About the Company

Manappuram Finance Ltd. is one of India’s leading gold loan NBFCs. Today, it has 4208 (Includes branches of subsidiary companies) branches across 28 states/UTs with assets under management (AUM) of Rs. 166.18 billion and a workforce of 24,717.

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- Manappuram Finance Limited recorded a consolidated net profit of INR415.3 crore in Q4 FY’23, a 59.1% improvement over the year-ago quarter.

- Full-year consolidated profits grew by 12.91% to INR1,500.2 crores.

- Consolidated assets under management (AEM) reached INR35,452.3 crore in Q4, a 17.2% increase over the year-ago quarter.

- Consolidated AUM for QE Mar’23 was INR 355 bn representing 11.2% growth sequentially and 17.2% YoY growth

- Gold Loan AUM has grown by 6% sequentially and de- grown by 2% YoY.

- Net yields on Gold Loans is at 21% during this quarter vs 22.4% in Q3FY23 due to increasing in the tenor of Gold loan from 3 months to 6 months

- Gold Loan LTV is at 60% as on 31st Mar 2023 (vs. 62% in QE Dec’22)

- PAT for MFI business has increased to INR 993 mn in Q4 FY23 vs PAT of INR 705 mn in Q3 FY23

Investor Conference Call Highlights

- The company stated that the microfinance subsidiary, Asirvad Microfinance, showed impressive growth with an AEM of INR10,042.9 crore, a 43.4% YoY growth.

- Other sectors such as vehicle finance, home loans, and non-MFI verticals also reported growth.

- The company aims to achieve a balanced and prudent growth strategy, diversifying its portfolio mix between gold loans and other segments.

- The management addressed concerns about increasing competition and the emergence of new players, stating that India’s underpenetrated financial market allows room for multiple players to coexist profitably.

- The company has faced legal challenges related to a 12-year-old case involving its proprietary concern, Manappuram Farm. They have submitted all necessary requirements and received a stay order from the court, expecting the written order soon.

- The company’s liquidity position is strong, with cash and cash equivalents of INR3,000 crore and undrawn bank lines of INR2,949 crores.

- The company stated that standalone borrowing costs decreased by 6 basis points in Q4 after a repo rate hike.

- The gold loan business constitutes 56% of consolidated AEM, and the remaining 44% includes microfinance, vehicle finance, housing, and SME finance.

- Asirvad Microfinance reported an AEM of INR10,040 crore, with a profit of INR99 crore in Q4.

- Vehicle finance reported an AEM of INR2,445 crore, with a collection efficiency of 96.01%.

- Home loans showed growth with an AEM of INR1,096 crores, a 29% YoY increase.

- The company aims to increase its presence in MSME and personal loan segments.

- Asset quality improved, with provisions decreasing in the standalone entity.

- The company’s capital adequacy ratio stands at 31.7%, and the net worth is INR9,645 crore at a book value of INR113.9.

- The Board declared an interim dividend of INR0.75 for the quarter.

- The management highlighted the company’s strong capital position and well-positioned ALM (Asset Liability Management) across all buckets.

- The company stated that there is a trade-off between gold loan growth and spreads/margins in the gold lending business.

- Competitive intensity from banks has eased, but the trade-off between loan growth and spreads remains.

- The company aims to operate at around 22% yield and expects a 10% growth in gold loan area.

- Microfinance business requires capital infusion, and plans include raising capital from outside sources and subsidiary support.

- Disbursements in the microfinance segment were around INR 7,000 crores for the full year.

- Write-offs in the microfinance business for FY ’23 were INR 113 crores.

- Approximately 35% of the gold loan book is for INR 2 lakh ticket size loans.

- The highest ticket size for gold loans is around INR 1 crore, but it is minimal in number.

- The company expects to achieve a 22% average yield for gold loans by the end of Q1.

- The company is confident about its legal case and expects a positive outcome.

- An RBI inspection notice raised concerns about loan extensions, which the company is discussing and awaiting feedback on.

- The proportion of loans between INR 1 lakh to INR 2 lakh has changed to 22% – 24%.

- The yield for FY’24 is expected to reach around 22% by the end of the quarter.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, the margin erosion from moving to a higher duration product, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance which might see a potential IPO in the coming 2 years, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

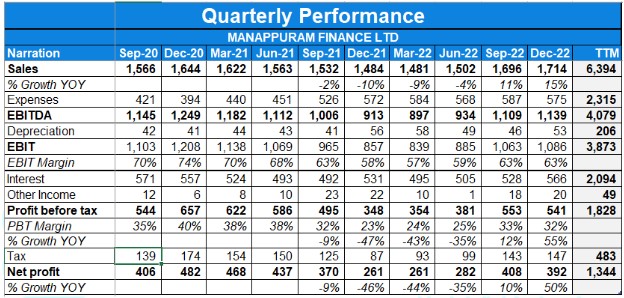

- The company reported a decent quarter with revenue growing by 15% while PAT grew by 50% YoY.

- The company’s ROE for Q3 decreased to 17.2% whereas its ROA decreased to 4.2%.

- The gold loan AUM increased by 2.1% YoY while LTV stood at 66%.

- The company’s consolidated AUM was at Rs 319 Bn which increased by 4.9% YoY and 4% QoQ basis.

- The book value per share at the end of the quarter was Rs 109.6.

- The company’s consolidated cost of funds stood at 8.5%.

- ROA & ROCE for standalone biz stood at 4.4% & 14.8% for Q3.

- In the gold loan business, the Opex to AUM stood at 7% for q3FY23.

- The standalone business has a GNPA of 2% and NNPA of 1% while the net yield stood at 22.5% for q3.

- The CAR for the standalone business stands at 32%.

- Gold AUM per branch stood at 51.3Mn.

- The online gold loan division contributed 47% to the company’s overall gold AUM in q3.

- Asirvad MFI saw a GNPA of 6.7% with NNPA at 1.7% for q3. Opex to AUM for Asirvad was at 7%.

- Asirvad saw PBT growth of 41% & ROE improving to 20%.

- The cost of funds at Asirvad was at 10.1% for q3.

- The company’s housing finance business reported an AUM of Rs.1000.48 Cr.

- The company’s vehicle finance business reported an AUM of Rs 2112.1 Cr.

- ALM is well positioned across all buckets.

- The Board has declared an interim dividend of 75 paise during the quarter.

Investor Conference Call Highlights

- The company expects the gold loan portfolio to pick up from Q4.

- The management expects GNPA in the affordable housing segment to reduce since it is making attempts to sell its real estate assets.

- The promoter’s daughter has been appointed as an Executive Director & will be trained to take over the succession of the company.

- In SME lending, the company is going towards micro factors where the average ticket size is around 6 lakhs, which is mostly secured by mortgages. So, there it is lending around 150- 60 crores per month.

- In NBFC lending, it is lending to different sectors of NBFCs where the average yield is around 13.3% while avg. ticket size is 12 crores.

- The ticket size & its proportion in the gold loan segment stands as follows: up to 1 lakh, 44%.1 to 2 lakh, 23%. 2 to 3 lakh, 10%. 3 to 5 lakh, 8%. And above 5 lakh, 15% as on quarter.

- The management feels tonnage growth is an insignificant criterion as the average redemption period is around two-and-a-half months & so the borrowing made is much lower than the cashflows of customers since they want to redeem within a short timeframe.

- In stage three, the LGD stands at 67%, and in stage two it is around 15%- 14.5% & the management is seeing collection efficiency improving Month-on-month basis.

- The company has completely stopped the teaser rate scheme.

- The auction for the current quarter stood at INR 353 Crores.

- The company expects to reach an ROE of 20% in a few quarters.

- The management states that its current gold loan branches stand at 3,985 & are increasing by around 100 branches quarterly.

- The consolidated AUM to gold loan stood at 58% & is expected to reduce to 50% in the coming 2 years.

- The company plans to raise funds in the Asirvad biz in the coming time when the market situation improves through private equity or listing in stock exchanges.

