacturing segment after a gap of nearly two years

- The company stated that revenues for the 4th quarter increased to Rs.523 crore, a 3% growth from the previous quarter, largely driven by volume growth and with price increases now anniversaries.

- The company stated domestic revenues were flat, while international revenue business reported a growth of 7%, driven by volume growth of 10% plus.

- seeds business generated revenue worth Rs.25 crore during the quarter, largely in line with the previous year.

- Company EBITDA loss for the quarter stood at Rs.65 crore, mainly due to provisions and impairments recognized during the quarter, including inventory provisions of Rs.39.8 crore and projects worth Rs.23.6 crore impaired during the quarter.

- The company’s Gross margins were lower due to high-cost volatility, largely mitigated through agile pricing and procurement decisions.

- The company’s domestic business operated under a challenging environment, while the international business performed relatively well with a growth of 24.5% for the year.

- The company states that Metribuzin volumes have started improving, and with Metribuzin and Pendimethalin both having secured technical equivalence, the company expects to win more customers in the coming years.

- The seeds business continues to face a difficult environment, and the company has re-evaluated its strategy with a renewed focus on liquidation, cost reduction, and a more rigorous evaluation of new product development.

- The company has spent approximately Rs.190 crore on capex during the year and expects FY ’24 spending to be in the range of Rs.150 crore to Rs.180 crore.

- The good news is that commodity prices in general have been good, which is positive for farm economics.

- The company is taking action to increase volume growth and improve market efficiencies.

- The company stated that new product development is its key area of focus, with a portfolio of products expected to be introduced in Q1, Q2, and beyond.

- The company also plans to scale up some of the products launched in the last few years.

- The company stated digitalization efforts, such as a monitoring app, are being used to guide field marketing activities.

- The company aims to achieve volume growth despite dropping prices.

- The company launched Project “Fit” in the seeds business and recalibrated its long-term sales plan. As a result of this, the company identified quite a few hybrids, especially in cotton, wherein stock levels are significantly higher than the future sales estimate.

- According to the company, key challenges are going to be the timely collections in monsoon, the chairman later added “but maybe getting the El Nino effect late in the season, the Kharif is expected to take off in a nice manner. So we don’t see any immediate issues.”

Analyst’s View

Rallis, a subsidiary of Tata Chemicals, has established a reputation of being a trusted solutions provider for agri-inputs, globally, with an accent on innovation, a thorough knowledge of farm science, and a penetrative distribution network. Rallis boasts of a robust product portfolio offering comprehensive crop care solutions, including formulations for crop protection and nutrition. It manufactures and markets a range of agri-inputs, which include pesticides, fungicides, insecticides, seeds, and plant growth nutrients. The product portfolio under each category covers a broad spectrum of crop-related requirements. The company has been in the business for more than 150 years now. It remains to be seen how the company’s near-term performance will pan out given the steady rise in inflation. Given the company’s strong working, Rallis India LTD is a good Agrochemical stock to watch out for.

Q3FY23 Updates

Financial Results & Highlights

Detailed results –

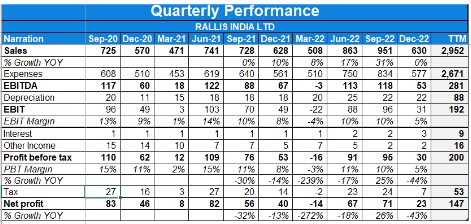

- The company had a poor quarter with revenue staying flat.

- EBITDA margins came in at 8.5%, lower by 2.3%, owing to lower gross margin and an increase in other expenses

- Profit for the quarter stood at INR 23 crore against INR 40 crore reported during the corresponding period last year.

Concall notes:–

- Domestic demand was sluggish at the industry level owing to delays in sowing on account of the extended monsoons, and higher channel inventory due to slow offtake during the kharif season.

- The domestic crop care business grew by 6.7%, primarily price driven while the crop nutrition business grew by 22%.

