About the Company

Craftsman Automation started the journey in the year 1986 as a small scale industry in the southern Indian city of Coimbatore, has grown to become a leader in precision manufacturing in diverse fields.

The co. manufactures several components and sub-assemblies on a supply and job-work basis according to client specifications in the automotive, industrial, and engineering segments. Headquartered in Coimbatore with 12 plants including 10 satellite units across India. The majority of its revenues come from auto ancillary parts.

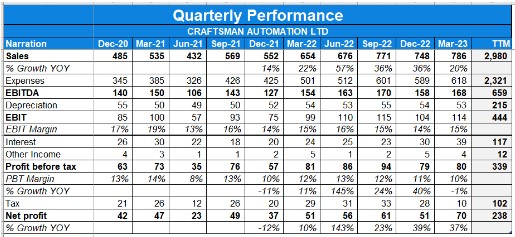

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The Company has clocked a sale of Rs. 2980 crores in FY23 growing by 35% YoY.

- The Profit After Tax (PAT) grew by 48% while EBITDA grew by 25% to 671 Crs.

- The auto powertrain has grown by 32% while EBIT grew by 26%.

- Aluminum segment has grown by 34% while EBIT grew by 26%.

- The industrial engineering segment has grown 42% while EBIT grew by 89%.

- Storage business has reported 49% growth.

Investor Conference Call Highlights

- The company has acquired 76% equity of DR Axion India Private Limited for a cost of INR375 crores And this company is engaged in the manufacture of 1 million parts which primarily consists of cylinder heads and cylinder blocks.

- The company in real value addition terms grew by 27%.

- While EBITDA growth stood at 25%, the EBIT growth stood at 37% owing to only 10 Crs increase in Capex.

- Further, PAT has increased by 48% owing to a shift in different tax regime where tax rates stood at 25% Vs the erstwhile 35%.

- The debt to EBITDA stood at 1.48.

- The ROCE has improved from 20% to 22.5%.

- The powertrain segment did not perform very well owing to higher contribution from exports where margins were lower coupled with muted demand from Construction Machinery and farm sector.

- The management states that the value addition for powertrain was INR241 crores, aluminum stood at INR79 crores, and industry engineering recorded INR73 crores.

- Direct exports contribution to total engineering biz stood at 116 Crs.

- Raw material costs as a % of sales were higher owing to change in product mix.

- The company’s margins in the aluminum segment rose significantly from 4% to 11% owing to the capacity utilization in terms of value addition to the total gross block increasing from 42% at the start of the year to 67% by the end of the year.

- The company has started witnessing newer orders from the 2W-EV producers.

- The company expects 20% valuation growth in each of the three segments in FY24 with revenues growing by around 25% on a standalone level & its acquired entity is expected to grow at 10-15% in the coming year.

- The management explains that the Total industrial solution revenue for FY ’23 has been INR713 crores, & Out of that, the storage solutions have contributed INR376 million.

- The EBITDA margins of DR AXION is expected to be around 15% in FY24.

- The management is confident that the MHCV biz will grow in Q3 & Q4 while Q1 & Q2 will be flat.

- The management expects the debt to come down by 200 Crs on a consolidated basis.

- The company doesn’t believe that potentially banning diesel CV LCV will not be a major risk as people will then migrate towards CNG where its products will still be used.

- The company ended FY23 with value addition as a % of gross block at 92%.

- The company is seeing higher demand owing to the Make in India initiative coupled with the China+1 policy.

- The powertrain segment is expected to grow on account of the addition of customers in the tractor segment, and passenger vehicle segment coupled with sales of higher tonnage off the highway CV & higher exports of vehicles that have higher horsepower.

- The power segment mix in FY23 came as: Commercial vehicle 53%, off-highway 20%, tractor 15%, and passenger vehicles mainly SUV 10%.

- The management states that the company’s real gross block is worth 3,600 Crs, however,25. the balance sheet showcases the same as 2,800 Crs.

- The company believes there is a long runway of 6-10 years of growth with Craftsman owing to the manufacturing sector of India growing by leaps & bounds in the future.

