About the Company

ISGEC Heavy Engineering Ltd is a diversified heavy engineering company engaged in manufacturing and project business with an extensive global presence. It manufactures process plant equipment, presses, Iron & Steel castings & Boiler pressure parts.

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- Stand-alone financial revenue for Q4 FY ’23: INR 1,425 crores, a 5% increase compared to the previous year.

- Stand-alone profit before tax for Q4 FY ’23: INR 84 crores, a 78% increase compared to the previous year.

- Consolidated revenue for Q4 FY ’23: INR 2,048 crores, a 28% increase compared to the previous year.

- Consolidated profit before tax for Q4 FY ’23: INR 126 crores, a significant increase compared to the previous year.

- The order book is strong, with consolidated orders in hand as of March 31, 2023, at INR 8,321 crores. 79% of the consolidated order book is for project business, and 21% is for product business.

- Segmental financial highlight-

- Manufacturing EBIT margin for FY23 stood at 6.9% and Q4FY23 stood at 8.9%

- EPC EBIT margin for FY23 stood at 4.4% and Q4FY23 stood at 3.8%

- Sugar & Ethanol EBIT margin for FY23 stood at 9.2% and Q4FY23 stood at 4.1%

Investor Conference Call Highlights

- The company expects better margins in both the EPC (Engineering, Procurement, and Construction) and manufacturing segments in the coming year.

- The company is conscious of taking projects with shorter durations to reduce risk and improve margins.

- The company stated that A significant portion of the order book is from public sector undertakings (PSUs), where costs can be indexed and passed on.

- The company expects debtors (receivables) to come down by the end of the current year.

- The company stated that the construction of the Cavite Biofuel ethanol plant in the Philippines is progressing and expected to be completed by the end of the next quarter.

- The company stated that the overall demand trend has improved, and the inquiry position for the company’s products and solutions is good.

- The domestic demand scenario for capital goods is optimistic, with both the public and private sectors investing in India.

- The company stated that overseas inquiries are increasing, but decision-making is getting delayed due to factors such as financing challenges and uncertainties.

- The company expects better margins in the coming year, with a focus on project duration, contingency margins, and passing on cost variations.

- The manufacturing business has crossed the INR 2,000 crores annual revenue mark and is expected to continue double-digit growth.

- The Philippines plant construction is ongoing, and the company plans to commission the plant by the end of the next quarter.

- In the Philippines, there is a 10% blending requirement for ethanol in petrol, and the country’s existing production is only about 5%, creating a demand for ethanol.

- The pricing of ethanol in the Philippines is controlled and regulated by the government, with a 22 peso conversion margin. The estimated EBITDA per liter of ethanol is between 25% and 28%.

- There are no major disruptions or slowdowns in orders from the oil and gas sector.

- The company expects orders from sectors such as oil and gas, boilers, automobile, specialty chemicals, and cement.

- The company stated that Hitachi subsidiary revenue is approximately INR 600 crores, with a profit margin of about 2%. The company expects an improvement in Hitachi’s performance in the current financial year.

- The company stated that the Eagle Press subsidiary in Canada had a challenging year due to low order bookings caused by the automotive sector’s slowdown in the US. However, sales have improved recently, and the company expects a turnaround in the current year.

- The profitability of the ethanol project should be seen in conjunction with the sugar plant. Factors such as higher sugar realization, less molasses production, and combined economics impact the ethanol plant’s profitability.

- The exposure from ISGEC’s balance sheet to Cavite Biofuel is INR 304 crores, with INR 45 crores provided as an expected credit loss. The balance loan of INR 90 crores is yet to be borrowed.

- The capital expenditure for the Philippines plant is expected to be around INR 110-115 crores. The company anticipates generating enough revenue and cash profits to pay off loans and recoup investments in 5-6 years.

- The payback period for the equity investment in the Philippines plant is estimated to be 5-6 years.

Analyst’s View

ISGEC Heavy Engineering is a well-known company that’s all about heavy engineering and manufacturing of industrial products like process equipment, boilers, and pressure vessels. They have a solid reputation and a lot of experience in the field, making them a great investment opportunity. They have a diverse product range, strong brand image, and strong relationships with clients from a variety of industries. Of course, there are also some challenges to consider, such as the ups and downs of the heavy engineering industry, competition from both domestic and international players, and the risk that comes with relying too much on a few key clients or industries. But things are looking up. The company is experiencing an overall increase in demand and has been receiving more export inquiries lately. It remains to be seen how profitable the new Philippines plant become in near future. Overall, ISGEC Heavy Engeneering Ltd. is an interesting stock to look out for.