- Exports revenue declined by 6.5%, chiefly due to inventory buildup at our customer end.

- The company introduced one new 9 (3) pre-emergent wheat herbicide, Daksh Plus during the quarter.

- The retail footprint reached 60,000 for the crop care business.

- Metribuzin has seen a gradual pickup in sales, following the normalization of inventory.

- In the contract manufacturing segment, the company expects PEKK shipments to commence in a small way from Q4 after a gap of two years.

- Domestic biz saw revenue growth of 6.7% while international biz saw volume degrowth of 6.5%.

- The company’s actions in H1 to liquidate the high-price inventory coupled with shorter procurement cycles have helped to mitigate the impact at the gross margin level largely.

- PBT has got impacted by the increased depreciation charge for the newly capitalized assets, coupled with higher interest expenses and lower other income.

- Domestic biz volumes were lower owing to delayed sowing season owing to extended monsoon, coupled with high channel inventory.

- Overall capex for the year would be INR 200 crore.

- The management states that the prices of key materials are coming down, including some of the intermediates.

- Metribuzin and Pendimethalin have technical equivalence in the EU which will aid sales in northern Europe in the coming period.

- The management expects overall agrochemicals volume growth in the global market to be around 3% in Q1FY24.

- The company expects to commission its 200 Cr capex in this financial year itself.

- The management states that it will take two years to three years before it will be able to have any significant revenues coming from the contract manufacturing opportunities.

- The company’s growth in domestic has largely been price-driven growth.

- The company has been witnessing higher sales returns, especially in the Eastern region owing to the vagaries of monsoon.

- The management is seeing good traction in the crop nutrition category & is targeting growth above the industry levels.

- Receivables increased primarily due to a higher share of exports, stoppage of discounting of one of its key customers & money stuck in the domestic market due to kharif rainfall.

Analyst views-

Rallis is a Tata group company involved in the business of agrochemicals. The company saw a poor quarter with revenue staying flat. The company is making strong waves in the export division however the seeds business is hurting its performance. The company is currently incurring a CAPEX in Dahej. It remains to be seen how the company will tackle the slowness in the seeds industry coupled with difficulty in liquidations & global macroeconomic instability. However given the potential growth prospects of the agrochemical industry, this remains a good stock to keep on the watchlist.

Q2FY23 Updates

Financial Results & Highlights

Detailed results-

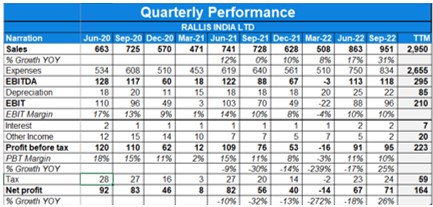

- The company saw its revenue grow by 31% YoY.

- The crop care biz saw a growth of 18% while the seed care biz grew 12%.

- Overall EBIDTA increased by 34%.

- EBIDTA for crop care biz grew by 28% while that for seed care remained flat.

Concall highlights

- The management states that delayed monsoon and erratic distribution impacted sowing, which was 1% lower compared to the previous year.

- The company reported revenue growth of 31% over the previous year, driven largely by its international business.

- The management states that while herbicides continued to perform well, especially in North India, sales of insecticides and fungicides remained muted.

- In terms of the contract manufacturing segment, the company expects PEKK shipments to commence from Q4 of FY2023, after a gap of 2 years.

- The company is making good progress in reducing its dependence on China’s imports. It is now sourcing 100% of its requirement for 2 of its products locally,& for two of its more important intermediates, it is now sourcing 20% of the requirements locally and targeting sourcing 80% of the other intermediates locally by the year-end.

- The domestic revenue was higher by 18.2%, primarily due to the price hikes undertaken earlier during the year while the Volumes during the quarter were largely the same.

- The company’s strategy continues to be focused on liquidation, cost optimization, and more robust evaluation of new product pipeline advancements.

- The company used short-term borrowings to meet working capital requirements. However, the company expects the cash flow situation to gradually improve.

