About the Company

Hester Biosciences Limited (HBL) is a publicly-traded Indian company headquartered in Ahmedabad, Gujarat. Hester is an animal and poultry vaccine manufacturing company with plants situated in Gujarat and Nepal. The company is India’s second-largest poultry vaccine manufacturer currently with a 30% market share of the poultry vaccine market in the country.

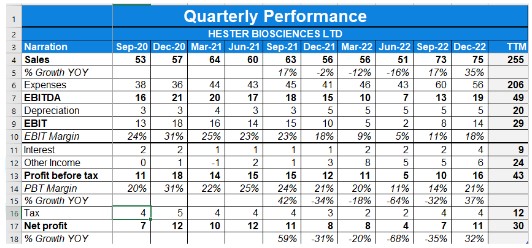

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a decent quarter with a 19% YoY rise in consolidated revenues while PAT degrew by 37% YoY at a consolidated level.

- EBITDA grew by 13% on a consolidated basis.

- The standalone EBITDA margin was at 18% in the current quarter vs 20% a year ago.

- GPM reduced from 68% to 67% YoY on a standalone basis.

- The standalone revenue growth in Q4 for the various segments is:

- Poultry Healthcare: down 8% YoY

- Animal Healthcare: Up 100% YoY

Investor Conference Call Highlights

- The dependence on the Poultry segment has reduced from 80% to 60% YoY.

- The animal healthcare division saw an upward trend from Q4 with the LSD outbreak in cattle where the Government of India allows the usage of the goat pox vaccine to prevent the LSD in cattle. It has also acquired a technology for the LSD vaccine from the Indian Veterinary Research Institute Government of India & it expects the vaccine to be ready by FY2024.

- The poultry healthcare division has been impacted with a degrowth of 8% in Q4, as the poultry industry continues to be under stress with the egg prices & meat prices being lower than the production cost which makes it very difficult for the farmers to invest into resources for rare birds and flocks.

- The pet care division saw the launch of around 10 products in 15 territories in the past 3 quarters & the management targets the launch of 2 new specialized products in the coming quarter.

- The company won a tender order for the supply of PPR vaccines of 40 Crs to Govt. of India.

- The company has started marketing campaigns for LSD vaccines.

- The company’s antigen capacity expansion will be completed in Q1FY24, double the company’s poultry capacity.

- Hester Nepal did a turnover of Rs.12 Crores.

- The company has begun the sales within Tanzania and has started the registration processes in other African countries with its joint venture called Thrishool Exim.

- The company expects the sales in Hester Africa to start coming in a meaningful manner after 6-9 months once it receives the registrations.

- The revenue potential of the African plant is $25 Mn which is very high compared to current turnover as the vaccine plants are required to be large by their nature.However, it will take 4-5 years to reach that turnover as per the management.

- The revenue potential of the Nepal plant is 50 Crs.

- Company’s current cost of debt stands at 8%.

- The company’s total revenue potential stands at 600 Crs.

- The company’s poultry biz growth is expected to remain lower Vs animal healthcare in the long run due to the lower base.

Analyst’s View

Hester Bio had a mixed quarter with a 19% rise in sales and a 37% fall in PAT due to rise in animal healthcare sales. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. FAO tenders have started coming up with the company receiving a decent order of 40Crs from the Indian Govt. While the management is confident of receiving more orders in the coming year & poultry cycle also rebounding from the current lows. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues coupled with poor demand for poultry vaccines and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

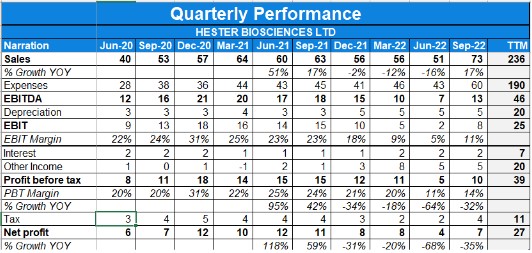

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a decent quarter with a 35% YoY rise in consolidated revenues and a 46% YoY rise in PAT at a consolidated level.

- The EBITDA margin was at 26% in the current quarter vs 28% a year ago.

- GPM reduced from 74% to 71% YoY.

- The standalone revenue growth in Q3 for the various segments is:

- Poultry Healthcare: down 22% YoY

- Animal Healthcare: Up 202% YoY

- Vaccine sales rose by 24% YoY.

- Sales of health products grew by 36% YoY.

Investor Conference Call Details:

- The company has supplied the Goat Pox Vaccine for the immunization of cattle in each and every state in the country.

- The poultry industry continues to remain under a recessionary condition where the input costs are still above the revenues they achieved by selling the meat and the eggs.

- The company had to write off expired poultry vaccine stock worth INR1.6 crores, which pulled down the gross margins.

- The government of India has embarked on a national immunization program for sheep and goats against PPR & Hester has won the tender.

- The commencement of the supplies of PPR was delayed because of governmental reasons. Nonetheless, the supply of vaccines has started from January 2023 & total value of the tender stands at 40 Crs.

- The company has acquired the technology of Avian influenza and are in the process of commercializing this technology.

- The company is in the process of acquiring the technology for the Lumpy Skin Disease vaccine.

- The company is also working on developing a better version of the Brucella vaccine.

- Expansion plans for fill-finish have been delayed from Q3FY23 to Q1FY24 which will double poultry vaccine capacity while the bulk antigen manufacturing facility has already commenced.

- The company invested 100 Crs in the BSL-III plant to produce a drug substance for Covaxin, however, that opportunity seems to have perished now & the company will give more information about the capacity’s utilization in the coming 3 months period.

- The management states that on the animal side, the vaccine biz is dependent on Govt. tenders while the healthcare products division is not.

- The company is taking efforts to promote its vaccines in the trade as well thereby reducing dependence on tenders.

- The management expects the poultry industry to turn around soon.

- The management, when asked about higher egg prices boosting the poultry vaccine demand said “whenever you supply lesser quantity at a higher price it does not mean that there is a boom in the industry.”

- The optimum capacity for the Tanzanian plant stands at 20 million while current sales are 1 million.

Analyst Views:

Hester Bio had a mixed quarter with a 35% rise in sales and a 46% rise in PAT due to rise in animal healthcare sales. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. FAO tenders have yet to come in a major way with FAO looking for funding for the tenders. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues coupled with poor demand for poultry vaccines and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a mediocre quarter with a 17% YoY rise in consolidated revenues and a 12% YoY drop in PAT at a consolidated level.

- The EBITDA margin was at 22% in the current quarter vs 30% a year ago.

- The standalone revenue growth in Q1 for the various segments is:

- Poultry Healthcare: down 14% YoY

- Animal Healthcare: Up 140% YoY

- Vaccine sales rose by 24% YoY.

- Sales of health products grew by 36% YoY.

Investor Conference Call Details:

- The management states that the poultry industry is going through a down period for the last two years due to higher costs of feed & lower prices of meat & eggs in the market because of which the poultry healthcare division reported negative growth for Q2 & H1FY23.

- The company is the main supplier of lumpy skin disease vaccine & has supplied 80-85% of the goat pox vaccine used to immunize cattle against lumpy skin disease.

- The company’s margins have decreased due to higher sales of health products which have lower margins coupled with high promotion expenses.

- The management is hopeful of the possible inclusion of Lumpy skin disease in the government’s national immunization program where a vaccine will need to be administered every year.

- The company’s PPR vaccine production has been delayed due to the utilization of capacity for catering to the demand for the goat pox vaccine.

- The company’s two divisions in the petcare segment are Therapeutics and Specialty Nutrition with the former being more active in the first half of the year & latter in the second half.

- The company was currently targeting metro cities for its healthcare division but it will start to penetrate Tier-II cities in the coming period.

- The company will look at biologicals for the pet division eventually.

- The company’s capacity expansion for bulk antigen & fillers to double the capacity will be completed by Q4.