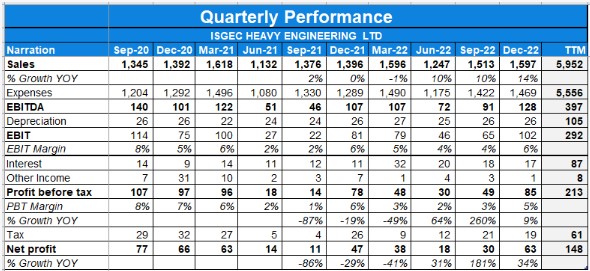

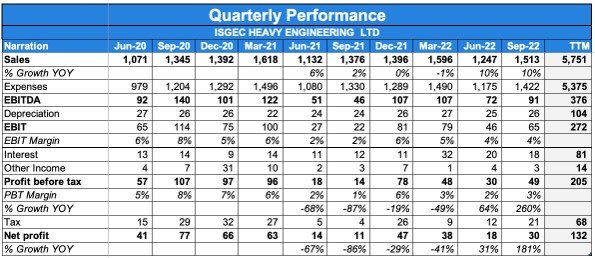

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The stand-alone revenue for Q3 FY ’23 is INR 1,103 crores compared to INR 1,119 crores in Q3 FY ’22.

- The stand-alone revenue for the 9 months ended 31st December 2022 is INR 3,261 crores, which is about 5% higher compared to INR 3,105 crores for the 9 months ended 31st December 2021.

- The consolidated revenue for Q3 FY ’23 is INR 1,598 crores, which is about 14% higher compared to INR 1,403 crores for Q3 F ’22.

- The stand-alone profit before tax for Q3 FY ’23 is slightly higher at INR 53 crores against INR 50 crores for Q3 FY ’22.

- For the 9 months ended 31st December 2022, the profit before tax is INR 150 crores, which is about 50% higher compared to INR 100 crores for the 9 months ended 31st December 2021.

- For 9 months ended 31st December 2022, the consolidated revenue was INR 4,363 crores, which is 11% higher compared to INR 3,915 crores for that of 31st December 2021.

- The consolidated profit before tax for Q3 FY ’23 is INR 85 crores compared to INR 78 crores for Q3 FY 22.

- The consolidated profit before tax for the 9 months ended 31st December 2022 is INR 164 crores as compared to INR 110 crores for the 9 months ended 31st December 2021.

- The consolidated order booking for Q3 of FY ’23 is INR 1,388 crores compared to INR 893 crores of orders booked in Q3 of last year. The consolidated order book on hand as on 31st December 2022 is INR 7,752 crores compared to INR 7,224 crores as on 31st December 2021.

Investor Conference Call Highlights

- The management stated that the consolidated profit is better because of higher profits in ISGEC stand-alone and in Saraswati Sugar Mills Ltd.

- The management informed that of the consolidated order book, 74% is for the project business and 26% is for the product business.

- The management stated that the Philippines project, construction is progressing at the Cavite Biofuels ethanol plant in the Philippines.

- The management expects to complete the Philippines project by July 2023 and make it operational in August 2023.

- The management explained that the order book for the Power segment is like 23% but 2 years back, it was more than 36%. And for refineries that has gone up from 10% to 26%.

- The management expects that the money stuck in a few orders like FGD will be released in the next 6 to 8 months.

- The management stated that the sustainable level of EBIT margin would be 8 %.

- The management stated that the consolidated debt across all the companies is INR 1,064 crores as of 31st of December 2022 out of which INR 350 crores is related to the Philippines plant.

- The management informed PSU is 44% of the order book and 56% was private.

- The management expects the revenue growth in FY’24 to be in the range of 10% to 15%.

- The management stated that the technology is indigenized to a very large extent. There is very little that they purchase for these technologies that they purchase from abroad.

- The management stated that INR 1,150 crores of retention which are largely from the projects business.

- The management explained that for the manufacturing business, the investment is largely in the inventories and the work in progress. Inventories include raw material and work in progress. There is some amount of investment in receivables, and there is some amount of investment in retentions. There is presently more investment in the EPC business.