- The company’s target audience is the lower income group who wants to get funds and pay back the same in a shorter time period so that they don’t miss their work & this is a major advantage Vs banks.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company reported a decent quarter owing to a strong turnaround in operations of Asirvad which generated a PAT of 70 Crs in the current quarter. The company is currently struggling due to high competition from banks & poor demand in rural areas in the gold loan segment. The management states that it views NBFCs as its main competition and these NBFCs should be in for a tough time given the rising rate scenario. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, the margin erosion from moving to a higher duration product, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance which might see a potential IPO in the coming 2 years, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company reported another set of poor results with consolidated revenue increasing by 12% YoY and PAT growing by 10.7% YoY.

- The company’s ROE for Q2 increased to 18.6% & whereas its ROA increased to 4.6%.

- The gold loan AUM increased by 2.1% YoY while LTV stood at 66%.

- The company’s consolidated AUM was at Rs 307 Bn which increased 7.9% YoY and 1.65% QoQ basis.

- The book value per share at the end of the quarter was Rs 105.8.

- The company’s consolidated cost of funds stood at 8.1%.

- In the gold loan business, the Opex to AUM stood at 7% for Q2FY23.

- The standalone business has a GNPA of 2% and NNPA of 1.8% while the net yield stood at 22.1% for Q2.

- The CAR for the standalone business stands at 32%.

- Gold AUM per branch stood at 53Mn.

- The online gold loan division contributed 47% to the company’s overall gold AUM in Q2.

- Asirvad MFI saw a GNPA of 8.8% with NNPA at 1.7% for Q2. Opex to AUM for Asirvad was at 6%.

- The cost of funds was 7.8% & standalone borrowings at 7.6%.

- The company’s housing finance business reported an AUM of Rs.921.6 Cr.

- The company’s vehicle finance business reported an AUM of Rs 1885.5 Cr

Investor Conference Call Highlights

- The management states that NBFC and MFIs are expected to see a 30% year-on-year growth in their loan book in 2022-2023 on the back of a resurgence in demand for microloans, especially from Tier-3 cities.

- The management believes the company is right on track to become a diversified NBFC which is evident from a contribution of 37% from non-gold loan verticals.

- The company’s current leverage stands at 3 times.

- The company is currently holding excess liquidity to meet the redemption of the 3- year secured fixed rate loan issued in the gold bond market which is due in January 2023

- The company’s Gold loan yields improved to 21.9% in Q2 FY2023 versus 19.4% in Q1 FY2023 which was largely driven by the rationalization of low-yielding schemes rolled out in H2 FY2022.

- The management states that the company has reached the end of the COVID-related provisioning cycle in Asirvad & thus profits improved to Rs.56 Cr Vs a loss of Rs.8 Cr QoQ.

- In September 2022, Asirvad had an equity infusion of Rs.250 Crores from the parent, Manappuram Finance through a rights issue.

- The yield rationalization program involved a reduction in the contribution of low-yield products to total growth from 35% to 25%.

- The company expects the gold loan portfolio to remain flat & high yield share in the mix to increase to 85% from the current levels of 70-75%.

- The management expects growth of high-yield gold loans to be 5-10% in the coming quarters owing to rural demand despite the company’s rates being 200-300 bps higher than Muthoot & target 21-22% yields.

- The company’s employee cost has increased owing to higher salary & addition of 1500 new employees in non-gold biz.

- Auction during the quarter stood at Rs.190 Crs.

- The company’s lending breakup based on ticket size stood at 78% for >2 lakhs & 22% for <2 lakhs along with 7% for >5 lakhs.

- The management is confident of decreasing NPA in the housing division from 4% to 3% due to an uptick in rural demand.

- The company is working with regulators to get branch expansion approval & meanwhile is using its subsidiary Asirvad to facilitate gold loans in areas where the parent doesn’t have branches.

- The management is committed to its long-term guidance of 20% CAGR in the standalone book & 20% ROE level.

- The gold loan AUM based on ticket size stood at 57% above 1 lakh & 43% below 1 lakh.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company is currently struggling due to high competition from banks & poor demand in rural areas. The management states that it views NBFCs as its main competition and these NBFCs should be in for a tough time given the rising rate scenario. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, the margin erosion from moving to a higher duration product, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1063 | 1319 | -19.4% | 1110 | -4.2% | 4587 | 5193 | -11.7% |

| PBT | 359 | 608 | -41.0% | 346 | 3.8% | 1750 | 2269 | -22.9% |

| PAT | 265 | 458 | -42.1% | 259 | 2.3% | 1304 | 1698 | -23.2% |

| Consolidated financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1491 | 1630 | -8.5% | 1507 | -1.1% | 6126 | 6375 | -3.9% |

| PBT | 354 | 622 | -43.1% | 348 | 1.7% | 1783 | 2316 | -23.0% |

| PAT | 261 | 468 | -44.2% | 261 | 0.0% | 1329 | 1725 | -23.0% |

Detailed Results:

- The company reported another set of dismal result with consolidated revenue decreasing by 8% YoY and PAT falling by 44% YoY.

- The company’s ROE decreased by 1280 bps YoY to 12.6% & 30 bps QoQ whereas its ROA declined by 290 bps YoY to 3.1%.

- The gold loan AUM declined by 1.4% sequentially while LTV stood at 62%.

- The company’s consolidated AUM was at Rs 303 Bn which increased 11.2% YoY and was flat on QoQ basis.

- Book value per share at the end of the quarter was Rs 94.1.

- The company’s consolidated cost of funds decreased by 110 bps YoY to 8%.

- In the gold loan business, the Opex to AUM stood at 6% for Q4FY22.

- The standalone business has a GNPA of 3% and NNPA of 2.7% while net yield stood at 18.8% for Q4.

- The CAR for the standalone business stands at 31%.

- Gold AUM per branch stood at 56.4Mn.

- Online gold loan division contributed 44% to the company’s overall gold AUM in Q4.

- The company’s advance mix saw a decline in gold loan business to 67% of total advances while MFI business was flat at 22% of total advances.

- Asirvad MFI saw a GNPA of 3.5% with NNPA at 0 for Q4. Opex to AUM for Asirvad was at 7%. Cost of funds was at 10.3%.

- Collections were at 99% for Q4 in MFI business.

- The company’s housing finance business reported AUM of Rs.845.3 Cr.

- The company’s vehicle finance business reported an AUM of Rs 1643.2 Cr

- The company has announced a quarterly dividend payout at Rs 0.75 per share.

Investor Conference Call Highlights

- The company was able to add 3.75 lakh new customers whereas the average ticket size and the average duration were Rs. 56,568 and 82 days respectively.

- The company’s loan tenure mix stood as 2/3rd of the loans for 3 months, 30% in 6 months. And below 5% is in the 1-year category.

- The management is optimistic about pricing wars between NBFC to settle soon and disbursement to be at 21%.

- The yields in the Asirvad segment went up by 4% due to higher credit costs.

- The company believes that its key competition comes from NBFC & not banks. Due to the rate hike by RBI, it expects the weaker NBFCs to reduce the intensity of competition leading to more stabilisation of its operations.

- The company is currently targeting yields of 5%.

- The management states the capital adequacy of Asirvad is 20% & so it has enough room to raise tier 2 capital.

- The amount spent on advertisement for Q4 stood at Rs.12 Cr while that for FY22 stood at Rs.89 Cr.

- The management expects gold loan growth to be at around 10% in the FY2023.

- The company expects yields to increase by around 150 bps to 200 bps.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company has also started seeing good collections in MFI and vehicle business. The management states that it views NBFCs as their main competition and these NBFCs should be in for a tough time given the rising rate scenario. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, the margin erosion from moving to a higher duration product, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 1110 | 1355 | -18.1% | 1170 | -5.1% | 3524 | 3875 | -9.1% |

| PBT | 346 | 623 | -44.5% | 474 | -27.0% | 1391 | 1662 | -16.3% |

| PAT | 259 | 465 | -44.3% | 355 | -27.0% | 1039 | 1240 | -16.2% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 1507 | 1650 | -8.7% | 1554 | -3.0% | 4635 | 4774 | -2.9% |

| PBT | 348 | 657 | -47.0% | 495 | -29.7% | 1430 | 1694 | -15.6% |

| PAT | 261 | 483 | -46.0% | 370 | -29.5% | 1068 | 1257 | -15.0% |

Detailed Results:

- The company reported another dismal result with consolidated revenue decreasing by 8% YoY and PAT falling by 46% YoY.