Analyst’s View

Craftsman Automation is a leading maker of engine parts in India. Having vertically integrated production capabilities, Craftsman Automation is a diversified engineering firm operating in three industry sectors: automotive powertrain and other, automotive-aluminum components, and industrial and engineering. The company delivered strong results with revenue in terms of real value addition growing by 27% & profits by 48% YoY. The management expects revenue & profits to grow by 20-25% for the next 3 years. It remains to be seen how the company’s near-term performance will pan out given the steady rise in inflation, tensions in Eurozone and how long will it take for the non-core businesses to grow. Given the company’s strong positioning and its rising segments, Craftsman Automation is a good auto ancillary stock to watch out for.

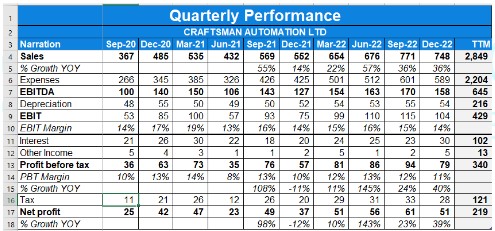

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The Company has clocked a sale of Rs. 2195 crores as compared to Rs. 2206 crores in Full Fy22.

- The Profit After Tax (PAT) for 9M was accounted for at Rs. 167 crores Vs 160 Crs for the full FY22.

- The EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) for 9M of the company was valued at Rs. 499 crores.

- Capex is at INR 249 crores, mainly the maintenance capex and technological improvement.

- The debt-to-equity ratio stood at 0.82, whereas the EBITDA margins have reduced from 24 to 23.

- Coming to PBT, it has been improving constantly and has reached to 12 as compared to previous quarter’s 11. The Profit After Tax (PAT) has also increased from 7% to 8%.

- Return on Capital Employed (ROCE)was 23% as compared to 20% of the last year.

- ROE, on the other hand, has shown an improvement as well to 18% in comparison to last year’s 15%.

- The value addition to its important business segments which are: –

- Powertrain Business- Rs. 249 crores.

- Industry Engineering- Rs. 58.3 crores.

- Aluminum Products- Rs. 61.5 crores.

- For The nine months, the auto powertrain has grown by 39% from INR 817 crores to INR 1,134 crores.

- The aluminum segment has grown from INR 385 crore to INR 544 crore. But on a quarter-to-quarter, there is some decline, in the aluminum segment

- The industrial engineering segment has grown 48% year-on-year from INR 350 crore to INR 517 crore.

- Storage business has achieved a turnover of INR 279 crore, thus reporting 48% growth.

Investor Conference Call Highlights

- The aluminum segment reported margins contraction owing to lower prices & top-line reduction by 20 Crs.

- The utilization of the aluminum segment stood at 60% for 9M due to lower offtake by 2-wheeler OEMs in the festive Q3 who contribute 70% of the total sales of the segment.

- The idea behind the DR Axion acquisition is to get the benefits of its strong presence in PV segment coupled with expertise in EV segment.

- The revenues from storage declined QoQ from 111 crs to 80 crs owing to the held-back of investments by the E-commerce player.

- The acquisition will help in reducing capex costs in the aluminum division through increased capacity on gravity die casting and low pressure die casting, which is the only segment in which DR Axion is there.

- Finance costs rose due to a hike in interest rates by 100-200 Bps, forex loss & new drawn-down loan of around Rs. 300 Crs which has been put in as FD.

- The estimated capex for FY24 will be between INR 325 crores – INR 350 crores.

- The management states that All powertrain business and aluminum business is pass-through although there can be a little delay due to quarterly or monthly contracts or because of the inventory, but on an annual basis, the company doesn’t face any pressure in passing costs.

- The cash conversion cycle stood at 59 days Vs 62 days YoY.

- The management is focused on meeting its IPO time guidance of 20% growth annually.

- The management is not guiding for any scope of margin expansion.

- The management states that D/E is not the right metric to measure the company’s risk profile as that will look very rosy, ideally, the company wants to maintain debt/EBITDA of 1.3X.

- The benefits of new orders of 200 & 150 Crs in aluminium segment will flow in Q2 & H2 of FY24.

- The company owing to its contract in Fy18/19 had to supply an equipment of 30 crs at zero margins in the current quarter leading to less EBIDTA.

- The management is sticking to its guidance of 18% EBIDTA margins in aluminum biz once operation leverage kicks in.

