Piramal Pharma Limited (PPL) is part of the Piramal group of companies. The pharmaceutical product portfolio of the company can be categorized into contract development and manufacturing organizations (CDMO), complex hospital generics (critical care), and consumer healthcare (OTC). The company has a presence in more than 100 countries and has manufacturing plants in India, the UK, and North America. Around 76% of the company’s overall revenue in FY21 came from North America, Europe, and Japan. The entire pharma business was earlier operated under Piramal Enterprises Limited until February 2020. However, in March 2020, the Board of Directors of PEL approved the transfer of the entire pharmaceutical business to its wholly-owned subsidiary, Piramal Pharma Limited. Furthermore, on October 7, 2021, the Board of PEL approved the demerger of PPL into a separate listed entity. PEL owns 80% in PPL and the Carlyle group holds the balance of 20%. Post the demerger, the entire pharmaceuticals business will get vertically demerged from PEL and consolidated under PPL, with the promoters holding a 35% stake, other shareholders holding 45%, and the balance of 20% being held by the Carlyle group.

Q4FY23 Updates

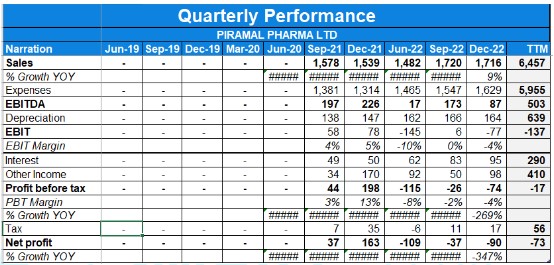

Financial Highlights & Results

Detailed Results:

- The company achieved a sequential revenue growth of 26% in Q4 compared to the previous quarter.

- The EBITDA margin for Q4 was 17%, an improvement from the 10% reported in Q3.

- In Q4, the company reported a YoY revenue growth of 2%. For the full year, the YoY revenue growth was 8%, with revenues reaching Rs. 7,082 crores.

- The CDMO business experienced a 7% YoY growth in FY23.

- Revenue contribution from differentiated offerings increased from 27% in FY21 to 37% in FY23.

- Power brands witnessed a growth of 37% in FY23, contributing 42% to total healthcare sales.

- Employee costs increased by 19% on a comparable basis, including hiring to operate new capacities. Other operating expenses grew by 18% primarily due to marketing spend and additional capacities.

- Approximately 69% of the net debt of Rs. 4800 crores resides overseas.

- The CAPEX spends in FY23 were around Rs. 965 crores, mainly on differentiated sites.

Investor Conference Call Highlights

- The company cleared 36 regulatory inspections, including 4 US FDA audits, with positive outcomes.

- The company held approximately 39% market share in the US market for sevoflurane, a leading product in the inhalation anesthesia portfolio.

- E-commerce accounted for approximately 16% of the company’s total consumer business sales.

- The company invested Rs. 965 crores in FY23 towards expanding facilities, particularly in high-demand areas such as Riverview, Grangemouth, and Turbhe.

- The company observed a significant pickup in order bookings in Q4, indicating improving demand and growth opportunities.

- For the full year, there was 1% year-on-year growth. The current quarter’s revenue growth was affected by softer demand for generic API and vitamins portfolio, low order book in the first 9 months, pipeline privatization, and execution issues at some facilities. However, there was a good pickup in order bookings in March, which will reflect in H2 FY24.

- The growth was driven by healthy demand for inhalation anesthesia product sevoflurane and improved supplies from CMO for injectable pain management products.

- Quarterly revenue growth was lower due to the discontinuation of sales of a COVID detection kit. Excluding this, the growth for the quarter was 15% and full-year growth was 19%.

- The reported EBITDA includes the impact of intercompany transactions between PEL and PPL, while like-to-like financials eliminate this impact. The scheme of demerger and amalgamation also affected the comparability of financial results.

- Other income was low due to a decline in FOREX gain. Tax liability was higher in Quarter 4 due to tax paid on dividends received from a joint venture company.

- The rate of borrowing ranges between 6.5% to 8.5%. The company expects the proceeds from the rights issue to flow in by the end of Q2 FY24, which will be used to reduce debt.

- The EBITDA for the full year included provisions for near expiry inventory and one-off provision for receivables.

- The management mentioned that the quarter is typically the biggest quarter due to customers wanting to run down inventories at the end of the calendar year and reorder in the fourth quarter of the financial year.

- Additionally, the opening of new capacities at Riverview and Turbhe during the quarter contributed to the growth recovery.

- The focus is on improving the CRO (Contract Research Organization) and CDMO (Contract Development and Manufacturing Organization) footprint in India.

- The discovery business is profitable and expanding capacity in the PDS (Pharmaceutical Development Services) business in Ahmedabad.

- Nearshoring is a growing demand from customers, with sites in the US and UK seeing good demand for patented and innovative products.

- The Morpeth and Lexington facilities have had execution challenges, but efforts have been made to address operational issues and improve customer experience.