- The company’s ROE decreased by 600 bps QoQ & 1610 bps YoY to 12.9% whereas its ROA declined by 160 bps QoQ & 300 bps YoY to 3.1%.

- The gold loan AUM increased by 8.8% sequentially driven by collateral growth of 7.8%.

- The company’s consolidated AUM was at Rs 30407 Cr which increased 10% YoY and increased 7% QoQ.

- The company’s subsidiary – Asirvad MFI saw its AUM being flat QoQ & increasing by 9% YoY.

- Book value per share at the end of the quarter was Rs 94.1.

- The company’s consolidated cost of funds decreased by 90 bps YoY to 8.4%.

- Consolidated Opex grew 13.8% QoQ and 47.1% YoY while Consolidated NII fell 8.3% QoQ & 12.3% YoY. Opex increased by 47.1% YoY.

- In the gold loan business, the Opex to AUM increased by 100 bps YoY to 7% in Q3.

- The standalone business has a GNPA of 1.4% and NNPA of 1%.

- The CAR for the standalone business stands at 30%.

- Gold AUM per branch increased from Rs 53.1 Cr to Rs 57.5 Cr QoQ.

- LTV of standalone business as on 31st December stood at 65%.

- Online gold loan division contributed 41% to the company’s overall gold AUM in Q3.

- Asirvad MFI saw a GNPA of 2.8% with NNPA at 0 for Q3. Opex to AUM for Asirvad was at 6%. Cost of funds was at 10.3%.

- Collections were at 97% whereas billing efficiency was at 96% in MFI business.

- The company’s vehicle finance business reported an AUM of Rs 1509.7 Cr which improved from 1267.2 Cr QoQ while GNPA stood at 5.6%.Collection efficiency stood at 103%

- GNPA of housing finance business stood at 12.3% while total loan book increased by 28.9% YoY & 11.5% QoQ to Rs.816 Cr. Collection efficiency stood at 100%

- The board declared an interim dividend of 75 paise for this quarter.

Investor Conference Call Highlights

- The management believes that it was able to perform reasonably well in terms of business volume growth in gold business despite the omicron variant affecting the quarter.

- Increased ad spending and better incentives to staff to bring back high-value customers lead to higher Opex.

- The microfinance portfolio saw a decline of 2.4% QoQ as the management consciously tailed back the lending due to uncertainties of the 3rd covid wave.

- The company’s focus on providing competitive interest rates to high ticket size gold loan customers will lead to better growth but decreased margins in future along with lower GNPA.

- Cash & equivalents stood at Rs.1654 Cr * undrawn bank line at Rs.3202 Cr.

- The company added 3.81 lakh new customers.

- Gold loan average ticket size stood at Rs.53397 & average duration at 111 days.

- Advertisement costs increased by 126% QoQ & 300% YoY to Rs.51.4 Cr

- Interest receivable on gold loans were 3.6% of total AUM & amounted to Rs.738 Cr.

- Write-offs to MSME and NBFC portfolios increased from Rs.10 to Rs.17 Cr due to revised IRAC norms.

- The management states that advertisement expenditure will be moderated to a much lower level in the future and the current increase was primarily due to low demand due to covid.

- The management is focused on maintaining its yield to 21% whereas other NBFCs are willing to go to 17% because of which growth is expected to moderate in further quarters.

- OGL customers decreased by 34% due to the company providing a rebate to other customers as well instead of previously providing the same to only OGL customers.

- The management expects the growth to moderate to 1.5-2% per month.

- Teaser loans stand at 20% of the total AUM.

- The contribution of 3-month loan tenure to the book stands close to 50%.

- The company didn’t see good momentum in January & February as well however the momentum is expected to improve due to the opening of institutions.

- The company believes the short-term loan portfolio won’t be affected due to lower yields of competitors however long term portfolio is expected to moderate.

- The NBFC’s major advantage over banks is a shorter turnaround and processing time for transactions.

- There has been a growth of 3-4% in customers with ticket value > Rs.1 lakh & their contribution to AUM stands at 54%

- The management still foresees the opportunity of AUM growth of 15-20% in the coming year.

- The management believes the pre covid level of collections will come by the 4th quarter of next year.

- Small ticket size customers will increase with improvement in the rural economy in the coming quarters.

- The contribution to total gold loan AUM stands at Metro 22%, urban is 28%, semi-urban is 32 and the balance is in rural categories.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company posted poor quarterly results with consolidated PAT declining by 46% due to higher Opex and ROE declining by 600 bps QoQ mainly due to rising A&P spend and the product mix shift towards lower-yielding loans. The management is expecting very moderate growth in the coming quarters due to high competition from other NBFCs who are willing to offer a lower yield. The company has also started seeing good collections in MFI and vehicle business. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, make up for the margin erosion from moving to a higher duration product, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 1170 | 1294 | -9.58% | 1243 | -5.87% | 2413 | 2520 | -4.25% |

| PBT | 474 | 544 | -12.87% | 570 | -16.84% | 1045 | 1039 | 0.6% |

| PAT | 361 | 419 | -13.84% | 410 | -11.95% | 780 | 775 | 0.65% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 1554 | 1578 | -1.52% | 1574 | -1.27% | 3128 | 3094 | 1.10% |

| PBT | 495 | 544 | -9% | 586 | -15.53% | 1081 | 1037 | 4% |

| PAT | 370 | 405 | -9% | 437 | -15.33% | 807 | 773 | 4.40% |

Detailed Results:

- The company reported a dismal result with consolidated revenue decreasing by 1.52% YoY and PAT falling by 9% YoY.

- The company’s ROE decreased by 444 bps QoQ & 708 bps YoY to 18.9% whereas its ROA declined by 113 bps QoQ & 41 bps YoY to 4.7%.

- The gold loan AUM declined by 5.2% YoY and increased by 13.2% QoQ.

- The company’s consolidated AUM was at Rs 28421.6 Cr which increased 5.6% YoY and increased 14.8% QoQ.

- The company’s subsidiary – Asirvad MFI saw its AUM increasing by 18% QoQ & 44% YoY.

- Book value per share at the end of the quarter was Rs 94.1.

- The company’s consolidated cost of funds decreased by 79 bps YoY to 8.5%.

- Consolidated Opex grew 23% QoQ and 29.5% YoY while Consolidated NII fell 3% QoQ & rose 4.5% YoY. Opex increased by 29.5% YoY due to higher non gold branches and increased employees.

- In the gold loan business, the Opex to AUM increased by 100 bps to at 7% in Q2.

- The standalone business has a GNPA of 1.6% and NNPA of 1.3%.

- The CAR for the standalone business stands at 32%.

- Gold AUM per branch increased from Rs 46.9 Cr to Rs 53.1 Cr QoQ.

- Online gold loan division contributed 45% to the company’s overall gold AUM in Q2.

- The company’s advance mix saw a decline in gold loan business to 66% of total advances and an increase in MFI business to 25% of total advances.

- Asirvad MFI saw a GNPA of 2.6% with NNPA at 0 for Q2. Opex to AUM for Asirvad was at 6%. Cost of funds was at 10.3%.

- Collections were at 91% whereas billing efficiency was at 93% in MFI business.

- The company’s vehicle finance business reported an AUM of Rs 1267 Cr which improved by 21.3% QoQ while collection efficiency was at 120%.

- The company has announced a quarterly dividend payout at Rs 0.75 per share.

Investor Conference Call Highlights

- The total loan book of the home loan business was at Rs 732 Cr which was up 9.6% QoQ and collection efficiency was 95%.

- The growth in the gold loan business was aided by recovery in the informal sector and the good monsoon along with a more focused marketing strategy.

- The management states that capital allocation for MFI business would not exceed more than 15%. Currently, the capital allocated stands below 10%. This is due to the risk allocation strategy where the company will keep at most 15% in unsecured lending for the company.

- The management states that it prioritizes allocating more than 50% of the capital towards the gold loan business and 20% for the home mortgage business.

- The management is focused on increasing its collection efficiency from 91% to 95% and decreasing its PAR from 26% in the coming quarters.

- The company did an auction of Rs 360 Cr of gold in Q2.

- The management is changing its strategy by going from a 3-month product to a 6-month product so that customers would get up to 9 months & because it was missing out on growth opportunities from higher ticket size segments. Thus, this new strategy is expected to facilitate higher growth in the loan book.