- The management states that After Toyota and Volkswagen, DR Axion is the Number 3 PV manufacturer for the last calendar year & No.2 in North american market for EV after Tesla.

Analyst’s View

Craftsman Automation is a leading maker of engine parts in India. Having vertically integrated production capabilities, Craftsman Automation is a diversified engineering firm operating in three industry sectors: automotive powertrain and other, automotive-aluminum components, and industrial and engineering. The management expects revenue & profits to grow by 20-25% for the next 3 years. It remains to be seen how the company’s near-term performance will pan out given the steady rise in inflation, tensions in Eurozone and how long will it take for the non-core businesses to grow. Given the company’s strong positioning and its rising segments, Craftsman Automation is a good auto ancillary stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 773.01 | 569.72 | 35.68% | 677.14 | 14.16% | 2,216 | 1,559 | 42.14% |

| PBT | 93.88 | 75.86 | 23.75% | 86.12 | 9.01% | 248 | 147 | 68.71% |

| PAT | 60.61 | 49.41 | 22.67% | 55.58 | 9.05% | 160 | 97 | 64.95% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 777.98 | 571.65 | 36.09% | 678.27 | 14.70% | 2,224 | 1,570 | 41.66% |

| PBT | 96.06 | 76.54 | 25.50% | 87.40 | 9.91% | 252 | 149 | 69.13% |

| PAT | 62.48 | 49.96 | 25.06% | 56.64 | 10.31% | 163 | 97 | 68.04% |

Detailed Results:

- The Company has clocked a sale of Rs. 1447 crores as compared to Rs. 1000 crores on H1 of the last year.

- The Profit Before Tax (PBT) was reported at a staggering 180 crores which is 62% higher than the H1 of the last year.

- The Profit After Tax (PAT) was accounted for at Rs. 116 crores which was 61% higher as compared to the H1 of the previous year.

- The EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) of the company was valued at Rs. 337 crores which was approximately 31% higher than the H1 of the previous year.

- The debt-to-equity ratio has slightly improved to 0.58, whereas the EBITDA margins have reduced from 24 to 23. An important note to keep in mind is that the EBIT has gone up to 16 (previously 15.)

- Coming to PBT, it has been improving constantly and has reached to 12 as compared to previous quarter’s 11. The Profit After Tax (PAT) has also increased from 7% to 8%.

- Return on Capital Employed (ROCE) for H1 was 24% as compared to 20% of the last year.

- ROE, on the other hand, has shown an improvement as well to 20% in comparison to last year’s 15%.

- The value addition to its important business segments which are: –

- Powertrain Business- Rs. 232 crores.

- Industry Engineering- Rs. 72 crores.

- Aluminum Products- Rs. 68 crores.

- Auto Powertrain business segment has seen a tremendous growth of sale from Rs. 524 crores to a staggering Rs. 726 crores over H1 of the previous year.

- Growth in the Industry Engineering business has been noticed as well; the sales had increased from Rs.234 crores to Rs. 353 crores.

- The Industry Engineering business segment went up to Rs. 368 crores from the original Rs. 242 crores as compared to H1 of the last year.

- The growth of CAPEX last year was about 40% and even now also, the CAPEX is more or less the same. However, it should also be noted that an additional 70 crores allocated for CAPEX are underway.

- A notable increase in the storage was observed. Storage solutions for H1FY22 was 134 and for this year H1FY23 witnessed 199.

- The current market capitalization of Craftsman Automation is Rs. 6486.52 crores and is currently ranked 14th within the auto and ancillary sector.

Investor Conference Call Highlights

- The company stated (in accordance with the automotive business segment) that there are a lot of parts the company does business in and they including transmission parts, gearbox parts, etc. However, since the commodity prices have increased, the EBITDA figures will be lower and only the top line will increase.

- The management spoke about its financial cost. They are able to borrow money because of our lenders, bankers, and other financial institutions at extremely low costs. The company always conducts a cost-benefit analysis. According to IndAS standards, the lease rentals that the company is paying are classified as depreciation and financial cost according to accounting standards, which is why the financial cost appears to be high. The Chairman of the company said,”70% is the actual financial cost, 30% is related to interest and depreciation” Currently, the long-term and short-term borrowing are approximately Rs. 720 crores.