- The company’s exports were lower to countries like Egypt & Nigeria due to high restrictions on international remittances in their country.

- The management has pitched for acquiring the technology for making lumpy skin disease vaccine to the Govt. coupled with registering the vaccine in Hester Africa to meet the increased demand in the future.

- The management believes that the company will be able to supply pet care products with similar qualities as its global peers at a cheaper rate to the customers.

- The company will be looking at creating a state-of-the-art animal testing facility in the coming financial year.

- The management states that registration for health products requires less time than vaccines.

- The management reiterates that even if FAO commits to 10% of its original plans, the company’s capacity will fall short to meet the demands.

Analyst Views:

Hester Bio had a mixed quarter with a 16% rise in sales and a 12% fall in PAT due to weak industry demand from poultry vaccine which was compensated by a rise in animal healthcare sales which is of a lower margin profile leading to falling in EBIDTA margins. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. FAO tenders have yet to come back to pre-pandemic levels but the management believes that it is slowly recovering. Hester is also looking to add capacity to its India operations which are expected to bring in incremental revenue of Rs 80-120 Cr. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues coupled with poor demand for poultry vaccines and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q1FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a poor quarter with a 16% YoY drop in consolidated revenues and a 68% YoY drop in PAT at a consolidated level.

- The EBITDA margin was at 18% in the current quarter vs 31% a year ago.

- The standalone revenue growth in Q1 for the various segments is:

- Poultry Healthcare: down 22% YoY

- Animal Healthcare: Up 13% YoY

- Vaccine sales fell by 30% YoY due to a higher base in the previous year due to a major disease outbreak coupled with adverse conditions in the form of high feed costs in the current quarter.

- Sales of health products grew by 42% YoY.

- Hester Nepal has seen a growth of 16% in Q1.

- The Company is strengthening its new product vaccine pipeline by developing new vaccines like

Classical Swine Fever (CSF), Sheep Pox, and an improved version of Brucella vaccines.

Investor Conference Call Details:

- The management states that a 30% fall in vaccine lead to a substantial fall in profitability as vaccines are more profitable than animal healthcare products.

- The higher base of the previous year also contributed to degrowth in the current numbers coupled with degrowth in the poultry industry.

- The margins have compressed due increase in total remunerations coupled with higher travel costs & inability to pass input costs hike.

- The management states that since The government of India has now allowed manufacturing and sale of the H9N2 avian influenza vaccine, it will lead to reduced demand for the Newcastle vaccine while the company will develop this new vaccine.

- The company expects to commercialize its CAPEX on bulk antigen division by Q3 while its plans for fill finish have been delayed to Q4 due to delay in import equipment.

- The company currently has 11 products in the market for the pet division & expects it to break even in the current FY itself.

- The management states that vaccine manufacturers always have a larger size of capacity Vs the production due to the humongous costs of increasing capacity, so the company will be happy even if it clocks 20% utilization levels in the Tanzania plant in FY23.

- The company expects strong growth in lumpy skin disease vaccines due to an outbreak of the disease.

- The company is currently working on improving its Brucella vaccine by acquiring technology from the govt. Of India.

- The management is hopeful of achieving break-even for the Africa unit in Q2FY24.

Analyst Views:

Hester Bio had a weak quarter with a 16% fall in sales and a 60% fall in PAT due to weak industry demand. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. FAO tenders have yet to come back to pre-pandemic levels but the management believes that it is slowly recovering. Hester is also looking to add capacity to its India operations which are expected to bring in incremental revenue of Rs 80-120 Cr. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues coupled with poor demand for poultry vaccines and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 51.3 | 63.2 | -18.8% | 55.2 | -7.1% | 224 | 210.1 | 6.6% |

| PBT | 7.2 | 12.5 | -42.4% | 13.7 | -47.4% | 53.2 | 54.7 | -2.7% |

| PAT | 4.9 | 8.8 | -44.3% | 10.5 | -53.3% | 39.5 | 39.9 | -1.0% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 63.6 | 66.6 | -4.5% | 58.4 | 8.9% | 248.7 | 219 | 13.6% |

| PBT | 11.3 | 13.8 | -18.1% | 11.6 | -2.6% | 53.5 | 50.1 | 6.8% |

| PAT | 9 | 10 | -10.0% | 8.3 | 8.4% | 39.4 | 34.6 | 13.9% |

Detailed Results:

- The company had a poor quarter with a 4% YoY drop in consolidated revenues and a 10% YoY drop in PAT at a consolidated level.

- FY22 performance saw with 13% YoY rise in revenues and 13% rise in PAT.

- The EBITDA margin was at 20% in the current quarter vs 30% a year ago. ROE has fallen to 13% Vs 17% a year ago.

- The standalone revenue growth in Q4 for the various segments is:

- Poultry Healthcare: down 16% YoY

- Animal Healthcare: Up 17% YoY

- Vaccine sales fell by 20% YoY due to higher base in the previous year due to a major disease outbreak coupled with adverse conditions in the form of high feed costs in the current quarter.

- The Q4 FY21 also had a one-time contribution from license fees leading to higher base in the previous year.

- Hester Nepal has seen a growth of 193% in FY22 sales and a net profit of Rs.22.86 million in FY22 as against a loss of Rs. 9.73 million in FY21

- Hester Africa received the regulatory approvals for the manufacturing of PPR and CBPP vaccines.

- During Q4FY22, the company acquired 50% equity stake in Threshold Exim Limited, Tanzania, a distribution company of vaccines and animal health products in Tanzania.

- The company is expected to launch the modified Inactivated Coryza vaccine in this year.

- The company will launch 3 products in the pet care division in this month (These three products are mainly for joint disorders, gut health and preventing pets from bacterial infections) & 6 more products are in the pipeline which will be launched during FY23.

Investor Conference Call Details:

- The management states that it achieved these revenues without any price hikes.

- The management states that the poultry industry is going through a tough situation since Egg & meat prices are lower than the production cost and therefore it is unviable for poultry farmers to spend their resources on vaccinating the poultry.

- The company’s health product saw margins decline due to prices remaining unchanged despite high input inflation.

- The management believes that due to its human vaccine facility being multipurpose, it would be able to utilise the same plant even if the demand for covid vaccines goes down.

- The company expects to generate revenues between Rs.9-15 Cr from its PPR tender contract from the Indian Govt. in FY23.

- The management states that the company currently has 70-75% market share in PPR vaccine sales worldwide although volumes are very low, even if the volumes increase by 2-3 times Vs the FAO expectation of 15-20 times, the company’s capacity would be fully utilised.

- The management states that although the healthcare segment has lower margins, due to the possibility of higher growth & higher asset turnover, it expects to generate healthy returns on investment once the biz scales up.

- The company incurred a capex of Rs.70 Cr on the covid facility & Rs.50 Cr on the fill finish unit & bulk antigen facility in FY22.

- The company is targeting a topline of Rs.3-4 Cr in FY23 from the pet-care division.

- The company’s GP fell by only 1% YoY despite higher contribution from health products (which generally have lower margins) due to the product mix.

Analyst Views:

Hester Bio had a weak quarter with a 4% fall in sales and a 23% fall in PAT due to weak industry demand. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. FAO tenders have yet to come back to pre-pandemic levels but the management believes that it is slowly recovering. Hester is also looking to add capacity to its India operations which are expected to bring in incremental revenue of Rs 80-120 Cr. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | ||

| Sales | 55 | 53 | 3.8% | 58 | -5.2% | 173 | 147 | 17.7% | |

| PBT | 14 | 18 | -22.2% | 16 | -12.5% | 46 | 42 | 9.5% | |

| PAT | 11 | 13 | -15.4% | 12 | -8.3% | 35 | 31 | 12.9% | |

| Consolidated Financials (In Crs) | |||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | ||

| Sales | 58 | 58 | 0.0% | 64 | -9.4% | 185 | 152 | 21.7% | |

| PBT | 12 | 18 | -33.3% | 15 | -20.0% | 42 | 36 | 16.7% | |

| PAT | 8 | 13 | -38.5% | 11 | -27.3% | 30 | 25 | 20.0% | |

Detailed Results:

- The company had a bad quarter with flat consolidated revenues and a 38% YoY fall in PAT at a consolidated level due to the high base in Q3FY21.