- The company paid incentives of Rs 31.2 Cr in the current quarter to get its employees back and do their marketing activities.

- The management intends to bring its Tier 1 capital down from 32% to 26% in the coming quarters.

- The company’s focus on winning back higher tickets acquisition also led to yield erosion however it was offset by higher loan book growth.

- The management is expecting the yield reduction by 200 bps out of which 1/4th will be offset by lower cost of borrowings and that would result in a 1.5% drop in the spread. However, due to increase in AUM in branches and stable Opex would lead to a lower Opex to AUM ratio.

- The management expects ROE and ROA of 4.5-5% under its new strategy in the coming quarters.

- The management states that due to delay in collections, the PAR is elevated even though collection efficiency improved.

- The management highlights that 80% of its new disbursal are to existing regular customers.

- Gold loan LTV at the end of the quarter was 67%.

- The company has done restructuring of Rs 1000 Cr out of which Rs 270 Cr is under direct assignment belonging to the bank and the company has provisions of 18% on the rest. Thus, its restructured book efficiency is down to 70%. Most of this was done in Asirvad.

- The management states that the company’s overall objective is to grow at a rate of 20%, where gold loan grows at 15%-20% YoY, and to maintain ROE at 20%.

- The management states that it does not consider banks as its competition because its USP is which is quick turn around and availability which is very different from Manappuram’s focus. The main source of competition for the company is the NBFC space according to the management.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company posted poor quarterly results with consolidated PAT declining by 9% due to higher Opex and ROE declining by 444 bps QoQ. The management is expecting good growth in the coming quarters due to the pivot from 3-month product to 6-month product which is done to cater to the higher ticket size market. The company has also started seeing good collections in MFI and vehicle business. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, the margin erosion from moving to a higher duration product, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q1FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 1243 | 1226 | 1.39% | 1319 | -5.76% |

| PBT | 570 | 495 | 15.15% | 608 | -6.25% |

| PAT | 410 | 333 | 23.12% | 480 | -14.58% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 1574 | 1516 | 3.83% | 1630 | -3.44% |

| PBT | 586 | 492 | 19.11% | 622 | -5.79% |

| PAT | 437 | 368 | 18.75% | 468 | -6.62% |

Detailed Results:

- The company reported a mixed quarterly result with consolidated revenue growing by 3.83% YoY and PAT growing by 19% YoY.

- The company’s ROE decreased by 165 bps YoY to 23.3% whereas its ROA increased by 98 bps YoY to 5.8%.

- The gold loan AUM declined by 6.8% YoY and 13.3% QoQ due to weak gold prices and lower new customer acquisitions due to physical disruption.

- The company’s consolidated AUM was at Rs 24756 Cr which declined 2.3% YoY and 9.1% QoQ.

- The company’s subsidiary – Asirvad MFI saw its AUM increasing by 20% YoY.

- Book value per share at the end of the quarter was Rs 90.5.

- The company’s consolidated cost of funds decreased by 79 bps YoY to 9.0%.

- In the gold loan business, the Opex to AUM has remained steady at 6% in Q1.

- The standalone business has a GNPA of 2% and NNPA of 1.6%.

- The CAR for the standalone business has risen to 34%.

- Gold AUM per branch decreased from Rs 54.1 Cr in Q4FY21 to Rs 46.9 Cr Q1FY22.

- Online gold loan division contributed 53% to the company’s overall gold AUM in Q1.

- The company’s advance mix saw a decline in gold loan business to 67% of total advances and an increase in MFI business to 24% of total advances.

- Asirvad MFI saw a GNPA of 3.6% with NNPA at 0 for Q1 of FY22. Opex to AUM for Asirvad was at 5%. Cost of funds was stable at 10.5%.

- Collections are back to 95% on July after poor collections in May and June.

- The company’s vehicle finance business reported an AUM of Rs 1045 Cr which was flat QoQ while GNPA in this business was at 5.6% in Q1.

- The company has announced a quarterly dividend payout at Rs 0.75 per share.

Investor Conference Call Highlights

- The company is seeing attrition among high ticket loans in the gold loan segment due to targeted pricing in this segment from non-gold loan-focused companies. It has launched special schemes to counter this attrition.

- The cash and cash equivalent at the consolidated level was at Rs 2893 Cr and it also has undrawn bank lines of Rs 7320 Cr.

- The company maintained an average LTV of 65% in Q1.

- The total number of gold loan customers was at 24.06 Lacs. The net new additions were at 2 Lacs vs 3 Lacs in Q4FY21 due to local lockdowns.

- The company’s gold tonnage was reduced from 65 to 58 tonnes due to auctioning procedure.

- The management foresees growth of around 15% for the next 9 months.

- The company disbursed Rs 1500 Cr or 4.5 tons of gold in the auction. It made a total of Rs 93000 Cr of disbursement in Q1.

- The management states that competition from banks is decreasing due to higher pressure on them for keeping LTV as high as 90%.

- There is no disclosed loan from the parent Manappuram to the subsidiary – ‘Asirvad’. The average tenure of customer loans is at 18 months while the average tenure of Asirvad’s debt is at 24 months. 30% of Asirvad’s loans are up for repayment next year.

- The company saw a YoY decrease in its online gold loan business due to lower gold prices as compared to a year ago.

- The management is expecting improved collections in its MFI and vehicle business in the coming quarters.

- The vehicle finance business is disbursing around Rs 100 Cr a month. The home finance business is making disbursements of Rs 35 Cr a month.

- The company has Rs 740 Cr of interest accrued in Q1.

- The management states that due to lockdowns prevailing in Southern India where the company has 2/3rds of its loan disbursements, the company saw low growth.

- The company has maintained provisions of Rs 90 cr in the MFI business, 30 crores in the Gold loan business, and close to Rs. 2 cr in the Housing finance business.

- The management has clarified that only those customers who have 3 or fewer EMIs pending are eligible for a repeat microfinance loan.

- The management expects yields to decrease by 1-1.5% due to aggressive schemes however it will be compensated by higher growth.

- The management states that the company helps the customers in a lot of ways to try to retrieve gold before auctioning which is the last option. The customer is also getting better value when auctioning the gold through Manappuram as compared to selling in the open market. This is why Manappuram still has around 80% of cush customers coming back to the company when they need gold loans.

- The management states that its results are not comparable to peers who lend for 9-12 months whereas the company lends for 3 months because of which the company manages price risk and maintains higher yields in the long run and has thus reported comparatively poor results.

- The company provides 6-month loans to its trust customers and according to the company’s risk management, they might auction the gold or wait for the complete repayment of the loan.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company posted mixed quarterly results with sales growth of 3.9% YoY and profit growth of 19% YoY. The management is expecting good growth in the coming quarters due to the further opening up of the economy after the second wave and reduced competition from banks who have already lent up to 90% LTV. The company has also started seeing good collections in MFI and vehicle business from June. It remains to be seen how the company would mitigate the possible risk of further decline in gold prices, the potential of lockdowns due to a third wave, and the increased competition in this industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1319 | 1191 | 10.75% | 1355 | -2.66% | 5194 | 4352 | 19.35% |

| PBT | 608 | 461 | 31.89% | 623 | -2.41% | 2270 | 1680 | 35.1% |

| PAT | 458 | 340 | 34.71% | 465 | -1.51% | 1698 | 1230 | 38.05% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1630 | 1618 | 0.74% | 1650 | -1.21% | 6375 | 5551 | 14.84% |

| PBT | 622 | 534.0 | 16% | 657 | -5% | 2316 | 2007 | 15% |

| PAT | 468 | 398 | 18% | 483 | -3.11% | 1725 | 1480 | 16.55% |

Detailed Results

- The company had a decent quarter with consolidated revenues rising 0.74% YoY and consolidated PAT rising 18% YoY.

- Standalone numbers were very good with revenue & profit growth of 11% & 35% YoY respectively in Q4 and 19% & 38% YoY respectively in FY21.

- RoA for the quarter came in at 6.0% while consolidated RoE came in at 26.4%.

- Total AUM grew 7.9% YoY to Rs 272 bn while gold AUM grew 12.4% YoY, highlighting excellent growth in standalone business.

- The company has a borrowing cost of 9.1% in the quarter.

- The share of new businesses in revenues was at 29.9% in Q4.

