About the Company

KNR Constructions is engaged in the business of the infrastructure sector, primarily in the construction of roads, bridges, flyovers, and irrigation projects.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

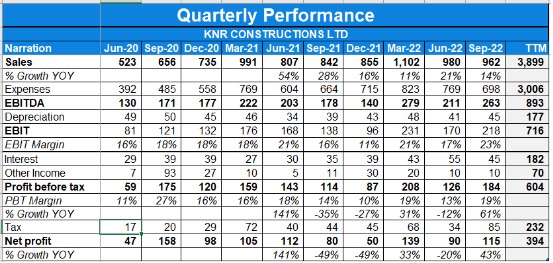

- Standalone Revenue rose by 12% YoY while consolidated grew by 14%. KNR Constructions Ltd. has a strong EPC Order Book ₹ 8041.5 crores- Roads Sector ₹ 5920.1 crores and ₹ 2221.4 crores.

- Gross Block of Plant & Machinery ₹ 1386.5 crores.

- EBITDA for Q2 FY2023 witnessed a growth of 13% & 48% on a consolidated basis .

- EBITDA margin in Q2 FY2023 stood at 22.3% & consolidated nos were 27.4%..

- The consolidated debt as of June 30, 2022, is Rs.1592 Crores as compared to Rs.1410 Crores as of March 31, 2022.

- This quarter the company did around Rs.60 Crores of capex.

- Net working capital stood at 54 days.

- The consolidated debt as of September 30, 2022, is Rs. 1,864 crores as compared to Rs. 1,593 crores as of June 30, 2022.

- The debt to equity on a consolidated basis as of September 30, 2022, stands at 0.74x as compared to 0.66x as of June 30, 2022.

Investor Conference Call Highlights

- The percentage progress as of September 30th 2022 for HAM project is as follows; Magadi to Somwarpet 65.5%, Oddanchatram to Madathukulam is 81.9%, Ramanattukara to Valanchery is 9.4% and Valanchery to Kappirikkad is 11.5%

- KNR Tirumala Infra Private Limited, a subsidiary company, has received a bonus amount of Rs. 8.13 crores, inclusive of taxes for early completion of the project by 52 days

- The company received a letter of acceptance for the construction of four lane road from IDA Pashamailaram Industrial Park to ORR worth Rs. 34.26 Cr.

- The total collection for the Bihar project that is Muzaffarpur to Barauni in Q2 FY23 and H1 FY23 has been Rs. 9.87 crores and Rs. 21.90 crores.

- Client-wise, 57% of the order book is from third-party clients and the balance 43% is from captive HAM projects. The third-party order book or non-captive order book, which accounts for 57% of the total order book position, is skewed between the state government contracts worth 42%, whereas 11% is from central government and the balance 4% order book is from other private players.

- The total order book position is Rs. 8,806.5 crores, including a new HAM project. With that, irrigation projects constitute 24%, roads constitute 28% and HAM constitutes 48%.

- The company’s receivables in irrigation stand at Rs.900 Crs & it expects to get Rs.50-60 Crs every month.

- The mobilization advance figure is Rs. 62.71 crores, and retention is Rs. 207 crores. & Unbilled revenue is around Rs. 470 crores.

- The company is targeting only 5% revenue growth in the coming quarter due to unseasonal rain in October & November.

- Rs. 32 crores of revenue is an exceptional item in this quarter in revenue.

- Employee costs increased due to the payment of the director’s pending variable pay.

- The management updates that the current environment of bidding is extremely aggressive in the industry.

- The total amount of claims pending against NHAI is Rs.500 Crs ( including interest).

- The management updates that it won’t be selling that Muzaffarpur-Barauni project & expects to be debt free by the end of FY23.

- The company would be targeting to get around Rs. 3,000-4,000 crores in order inflow in the coming year.

- The company is yet to receive any further notice from the IT department with regards to the raid conducted in March.

- The CAPEX guidelines for FY23 stand at Rs.100-120 Crs with around 75 Crs already incurred in H1.

- The management is confident of winnings coming through the Bharatmala project of the government.

- The is targeting maintaining margins of 18-19% for the current & coming FY as well.

- In the month of October 2022, the company completed the transfer of equity stakes in the following subsidiaries with Cube Highways and Infrastructure:-

- KNR Tirumala Infra Private Limited – 1.37X returns

- KNR Shankarampet Projects Private Limited – 1.26X returns

- KNR Srirangam Infra Private Limited – 1.87X returns

Analyst’s View:

KNRCL, listed on the Bombay Stock Exchange and National Stock Exchange, provides EPC services, primarily for the roads and highways segment. It has executed infrastructure projects independently and through joint ventures (to leverage the extensive experience and execution capabilities of both parties). This has helped it bag orders in diverse regions and of large value. Management has significant experience and a strong track record in timely execution of projects. Company has a healthy financial risk profile and Balance sheet strength.. KNRCL’s business risk profile is expected to improve with scaling up of operations supported by its healthy execution capabilities and strong order pipeline. This along with steady accruals and realization of sale proceeds for its HAM projects is likely to keep the financial risk profile healthy. It is suggested to see the progression of the company and track the upcoming progression of remaining quarters this year.

Q4FY22 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1029 | 945 | 8.9% | 774 | 32.9% | 3314 | 2752 | 20.4% |

| PBT | 180 | 148 | 21.6% | 146 | 23.3% | 579 | 381 | 52.0% |

| PAT | 112 | 77 | 45.5% | 101 | 10.9% | 381 | 244 | 56.1% |

| Consolidated financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1121 | 1000 | 12.1% | 863 | 29.9% | 3651 | 2955 | 23.6% |

| PBT | 207 | 159 | 30.2% | 87 | 137.9% | 552 | 512 | 7.8% |

| PAT | 140 | 95 | 47.4% | 44 | 218.2% | 366 | 382 | -4.2% |

Detailed Results:

- Revenue increased by 12% while PAT increased by 47% on a consolidated basis while PAT on a standalone basis in 45%.

- Consolidated EBITDA increased by 14% while EBITDA margins stand at 20.6%.

- Net working capital for FY22 stands at 63 days.

- Consolidated net debt to equity 0.29.

- The total order book is at Rs.9,000.8 Cr. The irrigation segment constitutes 25% & EPC & HAM 75% of total order book.

- Third-party order book accounts for 58% of the total order book position is distributed between state government contracts with 41% and 11% is from central government and balance 3% of order book is from other private players.

- The outstanding order book position of INR 6,511 crores.

- The percentage of physical progress as of 31st December 2021 for the HAM project is:

- Chittor to Mallavaram at 100%;

- Ramsanpalle to Mangloor at 100%;

- Trichy to Kallagam at 93.6%;

- Magadi to Somwarpet at 55.6%;

- Oddanchatram to Madathukulam at 56%

- Ramanattukara to Valanchery at 2.8%

- Valanchery to Kappirikkad at 2.4%

- Chittor to Thatchur at 0%

- KNR received a new order post 31st march for Six laning of Chittoor – Thatchur section (Package 3) in the state of Andhra Pradesh and Tamil Nadu on Hybrid Annuity Mode under Bharatmala Pariyoiana worth Rs.765 Cr.

- ROE for FY22 stood at 17%.

- Shareholders have approved 100% stake sale of KNR Shankarampet Projects Private Limited, KNR Srirangam Infra Private Limited and KNR Tirumala Infra Limited.

- Standalone Net debt to equity stood at 0.

Investor Conference Call Highlights:

- The industry saw 12,731 kilometers of road awarding which is a growth of 22% YoY.

- The company has received financial closure for KNR Ramagiri Infra Private Limited which received the financial closure from NHAI on 30th March 2022 for HAM projects.

- The toll collection for the Bihar project in Q4 FY22 and FY22 has been Rs. 10.42 crores and Rs. 38.58 crores respectively.

- The company is targeting further order book inflow of Rs. 4,000 to Rs. 5,000 crores for FY23.

- The income tax department has carried out a search operation at the company’s various business premises in March 2022. It has created no provision for any liability in the financial results.

- The management states that giving any projection of EBITDA at this stage may not be right, but it will try to maintain EBITDA margin of at least 15-16%.

- The company’s irrigation project has pending receivables of around Rs. 650 crores.

- The company expects to incur capex of around Rs.120-150 Cr.

- The company’s Retention receivable is around Rs. 181 crores and unbilled revenue are around Rs. 250 crores.

- The management expects a few problems this year due to the early monsoon of 1 to 1-1/2 months coupled with higher receivables from the irrigation biz.

- The company is currently not targeting Northern India due to the requirement of its quarry which the management, believes will be a margin decreasing activity.

- The management states that it currently has a sufficient order book in its existing portfolio, but if it doesn’t get any orders, it will venture into railways, mining operation areas & metros.

- The company’s EBITDA margins for irrigation are around 24%, HAM around 18%, and other roads are around 13%.

