Gujarat Themis Biosyn Limited (GTBL) was incorporated in 1981 and it is engaged in manufacturing of APIs namely Rifamycin S and Rifamycin O. Rifamycin S is an intermediate for manufacturing drug Rifampicin (Antibiotic used for treatment of several types of bacterial infections, including tuberculosis, Mycobacterium avium complex, leprosy, and Legionnaires’ disease). Rifamycin O is an intermediate for manufacturing drug Rifaximin (Antibiotic used for treatment of traveller’s diarrhoea, irritable bowel syndrome, and hepatic encephalopathy). These are niche products. The company’s manufacturing plant is located in Vapi, district- Valsad, Gujarat the same is CGMP approved.

Q4 FY23 Updates

Detailed Results:

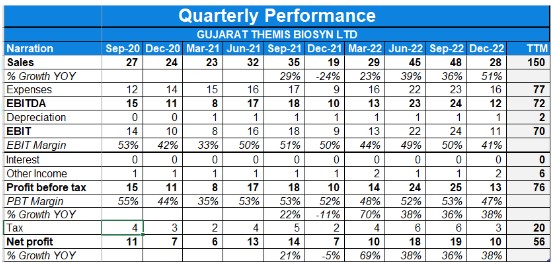

- The company had a poor quarter with revenue decreasing by 2% while PAT increased By 19% on a YoY basis respectively owing to a lower base as well.

- EBITDA margins stood at 52.98% while PAT margins stood at 41.5%.

- The board has recommended a dividend of Rs.5 per share coupled with a proposal of a split of shares in the ratio of 5:1.

Investor Conference Call Highlights

- The revenue growth was subdued for the quarter owing to the slowness in tenders.

- The management states that Rifamycin-O continued to see decent demand in the market, leading to sufficient dispatches of this product. However, Rifa-S offtake remained on the lower side during the quarter since this is largely a tender-driven segment.

- The company continued the production of Rifa-S to build inventory to be ready once the tenders open up entirely.

- The company’s 200 Crs capex plan is progressing well where it has capitalized 16 Crs, CWIP stands at 20 Crs & capital advances for the equipment stand at 10 Crs. The new warehouse, R&D, and API block is expected to be ready by September & The last leg of capex will be the new fermentation facility, which is expected to be ready by the end of the next calendar year.

- Better realization and lower R&D investment of about 3 crores helped to improve the profit margins for the current quarter.

- The management explains that it has a high R&D block in terms of cost as it is investing significantly in its CGMP pilot plant to ensure that they are able to receive approvals which will ensure that it can move forward with developing a full-fledged fermentation unit where Phase 1 itself costs around 80 Crs.

- The management expects the Patent for Rifamycin in the US to expire in FY29 after which, it can start supplying the product in the US & other geographies like certain parts of Europe.

- The management expects Inter-corporate deposits of 17 Crs where it earns decent interest to stay stable while the Other current assets have increased in the long term owing to higher interest rates in the market, & this amount will vary as per the expansion plans of the company.

- The company is running at full capacity as it is using its capacity to increase the inventory in anticipation of future demand.

- The management expects the API block to start giving revenues by the end of FY24.

- The new WHO regulations regarding the preference of 3HP rifapentine-based treatment as compared to the current prevailing Rifampicin -based treatment regime is a major positive development for the business as the company’s Rif-S will be required as an intermediate for the new drug, coupled with the fact that dosage required & the lower conversion ratio of Rifa-S to Rifapentine will ensure higher demand for the intermediate.

- The company has 6 products in the R&D phase & expects this to scale up after September once the R&D unit is capitalized.

- The company hasn’t taken any plant shutdowns in the current FY which it normally did in the past as the management believed that the plant is in good condition.

- The company isn’t seeing any pricing pressures from China & is in fact seeing realizations improve.

Analyst’s View

Gujarat themis biosyn is one the leading player in niche API intermediates like Rifa-O&S. It reported a mixed quarter with no revejue growth owinng to lack of tenders while profits rose owing to lower R&D costs coupled with higher realizations. The company is currently undergoing an ambitious capex of INR 200 crores & is targeting growth of 25%. It remains to be seen how the company will be able to scale its biz, deal with potential Chinese competition & maintain its extraordinary margins in the future. It remains an interesting small cap Pharm stock to keep on one’s watchlist.

Q3 FY23 Updates

Detailed Results:

- The company had a decent quarter with revenue and profits increasing by 51% and 38% on a YoY basis respectively owing to a lower base as well.

- EBITDA margins stood at 43% while PAT margins stood at 34.82%.

- The Board of Directors declared an interim dividend for the financial year 22-’23 of INR4.4 per equity share of the face value of INR 5 subject to shareholders’ approval.

Investor Conference Call Highlights

- The sales volume remained subdued due to the lower offtake of Rifa-S which is a tender-driven biz. Management expects the demand to revive in the coming two quarters & hence continued to build inventory in anticipation of demand.

- The company has done about INR14 crores of capex so far, and another INR13 crores are in CWIP.

- The management expects its API to block & R&D labs will be up & running by June-July.

- R&D expenditure of about INR2.44 crores had a bearing on the profit margins.

- The management states that despite a bit of lumpiness in revenue & margins in its current product, they are still one of the best products to be in owing to the extraordinary margins they generate.

- The company is in process of incurring a capex of INR200 crores, including a CGMP R&D center and also an API facility, increasing its fermentation capacity from 450 cubic meters to another 550 cubic meters & expand its current product basket in terms of APIs.

- The management is extremely cautious in selecting the product line its wishes to pursue since earlier, it was using an old facility with no depreciation charge, but now since it will be using a new facility, it will need a high gross margin product to meet the cost pressure.

- The company doesn’t see raw material prices as a major challenge at the moment.

- The management explains its capex plan by stating that its capex plans are divided into three. One is the R&D. The second is our API block and the third is our fermentation block. The R&D capex and the API block should come through by June-July of this year, Six to nine months after that it should be able to commercialize some products from its API block. And the fermentation block-additional capacity will come through by June-July of the next financial year & so, from then it will start trial batches in the production of the additional fermentation products.

- The management expects the new API block will help in achieving 25% to 30% growth.

- The company’s Rifa-O is not a tender-based product & it goes into the manufacturing of another API, which is used for gut infection.

- The majority of raw materials are sourced locally & it doesn’t have any long-term contracts for sourcing.

- The company believes that due to its product pipeline will consist synthetic API, it will be able to get higher margins Vs other API players.

- The management expects its R&D team to increase significantly once the R&D lab gets set up.

Analyst’s View

Gujarat themis biosyn is one the leading player in niche API intermediates like Rifa-O&S. It reported strong revenue growth of 50% YoY however its volume growth in the Rifa-S segment was lower on account of slow tenders. The company is currently undergoing an ambitious capex of INR 200 crores & is targeting growth of 25%. It remains to be seen how the company will be able to scale its biz, deal with potential Chinese competition & maintain its extraordinary margins in the future. It remains an interesting small cap Pharm stock to keep on one’s watchlist.