- The book value per share was at Rs 86.3 at the end of Q4.

- The company has access to Rs 7364 CR of undrawn bank lines.

- In the gold loan business, the Opex to AUM has remained steady at 6% in Q4 & FY21.

- Gold AUM per branch rose significantly to Rs 5.41 Cr per branch in FY21vs Rs 4.81 Cr per branch a year ago.

- The standalone business has GNPA and NNPA of 1.9% and 1.5% respectively while maintaining a CAR of 29%.

- The online gold loan’s share of total gold AUM was at 54% in Q4 & FY21.

- In Asirvad MFI, AUM was at Rs 5982.6 Cr which is up 8.8% YoY while RoE was at 0.2% in Q4.

- The GNPAs for Asirvad has risen to 2.5% in Q4 vs 2.1% in Q1. The NNPA is still due to the company’s good provisioning. Asirvad maintained a CAR of 23.3%. The cost of funds for Asirvad was at 10.5% in Q4.

- Collections are back to 101% in March.

- The company has announced a final dividend of Rs 0.75 per share.

Investor Conference Call Highlights

- About 70% of Manappuram’s loan book is against gold.

- The commercial vehicle business saw higher GNPAs due to lockdowns. It came down to 5% at the end of FY21.

- The company’s consolidated profit of Rs 468 Cr is its highest ever full-year profit.

- In Q4, the company added 3 lakh new customers and collateral of nearly 4 tonnes of gold. Gold loan average ticket size and the average duration were INR 44,600 and 100 days, respectively.

- Total gold holdings stood at 65 tonnes.

- The gold loan AUM declined 5.6% QoQ due to a significant decline in gold prices by 12% in Q4 and 21% from Q2 prices.

- The weighted average LTV stands at INR 2,922 per gram or 71% of gold price on 31st March 2021.

- Loans to NBFCs at INR 183 crores and loans to SME and others at INR 261 crores.

- The home loan business was up 5.2% QoQ at Rs 666 Cr.

- The collection efficiencies in Jan, Feb & March were at 99%, 100% & 101% respectively. The company has made provisioning of 5.71% of AUM for Asirvad.

- Collections have dipped 7-8% in April on account of the 2nd wave of COVID.

- The collection efficiencies for vehicle finance in Jan, Feb & March were at 106%, 105% & 113% respectively. Currently, they are at 90%.

- The company did a write-off of Rs 123 Cr in FY21.

- Of the Rs 5985 Cr MFI loan book, Rs 45 Cr is secured SME loans and Rs 2.5 Cr of loan deferrals the rest is all MFI. The company will be looking to use the 15% other lending limit in MFIs to develop gold loan businesses in the areas where they are not currently present and where Asirvad is present.

- On average, the company maintains around 15-20 days of repayments in cash.

- 62% of the loan book is of Rs 1 Lac plus size but it corresponds to around 20% of the customer set.

- The LTV holiday provided by RBI has been over the industry should see a rollover of existing customers to the normal LTV.

- The company policy has always been to retain non-defaulting and in-time repaying customers by giving them a higher ticket size.

- The company is targeting the ratio of 80:20 for existing to new customers for Asirvad.

- The company has done restructuring of 4% of MFI loans and 8% of vehicle loans only.

- The management believes that microfinance business on a sustainable model can bring forth an ROE of over 20%. Overall, it plans to keep microfinance at 10-15% of the overall AUM.

- The company is aiming to grow other secured lending segments like vehicle, home loans, etc to a higher proportion to match MFI contribution.

- The opportunity size for NBFCs in the gold loan space remains high since 75% of the gold loan market is still dominated by unorganized players according to the company’s research.

- The management is ambivalent on the need for doing an IPO for Asirvad as both Manappuram and Asirvad have enough capital with them now.

- The company is targeting a customer growth rate of 10-15% annually. In MFI, it is looking to add around 4-5 lac customers each year.

- Interest accrual as of FY21 was at Rs 716 Cr.

- The company auctioned off 1 ton of gold in Q2 amounting to around Rs 400 Cr.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company’s current quarter performance has been mixed with 0.74% YoY revenue growth & 18% PAT growth. Gold AUM fell 5.6% QoQ mainly due to a 12% drop in gold prices. The company saw a good revival in Asirvad and collections have improved to 101% in March before falling 7-8% afterward due to the 2nd wave of COVID. The vehicle finance division has also come back strong and posted collections around 113% in March before declining in FY22 due to the 2nd wave of COVID. It remains to be seen whether the company will be able to sustain its growth momentum in the gold loan space with falling gold prices and how will things pan out for Asirvad and the MFI industry given the accelerated upcoming waves of COVID. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 1355 | 1133 | 19.59% | 1294 | 4.71% | 3875 | 3161 | 22.59% |

| PBT | 623 | 456 | 36.62% | 544 | 14.52% | 1662 | 1219 | 36.34% |

| PAT | 465 | 334 | 39.22% | 406 | 14.53% | 1240 | 891 | 39.17% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 1650 | 1451 | 13.71% | 1578 | 4.56% | 4744 | 4042 | 17.37% |

| PBT | 657 | 560 | 17% | 544 | 20.77% | 1694 | 1516 | 11.74% |

| PAT | 483 | 414 | 17% | 405 | 19.26% | 1257 | 1114 | 12.84% |

Detailed Results

- The company had a decent quarter with consolidated revenues rising 13.7% YoY and consolidated PAT rising 17% YoY.

- Standalone numbers were very good with revenue & profit growth of 20% & 39% YoY respectively in Q3 and 23% & 39% YoY respectively in 9M.

- RoA for the quarter came in at 6.1% while consolidated RoE came in at 29%.

- Total AUM grew 14.7% YoY to Rs 27642.5 Cr while gold AUM grew 24.4% YoY, highlighting excellent growth in standalone business.

- The company has a borrowing cost of 8.95% in the quarter.

- The share of new businesses in revenues was at 26.9% in Q3.

- The book value per share was at Rs 81.2 at the end of Q3.

- The company also raised fresh borrowing of Rs 1925 Cr through NCDs, and bank loans.

- In the gold loan business, the Opex to AUM has remained steady at 5.5% in Q3.

- Gold AUM per branch rose significantly to Rs 5.7 Cr per branch vs Rs 4.8 Cr per branch a year ago.

- The standalone business has GNPA and NNPA of 1.3% and 0.8% respectively while maintaining a CAR of 25.9%.

- The online gold loan’s share of total gold AUM was at 59% in Q3.

- In Asirvad MFI, AUM was at Rs 5357.7 Cr while RoE was at 6.8% in Q3.

- The GNPAs for Asirvad has risen to 2.63% in Q3 vs 2.1% in Q1. The NNPA is still due to the company’s good provisioning. Asirvad maintained a CAR of 24%. The cost of funds for Asirvad was at 10.7% in Q3.

- Collections are back to 99% in Dec.

- The company has announced an interim dividend of Rs 0.65 per share.

Investor Conference Call Highlights

- The company has extended its doorstep gold loan facility to all our branches across India, which allows Manappuram to service customers, even beyond normal working hours, at their homes and offices.

- The CV finance segment saw good revival with collection efficiency reaching 110%. The CV division’s AUM stood at Rs 988 Cr which was down 7% YoY.

- The company has undrawn bank lines of Rs 2502 Cr bringing its surplus liquidity up to almost Rs 5000 Cr.

- CP exposure has come down to 8% vs 24% a year ago.

- Gold holding was at 68.24 tons which was flat QoQ and down 7.2% YoY.

- Gold loan average ticket size and average duration was INR 46,318 and 75 days respectively.

- The total number of gold loan customers stood at 26.24 lakh with an net increase of 67,000 new customers in Q3.

- The weighted average LTV is now at 63%. Gold loan disbursements during the quarter stood at INR 57,445 crores.

- The disbursements for Asirvad in Q3 were at Rs 1306 Cr.

- The home loan business had a total book of INR 633 crores, which was up 2.1% QoQ and 5.4% YoY.

- In MFI segment, the company has taken provision of Rs 48.4 Cr in Q3. The overall provisioning for FY21 so far is at Rs 320 Cr which the management feels is adequate enough.

- The states of WB and Odisha are showing revival in collections and the management has stated that the situation in these states should normalize by Q1FY22.