- 60% of the contract value in irrigation projects has cost escalations while HAM & EPC are fixed price contracts with no cost escalation.

- The company’s creditor days are based on purchasable calculator & not turnover.

Analyst’s View:

KNR has been one of the top performers in the construction industry. KNR has seen a great quarter with a 28% YoY rise in revenues. The company had a decent quarter with revenue & profit growth of 12% & 47% respectively. The company has done well to gather an order book of over Rs 9,000 Cr. It is already bidding for new projects and is targeting to get Rs 3000 Cr orders for irrigation projects in the coming year. The central govt push for PM Gati Shakti National Master Plan for multiple modal connectivity is expected to be a great boost for the entire industry and a seasoned player like KNR. It remains to be seen how the industry will fare going forward given the sustained rise in raw material costs and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q3FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 863 | 761 | 13.4% | 853 | 1.2% | 2529 | 1955 | 29.4% |

| PBT | 87 | 119 | -26.9% | 114 | -23.7% | 344 | 354 | -2.8% |

| PAT | 44 | 92 | -52.2% | 73 | -39.7% | 226 | 288 | -21.5% |

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 774 | 713 | 8.6% | 766 | 1.0% | 2285 | 1807 | 26.5% |

| PBT | 146 | 106 | 37.7% | 139 | 5.0% | 398 | 233 | 70.8% |

| PAT | 101 | 77 | 31.2% | 95 | 6.3% | 269 | 167 | 61.1% |

Detailed Results:

- Revenue increased by 13% while PAT decreased by 50% on a consolidated basis while PAT on a standalone basis in 31%.

- EBITDA increased by 17% while EBITDA margins stand at 100 Bps.

- Net working capital stands at 40 days.

- Standalone EBITDA margins increased by 154 bps to 22.2% while consolidated margins fell 501 bps to 21.1%.

- The total order book is at Rs.10,009 Cr. The irrigation segment constitutes 26% & EPC & HAM 74% of total order book.

- Third-party order book accounts for 58% of the total order book position is distributed between state government contracts with 42% and 10% is from central government and balance 5% of order book is from other private players.

- The outstanding order book position of INR 6,511 crores.

- The percentage of physical progress as of 31st December 2021 for the HAM project is:

- Chittor to Mallavaram at 99%;

- Ramsanpalle to Mangloor at 100%;

- Trichy to Kallagam at 86%;

- Magadi to Somwarpet at 48%;

- Oddanchatram to Madathukulam at 48%

- The working capital days were stable at 45 days.

- KNR received orders for the widening of existing service roads of Outer Ring Road, Hyderabad on Bill of Quantities basis worth Rs.312.8 Crs and received 1/2 of this for a value of Rs.1,041.5 Cr.

- Shareholders have approved 100% stake sale of KNR Shankarampet Projects Private Limited, KNR Srirangam Infra Private Limited and KNR Tirumala Infra Limited.

- Standalone Net debt to equity stood at 0.

Investor Conference Call Highlights:

- The industry saw 6,684 km contracts awarded in 9M vs 9,132 km last year.

- The company transferred 49% of the stake in two of the subsidiaries KNR Tirumala Infra Private Limited and KNR Shankarampet Projects Private Limited to Cube Highways and Infrastructure on 30th December 2021.

- The company has received sanction for the project from lenders with an estimated EPC cost of Rs. 765 Cr.

- The management states de-growth in EBITDA and PAT is on account of modification loss accounted in two of the HAM projects in KNR Tirumala Infra Private Ltd and KNR Shankarampet Projects Private Ltd which is due to the companies have achieved the PCOD and there is descope of the project and saving the total project cost and therein change of assumptions.

- The management expects financial closure of Chittor-Thatchur to be done by April end or Mid-May.

- Only Rs.50 Cr of work is pending in Mallanna Sagar and Vattem is also around 74%.

- Receivables of Rs.590 Cr are outstanding from irrigation projects.

- The company is pursuing irrigation projects even though they have high receivables since margins are better.

- The company is targeting Rs.3000 Cr from the irrigation project in the coming year.

- The company did Rs.130 Cr in 9M & is expecting to do Rs.180 Cr in this fiscal.

- The management states that it has 2.5 years of revenue in its hand

- The retention receivables is Rs. 157 Cr, mobilization advance is a liability which is Rs. 120 Cr & unbilled revenue of Rs.257 Cr.

- The Order book split is as follows:- For Kaleshwaram package 4 – Rs. 1,249 crores. For Kaleswaram package 4 – Rs. 695 crores. For Mallanna Sagar – Rs. 50 crores. For western – Rs. 495 crores. For Yedula – Rs. 29 crores. For KP Sagar – Rs. 11 crores. For PSK KNR JV – Rs. 24 crores. And others -Rs. 28 crores. Total put together is Rs. 2,500 crores.

- The company’s 9M depreciation stands at Rs.94 Cr & Q3 it is Rs.35 Cr.

Analyst’s View:

KNR has been one of the top performers in the construction industry. KNR has seen a great quarter with a 28% YoY rise in revenues. The company had a weak quarter due to rising input prices. The company has done well to gather an order book of over Rs 10,000 Cr already. It is already bidding for new projects and is targeting to get Rs 3000 Cr orders for irrigation projects in the coming year. The central govt push for PM Gati Shakti National Master Plan for multiple modal connectivity is expected to be a great boost for the entire industry and a seasoned player like KNR. It remains to be seen how the industry will fare going forward given the sustained rise in raw material costs and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 766 | 609 | 25.78% | 745 | 2.82% | 1511 | 1094 | 38.12% |

| PBT | 139 | 69*** | 101% | 113 | 23.01% | 252 | 127 | 98% |

| PAT | 95 | 50 | 90% | 73 | 30.14% | 168 | 90 | 86.67% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 853 | 664 | 28.46% | 812 | 5.05% | 1665 | 1193 | 39.56% |

| PBT | 114 | 175** | -34.86% | 143 | -20.28% | 257 | 234 | 9.8% |

| PAT | 73 | 154 | -52.60% | 108 | -32.41% | 181 | 196 | -7.65% |

** Contains exceptional item of profit of Rs 85 Cr

***Contains exceptional item of loss of Rs 10.7 Cr

Detailed Results:

- The consolidated revenues for Q2 were up by 28% YoY.

- Standalone EBIDTA grew by 35% YoY to Rs.168 Crs.

- Standalone EBITDA margins increased by 154 bps to 22.2% while consolidated margins fell 501 bps to 21.1%.

- The total order book is at Rs.11,594 Cr. The irrigation segment constitutes 27%, roads 28% and HAM 45% of total order book.

- The outstanding order book position of INR 6,511 crores.

- The percentage of physical progress as of 30th September 2021 for the HAM project is:

- Chittor to Mallavaram at 94%;

- Ramsanpalle to Mangloor at 97.8%;

- Trichy to Kallagam at 81.9%;

- Magadi to Somwarpet at 45.9%;

- Oddanchatram to Madathukulam at 39.2%

- The working capital days were stable at 45 days.

- KNR received orders for the widening of existing service roads of Outer Ring Road, Hyderabad on Bill of Quantities basis worth Rs.312.8 Crs and received 1/2 of this for a value of Rs.1,041.5 Cr.

- Shareholders have approved 100% stake sale of KNR Shankarampet Projects Private Limited, KNR Srirangam Infra Private Limited and KNR Tirumala Infra Limited.

- Standalone Net debt to equity stood at 0.

Investor Conference Call Highlights:

- The industry saw 4609 km contracts awarded in H1 vs 5052 km last year.

- The cumulative book value of the 3 projects up for sale is at Rs 392.3 Cr and the total consideration to be received is at Rs 450.5 Cr.

- The company is targeting another order inflow of INR 2,000 crores minimum for the remaining part of FY 2022.

- The management aborted its decision of investing in KNR CL since it is planning to do investment in a quarry in Kerala which could hamper its cash flow position.

- The management states that they don’t intend to develop any real estate projects.

- The key rationale behind investing in a quarry is to reduce its dependence on external sources for aggregates who used to charge a premium based on the demand-supply dynamics. Plus the management also expects several quarries to shut down in the future leading to scarcity and high demand.

- The current order book provides revenue visibility for 3 years.

- The net debt to equity ratio stood at 0.6 times at the end of Q2.

- The management reassured that the promoter group stake won’t go below 51% in the future.

- The company has been given an NGT notice for the Palamuru Irrigation Lift Project because of which the construction is stopped. Other than that all irrigation projects are in good shape.

- On the irrigation side, the company did around 30% of the work and its other EPC roadworks are around 18%.

- The company has completed 20% of work in Package 4 projects while it has halted the package 3 project due to land acquisition issues and hasn’t mobilized any resources for the same.

- Receivables worth Rs.700 Cr are pending from the irrigation projects.