- 9M performance was good with 22% YoY rise in revenues and 20% rise in PAT.

- The EBITDA margin was down 10.77% YoY to 28.21% in the current quarter. ROE has fallen 4.15% to 16.03% in Q3FY22.

- The standalone revenue growth in Q3 for the various segments is:

- Poultry Healthcare: Up 5% YoY

- Animal Healthcare: Up 25% YoY

- License Fees: Down 100% YoY

- The vaccine segment was flat YoY while health products grew 42% YoY in Q3.

- Hester Africa has started production of PPR and CBPP vaccines.

- Texas Lifesciences saw steady growth while Hester Nepal saw a turnaround with the execution of export orders. The company expects to see higher FAO volumes in Q4.

- The company expects to start production of Classical Swine Fever, Lumpy Skin Disease and Sheep Pox by Q1FY23.

- The company is also looking to launch modified Inactivated Coryza Vaccine by the end of Q4.

- The company was awarded the national PPR tender for 200 million doses in two years.

- The company is looking to commercialize the pet division by the end of Q4.

- The construction of the BSL-3 facility for the Drug Substance for Covaxin is expected to be completed in Q4.

Investor Conference Call Details:

- The company won the PPR tender with a consideration amounting to Rs.20-25 Cr.

- The company’s capex for increasing the capacity of antigen & finished vaccines are likely to be commercialized by Q4 and it will increase the capacity by 100%.

- The company’s African subsidiary has received licenses for starting manufacturing & inspection has also been done. They will start producing and selling 3 types of vaccines namely – PPR Vaccine – Nigerian, Newcastle Disease Vaccine for the poultry, and the CBPP- Contagious Bovine Pleuropneumonia Vaccine.

- World Animal Health Organization has put the tender to create a vaccine bank for PPR vaccine & Hester is one of the two companies to have won the tender. Furthermore, the business is expected to start from the current quarter.

- The company acquired a 50% stake in another trading entity in Africa wherein they want to transfer all the trading activity namely – Thrishool Exim.

- The pet division products launch will primarily be pharmaceuticals & the entire product range is expected to be launched by end of Q4.

- The construction work for human covid vaccines going on where there has been a little bit of delay of dependence on important consumables as well as imported equipment. Trial production is expected to start by April-May with 20 Lac doses initially & it will be scaled up to the peak capacity will be 70 lakh doses of the drug substance.

- The focus of Hester Tanzania will be to create demand & sell to private markets instead of depending on the tender business of Govt.

- Most of the revenue from the covaxin human vaccine deal is likely to be realized in FY23. The management will then focus on using the new facility primarily for other human vaccines as once it is used for animal vaccines, it cannot be used again for human vaccines.

- Hester has bought technology from Indian Veterinary Research Institute and other national and international organizations for vaccines including Classic swine fever, LSD, Brucella, and others.

- The breakeven for Africa business is expected to be at 20-25% of capacity utilization.

- Margins from the covaxin agreement will be lesser than animal vaccines produced by the company.

- The gross margins of vaccines are more than that of health products. Therefore, the company saw a margin decline as the share of health products rose in Q3.

- The company will be procuring the pet products currently and it will not be producing these products now.

- Investment for the covaxin project is Rs.60-70 Cr & the expected payback period is 4-6 years.

- The management believes setting up an adequate marketing structure in Africa will be an uphill task as most of the products will be new to the continent.

- The main competition for Hester Africa will be from a few private labs in Morocco and South Africa but the products being made by Hester are not made by any of them and are not being supplied from anyone from the EU as well.

- In the case of Nepal, the sales have been Rs. 7 Cr and loss of Rs.80 lakhs in the 9 months. In the case of Texas Lifesciences, Rs.20 Cr is the overall sales with Rs. 1 Cr as profit and in the case of Tanzania the sales have been Rs 2 Cr and the loss in that entity was at Rs 11 lakh.

- The institutional business contributes 4-5% of the total revenues of Hester India.

- The company has 200-250 salespeople in the field currently.

- The management states that the margins from the Hester Africa unit are expected to be more than Hester India.

Analyst Views:

Hester Bio had a flat quarter with flat sales on a YoY basis due to higher base and negligible licensing revenues coupled with higher SG&A expenses and rising health product mix leading to lower margins. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. FAO tenders have yet to come back to the pre-pandemic level, but the management believes that it is slowly recovering. Hester is also looking to add capacity to its India operations which are expected to bring in incremental revenue of Rs 80-120 Cr. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 58 | 54 | 7.4% | 60 | -3.3% | 117 | 93 | 25.8% |

| PBT | 16 | 14 | 14.3% | 17 | -5.9% | 32 | 24 | 33.3% |

| PAT | 12 | 10 | 20.0% | 12 | 0.0% | 24 | 18 | 33.3% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 64 | 54 | 18.5% | 63 | 1.6% | 127 | 94 | 35.1% |

| PBT | 15 | 11 | 36.4% | 15 | 0.0% | 31 | 19 | 63.2% |

| PAT | 11 | 7 | 57.1% | 11 | 0.0% | 22 | 12 | 83.3% |

Detailed Results:

- The company had a good quarter with a 18.5% YoY rise in consolidated revenues and an 57% YoY rise in PAT at a consolidated level due to the low base in Q2FY21.

- H1 performance was very good with 35% YoY rise in revenues and 83% rise in PAT due to the low base in H1FY21.

- The EBITDA margin was at 30.28% in the current quarter vs 32.59% a year ago. ROE has fallen to 18.62% in Q2FY22 from 18.81% a year ago.

- The standalone revenue growth in Q2 for the various segments is:

- Poultry Healthcare: Up 20% YoY

- Animal Healthcare: Up 8% YoY

- Poultry healthcare remains the biggest contributor at 73% contribution to revenues.

- The export sales have declined marginally in Q2 due to restricted cargo movements.

- The vaccines segment grew 13% YoY while health products grew 31% YoY in Q2.

- The development of Classical Swine Fever Vaccine, Lumpy Skin Disease Vaccine and Sheep Pox Vaccine is going as per the timeline and the commercial production is expected by the end of Q1FY23.

- Capacity expansion for the production line for animal vaccines is expected to be completed by Q3FY23.

- The company is also looking to introduce a Pet Health Division.

- Hester Nepal saw revenues at Rs 569 Lacs in Q2 from Rs 55 Lacs last year. FAO tender is expected to come through in Q3 FY 22.

- The Texas Lifesciences unit also saw good revenue growth of 81% YoY in Q2 to Rs 6.89 Cr.

- Hester Tanzania had a bad quarter with sales at Rs 20 lacs in Q2 vs Rs 86 Lacs a year ago.

- Release of first commercial vaccine manufactured by Hester Africa is expected to happen in November 2021.

- The company has added 2 new directors to its Board who are Priya Gandhi and Ameet Desai.

Investor Conference Call Details:

- Hester had no license fees and services in this quarter. Poultry healthcare grew by 20% and animal healthcare grew by 8% in this quarter.

- Domestic sales have grown 21% QoQ.

- The management wants to focus on health products because in the health products company is present at a smaller level.

- Hester faced challenges on the export side because the international issues were not fully resolved, and sales were mainly in the African continent.

- Though exports were not as per forecasts, the management expects to recover business there because of the investments made into the Hester Africa plant.

- In the core business, Hester has been working towards developing Swine fever, lumpy skin disease, and the sheep pox vaccines. Hester is the only company now to have acquired the technology in India for lumpy skin and sheep pox, giving it a 100% market share for the products.

