Lumax Auto Technologies Ltd was incorporated in 1981 and is a part of the D.K. Jain Group of companies. It is engaged in the business of manufacturing and supplying Automotive Lamps, Plastic Moulded Parts, and Frame Chassis to two, three, and four-wheeler segments. It has Partnerships with 7 Global players like Yokowo(Japan), JOPP(Germany), and a few others.

Q4FY24 Updates

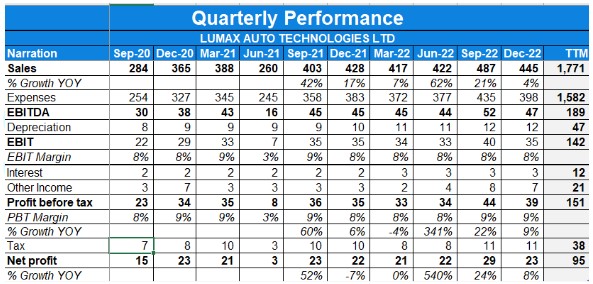

Financial Results & Highlights

Detailed Results:

- The company’s revenue & EBITDA grew by 18% & 26% YoY.

- EBITDA margins increase from 11.8% to 12.6%.

- Customer-wise revenue mix Q4:-

- Bajaj -24%

- Aftermarket-20%

- HMSI-8%

- LIL-7%

- MSIL-9%

- TATA-6%

- M&M-7%

- Others-20%

- Product-wise revenue mix Q4 –

- Plastic modules – 26%

- Aftermarket – 20%

- Fabrication – 13%

- Shifter – 16%

- Lighting – 8%

- Emission – 7%

- Others – 10%

3) Segmental revenue mix Q4 –

- 2/3W – 37%

- Passenger car – 29%

- Aftermarket – 20%

- CV – 9%

- Others – 4%

4) D/E stood at 0.2.

Investor Conference Call Highlights

- The PV market grew by 27% for FY’23, while the 2-wheeler market grew by 19%. The 3-wheeler & CV market also saw a high growth of 33% .

- During the quarter, the company helped launch the gear shifter system for Maruti Suzuki, Fronx and Jimny models, seat frames for Jeep Meridian, for two-wheelers, chassis and frames for Bajaj Pulsar 150 Twin Disc model in the passenger vehicle segment, along with telematic parts for the truck and buses for DICV, in the commercial vehicle segment.

- Lumax Mannoh Allied Technologies, the 55% subsidiary, which manufactures manual, AMT, and automatic gear shifter systems, contributed 16% to the total consolidated revenue.

- Lumax Cornaglia Auto Technologies, the 50% subsidiary, manufacturing air intake systems and urea tanks commanding a 100% share of business with Volkswagen and Tata Motors, contributed 7% to the consolidated revenue.

- Lumax Alps Alpine India Private Limited, a 50% subsidiary for the manufacturing and sale of electric devices and components, including software related to the automotive industry, has contributed 2% to the consolidated revenues.

- The capex incurred during FY ’23 was around INR132 crores Vs the actual capex outlay of INR85 crores.

- The urea tanks business saw sales of INR35 crores in FY ’23, expecting a minimum 15% YoY growth for the next three years with high double-digit EBITDA margins.

- The company won business from Maruti Suzuki, and 65% of the INR900 crores order book is from the passenger car segment.

- Aftermarket business is expected to continue robust growth, aiming to double revenue in three to five years.

- Overall, the company expects significant growth in FY ’24, with a projected turnover of around INR3,000 to INR3,100 crores, and a growth rate of over 30%.

- The fabrication revenues dropped from 18% to 13% due to Bajaj Auto’s volume decline in export models.

- The net debt post-acquisition of IAC is around INR 147 crores, with a debt-equity ratio of 0.2.

- Joint ventures and the aftermarket are expected to contribute to the overall growth of 30% in FY ’24.

- The outlook for the oxygen sensor business includes an order book of INR 125 crores and expected revenue of INR 20 crores in FY ’24.

- The company’s cash flow and repayment plans are robust, with no expected default on repayment of current liabilities.

- Synergy benefits from the IAC acquisition include cross-selling of products, leveraging relationships, and expanding IAC’s footprint.

- The potential revenue for Ituran and Alps Alpine is expected to be triple-digit in the next 18 to 24 months.

- The size of the tooling business of IAC is similar in terms of revenue and margins, around INR 40-45 crores in FY ’23.

- The interest cost will rise from INR 16 crores to INR 70 crores, with long-term interest cost at INR 41 crores.