- The management expects to incur a CAPEX of up to Rs.250 Cr for the current year.

- The company is currently in the process of submitting 10 bids for road projects because of which they are targeting an order book growth of around Rs.2000 Cr to 2,500 Cr.

- Due to extensive rains in Kerala, Mangalore, and other parts of the country, the management expects the current quarter to be weak and KNR is thus guiding for an EBIDTA margin of 18-19%.

- The management is guiding for depreciation of 35-40 Crs quarterly which has decreased from its depreciation during FY18-FY20 because it to acquire assets of Rs.200 Cr during that time whereas, in the past 2 years, it has done the acquisition of only Rs.100 Cr leading to lower depreciation numbers.

- The company expects to realize its receivables by the end of March FY22.

- The management is confident about acquiring land for its HAM projects within the next 5 months.

- The company has total availability of funds of Rs.1950 Cr out of which it has utilized 50% only.

- Due to the recent infusion of money in NHAI, the management expects the awarding activity to increase rapidly which will be beneficial for the company and the sector.

- The company will book an early completion bonus of Rs.9 Cr in this quarter.

- 80% of the Rs.70 Cr pending in arbitration case in Odisha will go to the EBIDTA while the rest is the part of other interest income.

- Retention money is Rs.196 Cr, mobilization money is Rs.136 Cr, mobilization advance paid to contractors is Rs.110 Cr & unbilled revenue is Rs.392 Cr.

- The current assets for H1 are Rs.602 Cr which involves Rs.233 Cr for HAM projects and the rest is of the EPC projects.

- The management states that banks are willing to offer credit to companies with a successful past track record like KNR constructions who are conservative in bidding for new orders.

- According to the management, there exists is a possibility of industry-wide consolidation since the banks are not lending more than INR 1,000 crores or giving any project extension, on the other hand, the road construction companies are not in a healthy balance sheet position to incur more debt.

Analyst’s View:

KNR has been one of the top performers in the construction industry. KNR has seen a great quarter with a 28% YoY rise in revenues. But the company faces a weak upcoming quarter and margin decline due to project delay in parts of South India due to unseasonal floods. The company has done well to gather an order book of over Rs 11,000 Cr already. It is already bidding for new projects and has made 10 bids from which is expects to bag orders worth Rs 2000-2500 Cr. The central govt push for PM Gati Shakti National Master Plan for multiple modal connectivity is expected to be a great boost for the entire industry and a seasoned player like KNR. It remains to be seen how the industry will fare going forward given the sustained rise in raw material costs and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 945 | 683 | 38.36% | 713 | 32.54% | 2752 | 2301 | 19.60% |

| PBT | 149 | 86 | 73.26% | 106 | 40.57% | 381* | 294*** | 29.6% |

| PAT | 77 | 67 | 14.93% | 78 | -1.28% | 244 | 225 | 8.44% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1000 | 740 | 35.14% | 761 | 31.41% | 2955 | 2517 | 17.40% |

| PBT | 159 | 93.0 | 71% | 120 | 33% | 512** | 313*** | 64% |

| PAT | 87 | 75 | 16% | 92 | -5.43% | 375 | 245 | 53.06% |

*Contains Exceptional item of loss of Rs 11.25 Cr

**Contains exceptional item of profit of Rs 85 Cr

***Contains exceptional item of loss of Rs 10.7 Cr

Detailed Results

- The consolidated revenues for Q4 were up 35% YoY.

- Consolidated PAT saw a rise of 16% YoY.

- EBITDA for Q4 rose 24% YoY and margin declined 228 bps to 19.5%.

- Consolidated Cash & cash equivalents as of 31st Mar 2021 was at Rs 108.2 Cr

- The EPC order book as of 31st Mar ’21 is Rs 7117.9 Cr out of which 25% are captive HAM projects and 44% are irrigation projects while other road projects were at 31%.

- The top 6 road projects are of Rs 2895 Cr while other projects consist of Rs 1114 Cr. Irrigation projects form Rs 3109.1 Cr of the order book.

- The order book distribution is:

- AP & Telangana: Rs 3864.7 Cr

- Karnataka: Rs 898.7 Cr

- Kerala: Rs 25.5 Cr

- Tamil Nadu: Rs 2328.9 Cr

- The net-working capital days were at 82 days in FY21.

- KNR received 2 new NHAI HAM projects worth Rs 4507.5 Cr & 1 EPC project of Rs 982.9 Cr.

- KNR completed share transfer of KNR Walayar to Cube for an EV of Rs 511.78 Cr.

- KNR issued 1:1 bonus shares in Feb 2021.

- KNR announced a final dividend of Rs 0.25 per share for FY21.

Investor Conference Call Highlights

- The central govt has set a target of road construction worth INR 15 lakh crore in the next 2 years.

- Highway awarding activity by MoRTH and NHAI was also higher in FY 2021 with about 10,965 km of highways awarded as compared to 8,948 km in FY 2020.

- The NHAI awarded 141 projects in 2020-’21 aggregating to 4,788 km.

- FASTag based toll collection on national highways rose more than 20% in March to INR 3,100 crore compared to INR 2,560 crore in February, helping India’s Highways Development Agency to improve its financials and increase the pace of asset monetization.

- The average operational effectiveness in this quarter stood at 95%.

- The percentage physical progress as on March 31, 2021, for the HAM projects is:

- Chittor to Mallavaram is at 82%,

- Ramsanpalle to Mangloor is at 80%,

- Trichy to Kallagam is at 66%,

- Magadi to Somwarpet is at 29%,

- Oddanchatram to Madathukulam is at 27%.

- The company has entered into a share purchase agreement with Cube Highways and Infrastructure III Private Limited for 3 projects.

- The company is in the process of making 4-5 bids with an average ticket size of Rs 1000 Cr each.

- The receivables outstanding is at Rs 863 Cr which includes billed and unbilled revenue. Of this around Rs 525 Cr is from captive HAM projects and the rest is from irrigation projects.

- The consolidated debt as of 31st March 2021 was at Rs 729 Cr. The net debt to equity was at 0.3x.

- Of the 3 projects to be sold to Cube, 2 are expected to be done in June while the Ramsampalle project is expected to be done in the next 2 months.

- The land acquisition issues in Mallana Sagar Pump House project have been completed and construction has started a month ago. The inflow canal project here is still due to pending land acquisition.

- The management maintains an internal target of reaching Rs 3000 Cr of sales in FY22 as well, but the actual sales level will depend on how fast the new projects will start and whether they will face any delays due to land acquisition issues or not.

- The company is looking to collect the disbursements in the month of June for the 3 soon to be completed HAM projects. Thus, the company has been able to complete nearly 60-70% of these projects just from the advance from NHAI and its internal cash flows.

- The management has not investigated expanding into other categories as there is plenty of room to grow in the road projects category currently.

- The company will also receive Rs 1-1.5 Cr from the Walayar deal in March 2023.

- Total order inflow in FY21 was at Rs 8400 Cr. The company is looking to target road orders of Rs 3000-4000 Cr in FY22.

- The company will have to do a capex of Rs 200-250 Cr in FY22 for the 2 new projects of Rs 4500 Cr which will involve a lot of earthworks.

- Capex in FY21 was at Rs 100-130 Cr.

- The residual amount left to be drawn out of the 3 HAM projects to Cube is around Rs 930 Cr.

- The tax rate in FY21 was at 35% as the company was running out its MAT credit. KNR will be following the new regime from FY22 and will have a tax rate of 25%.

- KNR’s SPV and EPC contracts do not have any pass-through clause for commodity price rise, so the company always does 5-6% padding in price. If commodity price rises are greater than the padding, then the margin profile for KNR will be affected.

- The management states that KNR doesn’t face any issues from the change in govt in TN.

- The revenue contribution from the new projects is expected to be around 10% of FY22 revenue.

- Q4 revenue breakup is Rs 180 Cr from irrigation, Rs 478 Cr from HAM and Rs 180 Cr from EPC. FY21 breakup is 23.5% from irrigation, 51% from HAM and 18.5% from other EPC.

- Mallana Sagar project is now 93% complete while Palamaru is 35% complete.

Analyst’s View

KNR has been one of the top performers in the construction industry. KNR has seen a phenomenal quarter with a 35% YoY rise in revenues. The company has done well to source 2 new HAM projects of Rs 4500 Cr. It is already bidding for new projects and has made 4-5 bids for orders of Rs 1000 Cr each. It has already entered a SPA with Cube for the sale of the 3 HAM projects which will be over soon. The central govt push for awarding road projects of Rs 15 Lac Cr is a great boost for the entire industry and a seasoned player like KNR. It remains to be seen how the industry will fare going forward and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 713 | 565 | 26.19% | 609 | 17.08% | 1807 | 1618 | 11.68% |

| PBT | 106 | 59 | 79.66% | 69* | 53.62% | 233* | 208 | 12.02% |

| PAT | 78 | 40 | 95.00% | 50 | 56.00% | 167 | 158 | 5.70% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 761 | 613 | 24.14% | 664 | 14.61% | 1955 | 1777 | 10.02% |

| PBT | 120 | 69 | 74% | 175** | -31.43% | 353** | 217*** | 62.67% |

| PAT | 91 | 50 | 82% | 155 | -41.29% | 288 | 170 | 69.41% |

*Contains Exceptional item of loss of Rs 11.25 Cr

**Contains exceptional item of profit of Rs 85 Cr

***Contains exceptional item of loss of Rs 10.7 Cr

Detailed Results

- The consolidated revenues for Q3 were up 24% YoY.