- Two expansions programs that the company is doing is to manufacture bulk antigen and another facility for the fill/finish facility. Both expansion plans complement each other according to the management.

- After the completion of these facilities, it would lead to a doubling of capacity. Antigen plant to be ready by 4th quarter of this FY and fill/finish by 3rd quarter of next FY. These capacities would cater to both Indian and international markets.

- The company is looking to introduce a pet health care division that would help them complete the animal healthcare portfolio.

- Besides the current PPR vaccine in Africa, the management is targeting to launch 3 more vaccines by Dec in the Tanzania plant.

- The management expects 4 to 5 years for 100% capacity utilization for Hester Africa which would result in around INR 250 Cr of revenues.

- The management expects Hester India to touch INR 500 Cr revenues in 3 to 4 years.

- In Africa, the management plans to sell 70% on the private market and 30% on the tender market.

- In addition to poultry recombinant vaccines, Hester is also working on a Brucella virus which will be ready by next year according to the management.

- All capex plans for Africa completed the Rs 50 Cr capex plan for India is planned to be funded through debt.

- In pet healthcare, the company is looking to launch therapeutic products and dermatologic products for pets initially. In the long run, the company would be launching rabies vaccines and other such products in pet healthcare.

- Hester has no plans to enter the American or European markets currently. The management is focused on stabilizing current markets.

- The revenue potential of the new Rs 50 Cr India capex plan is expected to be at Rs 80-120 Cr.

- The management is looking to address the gaps in the pet healthcare market which are being temporarily being addressed by using human drugs.

- The penetration in the poultry space is good for Hester while the animal vaccine space is still very underpenetrated. It has also partnered with a Scottish NGO called GALVMEDto supply vaccines to small holder farmers. The company is also looking at other ways to penetrate the rural market in India.

- The management has no current plans for QIP currently, but it has stated that if the company gets an opportunity for inorganic expansion, the QIP method would be used to raise funds for it.

- The management is looking to maintain a 60:40 debt to equity ratio.

Analyst Views:

Hester Bio had a good quarter with an 18% rise in sales and a 57% rise in PAT. The company is making good inroads in the animal health products space and the poultry business remains resilient. It is also looking to expand into the pet healthcare space. Hester Africa is also expected to start production and sales of vaccines in Q3 In addition to the current PPR vaccine made there, Hester is planning to add 3 new vaccines to the line-up in Africa. FAO tenders have yet to come back to pre-pandemic levels but the management believes that it is slowly recovering. Hester is also looking to add capacity to its India operations which are expected to bring in incremental revenue of Rs 80-120 Cr. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q1FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 60 | 39 | 53.85% | 63 | -4.76% |

| PBT | 17 | 10.0 | 70.00% | 13* | 30.77% |

| PAT | 12 | 8.0 | 50.00% | 9 | 33.33% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 63 | 41 | 53.66% | 67 | -5.97% |

| PBT | 15 | 8 | 87.50% | 14** | 7.14% |

| PAT | 11 | 5 | 120.00% | 10 | 10.00% |

*Contains an exceptional item of loss of Rs 5.3 Cr

**Contains an exceptional item of loss of Rs 3.3 Cr

Detailed Results:

- The company had a good quarter with a 54% YoY rise in consolidated revenues and an 120% YoY rise in PAT at a consolidated level due to the low base in Q1FY21. It also saw rise of 10% QoQ in PAT despite a 6% QoQ fall in revenues.

- The EBITDA margin was at 31.02% in the current quarter vs 34.25% a year ago. ROE has risen to 19.59% in Q1FY22 from 12.39% a year ago.

- The standalone revenue growth in Q1 for the various segments is:

- Poultry Healthcare: Up 61% YoY

- Animal Healthcare: Up 16% YoY

- Poultry healthcare remains the biggest contributor at 81% contribution to revenues.

- The export sales have declined by 8% in Q1 due to restricted cargo movements.

- The vaccines segment grew 41% YoY while health products grew 94% YoY in Q1.

- Hester entered into a licensing agreement with Bharat Biotech to make the drug substance for Covaxin on June 28th.

- The development of Classical Swine Fever Vaccine, Lumpy Skin Disease Vaccine and Sheep Pox Vaccine is going as per the timeline and the commercial production is expected by the end of Q3FY22.

- Hester Nepal saw revenues at Rs 40 Lacs in Q1 from Rs 16 Lacs last year. FAO tendering is yet to recover.

- The Texas Lifesciences unit also saw good revenue growth of 113% YoY in Q1 to Rs 4.95 Cr.

- Hester Tanzania had a good quarter with sales at Rs 1.45 Cr in Q1 vs Rs 69 Lacs a year ago.

- Commercial production at the Africa plant is expected to start from Q3.

Investor Conference Call Details:

- Certain poultry diseases in India helped increase the demand for vaccines in the domestic market.

- The company expects to see the BSL-3 plant making the drug substance for Covaxin to start in Q4.

- Hester has been one of the 2 companies shortlisted for a global PPR vaccine tender floated by OIE.

- The management expects to see good momentum coming from Hester Africa in H2.

- The management states that the global opportunity in the health products space is much bigger than the vaccines space and it is looking to expand aggressively in the health products space as it is very small for the company currently at almost 1/3rd the size of the vaccine business of Hester.

- The management reiterates that the Tanzania plant can bring in revenues of $25-30 million at full capacity and it needs $4-5 million sales to break even.

- The company is looking into expansion plans as the vaccine capacity utilization is nearing 100%.

- The company’s current capacity is at 6 billion doses for animal vaccines. It is looking to increase the capacity to 8-9 billion doses.

- The gross debt for the company is at Rs 95 Cr and gross cash is at Rs 21 Cr.

- Although the animal market in Africa is dominated by large animals, the management is optimistic about the poultry vaccine opportunity there due to the severe under-penetration in the vaccine market and the rise of the commercial poultry sector in Africa.

- Although vaccines have a higher gross margin than animal health products, at the EBITDA level, the health products segment is higher than vaccines.

- The major challenge in Africa according to the management is making and sustaining the demand in the continent as it is underdeveloped and the market there is in a nascent stage. The challenge in India is the expansion in the health products segment.

- According to the management, the market-making risk in Africa is somewhat mitigated by the high price of the vaccines there which sell at 3-10 times the price in India.

- Freight cost becomes a deciding factor when vaccines are sold at low prices in developed countries where the rise in freight cost increases vaccine cost by almost 2-3 times. This is not an issue in Africa as prices there are already 3-10 times normal global prices and thus the % increase due to freight costs is not that high here according to the management.

- The management has also stated that the demand level in exports remains intact but Hester India is primarily looking to address domestic demand before going for exports and thus if domestic demand rises too much it can affect exports from Hester India.

- The company is in the process of registering Hester Nepal for poultry vaccines as well so that export demand can be met entirely by Hester Africa and Hester Nepal so that Hester India is free to cater to the domestic demand.

- The management maintains its earlier guidance of reaching 20-30% growth in FY22 excluding the opportunity from Bharat Biotech.

- The management maintains that gross margins are dependent on the product mix and the falling gross margins in the last few years is not a cause for concern as EBITDA margins are not falling.

- The company is looking to introduce a full range of animal health products like antibiotics, growth promoters, disinfectants, sanitizers, etc.

