About the Company

CarTrade Tech Ltd is a multi-channel auto platform provider company with coverage and presence across vehicle types and Value-Added Services. The company operates various brands such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto, and AutoBiz. The platform connects new and used automobile customers, vehicle dealers, vehicle OEMs, and other businesses to buy and sell different types of vehicles. The company offers a variety of solutions across automotive transactions for buying, selling, marketing, financing, and other activities.

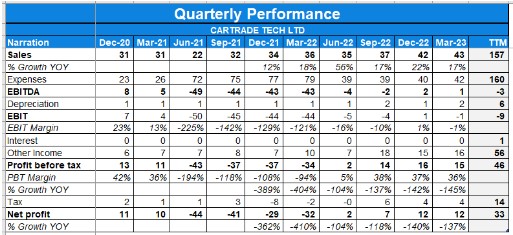

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The revenue for the quarter is INR 116 crores. The net revenue for the year is INR 421 crores. Revenue has grown by 20% for the year.

- Adjusted EBITDA was INR 124.9 crores for the year and INR 39.8 crores for the quarter. Adjusted EBITDA has grown by 28% during the year.

- Profit after tax is INR 40.4 crores.

- Adjusted PAT adjusted for ESOPs as well as deferred tax is approximately INR 80 crores for the year.

- The company has no loans or any kind of debt with a strong cash balance, almost INR 1,100 crores in the company.

- The total number of auction listings for the quarter amounted to 286,681, while the annual figure reached 1.1 million.

- The company had a five-year compound annual growth rate (CAGR) of approximately 23%.

- Cashless ESOPs is INR27 crores.

- The OEM business grew by 29%.

- The other expenses at consolidated levels was INR 24 crores last quarter and went up to INR 25 crores.

- Other expenses on the consolidated level have increased slightly from INR 3 crores to INR 3.2 crores.

Investor Conference Call Highlights

- The management stated that in March ’23, the company auctioned 1.1 million vehicles.

- The management thinks that in the past two quarters, they have encountered challenges primarily due to the increased supply of repossessed vehicles, resulting in a slight downturn, despite the markets showing signs of improvement.

- The organic monthly unique visitors have reached approximately 34 million in quarter 4, as compared to 29.8 million in the same quarter of the previous year. This indicates a notable increase in the number of unique visitors per month.

- The management highlighted that 86% of this growth in unique visitors is organic, emphasizing the strong performance of their consumer business.

- The management stated that the significant organic growth in unique visitors has contributed to the leverage observed in the adjusted EBITDA of the consumer business, further enhancing its financial performance.

- The management stated that an analysis of Google Trends reveals that their brand affinity reflects strong online search popularity. Notably, they maintain significant gaps compared to their competitors, with CarWale at an index of 83 versus the next at 21, and BikeWale at 90 versus 45. This demonstrates their continued strength and growth in online search popularity.

- In the consumer group, the percentage of used car revenue has increased from 9% to 16% this year, while new car revenue decreased from 91% to 84%.

- The used car business experienced significant growth of approximately 136%, while the new car business grew at a rate of around 26%, contributing to the overall growth of the consumer business.

- The management stated that In consumer business, there has been a shift in the OEM (Original Equipment Manufacturer) – Dealers split. It was previously 65% OEM and 35% dealer, but it has improved to 61% OEM and 39% dealer, indicating a positive trend.

- The management highlighted key metrics from Shriram AutoMall. The percentage of repo business has decreased from 69% to 55%, demonstrating a reduction in repossession supply as a proportion of their total business. Meanwhile, their retail business has experienced substantial growth, rising from 21% to 33%.

- The management stated that EBITDA has exhibited significant growth, reaching a CAGR of 69% over the same five-year period.

- The management stated that the OEM-dealer revenue mix was 62:38 for the quarter and 61:39 for the year.

- The new car and used revenue mix was 16:84 for the quarter and similar quarter-on-quarter.

- The management explained that in a scenario where supply surpasses demand, it benefits their operations by eliminating shortages in vehicles. The favorable condition arises when manufacturers and dealers do not require extensive advertising efforts.