- The current set of customers and the current set of products are currently doing well. More products would be added later on but, there will be a slight delay/ gestation period to scale up the revenues, and the sales figures; hence, the company would see a good traction in the industry engineering segment.

- The company ship mostly (it’s industry engineering segment products) to North America, Europe, and Japan each year. Customers vary, and the intended use varies. As a contract manufacturer, the company make things in accordance with customer specifications. Moreover, the company produce fully finished devices that are checked here before being shipped overseas It is too diversified because of the end user.

- The management states that the entry barrier is quite high, and in order to perform this type of high-end assembly, the company needs to have the necessary manufacturing infrastructure, a varied technical staff, and design and production capabilities. Therefore, the company don’t have many rivals.

- The company has not been actively adding clients there, but the business has been consistent; it has not been expanding rapidly, as you can see from our overall export revenue. However, the company believes there are some fresh opportunities for customer additions right now, albeit there will be some delay between product creation and real income.

- Since, the prices of electricity are increasing in Tamil Nadu, weighing the alternatives for renewable energy, the company are deciding between third-party and captive sources due to the costs associated with wheeling and other cross-subsidies.

- Therefore, entering into long-term contracts with any of the service providers or third-party power purchase agreements may not be sustainable for the company in the future because one won’t be receiving any carbon credits, which may also become more valuable in the future.

- The company stressed on its industrial engineering exports. The Chairman quoted, “Export per quarter is we are clocking around 40, 50 crores something like this, 40 crores on the industry engineering segment.” Hence, in the future the company may see more export of industrial engineering products and services.

- The company spoke about its revenue mix in the auto powertrain segment of business. Rs. 385 crores were initiated in H1 for commercial vehicles whereas, farm sector vehicles (tractors) amounted to Rs. 125 crores and passenger vehicles amounted to Rs. 66 crores.

- The company spoke about its aluminum products and how the prices of aluminum products went down which resulted in the prices of aluminum products.

- The Company explained how the powertrain segment of the business has faced soaring commodity prices resulting in a depression of EBITDA numbers. Moreover, due to this reason the company would only let the top line go up.

- The run rate of aluminum products clocked to around Rs. 196 crores in revenue for the last quarter. Hence, the company is at a steady run rate of Rs. 800 crores as their revenue from operations.

- Early this year, the company received orders for electric vehicles from new startups. Some of the orders are for parts that are still being developed, while others are already in trial production, but altogether, the financial results are not that appealing.

- The management clarified that the Rs. 190 crores did not take the EV orders into account. Moreover, the company said that they will account for that revenue in the following year but will start with the production and manufacturing from the current quarter.

- The company can see a MAT implication post Q2 of this current financial year, hence, the company thought of writing the MAT credit off of their books or to make a decision to change their tax structure which would take place from the Q4 of the current financial year.

- As of this quarter, the company, in consideration to its financial, is considering to switch into the new tax structure.

- The management stated that they were receiving a lesser selling price in comparison to what we were buying when prices were steadily rising. Therefore, the average of the current quarter or the monthly quarterly or monthly correction; both on pricing and fundamentally where there haven’t been any significant adjustments for a while. The aluminum prices soared up from Rs. 180 a kilo to Rs. 285 a kilo and that too within one year.

- More than 60% of the energy the company uses is consumed in Tamil Nadu, while 40% is used by the rest of India.

Analyst’s View

Craftsman Automation is a leading maker of engine parts in India. Having vertically integrated production capabilities, Craftsman Automation is a diversified engineering firm operating in three industry sectors: automotive powertrain and other, automotive-aluminum components, and industrial and engineering. The management expects revenue & profits to grow by 20-25% for the next 3 years. It remains to be seen how the company’s near-term performance will pan out given the steady rise in inflation, tensions in Eurozone and how long will it take for the non-core businesses to grow. Given the company’s strong positioning and its rising segments, Craftsman Automation is a good auto ancillary stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 660 | 538 | 22.7% | 553 | 19.3% | 2216 | 1559 | 42.1% |

| PBT | 81 | 73 | 11.0% | 57 | 42.1% | 248 | 147 | 68.7% |

| PAT | 51 | 47 | 8.5% | 37 | 37.8% | 160 | 97 | 64.9% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 661 | 540 | 22.4% | 556 | 18.9% | 2224 | 1570 | 41.7% |

| PBT | 81 | 74 | 9.5% | 57 | 42.1% | 252 | 149 | 69.1% |

| PAT | 51 | 47 | 8.5% | 38 | 34.2% | 163 | 97 | 68.0% |

Detailed Results:

- The company had a decent quarter with sales increasing by 22% YoY while PAT increasing by 8%.