Analyst Views:

Hester Bio had a good start to FY22 with a 61% rise in domestic sales. Despite the fall in gross margins, it saw a good rise in EBITDA margin. The company has made good inroads in the animal health products space and the poultry business remains resilient. The company has finalized its licensing agreement with Bharat Biotech and its new BSL-3 plant for making the drug substance for COVAXIN will be operational by Q4. Hester Africa is also expected to start production in Q3. FAO tenders have yet to come back to pre-pandemic levels but the management believes that it is slowly recovering. Hester is also looking to add capacity to its India operations which are running at near full capacity. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues and what challenges will the company face in ramping up production in Hester Africa once the plant is operational. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 63 | 42 | 50.00% | 53 | 18.87% | 210 | 172 | 22.09% |

| PBT | 13* | 7 | 85.71% | 18 | -27.78% | 55* | 41 | 34.1% |

| PAT | 9 | 5 | 80.00% | 13 | -30.77% | 40 | 31 | 29.03% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 67 | 48 | 39.58% | 58 | 15.52% | 219 | 190 | 15.26% |

| PBT | 14** | 6 | 133% | 18 | -22.22% | 50** | 41 | 22% |

| PAT | 10 | 5 | 100% | 13 | -23.08% | 35 | 31 | 12.90% |

*Contains an exceptional item of Rs 5.3 Cr

**Contains an exceptional item of Rs 3.3 Cr

Detailed Results

- The company had a great quarter with a 40% YoY rise in consolidated revenues and an 100% YoY rise in PAT at a consolidated level.

- FY21 figures were encouraging with a revenue gain of 15% YoY and a profit rise of 13% YoY.

- The EBITDA margin was at 32.62% in the current quarter vs 24.78% a year ago. ROE has risen to 14.92% in Q4FY21 from 9.85% a year ago.

- The standalone revenue growth in Q4 & FY21 for the various segments is:

- Poultry Healthcare: Up 57% YoY (FY21 up 25% YoY)

- Animal Healthcare: Up 17% YoY (FY21 up 19% YoY)

- Other: Up 83% YoY (FY21 up 14% YoY)

- Poultry healthcare remains the biggest contributor at 75% contribution to revenues.

- Domestic sales have registered a growth of 55% in Q4FY21 and 29% in FY21 and the export sales have grown by 4% in Q4FY21 and declined 4% in FY21.

- The Board of directors has recommended a dividend of INR 10.00 per equity share for FY21.

- Registration process continues for the Classical Swine Fewer vaccine, Lumpy skin disease vaccine and Sheep Pox vaccine.

- On 27 May 2021, an MOU was signed between Bharat biotech and Gujarat Covid Vaccine Consortium (GCVC) of which Hester is a part. The MOU was towards contract manufacturing of the Drug Substance for Covaxin, where Hester shall provide the complete infrastructure at its Gujarat plant for the manufacturing of the Drug Substance. Hester has invested Rs 40 Cr towards this initiative.

- Hester Nepal saw a dramatic fall in revenues. Revenues were at Rs 42 Lacs in Q4FY21 from Rs 11.6 Cr last year due to FAO tendering for PPR being extremely low.

- The Texas Lifesciences unit also saw good revenue growth of 91% YoY in Q4 to Rs 6.69 Cr.

- Hester Tanzania had a good quarter with sales at Rs 81 Lacs in Q3 vs Rs 61 Lacs a year ago. Commercial production in the Tanzania facility is expected to start from Sep 2021.

Investor Conference Call Highlights

- Hester has added a new CFO Mr. Nikhil Jhanwar recently.

- The company should have a 100% share of the tenders of sheep pox and lumpy skin diseases as it is the only manufacturer for these two in India.

- The company is looking to launch 3-4 new animal vaccines in the next year.

- Sales are divided into 70% from vaccines and 30% from health products.

- The pace of the vaccine development with IIT Guwahati has been slower than expected and they have yet to complete the master seed required for the next steps.

- According to the management, the growth of the Hester health product business and Texas Lifesciences business is directly proportional.

- The registration for CSF, LSD and sheep pox vaccine will be done first in India and then expanded to other countries.

- The company should be able to sell all three in Africa where it already sells goat pox vaccines.

- Hester is looking to increase the sales team by 40% to 50% within India in FY22.

- The management is confident of sales in Tanzania going up 3-4x in FY22.

- The animal healthcare division saw EBIT losses at the consolidated level due to poor sales in Nepal. The management believes that this is a one-off and should get resolved as Nepal sales come back to normal.

- There is not any significant capex planned for FY22.

- The management is expecting most of the business in Africa to be on the private side as the prevalent rates there are good. It also believes that the ramp-up in Africa will be faster than expected due to the latent demand there.

- The management has stated that it is preferable to make a greenfield investment for Hester than an outright acquisition. But in terms of acquisition or collaboration targets, it will prefer to investigate distribution companies in Africa.

- The management assures that although it expects the top line to rise by 25-30% in FY22, it will be looking to minimize any negative impact on margins from the shift in product mix.

- The company’s bid for the Brucella tender was the 2nd lowest and it has decided to not compete this year and go for it next year. It had already manufactured some vaccines in anticipation which have already been sold in international markets at much higher prices which have helped mitigate any impact from this tender loss.

- The management is confident that by making some changes, the Nepal plant can also be made ready to manufacture human vaccines.

- The new facility made for Bharat Biotech can also be used in the future by Hester to handle many more viruses or bacteria. The capacity for this plant is expected to be at 50 lakhs to 1.5 crore doses a month.

- The management expects the poultry business to grow 10-15% while the animal health business is expected to grow almost 50%. The management also expects to maintain current margins in the worst case.

Analyst’s View

Hester Bio has had a tough time in H1 this year with the COVID-19 outbreak and delays in the animal vaccine tenders. The company had a good Q4 with profits doubling YoY despite the absence of the domestic animal vaccine tender business & FAO tenders from Nepal. The company has made good inroads in the animal health products space and the poultry business remains resilient. The company has also entered an MoU with Bharat Biotech to make its drug substance which should yield 50 lacs to 1.5 Cr doses per month from August onwards. It is also looking forward to the start of production in Hester Africa in Sep. It remains to be seen how long the slowdown in animal vaccine tenders in India & from FAO continues and how long it will take for the company’s novel vaccine in partnership with IIT Guwahati to be completed. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 53 | 49 | 8.16% | 54 | -1.85% | 147 | 131 | 12.21% |

| PBT | 18 | 11 | 63.64% | 14 | 28.57% | 42 | 35 | 20.00% |

| PAT | 13 | 8 | 62.50% | 4 | 225.00% | 11 | 9 | 22.22% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 58 | 51 | 13.73% | 54 | 7.41% | 152 | 141 | 7.80% |

| PBT | 18 | 15 | 20% | 11 | 63.64% | 36 | 35 | 2.86% |

| PAT | 13 | 12 | 8% | 7 | 85.71% | 25 | 26 | -3.85% |

Detailed Results

- The company had a decent quarter with an almost 14% YoY rise in consolidated revenues and an 8% YoY rise in PAT at a consolidated level.

- 9M figures were encouraging with a revenue gain of 7.8% YoY and a profit fall of 3.85% YoY.

- The EBITDA margin was at 38.97% in the current quarter vs 29.97% a year ago. ROE has risen to 23.24% in Q3FY21 from 15.6% a year ago.

- The revenue growth in Q3 for the various segments is:

- Poultry Healthcare: Up 32% YoY

- Animal Healthcare: Up 4% YoY

- Other: Down 15% YoY

- Poultry healthcare remains the biggest contributor at 75% contribution to revenues.

- Domestic sales have registered a growth of 43% in Q3FY21 and 20% in 9MFY21 and the export sales have reduced by 51% in Q3FY21 and 5% in 9MFY21.

- Overall vaccine sales grew 20% YoY in Q3 and 12% YoY in 9M. Health product sales grew 48% YoY in Q3 and 31% YoY in H1.

- The National Animal Disease Control Program of the Government of India is expected to be implemented for the Brucella vaccine by March 2021.

- There has been no material impact on sales from the outbreak of bird flu in India.

- Hester is set to launch a new range of Herbal Health products this quarter.

- The company will be focussing on domestic demand for vaccines and exports will be for animal products mostly.

- The management will be looking to raise Rs 200 Cr to finance future expansion.