- The company incurred CAPEX of Rs.100 Cr in H1 & plans to incur an additional Rs.150 Cr by the year-end.

- The management states that it is in a better situation Than 3 months back in terms of high-cost inventory.

- The company is seeing some pricing pressure in Brazil & south-Asian states.

- The company is benefitting from the depreciation in the rupee due to its position as a net exporter.

- The management states that some issues in the seeds business include a lack of scaling of its products replacing the existing variety which is going out of favor coupled with the poor performance of the vegetable seeds biz leading to its scaling back into the field crop biz segment.

- The company is facing problems in terms of collections & liquidations, especially in eastern & western pockets. However, it doesn’t view this as a major concern as collections will be made even though with an elongated cycle.

- The management believes that the new CAPEX will start adding to the top line from FY24 with the commissioning of its MPP plant.

- The company will see revenues flowing from its CMO projects in the next 2-3 years.

- The management expects the share of exports to its crop care biz to increase from current levels of 33-35% to 40% in FY26.

- The management states that ROCE will remain under pressure due to new CAPEX being incurred, but it targets high double-digit ROCE in the future.

- The biggest product that the company exports into the Brazilian market is Acephate and it has also got registration for its Metribuzin-formulated product in the Brazilian market.

- The margins in the international biz are currently lower vis-a-vis the domestic biz but they are expected to improve because of higher contributions from formulations.

- The provisions in the seed biz for the H1FY23 stood at Rs.25 Crs.

- The management expects a considerable amount of pressure in terms of the liquidation of agrochemicals in the market in H2 as well due to the high rollover of inventory.

- In terms of capacity utilisations – the Acephate plant: is 100%, Pendimethalin:90%, Hexaconzole has been slightly lower because of a lot of inventory of Hexaconzole in the Vietnam and Chinese markets & PEKK plant is restarting after 2 years.

- The capacity for Pendimethalin would be close to 5,000 tonnes per year and for Metribuzin, close to 3,000 tonnes per year.

Analyst views-

Rallis is a Tata group company involved in the business of agrochemicals. The company saw a decent quarter with revenue growing by 31%. The company is making strong waves in the export division however the seeds business is hurting its performance. The company is currently incurring a CAPEX in Dahej. It remains to be seen how the company will tackle the slowness in the seeds industry coupled with difficulty in liquidations & global macroeconomic instability. However given the potential growth prospects of the agrochemical industry, this remains a good stock to keep on the watchlist.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 515 | 479 | 7.5% | 1278 | -59.7% | 2631 | 2470 | 6.5% |

| PBT | -16 | 12 | -233.3% | 122 | -113.1% | 222 | 303 | -26.7% |

| PAT | -14 | 8 | -275.0% | 90 | -115.6% | 164 | 228 | -28.1% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 515 | 479 | 7.5% | 633 | -18.6% | 2631 | 2470 | 6.5% |

| PBT | -16 | 11 | -245.5% | 53 | -130.2% | 222 | 303 | -26.7% |

| PAT | -14 | 8 | -275.0% | 39 | -135.9% | 164 | 228 | -28.1% |

Detailed Results:

- The company had a poor quarter with revenue increasing by 7% due to shortage of key raw materials coupled with phasing issues with one of its international clients.

- Company reported negative PAT of Rs.14 Cr Vs positive PAT of Rs.8 Cr YoY.

- EBIDTA margins for the quarter were flat.

- EBIDTA was hit due to higher provisions for slow moving seeds coupled with opportunity loss in the form of short of inputs

- EBITDA percentage for full year stands at 10.5% as against 13.3% in the base year which was impacted due to pricing volatility and inability to fully absorb seed inflation and the mix led headwind because of de-growth in seeds.

- The board recommended dividend of Rs.3 for the FY22.

Investor Conference Call highlights:

- Domestic business growth was soft due to soft Rabi season & rapid spread of black trips in the South coupled with the resurgence of Covid in the early part of the quarter according to the management.

