Fairchem Organics Ltd. (Fairchem) is engaged in the business of manufacturing of Oleo Chemicals and Nutraceuticals, for the last 25 years. The company’s key oleo chemical products include Dimer Acid, Linoleic Acid, Palmitic Acid, and Monomer Acid, and nutraceutical products include Mixed Tocopherols and Sterol concentrate. Fairchem is one of the only manufacturers of Linoleic Acid and Dimer Acid in India, which are the major part of the overall revenues and have a large addressable market size in India.Its customers include marquee names like Asian Paints, Huber, Arkema, Kensing, ADM, Cargill etc.

Q4FY23 Updates

Financial Highlights & Updates

Detailed Results:

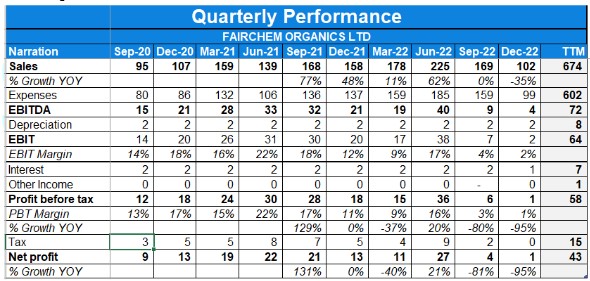

- Q4 FY23 operational revenue: Rs. 152 crores, a growth of 48% over the previous quarter.

- Q4 FY23 EBITDA: Rs. 19 crores, compared to Rs. 4 crores in the previous quarter.

- Q4 FY23 EBITDA margin: 12.64%.

- Q4 FY23 net profit after tax: Rs. 12 crores, compared to Rs. 60 lakhs in the previous quarter.

- Q4 FY23 PAT margin: 7.83%.

- Annual operational revenue for FY23: Rs. 648 crores.

- Annual EBITDA for FY23: Rs. 72 crores.

- Annual EBITDA margin for FY23: 11.17%.

- Annual net profit after tax for FY23: Rs. 44 crores.

- Annual PAT margin for FY23: 6.71%.

Investor Conference Call Highlights

- The company stated that there is revival in demand from the paint industry, especially for linoleic acid and dimer fatty acid and there is a positive feedback from paint companies and expectation of sustained demand in the coming quarters.

- The company installed capacity of 1,20,000 metric tons and expected utilization in the financial year 2025-26.

- Metric tons processed for FY22-23: 67,000 tonnes. Q4 metric tons processed: 17,000 tonnes.

- The company stated that Isostearic acid trial runs have started, with expected shipment to begin in Q2 FY24.

- The company expects sales for FY24 to be around Rs. 750 crores.

- The company stated that their targeted EBITDA margin: 15% plus or minus 1%.

- The company stated that their expected volume for FY24: above 70,000 tonnes.

- Introduction of a new product, isostearic acid, with applications in personal care, cosmetics, and lubricants.

- The company stated that Dimer acid and linoleic acid are the prime products, accounting for over 70% of sales.

- Sales volume for dimer acid is over 8,000 tonnes and for linoleic acid is over 24,000 tonnes for the entire year.

- The oleochemicals segment, excluding dimer acid and linoleic acid, is not significant in terms of sales volume.

- The industry size for the forward-integrated product is much larger than the company’s capacity, which is around 6% of the industry.

- The company stated that trial approvals for the product in the USA, Europe, and Japan are underway.

- Despite past challenges like demand slowdown, raw material volatility, and inventory write-offs, the company expects the next two years to be normal.

- Volatility in raw material prices, especially vegetable oil prices, has been observed in the last two years.

- The creation of capacity and raw material price volatility are not directly related.

- The company aims to achieve additional revenue through the manufacture of isostearic acid and development of another prime product.

- With 100% capacity utilization, the company expects to achieve a turnover of over Rs. 1,000 crores.

- The company is not currently facing significant risks from Chinese players and anticipates gaining market share from them in the future.

- Isostearic acid production is concentrated in Europe and the US, with no major presence in China.

- The competitive landscape for isostearic acid is not dominated by a single company, and the company’s market share is expected to be around 5-6%.

- Demand for the product in the US and Europe is positive, and the company has received a favorable response from buyers.