- Hester Nepal saw a comeback in revenues. Revenues grew to Rs 3.6 Cr in Q3FY21 from Rs 0.87 Cr last year. FAO orders for PR have resumed.

- The Texas Lifesciences unit also saw good revenue growth of 55% YoY in Q3 to Rs 5.17 Cr.

- Hester Tanzania had a good quarter with almost 100% YoY growth in Q3. Commercial production in the Tanzania facility is expected to start from June 2021.

Investor Conference Call Highlights

- The modest growth in animal health business in Q3 was due to the absence of tender business for animal vaccines.

- The income from technology transfer to Novapharma in Egypt is reflected in other income. This project is expected to be over in 1.5-2 years.

- Consolidated debt is now at Rs 114 Cr.

- The company is not yet committed as to how to raise the Rs 200 Cr funds for expansion. It is expected to be a mix of debt and equity.

- WC has seen good improvement YoY.

- The company has decided to concentrate on the domestic vaccine demand mainly as the margins for both domestic and export sales of vaccines are roughly the same for Hester. The management is confident of regaining lost export business once capacity expands to be able to address additional demand.

- Pending capex in Texas is around Rs 5 Cr and is 10% of the allocated amount.

- There haven’t been any overruns in any of the company’s capex projects so far.

- The company’s efforts in sales and marketing in FY20 have yielded results and thus the company is seeing unprecedented demand from the domestic sector which has forced the management to decide to concentrate on supplying vaccines only for domestic sales in the short term.

- The plan ahead for Africa is to look to set up or acquire animal health product making facility as the asset turnover ratio in animal health business is much higher than vaccines.

- The company will be looking to expand marketing in export destinations from Q1FY22 and creating a distribution network in Africa.

- The company does want to enter into the pet vaccine market but it is looking for an international partner for international marketing for this sector. Also, it has not entered this segment in India as it is very small here compared to the domestic animal vaccine market. This situation is the reverse of USA where the pet market is much bigger than the domestic animals market.

- The management expects massive consolidation to take place in the cattle farming segment in India in the future and other animal rearing sectors which should bring in demand for vaccines as the organized sector expands. A similar evolution is expected to take place in Africa at a slower pace as the organized sector is even smaller there as compared to India.

- The management has stated that it expects margins to stay at current levels or higher in the medium term and revenues to rise to Rs 400-500 Cr in the next 5 years.

- Around 75% of revenues come from vaccines while the rest is from animal health business.

- Vaccine capacity utilization is above 80%.

Analyst’s View

Hester Bio has had a tough time this year with the COVID-19 outbreak and delays in the animal vaccine tenders. The company had a good Q3 with minimal impact from bird flu and despite the absence of the domestic animal vaccine tender business. The company has made good inroads in the animal health products space. The management has identified domestic demand as the primary focus for vaccine sales in the near future till they can expand capacity while animal health products will continue to be exported. It is also looking forward to the start of production in Hester Africa in the next 6 months. It remains to be seen how long the slowdown in animal vaccine tenders in India continues and how long it will take for the company to establish itself in the new space of animal health products that it has entered. Nonetheless, given its excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 54 | 42 | 28.57% | 39 | 38.46% | 93 | 86 | 8.14% |

| PBT | 14 | 9 | 55.56% | 10 | 40.00% | 24 | 24 | 0.00% |

| PAT | 10 | 9 | 11.11% | 8 | 25.00% | 18 | 19 | -5.26% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 54 | 45 | 20.00% | 41 | 31.71% | 94 | 90 | 4.44% |

| PBT | 11 | 7 | 57.14% | 8 | 37.50% | 19 | 20 | -5.00% |

| PAT | 7 | 6 | 16.67% | 5 | 40.00% | 12 | 14 | -14.29% |

Detailed Results

- The company had a good quarter with an almost 20% YoY rise in consolidated revenues and a 17% YoY rise in PAT at a consolidated level.

- H1 figures were encouraging with a revenue gain of 4% YoY and profit fall of 14% YoY.

- The EBITDA margin was at 32.59% in the current quarter vs 28.38% a year ago. ROE has risen to 18.81% in Q2FY21 from 18.26% a year ago.

- The revenue growth in Q2 for the various segments is:

- Poultry Healthcare: Up 28% YoY

- Animal Healthcare: Up 41% YoY

- Other: Up 16% YoY

- Poultry healthcare still remains the biggest contributor at 64% contribution to revenues.

- The rise in demand was mainly attributed to the demand for milk and eggs going up, which directly positively impacted sales.

- Overall vaccine sales grew 26% YoY in Q2 and 8% YoY in H1. Health product sales grew 51% YoY in Q2 and 22% YoY in H1.

- Domestic sales grew 30% YoY in Q2 and 8% YoY in H1. Export sales grew 36% YoY in Q2 and 25% YoY in H1.

- The National Animal Disease Control Program of the Government of India is expected to be implemented for the Brucella vaccine by January 2021 (which was supposed to have been started from Feb 2020). Hester is one of the two suppliers for this vaccine. This delay has led to a delay in sales for the Brucella vaccine.

- The company is looking to launch the vaccine in the next 6 months for Lumpy Skin Disease (LSD) in cattle which is an emerging disease in India. Hester is the only company in India that has an LSD vaccine under development. As there is no treatment for the disease, prevention by vaccination is the only effective means to control the disease.

- Animal trials for Hester’s COVID-19 vaccine are expected to begin in December 2020.

- Hester Nepal saw a dramatic fall in revenues due to lockdown in Nepal and FAO not tendered for vaccines in Q2 & H1. Revenues shrank to Rs 0.5 Cr in Q2FY21 from Rs 1.5 Cr last year.

- The Texas Lifesciences unit also saw a marginal revenue growth of 12.4% YoY in Q2.

- Hester Tanzania had an average quarter with flat YoY growth in Q2. The company worked mainly towards creating a distribution and marketing network in Tanzania in the quarter.

Investor Conference Call Highlights

- The animal health products are more recession-proof as compared to vaccines and are continuously bought while vaccines can be skipped due to financial constraints.

- The govt is expected to do another tender for the Brucella vaccine order and Hester aims to become the largest supplier to this tender offer.

- There is a lot of opportunity in the LSD vaccine as Hester is the only one developing it and this is an emerging disease that is also endemic in Africa & Middle East thus having export potential as well.

- FAO has started releasing tenders from Q3 onwards which should help bring the Nepal business back to speed.

- The company’s manufacturing project in Africa has been delayed by 60 days due to transport and freight restrictions.

- The total population size to be vaccinated for LSD is around 300 million and Hester expects this to yield Rs 30 Cr of sales annually.

- The company is in the process of registration of products in 15-20 countries in Africa.

- In the past, the company has been able to account for 80% of Brucella sales and 70-75% of PPR tender order in India.

- The management has stated that ot expects the WC cycle to improve from Q3 onwards.

- Out of the total gross borrowings of Rs 120+ Cr, $10 million or Rs 70-75 Cr is from Bill & Melinda Gates Foundation.

- Since March ’20, the company has capitalized nearly Rs 100 Cr of assets. All of this has been for the Tanzania plant.

- Africa remains a fragmented market for the company and thus Hester is concentrating on setting up distribution channels and make sure that they are optimally utilized.

- The company is looking to only maintain its role in the development of human vaccines and the COVID-19 vaccine and it will look to outsource the manufacturing of these human vaccines when they get developed. This is because the company will need to do additional capex to set up manufacturing facilities for human vaccines as it does not have spare capacity. The company will indeed explore the option to start making human vaccines in-house in the future.

- But if required, the company can convert its Nepal facility to make human vaccines but that will be at the expense of the capacity of the PPR vaccine currently operating there.

- The management has stated that there isn’t any chance for Brucella and LSD to be eradicated soon. To date only 2 animal diseases have been eradicated using vaccine and PPR is expected to be the third one. But even this was tabled to take at least 15 years by world bodies 3 years ago.