- Consolidated PAT saw a rise of 82% YoY.

- EBITDA for Q3 rose 9% YoY and margin declined 260 bps to 19.7%.

- Consolidated Cash & cash equivalents as of 30th Sep 2020 was at Rs 32.6 Cr

- The EPC order book as of 31st Dec ’20 is Rs 7883.7 Cr out of which 30% are captive HAM projects and 45% are irrigation projects while other road projects were at 25%.

- The top 6 road projects are of Rs 3352 Cr while other projects consist of Rs 845.9 Cr. Irrigation projects form Rs 3465.6 Cr of the order book.

- The order book distribution is:

- AP & Telangana: Rs 4564.6 Cr

- Karnataka: Rs 1084.4 Cr

- Kerala: Rs 27.4 Cr

- Tamil Nadu: Rs 2043.4 Cr

- The net-working capital days were at 54 days in Q3.

- KNR received an order for upgrading Cheyyur – Vandavasi Polur Road including ECR link (ODR) Cheyyur – Panayur Road to 2 laning in the state of Tamil Nadu on EPC mode aggregating to Rs 538.9 Cr in Q3.

Investor Conference Call Highlights

- Infrastructure companies across the board have witnessed a marked improvement in execution during Q3 FY ’21 due to a fast bounce back in labour availability to pre-COVID levels and smoothening of raw material, supply chain, and passage of monsoon season.

- The Ministry of Road Transport and Highways has initiated a series of relief messages like a shift from milestone-based billing to typically used — to rate within 45 to 75 days to monthly billing, which significantly helped to ease the pressure on working capital inventory for the industry.

- Considering the huge capital bid pipeline of INR 72,000 crore and in the second half of Q4 historically witnessing a substantial awarding, the management expects significant order inflows for the road and highway success in the near term as well during FY ’22.

- The government envisages the development of 34,800 km of highways for INR 5.345 lakh crore under the Bharatmala Pariyojana. So far, the contract has been awarded for a length of 13,531 km road. And the detailed project report for 16,500 km is currently in the pipeline.

- Toll collections have risen 12-13% in Q3 implying growth in road traffic of 8-9%. According to ICRA, toll collections are likely to grow 14% to 15% in FY ’22 on a low base in FY ’21 as the traffic stands may just increase by 5% and toll rates are expected to increase by 3% to 4%.

- With more than 2.5 crore users, FASTag currently contributes about 80% of the total toll collection.

- The physical progress on KNR’s 5 ongoing HAM projects is:

- Chittoor to Mallavaram is at 72.1%,

- Ramsanpalle to Mangalore is at 64.2%,

- Trichy to Kallagam at 58.9%,

- Magadi to Somwarpet at 22.4%,

- Oddanchatram to Madathukulam at 14%.

- Out of INR 624.28 crore, equity requirement for all HAM projects, KNR has already invested INR 345.51 crore as of December 31, 2020. Its incremental equity requirement stands at INR 90 crore, INR 139 crore, and INR 50 crores for FY ’21, FY ’22, and FY ’23, respectively.

- KNR’s non-captive order book, which accounts for 70% of the total order book, is skewed between State Government contracts with 51%, whereas 3% is from Central Government and the balance 15% is from other players.

- The company has gotten back Rs 540 Cr of dues from Telangana already. Around Rs 140 Cr is due currently.

- KNR is targeting a further order inflow of around INR 3,000 crores to INR 4,000 crore in the rest of FY21.

- The management maintains its revenue guidance of Rs 2400 Cr for FY21.

- The total order inflow in 9M FY21 was Rs 4000 Cr.

- KNR has bid for 15 projects including 1 EPC project and it expects to bag at least 2-3 projects. Thus the management is confident of bringing in orders of Rs 3000-4000 Cr in Q4.

- KNR has done 5 major flyovers in the past which should add to its qualifications when bidding for urban infra projects and metro projects.

- Standalone gross debt for KNR is at Rs 16 Cr. The company has a standalone net cash balance of Rs 43 Cr.

- The management has stated that interest costs may stay at Rs 5-6 Cr per year going forward.

- The management has stated that it maintains EBITDA margin guidance of 17-18% and that margin in Q3 was high due to the high proportion of irrigation projects which made up 45% of the order book. As the irrigation projects come down so will the margin profile.

- The company is looking to complete 3 of its ongoing HAM projects by end of Q1 or Q2.

- Consolidated debt is at Rs 750 Cr and the cash balance is at Rs 75 Cr.

- KNR has done capex of Rs 60 Cr in 9MFY21 and expects this number to rise to Rs 100 Cr for FY21.

- The company has receivables of Rs 333 Cr sitting on the books currently.

- The management is guiding for capex of Rs 100-120 Cr in FY22.

- The majority of the current order book should be completed by June 2021.

- The company is in talks with Cube Highways for a deal to sell the 3 soon-to-be-completed HAM projects. This is so that KNR may be able to complete the sale as soon as the new regulation allows which is 6 months from the Completion Date.

- The Mallana project is 90% complete. The customer is asking KNR to complete this project by June or July but the management has stated that it will probably be done by March 2022 due to land acquisition issues.

- The management has stated that some price escalation is already built in the contract for EPC projects. Although this may not mitigate the whole rise in commodity costs, it can cover up to 50-60% of the rise. HAM projects have inflation built in using CPI and WPI to some extent.

- Mallana Sagar is expected to be done in 2021 while Navayuga is expected to be done in 2022.

- The EPC project that KNR is currently bidding for is Rs 1000 Cr.

- The total order book that KNR has submitted bids for is Rs 21000 Cr including the above EPC project.

- The company has already executed orders of above Rs 1500 Cr and the management is confident of being able to execute Rs 2000 Cr orders as well.

- Given the emphasis on infra by the govt, the management expects revenues to double in 2.5-3 years. It also expects the industry to grow at a CAGR of 15-20% going forward for the next 4-5 years.

Analyst’s View

KNR has been one of the top performers in the construction industry. KNR has seen a phenomenal quarter with a 24% YoY rise in revenues. The company has done well to source a new HAM project and is looking to replace the 3 HAM projects that will be over in the next 6-8 months. It is already bidding for new projects and has made bids for orders of Rs 21000 Cr. It has also started talks with Cube for the sale of the 3 HAM projects which will be over soon. It remains to be seen how the industry will fare going forward and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 609 | 572 | 6.47% | 485 | 25.57% | 1094 | 1053 | 3.89% |

| PBT | 69* | 90 | -23.33% | 57 | 21.05% | 1265* | 1489 | -15.04% |

| PAT | 50 | 70 | -28.57% | 40 | 25.00% | 90 | 118 | -23.73% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 664 | 614 | 8.14% | 530 | 25.28% | 1193 | 1164 | 2.49% |

| PBT | 175** | 95 | 84.21% | 59 | 196.61% | 234** | 151 | 54.97% |

| PAT | 155 | 75 | 106.67% | 42 | 269.05% | 197 | 120 | 64.17% |

*Contains Exceptional item of loss of Rs 11.25 Cr

**Contains exceptional item of profit of Rs 85 Cr

Detailed Results

- The consolidated revenues for Q2 were up 8% YoY.

- Consolidated PAT saw a rise of 106% YoY on account of the exceptional item which was earned from the sale of KNR Walayar to Cube Highways.

- EBITDA for Q2 rose 8% YoY and margin declined 87 bps to 26.1%.

- Consolidated Cash & cash equivalents as of 30th Sep 2020 was at Rs 32.6 Cr

- The EPC order book as of 30th Sep ’20 is Rs 8554.5 Cr out of which 31% are captive HAM projects and 45% are irrigation projects while other road projects were at 24%.

- The top 6 road projects are of Rs 3720 Cr while other projects consist of Rs 973 Cr. Irrigation projects form Rs 3861.5 Cr of the order book.

- The order book distribution is:

- Arunachal Pradesh: Rs 82.2 Cr

- AP & Telangana: Rs 5110.3 Cr

- Karnataka: Rs 1112.2 Cr

- Kerala: Rs 9.6 Cr

- Tamil Nadu: Rs 2240.2 Cr

- The net-working capital days have fallen to 44 days in Q2.