- The company has not lost any customers and does not foresee significant competitive threats.

- The global market size for the company’s products is estimated to be around 50,000-55,000 tonnes, with a market value of approximately $400 million.

- Initially, the company may need to price its products at a discount to competitors when entering developed markets.

- The realization and sales volume projections indicate potential revenue growth in the future.

Analyst’s View

Fairchem organics is the leading producer of fatty acid derivatives commanding market leadership in India. The company has witnessed a decent quarter with a growth of 48% in revenue when compared to its last quarter. The company has been in business for the last 25 years. It remains to be seen how the company capitalises the revival of demand in the paint industry, how the company deals with the steady rise in inflation and the results of the new capacity in near future. However, given its strong market positioning & past track record coupled with its management pedigree, it remains an interesting small-cap stock to keep track of.

Q3FY23 Updates

Financial Highlights & Updates

Detailed Results:

- The company had a poor quarter with revenue and profits decreasing by 35% and 95% on a YoY basis respectively.

- EBITDA margins dropped to 3.51% Vs 13.5% YoY for the quarter.

- There was a lack of demand mainly from the Paint industry where the fall in volume was more than 35 %. This was the main reason for the fall in quarterly revenue & substantially eroded the margin in absolute terms.

- There was an average fall of about 10 % on per unit realization vis-à vis the previous quarter while the raw material cost continued to fluctuate and tended to remain higher putting additional pressure on the margin.

Investor Conference Call Highlights

- The Sales volume for this quarter in terms of metric tons was around 9,700 tons vis-à-vis around 14,800 tons in the previous quarter.

- 8,700 tons was the raw material process quantity for the October-December quarter and 16,700 was the process quantity for the previous quarter that is July-September.

- The management explains that since it supplies to the decorative paint segment, it reported major volume degrowth Vs paint cos which saw flat volumes due to higher contribution from the automotive paints segment as well.

- Another reason for volume degrowth could be the use of old inventory by paint cos leading to fewer purchases from the company.

- The company expects a better recovery in numbers in Q4 but it is still not getting that visibility from the paint companies for the long term.

- The company is making a new product addition targeting the Epoxy industry to reduce dependence on the Paints industry.

- The company expects its export plans to fructify in Q1 of FY24.

- The company’s sample has been under analysis for the last 1 year for the decorative paints segment of Birlas & JSW paints.

- The combined contribution of its two main Fatty acids in terms of values was close to 70-75% of total revenues while Asian paints contribute 40% of total revenues.

- The management states that the new capacity of dimer acids of Hyderabad-based 3F Manufacturing will replace imports (which contribute 35% of total volumes in India) Vs the company’s share.

- The management when asked about how the Russia-Ukraine war is affecting its biz stated that “Between Ukraine and Russia, they are the world’s largest manufacturers of sunflower oil. So, that is the reason it is affecting, the overall commodity has become a little bit volatile because of that. So, once, we haven’t seen this type of volatility in the last 25 years of our existence.”

- The raw material prices have been very volatile wherein the prices reached 2X pre-covid rate high & have currently hovered around 1.3X pre-covid rates.

- The company’s selling price is decided on a monthly basis.

- The share of Tocopherol is 5% of total sales.

- The company is delaying the Tocopherol project to focus on the new chemicals.

- The company in the past has been continuously delaying the Tocopherol project owing to methanol-related restrictions in Gujarat state coupled with Corona & lack of focus on that biz due to niche market size.

- Dimer is a low volume-high price product Vs Lineolic acid.

- Dimer Acid value for 9 months was Rs. 130 crores and Linoleic Acid value for the 9 months was Rs. 234 crores.

Analyst’s View

Fairchem organics is the leading producer of fatty acid derivatives commanding market leadership in India. The company has been witnessing a horror Fy23 where it has witnessed high double-digit revenue & PAT degrowth. The revenue degrowth is primarily due to the low growth of the decorative paints industry coupled with wild fluctuation in inputs ailing its margins. It remains to be seen how management will recover from the demand side shock coupled with uncertain input prices due to War. However, given its strong market positioning & past track record coupled with its management pedigree, it remains an interesting small-cap stock to keep track of.