- The Brucella vaccine is a one-time lifetime vaccine and the demand for it is directly proportional to the number of calves born every year.

- Africa is not dependent on tenders for any of its business and if any tenders come its way then it will be a bonus for the company.

- The management has stated that the company will indeed prioritize capex for Brucella and LSD over FMD. One big reason for this is that FMD is 100% tender business while the others are blended with trade markets as well.

- The project with Novapharma is still under construction at the moment.

- The herbal animal products market opportunity is huge since the world is increasingly moving towards antibiotic-free animal food products. It has already been done in the west where many animal antibiotics have been banned and it will soon come to India as well.

- The profitability of these products is expected to match that of vaccines.

- Currently, Brucella and PPR account for 80% of the animal health business.

- The peak revenue potential of Hester Tanzania is around Rs 200-230 Cr while the same for Hester Nepal is Rs 50-60 Cr. The breakeven level for Hester Nepal is Rs 15 Cr.

- The top-selling products in the Animal health products division are ProtinC and ReproPlus which are used for improving milk production and reproduction respectively.

- The Texas facility is doing 90% of production for Hester and 10% for external contract manufacturing.

Analyst’s View

Hester Bio has had a tough time this year with the recession in the poultry industry and delays in the animal vaccine tenders. But Q2 has seen good performance which has also helped the company see some marginal growth in sales in H1. The company has made good inroads in the vaccine space and is also looking to capitalize on a new vaccine opportunity for LSD. The management has done well to clearly identify the growth path ahead with the focus to expand into the health products which has greater potential and lower development complexity in contrast to vaccines. It is also looking to capitalize on its resident vaccine development expertise to establish itself in human vaccines. It remains to be seen how long the slowdown in animal vaccine tenders in both India and abroad continue and how long it will take for the company to establish itself in the new space of animal health products that it has entered. Nonetheless, given their excellent technical expertise and the future potential of its international operations, and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q1FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 39 | 44 | -11.36% | 42 | -7.14% |

| PBT | 10 | 15 | -33.33% | 7 | 42.86% |

| PAT | 8 | 10 | -20.00% | 5 | 60.00% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 40 | 45 | -11.11% | 48 | -16.67% |

| PBT | 8 | 13 | -38.46% | 6 | 33.33% |

| PAT | 5 | 8 | -37.50% | 5 | 0.00% |

Detailed Results

-

- The company had a dismal quarter with 11% decline in consolidated revenues and a 38% fall in PBT at a consolidated level.

- PAT fell 37% YoY.

- The company made an equity investment into Texas Lifesciences of Rs 82.5 Lacs in Q1.

- The EBITDA margin was at 34.25% in the current quarter vs 39.84% a year ago. ROE has reduced to 14.48% in Q1FY21 from 20.23% a year ago.

- The revenue growth in Q1 for the various segments is:

- Poultry Healthcare: Down 11% YoY

- Animal Healthcare: Up 6% YoY

- Other: Down 11% YoY

- The poultry healthcare still remains the biggest contributor at 77% contribution to revenues.

- Gross margins were impacted due to the changed product mix. Low-value necessary products and vaccines were sold more rather than high-value products.

- The company is looking to put more focus on health products as they have a bigger market than vaccines.

- The National Animal Disease Control Program of the Government of India is expected to be implemented for the Brucella vaccine in the next few months (which was supposed to have been started from Feb 2020). Hester is one of the two suppliers for this vaccine.

- Hester Nepal saw a dramatic fall in revenues due to lockdown in Nepal and FAO not tendered for PPR vaccines in Q1.

- Texas has raised INR 15 million through a rights issue to acquire assets for increasing its production capacity.

- The Texas Lifesciences unit also saw flat YoY revenue growth.

- Hester Tanzania had a good quarter with sales of Rs 69.3 Lacs vs Rs 31.6 lacs a year ago. Profits for the unit rose to Rs 37.8 lacs vs Rs 2.5 lacs a year ago.

Investor Conference Call Highlights

- The company has reduced expenses mainly on travel.

- The company is looking to start an animal trial for the COVID-19 vaccine in November or December.

- Tenders for FAO orders in Nepal have started coming in.

- The company has a diagnostics lab in Anand for sample taking for the health of flocks and cattle and it is looking to set up another such lab in Tanzania in the near future.

- The company doesn’t have any plans to enter into the companion animal space as it is still very small in India as compared to the West and the USA.

- The company is looking to get into FMD space but has not had any concrete plans to do so yet.

- The gross debt in India is at Rs 39 Cr as of Q1FY21.

- Receivables have remained roughly the same as in Q4.

- The company expects the level of Rs 125 Cr of poultry product sales to be the bottom and sales are expected to get much better than this in the future.

- Exports form 11% of sales in Q1. This is expected to rise going forward.

- The product selection in health products is expected to have minimal impact on margins as per the management.

- The company expects to make up for the loss of sale from international orders for Brucella in the rest of the year.

- The central tender to supply Brucella and PPR vaccines is fully secured.

- There have no salary cuts for the company but it has managed to reduce travel and administrative costs as part of cost-cutting measures.

- The opportunity for health products is immense for the company as per the management. Each big company in this space has at least 2-3 times sales in health products as in vaccines while the case in opposite for Hester with vaccine sales at 2-3 times health products sales. This is also the case for domestic players like Virbac, Zoetis, and Zydus.

- The main reason for the big rise in Tanzania profits is the increase in product prices and profitability in Africa as compared to India.

- The full sales capacity for Brucella for Hester currently is around Rs 40 Cr per year.

- The company has no issues from the uncertainty of tenders from FAO as the demand for PPR remains stable and the countries that need are directly placing orders rather than wait to get the vaccine through tenders.

- The world requirement for FAO is around $500 million per year for vaccines and the company is targeting around 10% of that figure.

- The company supplies to almost 80% of PPR state tenders and 70% of Brucella tenders in India.

- Brucella is a onetime only vaccine while PPR and Newcastle vaccines need to be repeated multiple times for each animal.

Analyst’s View

Hester Bio has had a tough time this year with the recession in the poultry industry and delays in the animal vaccine tenders. The growth of Nepal has stalled due to the lockdown and the absence of FAO tenders. On the other hand, Tanzania has seen good profits due to the rise in prices in the continent. The management has done well to clearly identify the growth path ahead with the focus to expand into the health products division which is still very small for the company. It remains to be seen how long the slowdown in the domestic poultry market continues and whether the industry will bounce back as soon as the company expects. Nonetheless, given their excellent technical expertise and the future potential of its international operations and its upcoming foray into animal health products, Hester Biosciences remains a good small-cap stock to watch out for.

Q4FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 41.7 | 50.3 | -17.10% | 44.8 | -6.92% | 172.3 | 174.3 | -1.15% |

| PBT | 6.5 | 16.0 | -59.38% | 10.6 | -38.68% | 41.2 | 59.8 | -31.10% |

| PAT | 5.0 | 12.4 | -59.68% | 7.7 | -35.06% | 31.2 | 43.8 | -28.77% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 48.4 | 55.5 | -12.79% | 51.0 | -5.10% | 189.6 | 185.3 | 2.32% |

| PBT | 6.2 | 17.7 | -64.97% | 14.9 | -58.39% | 41.3 | 56.9 | -27.42% |

| PAT | 4.8 | 14.1 | -65.96% | 11.9 | -59.66% | 31.0 | 40.7 | -23.83% |

Detailed Results

-

- The company had a dismal quarter with 13% decline in consolidated revenues and a 65% fall in PBT at a consolidated level.

- PAT fell 66% YoY.

- The EBITDA margin was down 13.86% YoY to 24.79% in the current quarter while the net profit margin fell 13.27% YoY to 12.08%. Roe has reduced to 9.85% in Q4FY20 from 27.59% a year ago.