- WB exposure is at 12% of MFI AUM.

- The pressure on MFI margins is due to low AUM growth. The management reassures that as AUM growth revives, the margins will rise to normal levels.

- In standalone entity, ECL provision stands at Rs 223 Cr while in vehicle finance ECL stands at Rs 66% or nearly 6% of book.

- ECL in MFI is at Rs 322 Cr which is also close to 6% of book.

- Assam portfolio is very small at only Rs 38 Cr.

- The management maintains its growth guidance of 15% revenue growth in FY21 & FY22.

- RoA is expected to stay in the range of 6-7%.

- The management remains confident that it will not need to take any additional provisions related to COVID-19.

- The LTV in gold loan is capped at 75% and as gold price goes up, the LTV is taken down.

- The provisioning in NBFC lending is at Rs 20 Cr on a book of Rs 450 Cr.

- The company is now seeing 15-20% of new customers being onboarded online.

- The company made writeoffs of Rs 68 Cr in Q3.

- Out of the customer set of 23 Lac for Asirvad, around 1 Lac didn’t make any payments till Dec and as per RBI guidelines, the company has restructured the portfolio of this 1 Lac customer set.

- Many industry entrants in the gold loan space have seen QoQ growth of more than 10%. The management states that it is a temporary phenomenon as the LTV cap has been relaxed to 90% till 31st Thus these new entrants have been aggressively acquiring customers and expanding AUM by offering higher LTV. But ultimately this is temporary and should fade away as the cap comes back to normal levels.

- The incremental yield is expected to remain stable at current levels.

- The company has applied to RBI for permission to open up 300 new branches in North India. These branches are expected to break even within 1 year of opening.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company’s current quarter performance has been decent with 14.7% YoY overall AUM growth with continued growth momentum in gold loan segment. The company continues to see good traction in the online gold loan and it has also activated doorstep gold loan facility to all branches in India. The company has seen good revival in Asirvad and collections have improved to 99% in Dec. The vehicle finance division has also come back strong and posted collections around 110%. It remains to be seen whether the company will be able to sustain its growth momentum in the gold loan space with every big bank getting into this space and how will things pan out for Asirvad and the MFI industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1294 | 1077 | 20.15% | 1226 | 5.55% | 2520 | 2028 | 24.26% |

| PBT | 544 | 428 | 27.10% | 495 | 9.90% | 1039 | 763 | 36.17% |

| PAT | 406 | 336 | 20.83% | 369 | 10.03% | 775 | 556 | 39.39% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1578 | 1390 | 13.53% | 1516 | 4.09% | 3094 | 2591 | 19.41% |

| PBT | 544 | 548 | -0.73% | 492 | 10.57% | 1037 | 955 | 8.59% |

| PAT | 405 | 433 | -6.47% | 368 | 10.05% | 773 | 700 | 10.43% |

Detailed Results

- The company had a mixed quarter with consolidated revenues rising 13.5% YoY and consolidated PAT falling 6.5% YoY.

- Standalone numbers were very good with revenue & profit growth of 20% YoY in Q2 and 24% & 39% YoY respectively in H1.

- RoA for the quarter came in at 5.1% while consolidated RoE came in at 26%.

- Total AUM grew 18.6% YoY to Rs 26903 Cr while gold AUM grew 30.1% YoY, highlighting excellent growth in standalone business.

- The company has a borrowing cost of 9.13% in the quarter. The cash and undrawn bank lines of the company were at Rs 5440 Cr as of Q2.

- The share of new businesses in revenues was at 26.6% in Q2.

- The book value per share was at Rs 76.2 at the end of Q2.

- The company also raised fresh borrowing of Rs 2484 Cr through NCDs, and bank loans.

- In the gold loan business, the Opex to AUM has risen slightly to 5.5% from 5.4% in the last quarter while security costs have gone down 85.1% YoY.

- Gold AUM per branch rose significantly to Rs 5.6 Cr per branch vs Rs 4.6 Cr per branch a year ago.

- The standalone business has GNPA and NNPA of 1.1% and 0.7% respectively while maintaining a CAR of 24.8%.

- The online gold loan’s share of total gold AUM was stable 61% in Q2.

- In Asirvad MFI, AUM was up 5% YoY & down 1% QoQ while RoE has crashed for the subsidiary to -0.9% in Q2.

- The GNPAs for Asirvad has risen to 2.53% in Q2 vs 2.1% in Q1. The NNPA is still due to the company’s good provisioning. Asirvad maintained a CAR of 25.7%. The cost of funds for Asirvad was at 11% in Q2.

- Collections are back to 90% with only 9% doing no repayment in Oct.

Investor Conference Call Highlights

- Commercial Vehicle AUM fell 20% YoY.

- Gold loan AUM constitutes 73% of consolidated AUM.

- The gold loans’ average ticket size and the average duration were INR 46,499 and 47 days.

- The weighted average LTV stands at INR 2,869 per gram or 61% of the current gold price.

- Collection for Asirvad in WB was at 75%. The reason for this lower collection is the uneven state lockdowns in WB which have hampered business activities.

- Collections in Karnataka have seen a temporary blip and should come back to normal.

- In Asirvad, the loan breakup is term loans of close to 60%, debentures of 12%, and securitization of 25%.

- The number of customers in gold loans is at 26 lacs.

- The yields in the gold loan business have not been affected since the loans are small in size of up to rs 50,000 and of 2 months duration and thus the demand for the instant loan stays stable.

- The management expects to see at least 10% QoQ growth in Q3 & Q4 for gold loan AUM.

- The company has added headcount in Asirvad for collection to reduce pressure on the existing personnel and this has resulted in higher employee costs in Q2.

- The company will not be requiring any additional capital for Asirvad currently.

- Collection in commercial vehicles has been steadily rising from 59% in July to 81% in Oct.

- Vehicle Finance provision stands at INR 78 crore.

- The management shall continue to keep a conservative approach and keep higher provisions than required by regulation.

- The management has stated that the gap in the collection as compared to pre-covid figures is not due to delinquency but due to delay in payment schedule and lags in collections.

- The management expects collections to come back to pre-covid levels in Q4.

- The stagnation in collections from Sep to Oct is mainly on account of the festival period and temporary lockdown coming up in the country.

- The tonnage has gone down as people can now take bigger loans for smaller amounts of gold due to high gold prices. Once gold prices come down, the situation will reverse.

- Gold loan growth has been primarily pushed by the Online Gold Loan facility during the pandemic.

- In Q2, gold loan disbursement was at INR 93,368 crore vs INR 68,390 crore in Q1 & INR 50,250 crore in Q2FY20.

- Only 5% of loan customers are new and the rest are repeat customers.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s leading gold loan providers by growing its core business consistently. The company’s current quarter performance has been decent with 18% YoY overall AUM growth despite QoQ decline in Asirvad AUM. The company has also seen good traction in the online gold loan which has been the primary driver of the standalone business and now accounts for 61% of all loans. This brings a significant opportunity for the company to improve its operating model and reduce manpower and physical costs. The company has stayed cautious with Asirvad and collections have slowly improved to 90% in Oct. It remains to be seen how the company’s collections will be affected in the near future and how will things pan out for Asirvad and the MFI industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q1FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 1226 | 951 | 28.92% | 1191 | 2.94% |

| PBT | 495 | 335 | 47.76% | 461 | 7.38% |

| PAT | 369 | 220 | 67.73% | 340 | 8.53% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 1516 | 1201 | 26.23% | 1618 | -6.30% |

| PBT | 492 | 407 | 20.88% | 534 | -7.87% |

| PAT | 368 | 267 | 37.83% | 398 | -7.54% |

Detailed Results

-

- The company had a good quarter with consolidated revenues rising 26% YoY and consolidated PAT rising 38% YoY.

- RoA for the quarter came in at 4.8% while consolidated RoE came in at 25%.

- Total AUM grew 25.6% YoY to Rs 25345.8 Cr while gold AUM grew 33.4% YoY, highlighting excellent growth in AUM from all businesses.

- The company has a borrowing cost of 9.4% in the quarter. The cash and undrawn bank lines of the company were at Rs 6025 Cr as of Q1.

- The share of new businesses in revenues was at 30% in Q1.

- The book value per share was at Rs 71 at the end of Q1.