- The revenue growth for the entire industry was primarily price driven which was a result of high costs of inputs.

- The management states that on the exports front, demand for agrochemicals continued to remain strong driven by remunerative crop prices and supply shortages from China.

- In a bid to strengthen its product portfolio, the company added 7 new products in the current fiscal of which 3 were 9(3) products, 2 were 9(4) products & balance 2 products were through co-marketing.

- The company aims to launch at least 2 9(3) products annually.

- Despite these new introductions, the company’s ITI was around 11% which is lower than the target of 15%.

- Domestic seeds business continued to remain under challenge.

- Herbicides grew 20% YoY while Insecticide & Fungicide grew 5% YoY.

- The company’s retailer count was at 55,000 Vs 47,000 while its distributer count was at 4,100 Vs 3900 YoY.

- The crop protection segment grew by 17% YoY every quarter in FY22.

- In FY22, the company added six new products in the crop nutrition segment, two in-house and four through co-marketing

- Seeds business didn’t perform well in the current fiscal due to increased demand for illegal herbicide tolerant cotton seeds impacting the overall growth momentum and profitability of the business according to the management.

- The company’s retail footprint in the seeds business stood at 38,000 Vs 31,000.

- The management states that capacity expansion undertaken for Kresoxim-methyl, Acetamiprid and Lambda-Cyhalothrin have started contributing to the overall growth of the business.

- The company’s realizations have improved by around 5% in the domestic crop protection segment and 14% in the international business, but these efforts haven’t offset the impact of raw material inflation.

- The management expects to start the operation of Acephate formulation in Brazil by H1FY23 which will help in increasing the share of the formulations business.

- The company has started taking efforts to reduce supply dependence on China by finding suppliers in the local markets although the Chinese contribution remains above 50%.

- The management states that the company is on track towards introducing one new AI, Difenoconazole from the new multi-purpose plant in FY 23 & its new formulation facility at the Dahej CZ is also stabilizing & gearing up for larger volumes in FY 23.

- The company will liquidate its large inventory of seeds through prudent commercial interventions which will have an impact on EBIDTA margins.

- Shift towards increasing the share of formulation products has sustained growth and margins of the domestic crop protection business.

- The company’s Seeds business contribution to overall revenue dropped by 3% during the year. Since this business makes higher material margins in the range of 15% to 20%, margins were impacted by 50 bps by this shift in mix.

- The company’s total capex for FY22 stood at Rs.185 Cr & plans to do a capex of Rs.250 Cr in FY23.

- The growth of Metribuzen chemical was stalled due to a high inventory overhang in the market, but the management expects it to bounce back by Q2.

- Out of the growth of 25% in the crop protection segment, there was an equal split between contribution from price & volumes.

- The management believes that since on the illegal cotton side, the availability is even higher than last year, it does not see the challenges in its seeds business slowing down during the year.

- The international revenue for FY22 is Rs.780 Cr.

- The management recognizing the demand and stronger realization of pyrethroids have invested in a dedicated Lambda Cyhalothrin facility.

- The management expects a soft Q1 as the volatility and uncertainty will continue on input availability as well as raw material pricing front, which will affect margins.

Analyst’s View:

Rallis is one of the leading crop-care & seeds companies in India. It had a bad quarter with revenue growth of 7.5% YoY and Loss after tax of Rs 14 Cr in Q4. The company continues to see price inflation in raw materials. The demand scenario in the agrochemical space remains robust due to good crop prices available in India and supply shortages from China. Meanwhile, the company continues to see pressure on the high margin domestic seeds business which is also diminishing the overall margin profile for the company. Furthermore, the management expects to see soft demand in the coming quarter due to rising raw material prices and input unavailability. It remains to be seen how the company will be able to tackle inflation and raw material supply problems and how long will it take for the seeds business to get back on track. Nonetheless, given the company’s strong market position and operational history, Rallis India remains a good Chemical stock to watch out for.