- The management stated that they observe a shift towards a market where demand exceeds supply, indicating a more robust and competitive landscape.

- The management stated that their cost structures and unit economics are designed in a way that revenue growth often leads to a more significant increase compared to EBITDA. This pattern has been consistently demonstrated throughout the year, with a 34% growth in net revenue resulting in a remarkable 92% growth in profit.

- The management thinks that OEM advertising spend has gone down as a percentage of revenue due to COVID demand-supply mismatch, but trajectory on when it will lever is uncertain.

- The company expanded their retail presence by introducing a new category of outlets called signature outlets, in addition to their existing AbSure outlets. Currently, they are operating close to approximately 90 outlets.

- The management has reported a slight decrease in the volume of auction listings, particularly for repossessed vehicles. This decline can primarily be attributed to two key factors. Firstly, the improved state of the economy has allowed individuals to meet their loan payments, resulting in a decrease in the number of repossessions. Secondly, after conversing with their customers, the company discovered that the resale value of used cars and vehicles has increased. Consequently, individuals are opting to pay off their loans rather than surrendering their vehicles.

- The management stated that the company adopts a conservative approach towards acquisitions and investments. However, it remains open to making such strategic moves if they offer strong synergies and meet high thresholds of potential benefits.

- The management informed that other income includes treasury income, because they have large funds, which is about INR1,100 crores. These are found with highly conservative mutual funds and overnight funds, which in return, which is classified under the other income. Interest earned on these funds is 6%

- The management stated that while user-generated content holds importance, it is not the primary or most visited content on their website. A significant portion of their visitors engage in comparative shopping, where they compare different cars for various reasons. One of the major reasons users come to their platform is to gain insights into which car to purchase.

- The management informed that the retail could be C2B2B, or C2B, it could be customers coming to them, it could be customers coming through a very small broker or middleman to them either, both ways.

- The management highlighted that approximately 13% to 14% of the advertising budget allocated by manufacturers and dealers is currently spent on digital platforms. In comparison, in many countries, this figure stands at around 40%. This indicates that over the next few years, there is significant potential for growth as the share of digital advertising expenditure by manufacturers and dealers is expected to increase to around 20%, 25%, or even 30%. This trend presents an opportunity for their platform’s growth in the automotive industry.

- The management stated that the availability of new cars has increased, accompanied by improved delivery processes, leading to a positive trend in the new car market. As a result of this development, there has been a notable improvement of 28% in the supply of used cars. This significant trend is highly beneficial for the used-car industry.

- The management stated that the incremental EBITDA would mostly come from their advertising revenue growth, because of the leverage they have.

Analyst’s View

CarTrade Tech Ltd is a multi-channel auto platform provider company with coverage and presence across vehicle types and Value Added Services. The company achieved highest ever revenue and adjusted EBITDA in Q4 and FY ’23. Revenue grew by 20% for the year, adjusted EBITDA grew by 28% during the year. The is India’s leading automotive platform with almost 200-plus physical locations. In Q4, CarTrade Tech Limited received 34 million unique customers every month, with 86% coming organically. The company is investing in product development and technology to support these future revenue streams.

The company’s Consumer group has done well, while the other group has faced headwinds.

The repossession industry is expected to face similar challenges in the coming months as it has experienced in the past six to eight months. However, the company is actively working on acquiring supply from alternative sources to ensure their growth at Shriram AutoMall.

On the consumer side of their business, there is a noticeable increase in the demand for used cars, which is a significant positive for their company. Additionally, they have successfully established a new retail segment and expanded their supply options at Shriram AutoMall. Despite the ongoing challenges in the repossession sector, they remain confident about their overall business prospects.

Nonetheless given growth opportunities and challenges it remains an interesting stock to keep track off.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company, in a 9-month period, had a revenue growth of 23%, adjusted EBITDA growth of 30% and adjusted PAT by 43%.

