About Company

Incorporated in 2003, Clean Science and Technology Ltd are one of the leading chemical manufacturers globally. It manufactures functionally critical specialty chemicals such as Performance Chemicals (MEHQ, BHA, and AP), Pharmaceutical Intermediates (Guaiacol and DCC), and FMCG Chemicals (4-MAP and Anisole).

Q4FY2023

Financial Results & Highlights

Detailed Results:

- The company revenue grew 6% YoY while PAT grew 29% YOY.

- EBITDA margins improved from 41.3% to 49.1% YoY.

- FY23 revenues by Segment split-up as :-

- FY23 revenues by Geography split-up as :-

- The company ended the year FY23 with a debt-free balance and with a Cash balance of INR 300 crores.

- Revenues from exports stood at 72%.

Investor Conference Call Highlights

- The company’s manufacturing plants for HALS, Hindered Amine Light Stabilizers 701 and 770 that got commercialized in unit 3 in mid-November, has stabilized and is ramping up as per scheduled time frame.

- The company received a good response for HALS and recorded its maiden sales in Q4FY23.

- CRISIL recently upgraded the company’s long-term rating to CRISIL AA- Stable and reaffirmed the short-term rating to CRISIL A1+.

- During the year, the board announced an interim dividend of 200%. In addition to this, the Board has recommended a final dividend of 300% also.

- For FY ’23, sales improvement was led by a combination of good volume growth and improved realization across all products.

- The management states that new products now contribute to 9% of total revenues in FY ’23 as compared to 4% in FY ’22. Contribution from Americas and Europe region is also increasing steadily.

- The company incurred capex of INR 191 crores during FY ’23, with majority going towards new plants for HALS in Unit 3 and upgrading of existing equipment for efficiency improvement.

- Of this, INR 65 crores were invested in the subsidiary Clean Fino-Chem, CFCL, and entire capex continues to be incurred through internal accruals only.

- The construction activity at Clean Fino-Chem Limited is on track, various activities like site layout, initial civil construction, and allied activities are progressing well.

- During the year, the company’s third solar plant was capitalized with 5-megawatt capacity, taking the total solar capacity to 17.4 megawatts, helping in energy efficiency.

- The management confirms that it has a new series of products and a strong R&D pipeline, with continued focus on diversifying the product portfolio and expanding geographical presence.

- The management confirms that the CFCL project and all other projects will be commercialized as committed on time.

- For FY24, there will be very small maintenance capex in the parent company. But in the subsidiary company (Unit 4), INR 180 crores is planned with the incremental capex being announced by Q3 or Q4. It will mainly be towards HALS.

- The management clarifies that the initial commissioning in Unit 3 of HALS is 2000 ton, which in totality will go up to 15,000 ton in three to four years’ time. The average realisation for it is close to 8$ to 10$.

- The management clarifies that the volume growth was soft this quarter due to the de-stocking happening at a global MNC customer level, with freight costs having minimalized.

- The management explains that RM prices are coming down, which also shall result in pass-through of the RM deflation.

- The management clarifies that the company’s inventory stands at less than 30 days. Thus, GM got impacted by the recent lower RM cost and a better product mix.

- The management states that the total capex towards the entire 15,000 ton of HALS would be INR 300 crores.

- The management explains that it has an option to replicate capacities of MEHQ, BHA etc. in Unit 4 if the capacities are getting fully utilized.

- The PBQ product of the company is mainly at the agro side, which is facing slower business and is also resulting in unused capacities.

Analyst’s View

Clean Science & Tech is one of the most talked about recent IPO stocks owing to its strong operational characteristics with a handsome growth of PAT at 29% & EBITDA margins > 40%. The company delivered a strong performance YoY in FY23 with revenue growth of 37% despite a poor domestic scenario. It remains to be seen whether the company will be able to maintain its growth journey which seems to have been baked in at current valuations, how will it compete with players like BASF in its new chemical like HALS & handle input price & other global economic uncertainties. Nonetheless, given its strong competitive advantage & operational efficiency, it remains an interesting stock to keep on one’s watchlist.

Q3FY2023

Financial Results & Highlights

Detailed Results:

- The company revenue grew 31% YoY while PAT grew 45% YOY.

- EBITDA margins improved from 42.7% to 46.1% YoY.

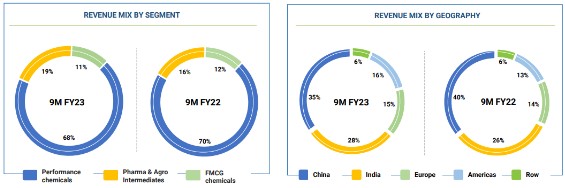

- 9M revenues by segment & geography stand at-

Investor Conference Call Highlights

- The company’s manufacturing plants for HALS 701 and 770 in Unit 3 got commercialized in early December.

- The ROCE stands at a very healthy number of 53.6%

- China opening up is a major tailwind for the biz due to their high exposure.

- The pharma biz grew slowly due to lower sales of PBQ.

- EBITDA margins improved due to the correction of raw materials, power & fuel costs, & operational leverage.

- In the MEHQ and BHA, capacity was increased by 50% in the month of April which should take care of 2 years of growth.

- The management states that new growth will come from new segments of product, which is the HALS segment, the new products like PBQ, TBHQ, and other pharma and agro intermediates.

- The company is confident of maintaining its share in the MEHQ segment.

- The company expects to scale up HALS in the coming 6 months & one of its major advantages is its price competitiveness.

- The company expects the utilization to be at least 50-60% in its 770 & 701 plants.

- The company will have to price its chemicals at 5-10% less Vs BASF price to ensure demand for its products.

- The QoQ numbers were lower since Q3 is a leaner quarter with the majority of revenues coming from exports which were also weak due to inventory destocking.

- The company expects to get a small share of HALS chemicals through its better service in the form of specialized packing unlike bigger players & which is bullish since the market itself is expected to grow at 10%.

- The management explains that in FY 24, in the parent company, there will be a small maintenance capex, but the majority of the capex will happen in the subsidiary company, which could be north of INR 150-odd crores.

Analyst’s View

Cleanscience is one of the most talked about recent IPO stocks owing to its strong operational characteristics with a Handsome ROCE of 53% & EBITDA margins > 40%. The company delivered a strong performance YoY with revenue growth of 31% despite a poor export scenario. It remains to be seen whether the company will be able to maintain its growth journey which seems to have been baked in at current valuations, how will it compete with players like BASF in its new chemical like HALS & handle input price & other global economic uncertainties. Nonetheless, given its strong competitive advantage & operational efficiency, it remains an interesting stock to keep on one’s watchlist.