- Capacity expansions are underway, with Bethlehem in the US seeing short-term improvements and Dahej and Digwal in India being medium to longer-term expansions.

- The demand for hospital generics exceeds supply, indicating successful commercial execution and market positioning.

Analyst’s ViewPiramal Pharma Limited (PPL) is part of the Piramal group of companies. The company operates through 3 major segments (1) Contract development and manufacturing organisations (CDMO), (2) Complex hospital generics (critical care), and (3) consumer healthcare (OTC).Company entered Pharma space back in 1988 with acquisition of Nicholas Laboratories and grew through a series of Mergers & Acquisitions and various organic initiatives. In 2010 the Domestic formulations business was sold to Abott for $3.7 billion and Diagnostic Services was sold to Super Religare Laboratories (SRL). The company focuses on increasing shots on goal, faster decision-making, and higher win rates. They’ve made personnel changes where needed and implemented cost control measures. With a strong compliance track record, the company has consistently been profitable. Measures for profitability improvement include cost optimization, operational efficiency, and aligning headcount with revenue. Strong order book and expected higher revenues in the second half should lead to improved profitability.

Q3FY23 Updates

Financial Highlights & Results

Detailed Results:

- The company registered a revenue growth of 11% in Q3.

- CDMO business grew by 14% and 12% respectively during Q3 & 9M.

- Complex Hospital Generics grew by 6% during the quarter and 9% for 9M.

- India Consumer Healthcare businesses registered a robust growth of 37% for the quarter and 19% for 9M.

- The normalized EBITDA margin during the quarter was 10% due to higher raw material costs, energy prices, wage inflation, and marketing costs.

- The board of directors of the Company has approved the recommendation to allot equity shares for an amount up to Rs.1,050 crores.

Investor Conference Call Highlights

- The capex that has gone live in the last few months includes a new In-Vitro lab at an Ahmedabad PDS site, capacity expansion at a peptide facility at Turbhe, and capacity addition at the Grangemouth facility in the US.

- The company had a successful US FDA inspection at its Riverview facility in the US while At the Sellersville and Lexington facilities inspection, it received 483 with the VAI classification. The company continues to maintain a zero OAI status across its sites in the last 12- years.

- In the Injectable Pain Management segment, performance was impacted by supply constraints at its CMO. It has 34 SKUs currently in the pipeline & launched two new products during the quarter

- Power brands grew by 39% & contribute 41% to total consumer healthcare sales in the first nine months. Littles grew 66% YoY and Lacto Calamine grew 44% over the last year and nine months, powered by new launches and traction, and e-commerce.

- The company spent about 15% of its revenue on media and trade promotion.

- The company launched 21 new products, and 25 new SKUs during the nine months of FY’23. New products launched over the last two years contributed about 17% of consumer business sales. E-commerce currently contributes about 14% of total consumer business sales

- CDMO’s growth was impacted largely because of continued delays in decision-making by customers due to the macroeconomic environment and pipeline prioritization based on the limited availability of capital coupled with softer demand for generic API and the vitamins portfolio.

- To address the muted revenue growth, the company is increasing the productive selling capacity of its business development team, increasing the number of proposals velocity and win rate, targeting new customers, and new markets in both our CDMO and CHG business, Capacity expanding to address the supply constraints in CDMO & hospital generics business, both in the injectable pain and inhalation anesthesia portfolios.

- Capex for 9M stood at $100 Mn.

- The company is not looking to dispose of its loss-making US & UK plants.

- The company’s margin erosion is majorly due to higher fixed costs & inflation in inputs & energy prices.

- The company will plan to reduce its debt level post-Q2FY24.

- The expected turnover for the new facilities for peptide as well as the new Riverview facility is up to 2.5 times.

- The CDMO biz is equally split between Big pharma, Biotech & Generic Pharma.

- The revenue from CBMO for 9M has mostly been from the generics segment.

- The management explains that if they do successful completion of clinical trials of a molecule, then the company almost always pursues commercial production with the company only.

- The management states that each of its 15 sites has separate capabilities & is not necessarily fungible.

- The inventory levels are higher to service the demand for its biggest quarter i.e. Q4.

- The company’s rationale for the acquisition of A)CCPL was to ensure supply of critical input which was scarce in the market, B)Hemmo Pharmaceuticals was to enter into its molecules which have higher margins & C)Sellersville was to provide onshore services in North America.

Analyst’s View

Piramal Pharma is the 4th biggest domestic player in CDMO. The company had a very poor quarter with major losses owing to lower revenue growth coupled with higher fixed costs & inflation in inputs. The company recently passed approval to raise up to 1050 Crores. It remains to be seen how the company will tackle the slowdown in decision-making by its CDMO customer coupled with the inflationary environment, weak demand in US & UK, high debt levels & lower equity valuation at the time of raising funds. However, given the company’s strong pedigree & past track record coupled with decent growth prospects of the Indian CDMO industry, the company remains an interesting stock to keep track of.