- The company saw a rise in EBIDTA of 20% YoY to Rs.539 Cr.

- The Automative powertrain segment saw a growth of 42% YoY in FY22 while EBIT stands at Rs.304 Cr Vs Rs.221 Cr YoY.

- The Auto aluminium segment clocked revenue of Rs.440 Cr Vs Rs.330 Cr YoY but this was mostly due to aluminium commodity price increase while EBIT increased from Rs.3 Cr to Rs.10 Cr.

- The Industrial engineering segment saw revenue increase from Rs.405 Cr to Rs.612 Cr YoY while its EBIT decreased from Rs.75 Cr to Rs.64 Cr.

- ROE increased from 11% to 15% YoY.

- Debt/ Equity improved from 0.72 to 0.63 meanwhile working capital increased due to higher inventory levels lead by availability issues and high commodity prices.

Conference Call Highlights

- The management is confident about delivering 20% growth in all the segments in the coming quarters even after factoring for commodity price hikes.

- The management is bullish about strong recovery in the 2-wheeler segment as volumes in Q1 will almost be 90% of Q4 which is better than the generally expected volumes in Q1.

- The company states that in the auto power train segment, it is immune from any commodity price hike as it does 100% pass through to its customers.

- The company expects to get the benefit from price hikes in its industrial engineering segment in the current quarter due to new arrangements with its long-term clients.

- The management expects to increase the turnover of the storage solutions business by 50% in the coming year with margins also improving from the current levels.

- The management is guiding for a double-digit ROCE & EBIT margins in its auto aluminium biz in the coming years.

- The capacity utilization levels for the auto powertrain & auto aluminium segment for FY22 stood at 60-70% & 57% respectively.

- The management is seeing strong order wins in its aluminium segment & expects to increase the revenues from Rs.446 Cr to Rs.1000 Cr within 3 years timeframe.

- The management expects some part of its revenue from Daimler will get affected due to its decision to stop production of medium duty vehicles coupled with a new deal with Cummins, However it doesn’t see this as a major threat since the majority of the Daimler biz comes from Brazil where the production will continue. Further, its reducing dependence on Daimler on the revenue front will reduce the impact on the company.

- The company can generate annual revenue of Rs.3600 Cr at peak capacity utilization.

- The company is expecting to repay the debt of Rs.100 Cr in FY23.

- The management expects the ROCE of the storage solutions business to reach the level of 20% since although EBIT margins are low, so is the capital intensity of the business.

- The Management believes it will once again reach EBIDTA margins of 17-18% in an industrial segment from current levels of 16% due to better pricing in the storage solutions business coupled with price correction in high-end assemblies.

- The company is targeting to reduce the contribution of two-wheelers to its auto aluminium biz from high 80s to 50% by FY25.

- The product-wise contribution to the powertrain segment’s FY22 revenue stood at commercial vehicle – ₹620 Cr, off-highway – ₹232 Cr, passenger vehicles – ₹97 Cr & farm equipment- ₹206 Cr.

- The management believes that one of the major threats for the biz is manpower cost inflation of 20-30% which constitutes around 18-20% of total value added for the company.

- The management expects the margins of auto powertrain & aluminium biz to be similar once the aluminium biz scales up.

Analyst’s View:

Craftsman Automation is a leading maker of engine parts in India. The company saw a decent Q4 with 23% YoY revenue growth but PAT growth was only at 8.5% YoY due to commodity price rises. It has however seen a phenomenal FY22 with 42% YoY revenues growth and 68% PAT growth. The company expects this margin blip to get mitigated in the near future as it passes on the cost rises to customers. The management expects the ROCE and EBIT margins for the aluminium business to rise above 10% in the near future. It remains to be seen how the company’s near term performance will pan out given the steady rise in inflation and how long will it take for the non-core businesses to grow. Given the company’s strong positioning and its rising segments, Craftsman Automation is a good auto ancillary stock to watch out for.