Investor Conference Call Highlights

- So far in H1 FY 2’21, NHAI has awarded road contracts for building 1,330 km of highways, worth INR 47,289 crore, which is 1.6x higher than 880 — 828 km awarded in the financial year 2020 and 3.5x higher than 373 km awarded in the FY ’19 during the same period.

- The NHAI has set a target of awarding 4,500 km of projects during FY ’21. NHAI has plans to award contracts worth INR 2 lakh crores in the second half-year.

- NHAI recently disclosed that the number of FASTag users in the country has crossed 2 crore landmark, registering a robust 400% growth in the year. Currently, revenue from FASTag constitutes about 78% of the toll collection.

- KNR’s average operational effectiveness this quarter stood at 80%.

- The percentage physical progress as of September 30, 2020, for 4 HAM projects is as follows: Chittoor to Mallavaram is at 64%, Ramsanpalle to Mangalore is at 56%, Trichy to Kallagam is at 50%, Magadi to Somwarpet at 14%.

- On October 5, 2020, KNR received a date for its 5th HAM project (Oddanchatram to Madathukulam, KNR Palani HAM project), which is worth INR 920 crore BPC.

- The toll collection in the Muzaffarpur Barauni project was at Rs 12 Cr in Q2.

- Client wise, 69% of the order book is from third-party clients and the balance 31% is from captive HAM projects.

- KNR is targeting a further order inflow of INR 2,000 crores to INR 2,500 crores in the second half of this fiscal year.

- It has also received a top challenger award and the 18th Construction World Annual Rewards in October 2020.

- There has been a delay in the collection of dues for the irrigation projects from the Telangana Government as the government has to divert its funding towards other essential sectors and services to prioritize COVID-19 relief measures. The total exposure for the Telangana Government projects as on September 30, 2020, amounts to INR 740 crore. KNR expects the set of fast tranche payments of INR 300 crores approximately from the Telangana Government by the end of November ’20 and the balance will be in the fourth quarter.

- KNR completed the sale of a 100% stake in the Walayar-Vadakkencherry BOT project, that is KNR Walayar Tollways Private Limited to Cube Highways in Q2.

- The management is expecting plus/minus 5% of Q2 revenues of Rs 600-700 Cr in Q3.

- The management expects the Rs 740 Cr due from Telangana Govt to be fulfilled by Q4.

- The company has started receiving payments for the Kaleshwaram project.

- The progress in the Palamuru-Rangareddy lift irrigation project with Navayuga is 30%.

- There was no impact on the execution of the Kaleshwaram lift project from the objection raised by NGT.

- From Rs 308 Cr from Cube, around Rs 210 Cr was used to pay off outstanding promoter loans while the rest was used for working capital.

- The exceptional item of Rs 11 Cr on the standalone level was the write off dut to fall in final value for Walayar transaction.

- The management believes that margins should be sustainable at 17-18%.

- The company is looking to add 3 more projects to replace the 3 HAM projects that are already at 60-70% completion.

- There hasn’t been any overhang on irrigation projects from political disputes over water in AP & Telangana.

- The order from Hooghly, Hospet is at Rs 188 Cr.

- In Mallanna Sagar, KNR has done 60% of the work while in Vettam it did 30%.

- Mallanna Sagar is expected to be completed in 6-8 months.

- The company is at 100% in terms of equipment but has only 80% of required labour and thus operational capacity is capped at 80%.

- Ramsanpalle is expected to be completed by March while Chittoor should be done by Feb.

- The Trichy project is stuck as a 5 km stretch is still not available and without it the project has gotten stalled. KNR expects the delay to be around 2-3 months in this project.

- The company has done Rs 35 Cr of Capex in H1. Overall Capex in FY21 should go up to Rs 100-120 Cr.

- The company is targeting 10-15 projects out of which, 4 projects are in Kerala, 3 are in Tamil Nadu & 3 are in Telangana. The overall size is around Rs 2000-2500 Cr.

- The company has received rs 66 Cr from the Palamuru project and is expecting Rs 160 Cr by the end of Nov.

- Revenue breakup was: Rs 138 Cr or 23% from irrigation, Rs 315 Cr or 53% from HAM & the rest from other EPC and back-to-back projects.

- Interest costs in Q2 were at Rs 5.9 Cr.

- In any new HAM project from NHAI, 40% of project cost comes as a grant before COD.

- There are no pending receivables from NHAI currently.

- The company is expected to follow the new tax regime in FY22 once the Mat credit gets exhausted.

- 80% of the Hubli project is expected to be done by March.

- Unbilled revenue is at Rs 500 Cr mostly from irrigation projects which are expected to be paid by end of Q3.

- The equity infusion in H1 in HAM projects was at Rs 27 Cr. In H2, this figure is expected to be at Rs 240 Cr.

Analyst’s View

KNR has been one of the top performers in the construction industry. Despite the industry headwinds and the general plight of the companies in this sector due to delays in payments from NHAI, KNR has been able to continue to improve its margins substantially. The company has been able to weather the severe issues regarding land acquisition and labour crisis which it met earlier this year and has been able to achieve marginal growth despite working at only 80% operational capacity. The management was expecting labour to start coming back after monsoons but COVID-19 fears have kept this issue from getting fully resolved. The company has done well to source a new HAM project and is looking to replace the 3 HAM projects that will be over in the next 6-8 months. It remains to be seen how the industry will fare going forward and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q1FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 485 | 481 | 0.83% | 683 | -28.99% |

| PBT | 57 | 59 | -3.39% | 86 | -33.72% |

| PAT | 40 | 48 | -16.67% | 67 | -40.30% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 530 | 549 | -3.46% | 741 | -28.48% |

| PBT | 59 | 56 | 5.36% | 93 | -36.56% |

| PAT | 42 | 45 | -6.67% | 75 | -44.00% |

Detailed Results

-

- The consolidated revenues for Q1 were down 3.5% YoY.

- Consolidated PAT saw a decline of 6.7% YoY.

- EBITDA for Q1 rose 12% YoY.

- The consolidated EBITDA margin improved 310 bps YoY to 24.9% in Q1.

- BOT toll operations were suspended from 1st April 2020 to 19th April 2020 which resulted in a Toll revenue loss of 19 days in Q1FY21.

- The company has not opted for any form of the moratorium and continues to meet all of its debt obligations in time.

- The EPC order book as of 30th June ’20 is Rs 7208.9 Cr out of which 31% are captive HAM projects and 54% are irrigation projects.

- The top 5 road projects are of Rs 2498.3 Cr while other projects consist of Rs 84074 Cr. Irrigation projects form Rs 3869.9 Cr of the order book. The company has an additional Rs 640 Cr worth HAM project which has not been included in the order book.

- The order book distribution is:

- Arunachal Pradesh: Rs 82.2 Cr

- AP & Telangana: Rs 5255.9 Cr

- Karnataka: Rs 1210 Cr

- Kerala: Rs 9.6 Cr

- Tamil Nadu: Rs 651 Cr

- The net-working capital days have risen to 66 days in Q1.

Investor Conference Call Highlights

- Till July, NHAI has awarded a project of about 460 km against the annual target of 4,500 km for FY ’21 vis-à-vis a target of 3,211 km in financial year ’20.

- Construction across national highways has rebounded to 637 km in May from just 210 km in April.

- The construction industry is expected to see a 10-13% decline in highway construction this year.

- Toll collections have reached 73% of pre-COVID levels according to an industry report by CRISIL.

- Of the company’s 5 HAM projects, 4 have started construction and the progress in them is:

- Chittor to Mallavaram: 6%

- Ramsanpalle to Mangloor: 5%

- Trichy to Kallagam: 43%

- Magadi to Somwarpeth: 3%

- The company expects to receive the appointed date for Palani by the first week of September.

- The total equity requirement for all the 5 HAM projects is INR 624.28 crores of which we have already invested INR 223.49 crores as on June 30, 2020. The balance equity will be invested over a period of 3 years with an investment of INR 250 crores in balance at the end of FY ’21, INR 110 crores in FY ’22, and remaining INR 40.79 crores in FY ’23.

- The deal to divest 3 HAM projects, Trichy to Kallagam, Chittor to Mallavaram, and Ramsanpalle to Mangloor is on track. The discussion with Cube for sale of 100% stake in KNR Walayar Tollways Pvt. Ltd. for an enterprise value of INR 529 crores is in the final discussions of negotiations and the transaction is expected to be closed in the next 2 months.

- The company is targeting a further order inflow of around Rs 2,000 Cr this financial year.

- The management assures that 80-85% of manpower requirements will be met in all projects and around 80% efficiency should come back by Q3.

- Essentially, the company only uses migrant labour to cover for 35-40% of requirements, and the rest is met using local operators and the workforce.

- The land acquisition in the Palani project is at 72% as of 15th August 2020. The management to reach 80% by the end of August.