- The management stated that they are booking new fresh orders in the areas of different kinds of boilers, for sugar machinery and distilleries as well as air pollution control equipment.

- The management informed that There is a loss in this quarter in Eagle Press. That gets consolidated to manufacturing of machinery and equipment.

- For Hitachi Zosen which is a subsidiary of Isgec Heavy Engineering Limited , the company has done about INR 150 crores in revenue and about INR 4 crores in profit.

Analyst’s View

ISGEC Heavy Engineering is a well-known company that’s all about heavy engineering and manufacturing of industrial products like process equipment, boilers, and pressure vessels. They have a solid reputation and a lot of experience in the field, making them a great investment opportunity. They have a diverse product range, strong brand image, and strong relationships with clients from a variety of industries. Of course, there are also some challenges to consider, such as the ups and downs of the heavy engineering industry, competition from both domestic and international players, and the risk that comes with relying too much on a few key clients or industries. But things are looking up. The company is experiencing an overall increase in demand and has been receiving more export inquiries lately. The ethanol plant capacity is being increased. And that will, help in reducing it will not really change the revenue very much, but it will reduce the fuel cost, it will reduce some of the costs. To that extent next year, ethanol will show a better margin.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- The consolidated sales for Q2 stood at 1515 Cr with EBITDA at 93 Cr and EBITDA margins at 6.2% vs 3.6% the previous year.

- The PAT for Q2 stood at 285 Cr vs 101 Cr the previous year. PAT margin stood at 1.9% vs 0.7% the previous year.

- On an overall basis, the diversified consolidated revenue contributors for the quarter were :-

- Manufacturing :- 29%

- EPC :- 58%

- Sugar and Ethanol :- 13%

- As of 30th September 2022, the order book stood at 776.2 Cr with composition of :-

- Refineries – 27%

- Power – 26%

- Steel Cement & Aluminium – 14%

- Sugar – 12%

- Chemicals/Petrochemicals & Fertilizers – 7%

- Railways – 3%

- Others – 11%

- Consolidated order book composition is also split-up into :-

- Sector Wise :-

- PSU & Government – 57%

- Private – 43%

- Geography Wise :-

- Exports – 11%

- Domestic – 89%

- Segment Wise –

- Projects – 23%

- Manufacturing – 77%

- The diversification across geographies was with a presence in 91 countries across 6 continents. Exports for FY22 contributed 10% of revenue with 11% of order book. Exports are expected to pick up as travel opens up.

- Segmental EBIT margins Financial Highlights for Q2 :-

- Manufacturing – 8.6%

- EPC – 4%

- Sugar – 9%

- Highlights of New Orders booked in Q2 :-

- 2 Wet Flue Gas Desulphurisation System for leading power company

- Order for Gas Boilers from a leading gas company

- Order for Dry Sorbent Injection Package from State Run Power generation company

- Cement Waste heat recovery boilers from some of the major cement companies

- Reactor Purge Bin for a gas company

- Ethanol Plant for a sugar and agro product company based out of South India

Investor Conference Call Highlights:

- The standalone result profitability is closer to normal both for the manufacturing and the EPC segment, results are also contributed by dividends from subsidiary companies.

- The management states that the consolidated results the profitability is better because of better profits in ISGEC Heavy Engineering Limited and profit with Eagle Press & Equipment Company Limited.

- Of the consolidated order book 77% is for project business and 23% for project businesses as on 30th Sept 2022.

- The order book includes Rs. 832 crores for export orders which is about 11%. The overall demand trend is encouraging as the inquiry position continues to be good, export inquiries have picked up. Mostly South East Asia, Africa and Central America.

- The order book for ISGEC Hitachi Zosen is INR 801 crores of orders as on 30th June, 2022. As per the management, the performance of Isgec Hitachi Zosen for the Quarter 2 was not very good because the amount of billing done was less, however the production was good.

- The revenue is recognized on the sale of goods basis at Isgec Hitachi Zosen. And equipment was not listed- the shipment was in the buyer’s port but the buyer was not ready for the shipment.

- Of the total order book 44% is coming from the PSU sector, largely central PSUs and two orders from state PSUs. While there are no issues in collecting receivables which are due, most of PSU sector orders are for a longer duration and have payment terms which are linked to milestones. The management is looking at shorter duration orders and better cash flows.