- The company also raised fresh borrowing of Rs 1900 Cr through NCDs, CPs, and bank loans.

- In the gold loan business, the Opex to AUM has fallen to 5.4% from 6.8% in the last quarter while security costs have gone down 72.8% YoY.

- Gold AUM per branch rose significantly to Rs 5.03 Cr per branch vs Rs 4.38 Cr per branch a year ago.

- The standalone business has GNPA and NNPA of 1.3% and 0.7% respectively while maintaining a CAR of 22.9%.

- The online gold loan’s share of total gold AUM has gone up to 63% in Q1.

- In Asirvad MFI, AUM grew 20% YoY but declined 8.4% QoQ while RoE has crashed for the subsidiary to 0.2% in Q1.

- The GNPAs for Asirvad has risen to 2.1% in Q1 vs 1.56% in Q4FY20. The NNPA is still due to the company’s good provisioning. Asirvad maintained a CAR of 26.9%. The cost of funds for Asirvad was at 11.1% in Q1. Provision of Rs 75 CR added in Q1 bringing the total provision for COVID-19 up to Rs 130 Cr.

- Asirvad now boasts of 1041 branches and a customer base of 2.3 million.

- The Housing and Vehicle finance divisions have shown AUM growth of 15.8% and 3.5% YoY respectively.

Investor Conference Call Highlights

- The company’s gold loan portfolio which accounts for nearly 70% of the total portfolio, has a tenure of fewer than 3 months while all of the company’s borrowings are long term in nature. This provides a natural hedge against short-term liquidity mismatches.

- Growth in gold AUM was driven by a 1% YoY increase in gold holdings and rising gold prices.

- Online gold loan customers and digital payments were up by 1.2x QoQ in Q1.

- Average LTV is at 57% vs the RBI limit of 75%.

- Cash and cash equivalents on a consolidated basis for the company were at Rs 5006 at the end of June. The average duration of liabilities has increased to 452 vs 260 days a year ago. CP exposure has come down to 9% vs 23% last year.

- There was no moratorium on the gold loan book. Around 26% of non-gold businesses were under moratorium in the stand-alone entity.

- The majority of MFI customers opted from moratorium in phase 1. Collection efficiency from MFI business was at 55% in June and it is expected to be at 70% in July.

- 37% of customers opted for a moratorium in phase 1 in the vehicle finance business.

- In Loan to NBFCs, the portfolio got reduced by 15.5% QoQ.

- The management believes that collections in Asirvad will return to normal after the moratorium ends.

- Around 25-30% of customers are still under moratorium at the end of July.

- The accrued interest in Q1 was at Rs 492 which is 2.7% of AUM.

- The management believes that the current provisioning is adequate enough to account for aggressive scenarios.

- GNPA in Vehicle finance is at 10% and for housing finance, it is at 5%. NNPA for the vehicle & housing finance divisions are at 4% and 3.9% respectively.

- Gold tonnage for Q1 was down by 4.3%. This is because as gold prices have gone up, people use less gold to borrow the same amount rather than use the same amount of gold to borrow more.

- Overall demand seems to be down by 25%. Around 10% of branches are operating partially.

- The company made no disbursements in Asirvad in Q1. It started to lend in MFI in July with disbursements of Rs 70-75 Cr in the month. The company is keeping a cautious stance of lending only to customers who have completed at least one cycle.

- Around 6-7 lacs of customers have not paid in the past 4 months during the moratorium.

- The management expects normalcy to come back by the start of Q3.

- The company is still unable to make any collections in 26,000 of its collection centers out of the 2 lac centers.

- In vehicle finance, the management expects the collection to be at 85% in July with at least 4-5 months to get normalcy back.

- The management expects a medium to long term CAGR to stay at 20% for the consolidated portfolio. It expects growth in FY21 to be at 10-12% mainly from the gold book.

- Gold loan is expected to stay at 78-80% of total AUM at the end of FY21. The unsecured MFI portfolio is not expected to grow more than 1% in FY21.

- In vehicle finance, the company does not have any customers who are currently under moratorium. This is because of a conscious effort on part of the company to convince customers to pay up the EMIs.

- Overall moratorium book is at 32.83% of the total book.

- The major contributor to the reduction in OPEX in Q1 was from a waiver of rent in many cases for the company.

- The management expects that there is no additional manpower requirement at the gold loan branches. Employee costs are expected to come down to 6% by the end of FY21.

- The management expects slowness in demand for the gold loan as the major reasons for short term gold loans like the requirement for education during the academic seasons, use in festivals, etc are coming down due to COVID-19.

- Total disbursement for the MFI industry in June was at Rs 100 Cr.

- Unlike some of the competition for Asirvad, the company is not looking to add additional loans to existing customers like emergency loans and top-up loans more for adjusting the interest, moratorium interest, and the EMIs.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s gold loan providers in India by growing its core business consistently. The company’s current quarter performance has been decent with >20% YoY overall AUM growth despite QoQ decline in Asirvad AUM. The company has also seen good traction in the online gold loan which growing even faster in current times of COVID-19 disruption and is now accounting for 63% of all loans. This brings a significant opportunity for the company to improve its operating model and reduce manpower and physical costs. The company has stayed cautious with Asirvad and has not disbursed any amount in Q1. It remains to be seen how the company’s collections will be affected once the moratorium ends and collection for disbursals in FY21 starts and how will things pan out for Asirvad and the MFI industry. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in India Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q4FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 1191 | 892 | 33.52% | 1133 | 5.12% | 4352 | 3427 | 26.99% |

| PBT | 461 | 314 | 46.82% | 456 | 1.10% | 2672 | 2209 | 20.96% |

| PAT | 340 | 214 | 58.88% | 334 | 1.80% | 1230 | 790 | 55.70% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 1618 | 1167 | 38.65% | 1414 | 14.43% | 5551 | 4242 | 30.86% |

| PBT | 534 | 409 | 30.56% | 544 | -1.84% | 2007 | 1457 | 37.75% |

| PAT | 398 | 277 | 43.68% | 402 | -1.00% | 1480 | 949 | 55.95% |

Detailed Results

-

- The company had a very good quarter with consolidated revenues rising 39% YoY and consolidated PAT rising 44% YoY.

- RoA for the quarter came in at 5.7% while consolidated RoE came in at 28.2%.

- Total AUM grew 29.8% YoY to Rs 25225.2 Cr while gold AUM grew 30.9% YoY, highlighting excellent growth in AUM from all businesses.

- The company has a borrowing cost of 9.46% in the quarter. The cash and undrawn bank lines of the company were at Rs 2300 Cr as of Q4.

- The share of new businesses in revenues was at 32.7% in Q4.

- The book value per share was at Rs 68 at the end of Q4.

- The company also raised incremental borrowing of Rs 3979 Cr through domestic and overseas bon issuances and bank loans in the standalone business.

- In the gold loan business, the Opex to AUM has fallen to 6.8% from 7.6% in the last quarter while security costs have gone down 53.9% YoY.

- Gold AUM per branch rose significantly to Rs 4.81 Cr per branch vs Rs 3.84 Cr per branch a year ago.

- The standalone business has GNPA and NNPA of 0.9% and 0.5% respectively while maintaining a CAR of 23.4%.

- The online gold loan’s share of total gold AUM has gone up to 48% in Q4.

- In Asirvad MFI, AUM grew 43.3% YoY while delivering 25.5% RoE for FY20.

- The GNPAs for Asirvad has risen to 1.56% in Q3 vs 1.34% in Q2. The NNPA is still due to the company’s good provisioning. Asirvad maintained a CAR of 25.4%. The subsidiary made a COVID-19 provision of Rs 50 Cr.

- Asirvad has undrawn bank lines of Rs 1760 Cr and excess cash of Rs 1190 at the end of Q4. 100% of loans qualify for PSL.

- Asirvad now boasts of 1042 branches and a customer base of 2.37 million vs 1.8 million a year ago.

- The Housing and Vehicle finance divisions have shown good AUM growth of 21% and 20% YoY respectively.

- % of digital collections for Manappuram were at 72% while for Asirvad it was 9%. The digital tracing of MFI customers was at 94%.

- The company has announced a dividend of Rs 0.55 per share in the quarter bringing its dividend for FY20 to Rs 2.20 per share.