- It also achieved the highest ever revenue close to 116 crores for the quarter and 9 months close to 311 crores.

- It also achieved the highest ever adjusted EBITDA in a quarter which is 36.6 crores which is almost by about 85.1 now over the 9-month period.

- PAT is 14 crores for the quarter by adjusted PAT, adjusted for ESOP, and deferred tax which is deferred tax for ESOP is for 9 months approximately 52 crores.

- The company is debt free and continues to have strong cash balances approximately over 1,000 crores.

- Dealer shares of this business has been going up over the last year now about approximately 38% of consumer business comes from dealers and 62% in the last quarter came from OEMs

- The number of vehicles auctioned are almost more than approximately 1.1 million annualized, traffic is 35 million unique visitors per month for the last quarter, organic continuous which is unpaid or traffic the company does not pay for is 87.6 which is again healthy in the last quarter.

Investor Conference Call Highlights

- The company states that the fundamentals of the business remain the same where increase in revenue does not have proportional increase in cost just as the nature of the business.

- Management explains its revenue model – On the consumer business it monetizes car manufacturers and dealers who have step products for sale for new cars and used cars for sale to consumers and they monetize both of them for advertising a lead revenue, the transaction revenues are insignificant here. On the auction side of the business where there are sellers and buyers auctioning vehicles it is all transaction revenue.

- The company thinks that the growth rates would be much lower than this 25%, 28% in the car industry next year.

- Management thinks that the supply will be higher than demand and that will become a little more favourable for the business because then dealers and car manufactures can spend heavily on advertising.

- The management believes that the dealer growth rate may continue to possibly outgrow the manufacturer growth rate.

- There was a decrease in unique visitors quarter on quarter because of the seasonal phenomena as October and September are heavy buying seasons in India

- The management states that Absure, which is one part of their used car business, is an insignificant part of the business as it is an early stage business. This business is volatile as well because there are other businesses which are more stable.

- The management is planning to grow its business by focusing on other vertices by becoming more and more widespread out from supply sources now rather than some part coming from the repossessed.

- there was a degrowth of 9% in the remarketing business because of their valuation business which is a low margin business because of increase in variable cost such as cost of inspection. the company claims that this increase in variable cost would not be there in the next quarter

- The company hardly spends 13-14% of manufacturer’s , dealer’s money on digital advertising.

- Dealer business is growing at a faster rate than OEM business because more and more dealers are coming on the platform both for new cars and used cars.

- the company states that they make better margins on retail just because the supply is more fragmented

- The ESOP cost is roughly 27 crores a year and that is impacted in quarterly accounts and will probably be the same next year.

- The management thinks that the product launches are highly positive for their business whether it is EV or ICE vehicle.

- The management states that the revenue of the company is not dependent on the number of consumers coming to the platform. It is highly dependent on the amount of money manufactures and car manufacturers or vehicle manufacturers and dealers spend on digital advertising.

Analyst’s View

The company offers a variety of solutions across automotive transactions for buying, selling, marketing, financing, and other activities.Cartrade tech is the only profitable digital automotive platform company among their key peers. The company generates the majority of its revenue from Commission charges (61% of the revenue), followed by Website service fees (36%), and the remaining ~3% from the sale of used cars. The company had an increase in net profit in this quarter by 33.33%. The company faced degrowth of revenue and increase in expense. The company will expand its OEM business because of digital integration. The co. generates a major part of its income through remarketing platforms in which they have faced difficulties repossessions volumes coming down. Since the supply will be more than demand it would be favourable for the company for expansion.