- The revenue growth in Q4 for the various segments is:

- Poultry Healthcare: Down 15% YoY

- Animal Healthcare: Up 4% YoY

- Other: Down 39% YoY

- The poultry healthcare still remains the biggest contributor at 73% contribution to revenues.

- The poultry health division declined 5% YoY for FY20. The division was directly impacted due to the poultry industry which remained in a recessionary condition throughout the year.

- In Animal Healthcare, the trade business grew 6% YoY in FY20 but purchases by various state governments got delayed which resulted in lower revenues than expected.

- Exports grew by 63% in FY20.

- The company has set up a Manufacturing Science & Technology Division to focus on implementing innovation and best practices and solutions for vaccine manufacturing. One of the objectives of this division is to work on the improvisation of production yields and performances of the vaccines in the field.

- The National Animal Disease Control Program of the Government of India is expected to be implemented for the Brucella vaccine (which was supposed to have been started from Feb 2020). Hester is one of the two suppliers for this vaccine.

- Hester Nepal saw phenomenal YoY revenue growth of 88% for Q4. FY20 revenues for this unit rose 109% YoY.

- Profit from Hester Nepal for Q4 grew 113% YoY bringing the total profit for the year to Rs 3.93 Cr which is the first year of profit for Hester Nepal.

- The Texas Lifesciences unit also saw a YoY revenue growth of 57.6% in Q4 and 53.3% in FY20.

- Hester Tanzania had a good quarter with sales of Rs 69.5 Lacs. Total Sales for the unit in FY20 was Rs 2.78 Cr vs Rs 23.4 Lacs in FY19.

- The company has announced a dividend of Rs 6.6 per share.

Investor Conference Call Highlights

- The management stated that the poor performance in Q4 was mainly due to the crash in the poultry industry which was hit hard by the rumours of COVID-19 transmission through livestock.

- The tenders for animal health vaccines were again delayed but the company has indeed received an allocation for Brucella. These orders for Brucella vaccines are expected to come in the next few months.

- The company managed to hold on to its market share of 35% in the poultry vaccine market.

- The company expects exports to double in FY21 as all disruptions in shipping and logistics due to COVID-19 get resolved.

- The company has started the registration process into Tanzania, Uganda, Kenya and other neighbouring countries through a common registration. The company expects this to be done in the next year.

- The company has made a big shipment to Hester Tanzania of the PPR vaccine and expects sales to commence in the next 60 days.

- The management has stated that the company will be able to come out with a COVID-19 vaccine by the end of 2021 at the earliest.

- Although the home consumption of poultry has taken a minor blip, the major damage to the overall demand for poultry has come from the catering industry which accounts for roughly 505 of overall demand.

- The management expects feed manufacturers to recover in 4-5 months’ time.

- The management has reassured that despite the spike in inventory, there isn’t any danger of losses from expired inventory at hand.

- The company is seeing good potential in the poultry segment for West and East India and on the livestock segment in North and South India.

- PPR procurement remains at the hands of individual states while Brucella and FMD procurement has shifted to the centre.

- In Hester Nepal, 90% of sales are from exports while the remaining 10% is from domestic sales.

- The company will not expand its sales team currently and will focus on consolidating the expanded team and bring in operational efficiency before looking to add on to it.

- The management has admitted that even with the size of large integrators like Godrej and Venky’s increasing through integrating small farmers, the market for the company is still the same as long as the volume of poultry on the ground does not go down.

- The management has stated that the core competency required to make human vaccines is not too different from animal vaccines and Hester is already using the Paramyxovirus virus, which is ordinarily used for poultry vaccines, as a platform to develop its COVID-19 vaccine.

- The company will be proceeding cautiously in expanding the team in Africa. It will set up distributors who at a later date will be integrated back into the company directly. This is how it went ahead in Tanzania and now the exclusive distributor for the country is part of the company.

- The company is not expecting much debtor defaults in India and bad debt so far has been limited to 0.6%.

- In R&D, the company is currently developing diagnostic kits for poultry. It is also looking to develop a thermotolerant PPR vaccine as well a nasal mechanism for delivery of PPR vaccine. In poultry, the company is looking to combine a Newcastle and a Gumboro vaccine into a 2in1 shot.

- In Hester Africa, the company is looking to develop 16 types of different vaccines which are for Africa only.

- The company already has a few products which it has not registered yet in Africa since the markets are too small for these products. Once the markets expand, the company can register and start selling these as well.

- In Poultry, the company has a full range of vaccines and is mainly working on improving production efficiency and other operational details.

- The management expects the Brucella tender to be almost Rs 100 Cr per year and PPR to be Rs 12-15 Cr per year.

- The management has stated that the company can easily double the capacity in Hester Nepal with any new land acquisition and with only an investment of Rs 5 Cr into plant and machinery. Overall the company has enough plot to increase capacity up to 4-5 times.

- The market size for FMD in India is expected to be Rs 1000 Cr. There 3 main competitors in this space which are Indian Immunologicals, Brilliant and Biovet.

- The management expects exports to overtake domestic sales in at least 2-3 years.

- In FY20, the sales from Brucella tender were around Rs 4-5 Cr while sales from PPR tender were less than Rs 10 Cr.

Analyst’s View

Hester Biosciences has been a darling of small-cap picks in the recent past. The company has had a tough time this year with the recession in the poultry industry and delays in the animal vaccine tenders. The growth of their international units has been very good and has helped shore up most of the shortfall in the domestic market. The management has done well to clearly identify the growth path ahead for the different vaccine divisions for the company and for foraying into the human vaccine with a potential COVID-19 vaccine in collaboration with IIT Guwahati. It remains to be seen how long the slowdown in the domestic poultry market continues and whether the industry will bounce back as soon as the company expects. Nonetheless, given their excellent technical expertise and the future potential of its international operations and its foray into human vaccines, Hester Biosciences remains a good small-cap stock to watch out for.

Q3 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 44.85 | 42.11 | 6.51% | 42.02 | 6.73% | 130.62 | 123.97 | 5.36% |

| PBT | 10.61 | 16.47 | -35.58% | 9.46 | 12.16% | 34.72 | 43.71 | -20.57% |

| PAT | 7.73 | 11.86 | -34.82% | 8.69 | -11.05% | 26.22 | 31.47 | -16.68% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 50.99 | 45.99 | 10.87% | 44.89 | 13.59% | 141.22 | 129.77 | 8.82% |

| PBT | 14.95 | 16.69 | -10.43% | 7.11 | 110.27% | 35.08 | 39.14 | -10.37% |

| PAT | 11.95 | 12.43 | -3.86% | 6.2 | 92.74% | 26.24 | 26.62 | -1.43% |

Detailed Results

-

- The company had a modest quarter with 11% growth in consolidated revenues and a 10% fall in PBT at a consolidated level.

- PAT fell 4% YoY mainly on account of the new reduced tax regime.

- The EBITDA margin was down 14.29% YoY to 29.93% in the current quarter while the net profit margin fell 10.76% YoY to 17.78%.

- The main reason for the fall in margins in Q3 is the change in product mix. The management had taken the decision to derive sales from fast-moving products rather than high margin products. The product mix has already started rolling back to a more profitable level and this should be evident in the next quarter.

- The revenue growth for the various segments is:

- Poultry Healthcare: Up 6.25% YoY

- Animal Healthcare: Up 17.5% YoY

- Other: Down 21.9% YoY

- The poultry healthcare still remains the biggest contributor at 69% contribution to revenues.

- In 9MFY20, the poultry healthcare industry was adversely affected due to the high cost of feed from the spike in maize prices. The industry has come out of this crisis and a major boost in sales is expected in the near future.

- In Animal Healthcare, the trade business grew 29% YoY in the 9M period but purchases by various state governments got delayed which resulted in lower revenues than expected.

- The company has increased its credit cycle which has resulted in increased finance costs. The credit cycle is expected to return to normalized levels by the end of the year.