Investor Conference Call Highlights

- The company saw a gold tonnage growth of 7.2% YoY in FY20.

- At the portfolio level, the average LTV is less than 50% against the target limit of 75% showing significant room for borrowing for customers against their collateral.

- The management has stated that Asirvad Microfinance follows strict guidelines for diversification of risks like a 10% lending cap on states and a 1% lending cap on districts with an aim to reduce the district cap to 0.5% in the next three years. This has enabled the MFI to be able to minimize geographical concentration risk.

- Asirvad also has the lowest operating expenses in the industry according to the management.

- The commercial vehicle finance division saw higher GNPL mainly due to the auto industry slowdown which was further exacerbated by the lockdown for COVID-19.

- During Q4, the company consciously chose to reduce lending to smaller NBFCs and MFIs given the current macro environment.

- In the current environment, the company is focussing on digital collections and customer communications.

- The average goal load size and duration were Rs 38,500 and 58 days respectively. Most of the gold loan customers did not opt for the moratorium.

- Asirvad was rated AA- by CRISIL which is the highest rating in the MFI industry at present.

- The company has reduced the CP ratio to 11%.

- Only 100 gold loan customers have applied for a moratorium as of April.

- Despite the loss of business due to the lockdown, the management remains confident of achieving 10% revenue growth in FY21.

- The total value under moratorium for the vehicle finance division is Rs 130 Cr.

- The consolidated cash position of the company is Rs 2500 Cr in cash and Rs 1500 Cr in undrawn lines.

- The company was disbursing around Rs 700 Cr every day.

- The management has stated that the majority of customers in the vehicle finance business are 1-2 vehicle owners and thus this customer set should be in a more advantaged position as compared to fleets and wholesale customers. In this division, 10% of customers applied for the moratorium.

- After COVID-19, the bounce rate on gold loans has gone up 18-20%.

- The online gold loan business has seen good traction since the lockdown started and it has witnessed a portfolio growth of 10-12% already.

- The management expects almost 70% of gold loan volumes to shift to online by the end of Fy21.

- In the 1.5 months since 1st April, the company has disbursed Rs 20,000 Cr.

- The management has clarified that Manappuram does not provide any corporate guarantee for any of the subsidiaries’ borrowings and all of them raise debt on their own.

- The management has stated that employee costs in Asirvad have gone up almost 50% YoY mainly due to the company opening up more than 100 branches in FY20. As a percentage of revenues, Opex is kept below 5% which is very good for an MFI.

- The company has managed to reduce back-office costs of Rs 20-25 Cr per year. This was done mainly through outsourcing various back-office tasks. For example, the company has outsourced infrastructure management to IBM.

- The main focus of cost savings from an online gold loan is that it shall reduce the number of employees required to run a branch. The management believes that the current number of employees in branches can handle up to Rs 15 Cr per branch as opposed to the current Rs 5 Cr per branch.

- The company will institute a 100% bank disbursal in Asirvad from August 17 onwards.

Analyst’s View

Manappuram Finance has long been one of the most consistent players in the NBFC sector in India. The company has cemented its position as one of India’s gold loan providers in India by growing its core business consistently. The company’s current quarter performance has been very good with >20% YoY AUM growth across all segments. The rise of Asirvad in FY20 has been particularly good. The company has done well to emphasize good risk management for the MFI unit by capping lending % at both state and district level. The company has also seen good traction in the online gold loan which is expected to keep growing even faster in current times of COVID-19 disruption. It remains to be seen how the company’s collections will be affected once the quarter ends and collection for disbursals in FY21 starts. Nonetheless, given the company’s resilient customer base and gold loan AUM along with the rising star among MFIs in India Asirvad Microfinance, Manappuram Finance seems like a pivotal finance stock to watch out for.

Q3 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 1133.3 | 900.93 | 25.79% | 1077.29 | 5.20% | 3161.1 | 2534.61 | 24.72% |

| PBT | 456.42 | 333.88 | 36.70% | 427.55 | 6.75% | 1219.38 | 903.41 | 34.98% |

| PAT | 334.06 | 211.91 | 57.64% | 336.17 | -0.63% | 890.54 | 576.88 | 54.37% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 1414.25 | 1100.81 | 28.47% | 1334.09 | 6.01% | 3933.04 | 3075.51 | 27.88% |

| PBT | 544.36 | 387.83 | 40.36% | 514.44 | 5.82% | 1473.23 | 1047.15 | 40.69% |

| PAT | 402.23 | 247.14 | 62.75% | 407.65 | -1.33% | 1082.11 | 671.14 | 61.23% |

Detailed Results

-

- The company had a very good quarter with consolidated revenues rising 28% YoY and consolidated PAT rising 63% YoY.

- RoA for the quarter came in at 6.3% while consolidated RoE came in at 30.4%.

- Total AUM grew 35.5% YoY to Rs 24099 Cr while gold AUM grew 29.7% YoY to 16243 Cr, highlighting excellent growth in AUM from all businesses.

- The company has a borrowing cost of 9.12% in the quarter. The cash and bank balance of the company rose to Rs 2196 Cr.

- The share of new businesses in revenues was at 32.6% in Q3.

- The company also raised $300 million via its US dollar medium-term note which was subscribed 3.8 times.

- In the gold loan business, the Opex to AUM has fallen to 7.6% from 8% in the last quarter while security costs have gone down 51% YoY.

- The standalone business has GNPA and NNPA of 0.5% and 0.2% respectively while maintaining a CAR of 23.4%.

- The online gold loan’s share of total gold AUM has gone up to 44% in Q3.

- In Asirvad MFI, AUM grew 57.2% YoY while delivering 26.8% RoE.

- The GNPAs for Asirvad has risen to 1.34% in Q3 vs 0.86% in Q2. The NNPA is still due to the company’s good provisioning.

- The company has announced a dividend of Rs 0.55 per share in the quarter bringing its dividend for the 9M period to Rs 1.65 per share.

Investor Conference Call Highlights

- The rise in gold loan AUM was a result of a combination of increase in gold holdings of 11% YoY and higher gold prices.

- Despite growth being driven by new customers, the average ticket size for the company has remained around historical levels of Rs 22000. All disbursals were done using non-cash methods.

- Asirvad Microfinance was awarded AA- by CRISIL which is the highest rating for anyone in the Indian MFI sector.

- The vehicle finance business saw AUM growth of 43.2% YoY to Rs 1397 Cr with NPA at 2.87%.

- The home loan business saw AUM growth of 25.8% YoY to Rs 601 Cr while the loans to corporates saw AUM decline of 12.8% QoQ to Rs Rs 667 Cr.

- The company’s presence in Assam is very small with a book of only 47 Cr where only NPA is around only Rs 43 Lac.

- The number of vehicle finance branches has gone down due to the consolidation of a few locations into a single branch.

- The company is targeting to shave off another 100 bps from the current Opex to AUM ratio by next year.

- The management expects tonnage to increase by 3-4% in the quarter. The current LTV is around 61%.

- The company is very particular about risk management, especially in Asirvad. It has instituted lending caps of a maximum of 10% for all states as a risk management measure. It has also moved to district level risk exposure.

- The company has also consciously kept the ticket size limited to Rs 45000 as a measure of risk management.

- And the final measure of risk management that the company practices is to keep lending ticket size in new regions capped at 25000-30000.

- The company has also mandated that a borrower cannot have more than 3 loans (2 MFIs + 1 bank) including the companies at a time.

- The accrued interest as of Q3 has been around Rs 512 Cr.

- The management has stated that the total possible exposure of the company to the affected districts in Karnataka is around Rs 36 Cr. Out of this possible Rs 36 Cr the company has already made provision of Rs 15 Cr.

- In the CV loan business, the management expects GNPAs to stay at current levels and it does not expect any additional stress to appear in this business area.

- Around 50% of the gold loan book is in ticket sizes of above Rs 1 lac.

- While expanding into a new state, the company follows a hub and spoke model where it chooses a central district to expand into first after which it expands into other neighbouring spokes once the central hub for the region is consolidated. In most cases, the company will try and choose the most beneficial district in the state for its hub. The hub district does not need to be contiguous to every other district necessarily.

- In the CV loan business, around 87% of the book is for used-vehicle finance. Around 35% of the book is in South India while North and West count for 27% each and the East has around 115 of the book.