- Irrigation projects are expected to yield EBITDA margins of 18-20% normally. Right now due to delay in payments it is coming out to be 16-17%.

- The company does not have any plans for incremental capex for FY21.

- The company has receivables of Rs 540 Cr pending from Telangana Govt at present. It expects this payment to be completed within the next 2 weeks.

- The company has applied for 7 tenders orders already and plans to submit another 10 more bids in September. Most of these projects are above Rs 1000 Cr and 3-4 of them are of Rs 500-600 Cr in size.

- The competition in tender bidding for NHAI projects has intensified with a few new entrants in the mix.

- The company has received mobilization advance of Rs 102 Cr and retention money receivables are at Rs 163 Cr. Gross debt is at Rs 334 Cr. Consolidated debt is at Rs 1048 Cr.

- The management does not expect any delay in payments from NHAI.

- The new orders added in Q1 were the 2 new irrigation projects of Rs 2300 Cr.

- The management expects the company to be able to achieve revenues of Rs 2250 Cr in FY21 and an additional Rs 200-300 Cr can be added depending on how execution on the irrigation projects goes.

- The management cannot guarantee that margins will stay at current levels as key input prices like cement and diesel are on the rise.

- The company is operating at 90% efficiency in day shift and is not operating at night shift. Overall work efficiency is at 70% at present in irrigation projects. In highway projects, efficiency is at 60%.

- The dent went up in Q1 due to a delay in payments. As the payments come back debt will be reduced to previous levels.

- The management believes that there may not be enough projects available in the future in the company’s core area of highways and so it is good to go into other project areas and develop competence.

- The rise in WC days was mainly due to COVID-19. The management doesn’t see any further rise in WC going forward for the next 1-2 years.

- There is an upcoming augmentation issue in Muzaffarpur-Barauni which will come up in the next 3-5 years. This is what is keeping the buyer away as it is making previous valuations uncertain.

- The order backlog in irrigation projects is KP Sagar at Rs 84 Cr, Yedula at Rs 12 Cr, Mallana Sagar at Rs 518 Cr, Vattem at Rs 847 Cr. The new projects have added Rs 1600 Cr and Rs 695 Cr.

- Unbilled revenue from Telangana is Rs 440 Cr and the company also has additional work done but not certified of Rs 180 Cr.

- The management has stated that it doesn’t expect debt to rise as the company is expecting inflows from the Telangana payment and the sale to Cube Highways.

- The company will see higher levels of depreciation due to the addition of big irrigation projects. The Net Block is at Rs 75 Cr while the gross block in Q1 was at Rs 300 Cr. The depreciation is expected to rise to Rs 150-160 Cr in FY21.

- Irrigation revenue in Q1 was at Rs 108 Cr.

- The company may have to do a maximum capex of Rs 100-120 CR to purchase some cranes for additional projects if the need arises.

- Of the Rs 475 Cr of debtors at the end of Q1, Rs 127 Cr is from irrigation and the balance is from road projects. Out of the remaining Rs 348 Cr, Rs 20 Cr is from Tirumala and another SPV. Of the Rs 348 CR, the company has already received Rs 180 Cr in July.

- The main areas for negotiation for the Cube deal were the high rise in project insurance and revenue shortage during the COVID period and lockdown periods.

- The company has stayed away from expressways tenders in the past but it will be interested in bidding for them in the future in MP, Maharashtra, and other states.

- The only major capex to be done this year is for a pump house in an irrigation project. The project designs are yet to be approved.

- The management remains confident that the NHAI will be able to meet its target of tendering of 4500 km in FY21 based on the rapid pace it is setting on land acquisition.

Analyst’s View

KNR has been one of the top performers in the construction industry. Despite the industry headwinds and the general plight of the companies in this sector due to delay in payments from NHAI, KNR has been able to continue to improve its margins substantially. The company has been able to weather the severe issues regarding land acquisition and labour crisis which it met earlier this year. The management expects labour to start coming back after monsoons but it remains to be seen whether the company to get back to normal operating levels at its prescribed time. The company has done well to win crucial irrigation projects in Q1 and reduce dependence on highway projects. It remains to be seen how the industry will fare going forward and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q4FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 683 | 731 | -6.57% | 565 | 20.89% | 2301 | 2201 | 4.55% |

| PBT | 86 | 101 | -15.22% | 59* | 46.16% | 294** | 291 | 1.06% |

| PAT | 67 | 92 | -27.08% | 40 | 67.16% | 235 | 263 | -10.65% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 741 | 787 | -5.86% | 613 | 20.82% | 2517 | 2366 | 6.40% |

| PBT | 93 | 113 | -17.04% | 69* | 36.18% | 313** | 289 | 8.22% |

| PAT | 75 | 104 | -28.06% | 50 | 49.42% | 245 | 262 | -6.63% |

*includes an exceptional item of Rs 6.7 Cr

**includes an exceptional item of Rs 10.7 Cr

Detailed Results

-

- The consolidated revenues for Q4 were down 6% YoY.

- Consolidated PAT saw a big decline of 28% YoY.

- The exceptional item of Rs 6.7 Cr in Q3 was due to impairment of KNR Walayar Tollways which is to be sold to Cube Highways with whom KNR has signed a SPA.

- EBITDA for Q4 rose 2% YoY.

- The consolidated EBITDA margin improved 160 bps YoY to 21.7% in Q4.

- It currently has 5 HAM projects worth Rs 6049 Cr.

- The company entered into a Concession Agreement for KNR Palani Infra Pvt. Ltd. (NHAI HAM) project worth Rs 920 Crores (BPC) in Tamil Nadu has been signed on 6thDec ’19 and submitted documents for financial closure on 22nd May ‘20.

- The company has received 2 irrigation projects worth Rs. 2,309.23 Cr from Irrigation & CAD Department, Govt. of Telangana on 17th May 2020.

- The order book as of 31st March ’20 is Rs 5229.7 Cr out of which 47% are captive HAM projects.

- The top 5 road projects are of Rs 2697.8 Cr while other projects consist of Rs 958.4 Cr. Irrigation projects form Rs 1573.5 Cr of the order book. The company has an additional Rs 2658.1 Cr worth HAM projects which have not been included in the order book.

- The order book distribution is:

- Arunachal Pradesh: Rs 93.2 Cr

- AP & Telangana: Rs 3122 Cr

- Karnataka: Rs 27 Cr

- Kerala: Rs 1256 Cr

- Tamil Nadu: Rs 732 Cr

- The net-working capital days has risen to 53 days in Q4.

Investor Conference Call Highlights

- The transport infrastructure sector in India holds a further investment opportunity of USD 575 billion over the next 5 years.

- Roads and railways constitute 80% of the total investment opportunity, driven by investments in flagships, such as Bharatmala Pariyojana, etc.

- The Ministry of Road Transport and Highways has decided to release INR 7,500 crore to INR 8,000 crore of retention money to provide liquidity support to EPC concessionaires.

- The physical progress as on March 31 2020 for the 4 HAM projects are as follows:

- Chittor to Mallavaram: 54.4%

- Ramsanpalle to Mangloor: 43.7%

- Trichy to Kallagam: 37.4%

- Magadi to Somwarpet: 6.9%

- The company has signed a SPA with Cube Highways for sale of 100% stake in KNR Walayar Tollways Pvt. Ltd. for an enterprise value of INR 529.27 crores. The transaction to be completed within the next 1 to 2 months.

- The toll revenue during the quarter is INR 17.9 lakhs per day.

- In terms of order book breakup, road constitutes INR 3,666 crores (70%) and irrigation projects constitute INR 1,574 crores (30%).

- Migrant labour is a real issue for the company with only 20-30% of labourers remaining at sites currently. Projects are running at an efficiency of 50-65%.

- The company expects Q1 & Q2 to be muted for the company and most of the work for the year to be done in Q3 & Q4.

- The management has stated that the company can easily expect a 2-3% premium on regular margins from irrigation projects.

- The company has Rs 500 Cr outstanding from Telangana govt. Payment of around Rs 200 Cr got delayed in March due to COVID-19.

- Land acquisition is another area that has been severely affected due to COVID-19.

- The company is targeting 3-4 big projects of Rs 3000 Cr to come in this year and is looking to NHAI for these orders.

- The company will only do maintenance capex of Rs 15 Cr this year and will refrain from any other capex for FY21 in the irrigation projects.

- Quarterly depreciation run rate of Rs 50 Cr is expected to continue.

- Other expenses have gone u as the company brought in an external consultant for design and consulting in Q4.

- The company has applied for a tender offer in Tamil Nadu for an annuity project which it expects to gain in the near future.

- The company expects NHAI order pipeline to be 4000-4500 km in FY21. The company received arbitration of Rs 61 Cr in FY20.

- The management expects a dip in margins in Q1& Q2 going forward.