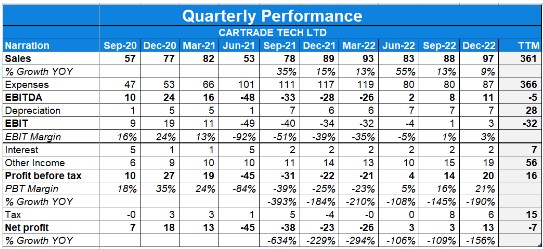

Q2FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 54.93 | 39.13 | 40.38% | 42.02 | 30.72% | 157 | 113 | 38.94% |

| PBT | 13.93 | -37.31 | 137.34% | 1.60 | 770.63% | -152 | 20 | -860.00% |

| PAT | 7.47 | -40.58 | 118.41% | 1.68 | 344.64% | -146 | 79 | -284.81% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 102.49 | 88.08 | 16.36% | 92.77 | 10.48% | 359 | 281 | 27.76% |

| PBT | 13.75 | -30.59 | 144.95% | 3.79 | 262.80% | -119 | 47 | -353.19% |

| PAT | 5.57 | -35.34 | 115.76% | 3.31 | 68.28% | -132 | 91 | -245.05% |

Detailed Results:

- The company had a good quarter with consolidated revenue growing by 16% YoY and 10% QoQ and PAT growing 116% YoY and 68% QoQ. The high growth YoY numbers are due to losses in Q2FY22.

- The company has grown revenues by about 30%, adjusted EBITDA grew by 47%, and the adjusted PAT grew by 80% in H1.

- The company has now 190 plus physical locations including automalls and abSure outlets.

- Consolidated adjusted EBITDA margin is 30% versus 20% the previous quarter.

- The car new business in half has grown by 31%.

- The Used Car business has grown by 160% year-on-year for the first six months, although it’s at a smaller base.

- OEM dealer has grown by 33%

- Dealer business has grown by 59%

- In the company consumer group, the dealer business is about 40% of the business and the OEM is about 60%

- The average monthly unique visitors stand at 37 million

- The company auctioned 304,000 vehicles. But the growth rate of auction listings is only 12% in H1 and volume has grown by about 30% in H1

- OEM grew by about 21% and dealers grew by 47% quarter-on-quarter.

- The growth in retail is about 51% in Q2.

Investor Conference Call Highlights

- Last quarter, the company recorded 37 million unique visitors on its platforms, which is the highest consumer traffic in a quarter. 86.6% of them still come organically.

- The dealer business is growing at a faster rate than OEM business and Used is going faster than New.

- Even though the Group has grown by 31% year-on-year for the first six months, Shriram Automall has had a tough quarter with the growth of only 9% in the last quarter, and that’s been highlighted due one of the company’s segments, which is auction of repossessed vehicles, which has been close to flat for the quarter.

- For the repossess business, the management stated that if money is lent against vehicles, repossession is going to be required to be done. And the rate of repossession is unlikely to go down in the medium to long term. So, this is a short-term cyclical issue, not a long-term structural issue.

- The management stated their focus is on the retail side of its business or supply of vehicles for auction, which is a big fast-growing segment for them and it is 30% of its business.

- The management stated when there is a shortage of vehicles and customers have to wait, generally, manufacturers spend less money or dealers spend less money on advertising.

- Giving an update on abSure, the management stated that the company has got about 62 locations now. And the company’s objective has been to keep growing the locations and get to about another, maybe between 100 by the end of the year. Focus had earlier been to roll out locations. Now the focus is really on operational efficiency and customer experience within the location and within the abSure model itself. What is the customer’s experience when they buy a vehicle? And that whole experience of booking it online and picking up the vehicle. So, the focus is on the certification product, the warranty, the money-back guarantees, and all of that. And there we find we made a lot of progress.

- The company is now working on franchise viability. How many cars does the company need to sell to break even? How does the company make profits? How does it make sure that franchisees are having a very healthy business? And then of course, how does the company make a sufficient return from this business?

- The objective is to keep growing and get to 100 outlets of abSure by the end of the year, each one doing 15 to 25 cars a month.

- The management explains the stable marketing expense that with the car industry growing, more and more users come to the company automatically, and 87% of traffic is organic. And that’s reflected in the 37 million users.

- The company has Rs 1,000 crore cash on a balance sheet, and the intent is to look at investments and acquisitions in the company’s ecosystem. Over the last six months, the company has aggressively looked for acquisitions but has not yet zeroed down on a particular acquisition in the investment area.