- Moreover, many PSU orders have price variation clauses which permit variations for changes in steel price based on the index, cement price, labor index and fuel. Some of them also have further variations allowed for copper, nickel and aluminum. The company is able to pass on only about 40%, 50% of the price variation (increase as well as decrease).

- All the private sectors and export orders are at fixed price.

- The consolidated debt is Rs. 1,177 crores as of 30th of September across all the group companies.

- In terms of term loans, about Rs. 100 crores of term loans are for the Saraswati Sugar Mills

which is for the ethanol plant that was established in December last year and Eagle Press has term loan outstanding of about Rs. 30 crores. The other term loan is for the Cavite Biofuel Philippine plant. The rest of the borrowing is working capital borrowing. - The construction at the Cavite Biofuel Ethanol plant in the Philippine has started and is expected to be completed by July 2023. The company is working on developing the feedstock and preparation for running the plant from August 2023. There is a quarterly cost about Rs. 8-9 crores per quarter which is largely for salaries. This quarter there was a large payment for insurance of the plant also and there has been some impact of the currency depreciation between peso, dollar, and rupee, according to the management.

- The capex to complete the plant is Rs. 180 crores and is being borrowed on loan in Philippines.

- The annual ethanol production capacity is about 42 million liters and so the expected revenue from the sale of ethanol biproducts is about Rs. 320 crores a year. But the price is fixed by the Philippine government, and they take into account the price of molasses and the price of sugar cane and based on that the price of ethanol changes every 15 days.

- The plant can run both on sugarcane and on molasses. The management expects after about three years, the plant to run 210 days on sugarcane and 120 days on molasses.

- Going forward the margins are expected to continue to improve because the raw material prices are stabilized, for manufacturing segment 8%-9% is sustainable, EPC segment 5%-6% is sustainable.

- Philippines plant construction has started, and the company is on schedule to meet the target date. It is expected to be completed by July 23, and expected to start operations Aug 23.

- There is a quarterly cost about Rs. 8-9 crores per quarter which is largely for salaries. This quarter there was a large payment for insurance of the plant also and there has been some impact of the currency depreciation between peso, dollar, and rupee.

- The capacity of the Ethanol distillery will be increased from 100 KLPD to 150 KLPD with a capex of Rs. 12.5 crores for the 50 KLPD expansion. It is a work in progress; and will get operational sometime by the end of January 2023.

- The capex & demand cycle sentiment is slowly turning to positive.. Power sector is seeing increasing demand while automobile is still slagging.

- There are lot of uncertainties because of the Ukraine war and demand in Europe almost finishing and there are expected recessionary conditions in Europe and North America.

- The management clarifies, “we will be going to 150 and we will be reducing the number of days the distillery will run which will give us efficiencies in operations and will pay back. However, if our distillery can use various raw materials and if it is found to be economical depending on the sugar price and ethanol price we could extend the season, but as of now if this is more for operational efficiency and to reduce the cost of production of unit of ethanol.”

- The management states that they are targeting an increase in the manufacturing turnover by 15%, while projects business is certainly expected to have positive single digit growth.

- The execution timeline for FGD is typically 36 to 50 months. The execution timeline for equipment for refineries and petrochemical can vary: if it is ISGEC it is normally anywhere between 10 to 14 months while if it is a joint venture with Hitachi Zosen it could go up to 21 months. Sugar plants and ethanol plants are normally anywhere between 12 months to 14 months and on the process side generally the cycle times are lower.

Analyst’s View:

ISGEC is a large heavy engineering company that is involved in diverse and multiple industry sectors like power, refineries, and others. ISGEC is a significant global player across business areas in Manufacturing and EPC. Comfortably placed to counter the Cyclicality of any specific industry as the company is diversified across different sectors. Exports contributed 10% of revenue, and 11% of the total orderbook. Exports expected to pick up as travel has opened up after COVID. Nonetheless, given the company’s strong track record, strong tailwinds of the industry, and sustained demand from its customer segments ISGEC remains a pivotal heavy engineering stock to watch out for. Management guided that the now no new major capex, with travels resuming exports may rise, debt level would go down in the near term and this would be favorable to the company. Overall, ISGEC is a candidate to keep a watch while the company is comfortably placed in the long term.