- Land acquisition in KSHIP project is at 72% while in Palani it is at 50%. The company should get the appointment date for the Palani project in the next 2 months.

- The company has put up Rs 140 Cr in total in projects where Rs 100 Cr was in KSHIP and Rs 40 Cr was in Palani.

- According to the current order book and payment schedule, Q1 revenues should be around Rs 450 Cr.

- The company has outstanding MAT of Rs 34 Cr which it expects to run down in FY21 before switching to the new tax rate next year.

- The tenders from NHAI are expected to be 20 in number with a worth of around Rs 20,000 Cr in total. Out of these the company has identified 5-6 projects to apply for. The bidding for these projects has gotten delayed due to COVID-19.

- In Q1, the company has done Rs 300 Cr worth of irrigation and Rs 500 CR is outstanding here.

- The monthly fixed cost for the company is at Rs 15 Cr.

- The HAM projects that the company is targeting are of around Rs 6000-7000 Cr.

- The current order backlog for Megha is Rs 518 Cr and for Navayuga is Rs 847 Cr.

- The annuity project for Tamil Nadu is expected to be of Rs 500 Cr.

- The management expects the company to reach normal operating capacity from Q3 onwards.

- The company had only a 20-30% execution in April & May.

- The retention money of the company with NHAI is around Rs 150 Cr.

- The management expects labour to start returning from after monsoons are over.

Analyst’s View

KNR has been one of the top performers in the construction industry. Despite the industry headwinds and the general plight of the companies in this sector due to delay in payments from NHAI, KNR has been able to continue to improve its margins substantially. But the company does face severe issues regarding land acquisition and labour crisis which is expected to hit the construction industry hard. The management expects labour to start coming back after monsoons but it remains to be seen how long it will take for the company to get back to normal operating levels. The awarding of projects and tenders has also gotten delayed which has put many industry players under stress. It remains to be seen how the industry will fare going forward and how long will it take for the Govt’s push in infrastructure to gain proper momentum. Nonetheless, given its strong balance sheet, good operational history, and resilient order book, KNR Constructions remains a pivotal construction sector stock to watch out for.

Q3FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 564.85 | 470.56 | 20.04% | 571.75 | -1.21% | 1617.98 | 1469.78 | 10.08% |

| PBT | 58.8 | 59.52 | -1.21% | 90.05 | -34.70% | 207.73 | 189.22 | 9.78% |

| PAT | 40.2 | 52.1 | -22.84% | 70.09 | -42.65% | 158 | 171.11 | -7.66% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 612.95 | 505.79 | 21.19% | 614.39 | -0.23% | 1776.81 | 1579.16 | 12.52% |

| PBT | 68.55* | 58.1 | 17.99% | 94.69** | -27.61% | 219.69*** | 176.74 | 24.30% |

| PAT | 49.96 | 50.5 | -1.07% | 74.64 | -33.07% | 169.86 | 158.33 | 7.28% |

*includes an exceptional item of Rs 6.7 Cr

**includes an exceptional item of Rs 4 Cr

***includes an exceptional item of Rs 10.7 Cr

Detailed Results

-

- The consolidated revenues for Q3 were up 21.2% YoY.

- Consolidated PAT saw a modest decline of 1% YoY.

- The exceptional item of Rs 6.7 Cr in Q3 was due to impairment of KNR Walayar Tollways which is to be sold to Cube Highways with whom KNR has signed a SPA.

- EBITDA for Q3 rose 38% YoY.

- The consolidated EBITDA margin improved 240 bps YoY to 26.7% in Q3.

- It currently has 5 HAM projects worth Rs 6049 Cr.

- The company entered into a Concession Agreement for KNR Palani Infra Pvt. Ltd. (NHAI HAM) project worth Rs 920 Crores (BPC) in Tamil Nadu has been signed on 6th Dec ’19.

- The company has 2 irrigation projects from Megha Engineering & Infrastructure Ltd and Navayuga Engineering Company Ltd worth Rs 1697 Cr.

- The order book as of 31st Dec ’19 is Rs 5888.3 Cr out of which 49% are captive HAM projects.

- The top 5 road projects are of Rs 3155 Cr while other projects consist of Rs 1077 Cr. Irrigation projects form Rs 1654 Cr of the order book. The company has an additional Rs 920 Cr worth HAM projects which have not been included in the order book.

- The order book distribution is:

- Arunachal Pradesh: Rs 109 Cr

- AP & Telangana: Rs 3454 Cr

- Karnataka: Rs 1379 Cr

- Kerala: Rs 44 Cr

- Tamil Nadu: Rs 901 Cr

- The net-working capital days has stayed stable at 43 days.

Investor Conference Call Highlights

- The management has stated that interest costs were higher due to interest incurred in mobilizing advances for HAM projects going higher in Q3.

- Out of the 5 HAM projects, 3 projects have already been commissioned.

- The company is still following the old tax regime and the current MAT credit is Rs 60 Cr. The company will stay on this regime for the next 1.5-2 years until this credit is exhausted.

- In the Magadi project, 70% of the land is available and 80% of the project is expected to be completed in the next 6 months. In the Palani project, the company is waiting for confirmation on how much land is available for the project.

- In KNR Walayar, the company expects to get all NOCs from all vendors in the next two weeks.

- The company expects to get Rs 1000-1500 Cr by the end of FY20. The majority of these projects will be HAM.

- The company is targeting 2 road projects and 1 irrigation project in the next month.

- Standalone debt is Rs 329 Cr including Rs 194 Cr of promoter debt.

- The revenue contribution of irrigation projects is 30% in Q3 and 20% in 9M.

- The land acquisition in the Navyuga project is pending as the company has only 1 km of the 6 km required. The management expects this project to go slowly as more and more land is available.

- The Capex in 9M is Rs 120 Cr. The management expects to complete the current order book by March 2021. The company will be able to have clarity on Capex plans for FY21 in Q4.

- The company has acquired 90% of land in Srirangam. The company is short of 4-5% in the Mangaluru project which is expected to be done by end of Feb. The Tirupati project land acquisition is already above 90% and the company has also applied for a 50% grant from NHAI in this project.

- The company is confident of achieving the 3rd milestone in the Trichy project in time.

- The management has expressed its intention to bid on the Mumbai-Delhi Expressway. The company is targeting 10-15% revenue growth in FY21. The revenue target for FY20 is Rs 2500 Cr.

- For the 2 remaining HAM projects, the total equity requirement is Rs 120-125 Cr in FY21.

- The irrigation projects which are not part of the backlog are Rs 655 Cr project from Megha Engg and Rs 847 Cr project from Navayuga.

- The company will be completing 60-65% of the Magadi project next year.

- The management has stated that the company needs to add 2000-3000 Cr in FY21 to maintain its revenue growth.

- The company is expecting tenders in Kerala to go through in March.

- The company expects to realize any arbitration claims only in FY21.

- The company will be realizing the profits from sales to Cube only on the date of completion of projects which is expected to be in FY21.

- The management has clarified that subcontracting has gone down as the projects requiring subcontracting has gone down. Only when the project is Rs 100-150 Cr does the company looks to subcontract.

- The company has receivables of Rs 350 Cr where Rs 320 Cr is from SPVs and thus the company is not going for debt raising at SPV level.

- The management has stated that debt levels should stay stable at the standalone level.

- The arbitration award in favour of KNR is Rs 600 Cr.

- The management is not expecting too many orders from the 3 capital formation in Andhra Pradesh fir itself. This is because most of the road projects there are being done by central govt and the state govt is mainly commissioning building projects.

Analyst’s View

KNR has been one of the top performers in the construction industry this year. Despite the industry headwinds and the general plight of the companies in this sector due to delay in payments from NHAI, KNR has been able to clock an impressive 21% revenue growth while improving its margins substantially. It remains to be seen how long the company can manage to maintain its current margin profile which is among the best in the industry. It also needs to be seen how will the road projects announced by in the Union Budget in January will be awarded and how many will the company be able to win. Nonetheless, given the company’s spectacular performance so far in FY20 and its robust balance sheet, KNR remains one of the best construction stocks to watch out for.

Q2 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY20 | Q2FY19 | YoY % | Q1FY20 | QoQ % | H1FY20 | H1FY19 | YoY% | |

| Sales | 571.75 | 425.1 | 34.50% | 481.37 | 18.78% | 1053.13 | 999.22 | 5.40% |

| PBT | 90.05* | 45.26 | 98.96% | 58.88 | 52.94% | 148.93 | 129.69 | 14.84% |

| PAT | 70.09 | 45 | 55.76% | 47.71 | 46.91% | 117.81 | 119 | -1.00% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY20 | Q2FY19 | YoY % | Q1FY20 | QoQ % | H1FY20 | H1FY19 | YoY% | |

| Sales | 614.39 | 460 | 33.56% | 549.45 | 11.82% | 1163.85 | 1073.37 | 8.43% |

| PBT | 94.69* | 35.94 | 163.47% | 56.44 | 67.77% | 151.13 | 118.64 | 27.39% |

| PAT | 74.64 | 35.62 | 109.55% | 45.26 | 64.91% | 119.9 | 107.83 | 11.19% |

*includes an exceptional loss of Rs 4 Cr.