- The management discussed the growth driver for the ad business. Over the years, out of ad spend for OEM or dealers, the digital ad part is growing, and the overall budget of ads is also growing, so two growth drivers.

Analyst’s View

CarTrade’s asset-light model can provide it an edge against its competitors who follow an asset-heavy model. While management believes that the asset-light franchisee model would generate superior unit economics with an ability to scale faster, it would be too soon to pin hopes on it when it has yet to significantly add to the top line. Apart from that, the competition in the segment is intense. Neither the consumer nor the dealers are sticky. Will CarTrade be able to take advantage while its competitors try to optimize their costs and face senior management exits remains to be seen?

Q1FY23 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 34.8 | 22.37 | 55% | 36.4 | -4.4% | 157 | 113 | 38.9% |

| PBT | 1.6 | -43.3 | NA | -34.1 | NA | -152 | 20 | -860.0% |

| PAT | 1.68 | -44.3 | NA | -31.6 | NA | -146 | 79 | -284.8% |

| Consolidated financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 92.7 | 63 | 47% | 105.8 | -12.4% | 359 | 281 | 27.8% |

| PBT | 3.8 | -44.7 | NA | -21.4 | NA | -119 | 47 | -353.2% |

| PAT | 2.57 | -45.4 | NA | -21.1 | NA | -132 | 91 | -217.5% |

Detailed Results:

- Consolidated Sales grew by 47% YoY while it declined 12.4% QoQ.

- EBITDA margins: 13.4% | Adj EBITDA [excl ESOP]: 20%

- Avg monthly unique visitors (UV) per quarter stood at 31.1 million out of which 84.7% were organic.

- Total UV grew 14.7% YoY and 4.3% QoQ.

- The auction listing for the quarter stood at 272,275 an increase of 28% YoY, while the volume sold increased 92% to 57,710 units. [Lower Base in Q1FY21 due to 2nd Covid Wave]

- Conversion of listing to sold units: 21.2% [Calculated as Auction Listing/Volume Sold]

- Remarketing Business [Shriram Automall] grew 52% to Rs.51 cr YoY and reported a positive PAT of Rs.2.8 cr.

- CarWale and Bikewale way above their competition on Google Search Trends in relative terms, demonstrates higher brand recall and helps in incoming traffic.

Investor Conference Call Highlights:

- There is a little seasonality in the business with Q1 being lower than other quarters.

- Revenue Breakup – New Vehicle: 33% | Used Vehicle: 67% [New vehicle business grew 48%]

- Dealer business grew 76% and contributed 40% to the Standalone [Consumer Group] revenue.

- abSure outlets stand at 57 across 34 cities. Management is heavily focussing on this segment and working with manufacturers, dealers and lenders to complete the customer journey from research to one-click purchase on their platform. These initiatives are driving the expenses higher.

- Benefited from lower marketing spends of competition, resulting in better traffic and search trends on Google.

- Working on the franchise model of abSure to ensure that the customer experience remain smooth inspite of them not owning the whole experience. Inventory is owned by franchise, moneyback guarantee, quality assurance product owned by CarTrade. Management believes this asset-light model will help them scale faster and provide better unit economics.

- Expect semi-conductor-related supply chain issues to ease out over the next couple of quarters. [Impacts new vehicle segment]

- Expenses have only a small variable component, especially in the Remarketing segment. This leads to steeper operating leverage which cuts both ways and in case of lower revenue results in a sharper drop in margins.

- Dealers are on a subscription model. Manufacturers’ revenue can be from fees to generate leads, ad revenue, conversion models and so on.

- Targeting 100 abSure outlets and aim to sell 10-20 vehicles per month from each outlet.

- Remarketing business expected commission range: Rs.7500 – 8000

- Supply from single users has higher margins compared to bigger suppliers. Offline has higher margins than online. Commercial vehicles have slightly higher margins.

- ESOP expense range for the year: Rs.25-30cr.