Analyst’s View

The company is one of the leading players in the automotive lighting & gear shift space with a strong presence in the aftermarket segment. The company reported a strong quarter with revenue growth of 18%. The company is confident it to grow its topline by 30% in FY24 led by a healthy order book & maturity of its JVs. It remains to be seen how the company will tackle the inflationary environment coupled with the possibility of a slowdown in the Auto segment due to the global crisis, penetrate the EV segment with a proper strategy & increase the profitability of its JV biz. However, Lumax Auto remains a solid small-cap auto ancillary stock to keep on one’s watchlist.

Q3FY24 Updates

Financial Results & Highlights

Detailed Results:

- The company’s revenue & EBITDA grew by 4% & 13.4% YoY.

- EBITDA margins increase from 11.2% to 12.2%.

- Customer-wise revenue mix Q3:-

- Bajaj -25%

- Aftermarket-22%

- HMSI-8%

- LIL-6%

- MSIL-8%

- TATA-6%

- M&M-5%

- Others-20%

- Product-wise revenue mix Q3 –

- Plastic modules – 24%

- Aftermarket – 22%

- Fabrication – 13%

- Shifter – 16%

- Lighting – 8%

- Emission – 8%

- Others – 10%

3) Segmental revenue mix Q3 –

- 2/3W – 36%

- Passenger car – 25%

- Aftermarket – 22%

- CV – 10%

- Others – 6%

4) D/E stood at 0.03 while ROCE & ROE stood at 26.1% & 15.5%.

Investor Conference Call Highlights

- The PV market grew by 22% YoY in January 2023, while the 2-wheeler market grew by 10%. The 3 wheeler & CV market also grew by 60% & 16% respectively in January.

- During the quarter, the company helped launch the gear shifter system and the antenna feeder cable assembly for Toyota Hycross and the gear shifter for Maruti EECO in the passenger vehicle segment, along with Force Motors, Urbania, in the commercial vehicle segment.

- In the two-wheeler segment, the company has been able to add plastic products for the Pulsar P150 model.

- Lumax Mannoh Allied Technologies, the 55% subsidiary, which manufactures manual, AMT, and automatic gear shifter systems, contributed 16% to the total consolidated revenue.

- Lumax Cornaglia Auto Technologies, the 50% subsidiary, manufacturing air intake systems and urea tanks commanding a 100% share of business with Volkswagen and Tata Motors, contributed 7% to the consolidated revenue.

- Lumax Metallics Private Limited, the 100% subsidiary, manufacturing seat frames, contributed 4% to the total consolidated revenues. The company’s application for a merger with Lumax Auto Technologies Limited has been approved by the Honorable NCLT.

- Lumax Alps Alpine India Private Limited, a 50% subsidiary for the manufacturing and sale of electric devices and components, including software related to the automotive industry, has contributed 2% to the consolidated revenues.

- The capex incurred during nine months is INR40 crores & the yearly capex guidance has been decreased from 75-80 crores to 50-60 crores owing to delays in product launches.

- The company continues to maintain its volume share within Bajaj Auto.

- The company’s endeavor is to double the aftermarket revenue in a period of about three to four years. The network expansion in the last year is close to 15%.

- The plastic modules saw sharp degrowth due to volume degrowth in Honda & Bajaj which are its main customers. Its order book for plastic stands at INR40-50 Crs.

- The company expects strong growth in seat frame & chassis biz to continue owing to its presence in the premium KTM space & order wins in the EV segment.

- Urea biz grew due to higher growth in Tata’s volumes.

- The current order book stands at 500 Crores & capacity utilisations stands at around 70%.

- The company is on track to do double-digit revenue growth in the coming year as well & is targeting EBITDA margins of 12-13%.

- The current quarter’s growth was muted on a QoQ basis despite strong growth in the aftermarket segment owing to a decline in volumes of Bajaj Auto (18%-20%), HMSI (28% decline) & Maruti Suzuki (17% decline)& these companies contribute close to almost 40% of the business.

- Lumax Yokowo & Lumax Ituran got into prestigious SOPs starting from the month of April and May 2024, which is when they start supplying to Honda Cars in terms of Lumax Yokowo and to Daimler in terms of Lumax Ituran.

- The company is expecting very strong revenue growth across all its JVs.

- The company’s contribution from PV has already increased from 20% to 25% in a year, & the management is targeting a contribution of 33.33% in the coming period. The management is also targeting to increase the share of JVs from 25% to 33.333%.

Analyst’s View

The company is one of the leading players in the automotive lighting & gear shift space with a strong presence in the aftermarket segment. The company reported a mediocre quarter with revenue growth of 4% owing to a slowdown in volumes of its key clientele. The company is confident it to grow its topline by 20% in the coming 3 years led by a healthy order book & maturity of its JVs. It remains to be seen how the company will tackle the inflationary environment coupled with the possibility of a slowdown in the Auto segment due to the global crisis, penetrate the EV segment with a proper strategy & increase the profitability of its JV biz. However, Lumax Auto remains a solid small-cap auto ancillary stock to keep on one’s watchlist.