Detailed Results

-

- The consolidated revenues for Q2 were up 34% YoY.

- Consolidated PAT saw a big rise of 163% YoY.

- The consolidated EBITDA margin improved 410 bps YoY to 27% in Q2.

- It currently has 5 HAM projects worth Rs 6049 Cr.

- The company has received an arbitration claim in one of its projects amounting to Rs. 57.15 Cr in the quarter (including interest of Rs. 21.75 Cr).

- The company received LOA for an irrigation project worth Rs 850 Cr from Megha Engineering & Infrastructure Ltd.

- The order book as of 30th Sep ’19 is Rs 5146.8 Cr out of which 43% are captive HAM projects.

- The top 5 road projects are of Rs 2732 Cr while other projects consist of Rs 563 Cr. Irrigation projects form Rs 1850 Cr of the order book. The company has an additional Rs 2064.5 Cr worth HAM projects which have not been included in the order book.

- The order book distribution is:

- Arunachal Pradesh: Rs 109 Cr

- AP & Telangana: Rs 3461 Cr

- Karnataka: Rs 492 Cr

- Kerala: Rs 71.2 Cr

- Tamil Nadu: Rs 1013 Cr

- The net-working capital days has stayed stable at 42 days.

Investor Conference Call Highlights

- The management maintains that road and highway makers have continued to have muted performance in the year so far. The contract awarding has remained low and projects have been going slowly due to issues relating to land acquisition and funding.

- The management expects NHAI to be awarding almost 6000 km of projects in the rest of the year.

- NHAI has a pipeline of projects of Rs 7,00,000-8,00,000 Cr for the next 3 years.

- In the company’s Chidambaram project, the concessional agreement has been deemed as terminated as NHAI was unable to provide the required 80% of the land required due to disputes.

- The company has a total of 2 BOT annuity projects, 2 BOT toll projects and 5 HAM projects currently. It also has 2 irrigation projects in addition to the above.

- The progress in the company’s ongoing HAM projects is as follows:

- Chittor to Mallavaram: 5%

- Ramsanpalle to Mangloor: 4%

- Trichy to Kallagam: 5%

- In the Walayar Tollways BOT project, the average toll collection is at Rs 18.6 Lacs per day. The company is looking for other opportunities to monetize this project. In the Muzaffarpur Barauni Tollway project, the average toll collection is at Rs 22.65 Lacs per day.

- The company is planning to bring in an additional Rs 1000-1500 Cr of orders in the rest of the year.

- The management has decided to follow the old tax regime to use up their MAT reserves which will take around 2 years to get used up.

- The revenues from irrigation projects were 18% of revenues in Q2.

- The Capex done in H1 was Rs 142 Cr.

- The Capex may go up to Rs 200 Cr for the whole of FY20.

- The revenue guidance of Rs 2300-2400 Cr for FY20 remains intact for the management.

- The management has guided that they should get margins of 15-16% from road projects and >20% from irrigation projects.

- Employee costs have risen sharply in the current quarter because of the payment of variable bonuses to the employees and directors of the company.

- The company has stated that it has not faced any problems with billing and dues payment from NHAI on the surface.

- The equity requirement for the 2 pending HAM projects is around Rs 220 Cr.

- The management has guided for revenues above Rs 2600-3000 Cr in FY21.

- The management has maintained that they will not stretch themselves by bidding for more HAM projects than what they can handle and they will be bidding for high margin projects since they have the strength of balance sheet to compete effectively for such projects.

- The management expects the other income figure of Rs 30 Cr for FY20 for the company.

Analyst’s View

KNR has been one of the top performers in the construction industry this year. Despite the industry headwinds and the general plight of the companies in this sector due to delay in payments from NHAI, KNR has been able to clock an impressive 34% revenue growth while improving its margins substantially. The company has done well to maintain a healthy balance sheet to be able to compete effectively while bidding for attractive projects and have seen good success in bagging high margin irrigation projects. Furthermore, the management is optimistic that NHAI will be handing out a greater number of projects in the near future. It remains to be seen how long the company can manage to maintain its current margin profile which is among the best in the industry. It also needs to be seen whether they will be rewarded in time from the increased number of projects handed out by the NHAI. Nonetheless, given the company’s spectacular performance so far in FY20 and its robust balance sheet, KNR remains one of the best construction stocks to watch out for.

Q1 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY20 | Q1FY19 | YoY % | Q4FY19 | QoQ % | |

| Sales | 481.38 | 574.12 | -16.15% | 730.85 | -34.13% |

| PBT | 58.88 | 84.42 | -30.25% | 101.37 | -41.92% |

| PAT | 47.71 | 74 | -35.53% | 92.15 | -48.23% |

| Consolidated Financials (In Crs) | |||||

| Q1FY20 | Q1FY19 | YoY % | Q4FY19 | QoQ % | |

| Sales | 549.45 | 613.32 | -10.41% | 786.68 | -30.16% |

| PBT | 56.44 | 82.69 | -31.75% | 112.52 | -49.84% |

| PAT | 45.26 | 72.2 | -37.31% | 103.46 | -56.25% |

Detailed Results

-

- The consolidated revenues for Q1 were down 10% YoY. This was mainly due to the delay in receiving an appointed date for HAM projects from the NHAI.

- Consolidated PAT saw a big decline of 37% YoY. This was mainly due to higher depreciation from irrigation projects and higher tax expenses.

- The consolidated EBITDA margin declined 100 bps YoY to 21.8% in Q1.

- The company recently won an NHAI HAM project worth Rs 920 Cr in Tamil Nadu.

- It currently has 6 HAM projects worth Rs 6531 Cr.

- The company received LOA for an irrigation project worth Rs 847 Cr from Navayuga Engineering Company Ltd.

- The company’s credit was revised to AA- Stable from A+ Positive by CRISIL and Care India.

- The company expects to get around Rs 262 Cr from the SPA with Cube Highways for 3 HAM projects.

- The order book as of 30th June ’19 is Rs 4633.8 Cr out of which 54% are captive HAM projects.

- The top 5 road projects are of Rs 3059 Cr while other projects consist of Rs 600 Cr. Irrigation projects form Rs 972 Cr of the order book. The company has an additional Rs 2546 Cr worth HAM projects which have not been included in the order book.

- The order book distribution is:

- Arunachal Pradesh: Rs 125 Cr

- AP & Telangana: Rs 2773 Cr

- Karnataka: Rs 526 Cr

- Kerala: Rs 104 Cr

- Tamil Nadu: Rs 1104 Cr

- The net-working capital days has risen to 42 days from 36 days in Q4FY19.

Investor Conference Call Highlights

- The company expects around Rs 40-50 Cr to be added to next quarter revenues which should have been added in Q1.

- In the Chidambaram project, the company is facing issues regarding land acquisition and the NHAI is expected to take the critical decision regarding how to proceed here by the end of August. The company is not much concerned about the cancellation of this project as there are provisions in place within the government contract like penalties that shall help the company avoid losses here.

- The land availability in their projects is as follows:

- Chittor to Malavaram: 94%

- Ramsanpalle to Mangloor: 80%

- Trichy to Kallagam: 83%

- Meensuruti to Chidambaram: 64%

- Magadi to Somwarpeth: 64% (expected to go to 80% in 2-3 months)

- The irrigation revenue has contributed to 10% of revenues in Q1.

- The monetization process for the Valyar project is on and the company should be able to get it on track by the end of the year. The company may suffer a loss of Rs 10-15 Cr on its investment into this project but they are hopeful of bagging the augmentation and other follow up projects after this one in the next 1-2 years.

- The company had seen the appointed date delayed for one of their irrigation projects in Q1 and they were not able to execute it as desired. They expect the revenues would be reflected in Q2.

- The management feels that they are on track to achieve their yearly revenue growth target of Rs 2400 Cr, most of which they expect to derive in Q3 and Q4 on the 3 HAM projects that the company has started execution on.

- The company expects to execute around Rs 500-600 Cr of orders in an irrigation project in the rest of the year.

- The standalone cash position is around Rs 20 Cr.

- Other than the 3 HAM projects whose shares are being sold to Cube, there is a fourth project in the SPA where the company has invested Rs 52 Cr and they will get Rs 95 Cr for it from Cube.

- The company shall continue to bid for both EPC and HAM projects based on the return estimates. They will also be looking to sell forward their stakes in these projects like in the case of the Cube deal.

- The receivables have gone up as the company has finished some work on HAM projects but they have not received any date of disbursement for this work. Thus this amount has been classified as receivables.