Brief Introduction

Gufic Biosciences Limited is engaged in the manufacture of pharmaceuticals, medicinal chemicals, and botanical products. Gufic was in the business of manufacturing and marketing injectable products since the late 1970s. The group had earlier exited its API and formulations manufacturing division by selling its six major brands such as Mox (Amoxycillin) Injection, Zole (Miconazole Nitrate), etc. to Ranbaxy in 1997. The promoters then re-entered the pharmaceutical formulations segment through the incorporation of Gufic Biosciences Limited in 2000. Gufic Biosciences has been manufacturing lyophilized injectables (their main business) for 40+ years.

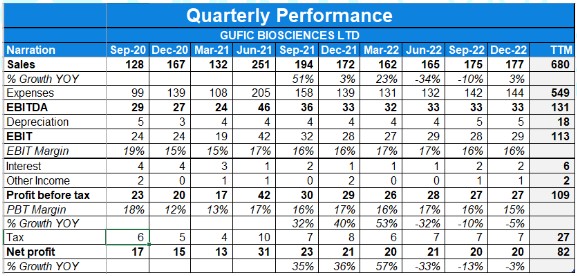

Q4 FY23 results

Financial results & highlights

Detailed Results:

- The company had a poor quarter with revenue and profits increasing by 7% and negative 11% on a YoY basis respectively.

- The PAT margin for the current Q4 is 10.47%, Q4 of last year was 12.49% while the EBITDA margin for the current Q4 is 18.58% Vs 20.14% YoY.

Investor Conference Call Highlights

- In Critical Care Division, the company has completed a detailed door-to-door market mapping for the various molecules that are offered by Sparsh Division. It surveyed almost 8000 hospitals and has commenced supplies of medicines to a few of those hospitals.

- In Critical Care Division, the company received DCGI approvals for Biapenem and dual chamber bag. The launch of Ceftazidime+Avibactam was very successful and received good initial response. In the coming year market presence will increase in this particular product.

- In Critical Care Division, the company plans to launch the novel once a week anti-infective Dalbavancin for the first time in India in H1 of the coming year. Both these molecules will also be offered to a select few CMO partners in the coming year.

- The management states that on the penem front, most of the captive requirement now is being fulfilled by the facility at Navsari which was initially being outsourced.

- The management states that it also plans to launch the oral form of Isavuconazole within the Critical Care division. The injectable form has already been launched. The launch went off very well.

- In the Ferticare division, the launch of Dydrogesterone was successful. To increase presence in this particular market, there is a plan to launch a sustained release form of the same in the coming financial year.

- The company has market leadership position in hMG and hCG and has now launched a more potent form of hMG which reduces the chances of failures of IVF cycle. And innovations like these will help solidify the position as a Top 5 player in the Infertility segment.

- In other divisions, the trials for a new product which is derived from Boswellia Serrata has gone off well. This particular candidate will be used for management of asthma with plans to launch in the coming financial year.

- The company’s brand Sallaki continues to be a market leader in Boswellia Serrata products. The launch of new zinc-based multivitamin has contributed to the massmarket division.

- In the Healthcare, Stellar and Spark division, the company plans to launch a novel analgesic in the coming year, Polmacoxib, a NSAID for relief of signs and symptoms in osteoarthritis.

- The company has successfully completed a split phase trial between Stunnox and Botox. Stunnox continues to increase penetration in the market and Gufic 1 is now the second largest player in the Botulinum Toxin market in India. The process of registration for a range of fillers to complement and augment our basket of products in this category is initiated.

- On the international business front, the ANVISA Brazil Audit was cleared successfully without any observations. The company also received four new registrations.

- The management states that inventory has gone up due to the launch of Sparsh and dual-chamber bags.

- The management states that efforts will be on to get dual chamber bags approved for Meropenem and Piperacillin Tazobactam also. Meropenem, the NPPA clarification has come one on 1st of April. In a month or two that Meropenem clarity is expected to come.

- The management states that working capital has increased as normal payment terms have been stretched to 90 to 120 days in contract manufacturing as well as to export sales.

- The management states that for Ceftazidime + Avibactam the patent went off in Jan end 2023, they have sold some only in the month of Jan all the way to March close to approximately 98000 to 99000 vials combining both contract manufacturing and domestic market also.

Analyst’s View:

Gufic Biosciences is one of the most formidable pharma stocks owing to its presence in niche spaces like Ferticare, Botulinum Toxin range of products, immuno-oncology as well as CMO. The company reported a mediocre quarter with 7% revenue growth and negative PAT growth owing to the higher base of the previous year because of covid related biz. It remains to be seen how the company will scale up its new Indore unit, and deal with increased working capital requirements, inventory destocking & macroeconomic headwinds. However, given its strong historical operating performance & promoter’s experience, it remains an interesting small-cap stock to keep track of.

Q3 FY23 results

Financial results & highlights

Detailed Results:

- The company had a poor quarter with revenue and profits increasing by 3% and negative 3% on a YoY basis respectively.

- The PAT margin for the current Q3 is 11.4%, Q3 of last year was 10.1% while the EBITDA margin for the current Q3 is 19.1% Vs INR19.7% YoY.

Investor Conference Call Highlights

- With regards to new capex in Indore: focused all its energies on ensuring that it is on track with commercializing its Indore facility,

- The company launched Sparsh – a division, where it completed its primary and secondary research on the field which involves reaching out to nearly 5000 hospitals where it maps the potential for around 100 and 150 molecules.

- The company foresees the annual market of its new molecules to be around INR500 to INR600 crores and is targeting a 20% to 25% market share within the next year.

- The company filed Amsterdam has started the process for registering dermal fillers & it received three-product approvals, one each from Colombia, Kenya, and the Philippines.

- The revenues have been lower YoY owing to the higher base of the previous year because of one-time covid led revenues.

- In the new molecules which were launched in December, the company will target 5 states in the initial phase, & is targeting a revenue rate of 100 Crs from FY24-25 onwards.

- The margins have improved from 13% to 19-20% in the past 5 years owing to operational leverage.

- The company’s primary growth levers for 15-20% growth are lower penetration in the international market, followed by organic growth in the domestic market, & Indore facility kicking in which will ensure the total capacity of BofI becomes almost 2.5x.

- The management expects revenue of the dual chamber back should start capturing from Q1 2024 post rationalization of MRP prices.

- The company is eyeing its dydrogesterone tablets brand to become an INR 10 Crs brand within 2 years.

- The Zarbot product is facing a tough time growing, unlike Tanex which has already become 4X YoY.

- The company has passed 5 batches from Alicia to Gynecologists.

- The CMO biz is seeing margin compression primarily due to inventory issues.

- The working capital cycle has elongated priorly due to increased inventory & credit period in the CMO biz coupled with an increased channel in exports leading to higher investments in working capital.

- The management states that the entire unit 1 of the Navsari factory, which is a legacy factory will be converted into infertility products manufacturing site.

- India’s contribution to formulations stands at 75% & is expected to reduce up to 60% due to higher growth of exports.

Analyst’s View

Gufic biosciences is one of the most formidable pharma stocks owing to its presence in niche spaces like Ferticare, Botulinum Toxin range of products, immuno-oncology as well as CMO. The company reported a mediocre quarter owing to the higher base of the previous year because of covid related biz. It remains to be seen how the company will scale up its new Indore unit, and deal with increased working capital requirements, inventory destocking & macroeconomic headwinds. However, given its strong historical operating performance & promoter’s experience, it remains an interesting small-cap stock to keep track of.