Q1FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 993 | 811 | 22.4% | 1366 | -27.3% | 4470 | 4345 | 2.9% |

| PBT | 40 | 19 | 110% | 47 | -15% | 147 | 284 | -48.2% |

| PAT | 30 | 14 | 114% | 35 | -14% | 113 | 218 | -48.2% |

| Consolidated Financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1250 | 1133 | 10% | 1597 | – 22% | 5512 | 5477 | 0.6% |

| PBT | 30 | 18 | 66.67% | 48 | -37% | 158 | 356 | -55.6% |

| PAT | 18 | 13.8 | 31% | 39 | -54% | 115 | 253 | -54.5% |

Detailed Results:

1) The consolidated order booking for Q1 of FY 2023 is INR 1,331 crores compared to INR 2,366 crores of order book in Q1 of last year.

2) The consolidated orders in-hand on 30th June, 2022, are INR 7,736 crores against INR 7,924 crores as on 30th June, 2021.

3) Total borrowing on a consolidated basis is INR 1,194 crores that as of 30th of June, 2022. This includes Philippines group of companies borrowing of about INR 273 crores.

4) Consolidated Revenue share of- Manufacturing (29% revenue), EPC (58% revenue) and Sugar and Ethanol contribute 13% to Revenue.

5) In Q1FY23 EBIDTA Margin- 6.0% and PAT Margin- 1.4%.

Investor Conference Call Highlights:

- Of the consolidated order book 73% is for project business and 27% for product businesses.

- The order book for Isgec Hitachi Zosen is INR 792 crores of orders as on 30th June, 2022.

- According to the management, manufacturing order book is very good at this point in time, actually booked for maybe 12 months now except orders where they cater to very short delivery orders, where the cycle time is 2 months or 3 months.

- Even though the steel prices are low margins would not improve as the order has been done at the high steel price. So, there will be a lag of a couple of quarters before you see higher margins coming.

- In Philippines plant company has started construction and getting good offers for it. So, in 12 months’ time, company would hope either the plant is sold, or they would start to run the plant. While it is reporting losses currently, management don’t see a huge financial impact.

- Company lost money in one export order, it’s a one-off loss. Impact of loss has been taken in the June quarter.

- Management expects that the manufacturing business margin going forward in a normalized scenario would improve significantly between 8% and 9%.

- Management said that in manufacturing, they are increasing order book by doing very marginal investments, like debottlenecking. In one particular area, they invested some amount of money to increase the output. Being hit by COVID and the project businesses were becoming increasingly difficult because of COVID conditions, labor shortages at sites.

- Management guided that debt level is high as there are some large duration PSU projects including the FGD projects which got extended due to covid and payments are linked to milestone, so borrowings should be coming down progressively over the next year.

- Management hopes that as they are having milestone project borrowing is going to come down substantially over the next one year as milestone gets achieved.

- Management think that export order book will build up progressively as travel has opened up.

- CapEx should be about INR 40 crores this year as they are implementing IT system and CapEx of close to INR 20 crores on the manufacturing side to debottleneck and to increase production.

- Management commented that there are a good number of projects coming up in the domestic sector. There is a lot of investments coming up by various refineries. The biggest growth is in the domestic sector for the kind of equipment Isgec Hitachi does. For Isgec Heavy, inquiry base for exports has picked up while order finalization is still slow and company is being selective in order booking.

- Client concentration of about 18-20% where Indian Oil more than 10% of total order book and in the case of NTPC, it will be less than 10%.

Analyst’s View:

ISGEC is a large heavy engineering company that is involved in diverse and multiple industry sectors like power, refineries, and others. Isgec is a significant global player across business areas in Manufacturing and EPC. Comfortably placed to counter the Cyclicality of any specific industry as the company is diversified across different sectors. Exports contributed 10% of revenue, and ~14% of the total orderbook Exports expected to pick up as travel has opened up after COVID. Nonetheless, given the company’s strong track record, strong tailwinds of the industry, and sustained demand from its customer segments ISGEC remains a pivotal heavy engineering stock to watch out for. Management guided that the now no new major capex, with travels resuming exports may rise, debt level would go down in the near term and this would be favorable to the company. Overall, ISGEC is a candidate to keep a watch while the company is comfortably placed in the long term.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1366 | 1342 | 1.8% | 1118 | 22.2% | 4470 | 4345 | 2.9% |

| PBT | 47 | 93 | -49.5% | 49 | -4.1% | 147 | 284 | -48.2% |

| PAT | 35 | 74 | -52.7% | 37 | -5.4% | 113 | 218 | -48.2% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1597 | 1627 | -1.8% | 1402 | 13.9% | 5512 | 5477 | 0.6% |

| PBT | 48 | 95 | -49.5% | 78 | -38.5% | 158 | 356 | -55.6% |

| PAT | 39 | 68 | -42.6% | 52 | -25.0% | 115 | 253 | -54.5% |

Detailed Results:

- The company saw a very poor quarter with flat revenue growth while PAT de-grew by 50% YoY.

- Quarterly EBIDTA decreased by 18% YoY.

- Segment revenue for FY22 stood at –

- Manufacturing : 29%

- EPC : 59%

- Sugar : 12%

- Debt/Equity stood at 0.5 while interest coverage ratio stood at 3.4 times.

- Fixed asset turnover for FY22 stood at 6.3.

- Export: domestic stood at 10:90.

- Order book for FY22 stood at Rs.7,332 Cr.

Investor Conference Call Highlights:

- The company’s EPC segment’s profitability was sharply lower due to a steep increase in material costs due to an increase in commodity prices, mainly steel, aluminium, nickel and copper, and time and cost overrunning EPC projects due to the impact of COVID-related disruptions coupled with a shortage of skilled manpower, a sharp increase in freight cost – both for purchase of materials and supply of goods to the customers along with higher employee costs.

- The management states that lower profitability on the EPC segment will continue for some time as the fixed price longer duration orders presently under institution were booked before the increase in commodity prices.

- The company’s profits in the Sugar segment are lower due to a a lower quantity of sugar sales i.e. 16.19 lakh quintals in FY22 versus 21.76 lakh quintals in FY 2021 due to lower exports.

- The Saraswati sugar mills plant is operating at full capacity.

- The construction of the the company’s Cavite biofuel plant in the the Philippines will be starting in June 2022 and it expects expectedto complete the plant by June 2023.

- The company’s largest operating sectors are Automobile & oil & gas segment.

- The company expects its Philippines plant to get operational within a year.

- The management expects topline growth of 5% in FY23.

- The company’s feedstock for ethanol production at Saraswati Sugar Mills is B-heavy.

- The company’s PSU order book is about 39% of its total order book & the management expects this to decrease to 25-30% in the coming period.

- The Order intake for the quarter on a consolidated basis was Rs.1,442 Cr.

- The company’s order booking from Hitachi for FY22 roughly doubled on a YoY basis to Rs.520 Cr.

- The exports for this quarter were nil due to high competition from coastal states & lack of geopolitical stability in its key exporting countries like Afghanistan & Sri Lanka.

- The management states that it is not entering into any long-term tie-up for one particular product in the defence sector because the investments are heavy, the gestation period is high, and the market is also uncertain.

Analyst’s View:

ISGEC is a large heavy engineering company that is involved in diverse and multiple industry sectors like power, refineries, and others. The company saw a big decline in performance in Q2 due to rising commodity costs and the unavailability of skilled manpower. It also saw a delay in the shipping of major orders which led to the postponement of revenue recognition of those orders. The management expects the margins for ISGEC to remain subdued if the RM inflation continues to rise. The Philippines project had also gotten delayed due to COVID in the country and the management expects the projects to be completed in the next 10-12 months. It remains to be seen how long the inflated commodity price scenario continues and whether the company will be able to bring back margins to normal levels soon. Nonetheless, given the company’s strong track record, strong tailwinds of the industry, and sustained demand from its customer segments ISGEC remains a pivotal heavy engineering stock to watch out for.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 1173 | 1051 | 11.6% | 814 | 44.1% | 1968 | 1818 | 8.3% |

| PBT | 31 | 78 | -60.3% | 19 | 63.2% | 50 | 117 | -57.3% |

| PAT | 27 | 60 | -55.0% | 14 | 92.9% | 41 | 89 | -53.9% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 1379 | 1352 | 2.0% | 1134 | 21.6% | 2513 | 2426 | 3.6% |

| PBT | 14 | 107 | -86.9% | 18 | -22.2% | 32 | 164 | -80.5% |

| PAT | 10 | 78 | -87.2% | 14 | -28.6% | 24 | 120 | -80.0% |

Detailed Results:

- The company witnessed tepid revenue growth of 2% YoY in consolidated terms in Q2.