Analyst’s View:

CarTrade’s asset-light model can provide it an edge against its competitors who follow an asset-heavy model. While management believes that the asset-light franchisee model would generate superior unit economics with an ability to scale faster, it would be too soon to pin hopes on it when it has yet to significantly add to the top line. Apart from that, the competition in the segment is intense. Neither the consumer nor the dealers are sticky. Will CarTrade be able to take advantage while its competitors try to optimize their costs and face senior management exits remains to be seen?

Q4FY22 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 46 | 38 | 21.1% | 42 | 9.5% | 157 | 113 | 38.9% |

| PBT | -34 | 11 | -409.1% | -37 | -8.1% | -152 | 20 | -860.0% |

| PAT | -32 | 10 | -420.0% | -29 | 10.3% | -146 | 79 | -284.8% |

| Consolidated financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 106 | 92 | 15.2% | 102 | 3.9% | 359 | 281 | 27.8% |

| PBT | -21 | 19 | -210.5% | -22 | -4.5% | -119 | 47 | -353.2% |

| PAT | -21 | 16 | -231.3% | -18 | 16.7% | -121 | 103 | -217.5% |

Detailed Results:

- Sales grew by 15% YoY on a consolidated basis with 4% rise QoQ.

- Adjusted EBIDTA margins for the quarter stood at 26%.

- AVG monthly unique visitors (UV) stood at 30 million out of which 84.2% were organic.

- The auction listing for the quarter stood at 3,23,693 while the number sold stood at 74,603.

Investor Conference Call Highlights:

- The manpower costs increased by 25% YoY due to a lower base in the previous year due to Covid.

- The management states that the company’s marketing expenses are relatively lower than its competitors due to higher brand affinity & the ability to generate 30 Million new traffic out of which 84% is organic, leading to lower requirements for spending.

- The management believes the presence of physical infrastructure due to its SAMIL biz segment provides it with a clear differentiation Vs its competitors.

- The management believes that the simplification of GST rules for the used car market will help fuel the industry’s growth in the coming time.

- The company’s volumes have grown at a higher pace vis-a-vis the revenue due to higher contribution from the non-physical segment due to Covid where commissions are comparatively lower.

- The company’s abSure biz is a franchisee model where the company is expected to incur higher costs initially, but the management is very bullish about its growth prospects in the long run.

- The management believes that without increasing traffic it could rapidly grow its revenues if manufacturers give more budgets to go up on digital advertising.

- The management states that 14% of the OEM spends are digital which amounts to about Rs.850 Cr out of which the company gets a pie of close to Rs.120 Cr.

Analyst’s View:

CarTrade Tech is one of the biggest auto platform providers in India and the only profitable one to date. The company had a good IPO post which it saw a serious fall in its share price of over 60%. The overall revenue growth has been decent in Q4 with revenues growing 15% YoY. The profits for Q4 and FY22 remain subdued due to a non-cash exceptional item regarding ESOPs issued by the company in 2022. The company has a lot of plans in place for the expansion of its new business segments like the abSure outlets and the fintech loan platform. It has also earmarked Rs 750 Cr for investments in growing new businesses. SAMIL has also added Ashok Leyland to its institutional auto auction business and expects to add more OEMs in the future. It remains to be seen what obstacles the company will face in its expansion into new business segments and how will the whole online vehicle ecosystem develop in the future. Given the brand strength of the company and its status as the only profitable player in this rising segment, CarTrade Tech is a pivotal auto platform stock to watch out for, particularly considering its currently attractive valuation levels.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 42 | 37 | 13.5% | 39 | 7.7% | 110 | 75 | 46.7% |

| PBT | -37 | 13 | -384.6% | -37 | 0.0% | -118 | 9 | -1411.1% |

| PAT | -29 | 11 | -363.6% | -40 | -27.5% | -114 | 69 | -265.2% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 102 | 86 | 18.6% | 88 | 15.9% | 253 | 189 | 33.9% |

| PBT | -22 | 27 | -181.5% | -30 | -26.7% | -98 | 27 | -463.0% |

| PAT | -18 | 24 | -175.0% | -35 | -48.6% | -100 | 87 | -214.9% |

Detailed Results:

- Sales grew by 18% YoY on a consolidated basis with 16% rise QoQ.

- Adjusted EBIDTA margins for the quarter stood at 32% up 400 Bps on quarterly basis.

- AVG monthly unique visitors (UV) stood at 31.2 million out of which 86.2% were organic.

- UVs increased by 1% YoY & decreased by 9% QoQ.

- Auction listing for the quarter stood at 3,26,319 while the number sold stood at 72,639.

- The company is geared to scale at 200 outlets in the next 2 years.

Investor Conference Call Highlights:

- The overall car market was down 15% YoY in Q3.

- 9M revenues grew 33% YoY while adjusted EBITDA grew 30% YoY.

- The average monthly visitors to the company’s sites were at 31 million of which 86% came in organically.

- There was an exceptional non-cash adjustment of Rs 140 Cr in Q3 for ESOPs granted in April 2021.

- The consumer business of CarWale, CarTrade, and BikeWale grew 47% YoY while adjusted EBITDA grew 56% YoY in these segments.

- Among the new businesses that the company is looking to launch, the B2C used car franchising is expected to do well. The company has also created a fintech product where customers can get linked to various auto financiers with approval from Cartrade once the customer puts in the requisite data.

- The Board has earmarked Rs 750 Cr for investment into businesses like car servicing, car repair, car financing, electric vehicles and other avenues.

- Cartrade is aiming to digitize the entire journey of acquiring a new or used vehicle.

- The company is also aiming to enhance the online used car buying experience with its CarWale certified or CarWale abSure outlets. Currently 22 outlets are certified abSure. The company aims to bring this number up to 200 in the next 2 years.

- In Q3, the company tied up with Ashok Leyland for auctioning the exchange vehicles brought to Ashok Leyland dealerships. The company also has such ties with Bharat Benz.

- Despite the slowdown in the Indian auto sector, investments in online promotion and advertising have gone up and the management expects this to continue going up. There is still room for expansion for digital advertising in the auto space in India which is currently at only 13-14% of total ad spend vs 40% globally.

- The company includes other income in its EBITDA calculations according to the management.

- The realization per vehicle for SAMIL has fallen but the management remains confident that of it given that it is still yielding an adjusted EBITDA margin of 35%.

- The abSure division has a separate CEO and the company is very bullish on developing this business. The main model of monetization here is transaction of sales of vehicles from the franchise stores where Cartrade charges a take rate on the selling price. The company’s cut on the final sales price ranges from 1.5% to 3% depending on the services provided to the specific dealer.

- The management said that Cartrade has already done tens of thousands of loan approvals through its fintech product already and is one of the largest approvers of loans in this segment in the industry.

- The management reiterates the company’s target to maintain a 30 30 30 model with growth target of 25-30%, margin of close to 30% and profit growth of 30%.

Analyst’s View:

CarTrade Tech is one of the biggest auto platform providers in India and the only profitable one till date. The company had a good IPO post which it saw a serious fall in its share price of over 60%. The overall revenue growth has been decent in Q3 with revenues growing 19% YoY and the classified businesses of Carwale, Bikewale and CarTrade growing 47% YoY. The profits for Q3 and 9M remains subdued due to a non-cash exceptional item of Rs 140 Cr regarding ESOPs issued by the company in 2021. The company has a lot of plans in place for the expansion of its new business segments like the abSure outlets and the fintech loan platform. It has also earmarked Rs 750 Cr for investments in growing new businesses. SAMIL has also added Ashok Leyland to its institutional auto auction business and expects to add more OEMs in the future. It remains to be seen what obstacles the company will face in its expansion into new business segments and how will the whole online vehicle ecosystem develop in the future. Given the brand strength of the company and its status as the only profitable player in this rising segment, CarTrade Tech is a pivotal auto platform stock to watch out for, particularly considering its currently attractive valuation levels.

Disclaimer

This is not a piece of investment advice. Please read our terms and conditions.