- The profits for the company were down for Q2 with a decline of 87% YoY in consolidated terms.

- The drop in profits was attributed to commodity price increases and time and cost

overruns in projects. - The company also states that delayed lifting of certain orders by customers as

they could not arrange shipping led to loss of revenue and profit in the quarter. - Total debt to equity was at 0.5 times while interest coverage ratio was at 2.4 times.

- Asset turnover ratio was at 3.3 times in H1 while inventory turnover was at 4.9 times.

- 60% of the order book is from the private sector while 40% is from govt & PSU projects.

- 88% of order book is from domestic orders while the rest 12% is from export orders.

- the order book breakup according to industry is:

- Power: 28%

- Sugar: 10%

- Railways: 8%

- Refineries: 20%

- Chemicals: 7%

- Metals: 14%

- Others: 13%

- The total order book is at Rs 7518 Cr.

- The company bagged 4 new orders in Q2 and the Saraswati Sugar distillery is complete and commercial production is expected to start from Nov 2021.

Investor Conference Call Highlights:

- Orders booked in Q2 were at Rs 849 Cr vs Rs 1396 Cr last year.

- The H1 orders booked were at Rs 3215 Cr vs Rs 1922 Cr last year.

- The Philippine project was owned by a private equity company that decided to cash out and close their fund and this project before completion raised all the issues regarding the project. The company has now decided not to participate in any private equity-owned projects after this experience.

- One of the things the company has implemented as a result of experiences in the EPC space is to do a quicker implementation of projects and do more engineering upfront so that ordering can be done very fast after the project is awarded. It also monitors the projects closely and stays clear on certain clauses that customer delays will cause delays and ISGEC needs to be compensated by the customer for any delays on their part.

- The company is now taking orders on the current high commodity prices only and the management doesn’t expect any such shocks to recur in the near future.

- The management states that the company got lesser orders in Q2 as it had already booked a lot of orders in Q1 and wanted to maintain enough executing capability.

- The company expects to start construction in the Philippines project by Dec and to complete it within the next 10-12 months.

- The Hitachi Zosen unit has seen a decline in performance due to delays in shipping out of orders for 3 major customers which prevented the company from booking those revenues in Q2.

- ISGEC Hitachi Zosen and Eagle have both also faced challenges due to the slowdown in the auto industry.

- The company’s market share in the sugar distillery space in India is around 15%.

- The company is now staying cautious by keeping higher contingency in its contracts for RM price increases.

- Margins are expected to remain subdued in Q3 as well according to the management.

- Auto sector orders are lagging but power, steel, cement, railways, and metals are all growing for the company.

- The company is indeed receiving re inquiries for air pollution control equipment, and it is expected to be finalized soon.

- The management expects Eagle to have some losses in FY22, but the rest of the JVs and subsidiaries should do fine.

- The management expects the order book to increase by Rs 1000 Cr at least by the end of FY22.

- The company is looking to bag new export orders from Q4 when travel restrictions go away.

- Close to 1/4th of the revenues in EPC are for boilers.

- In boiler orders, the company only manufactures pressure vessels which are 15% of the boiler value and the rest is outsourced.

- The working capital of ISGEC is stretched due to a large portion of govt orders.

- Yearly revenue from the ethanol plant is expected to be at Rs 200 Cr.

Analyst’s View:

ISGEC is a large heavy engineering company that is involved in diverse and multiple industry sectors like power, refineries, and others. The company saw a big decline in performance in Q2 due to rising commodity costs and the unavailability of skilled manpower. It also saw a delay in the shipping of major orders which led to the postponement of revenue recognition of those orders. The management expects the margins for ISGEC to remain subdued if the RM inflation continues to rise. The Philippines project had also gotten delayed due to COVID in the country and the management expects the projects to be completed in the next 10-12 months. It remains to be seen how long the inflated commodity price scenario continues and whether the company will be able to bring back margins to normal levels soon. Nonetheless, given the company’s strong track record, strong tailwinds of the industry, and sustained demand from its customer segments ISGEC remains a pivotal heavy engineering stock to watch out for.

Disclaimer

This is not investment advice. Please read our terms and conditions.