Is CarTrade Tech (CTT) a fallen angel or a value trap?

This blog is my attempt to answer this question for you. But do not expect a direct answer. 🙂

It is fun to write about fallen or ignored stocks (read businesses).

First, very few people are tracking them. And second, and more importantly, if they do well after you have written about them, you can brag about it. (Maine Bola Tha! 🙂)

This is what I wrote about MHRIL in April 2020 & VIP Industries in September 2020.

After three eventful years, the falling stock market and the crashing stock prices of some businesses have motivated me to write again.

There is another big motivation to write.

We asked for either 100 Retweets or 500 Likes on our Tweet below:

Since we got more than 100 Retweets we have to keep our promise of writing on at least 2 businesses from our portfolio.

So let’s begin.

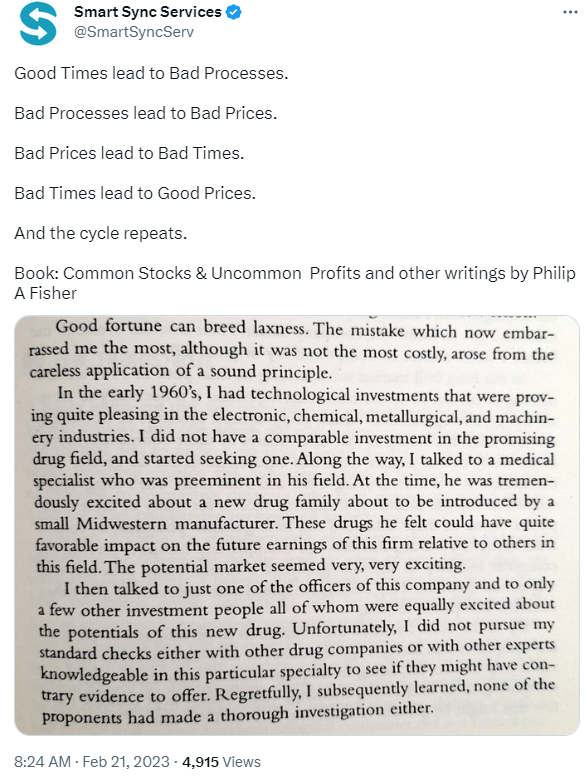

We tweeted this a month back:

Let’s understand the above point from CarTrade Tech’s perspective

| Good Times | Buoyancy in the Indian stock market in FY21 |

| Bad Processes (By investors) | The euphoria around New Age Tech business. CarTrade Tech (CTT) IPO oversubscribed 20 times |

| Bad Prices | The IPO gets priced at an obscene valuation (28 times Sales) |

| Bad Times (for investors) | Despite the business showing growth, the share price has come down sharply since the time of listing |

| Good Price | Valuation has come down sharply (75% fall). This is debatable, I will cover it later |

Let’s start with the IPO details

| IPO Price (August 2021) | 1618 |

| IPO Size (INR Cr) | 3000 |

| Oversubscription | Retail=2.75 times, QIB= 35 times, NII=41 times |

| Market Cap at listing (INR Cr) | 6345 |

| Market Cap at CMP (INR Cr) | 1760 |

| If bought at IPO and held till now | Staring at a loss of 75% |

Just to put things in perspective, if you had bought shares of Cartrade Tech in the IPO and still hold the stock, you need it to deliver 400% returns (or 4x) from here to just break even on your investment.

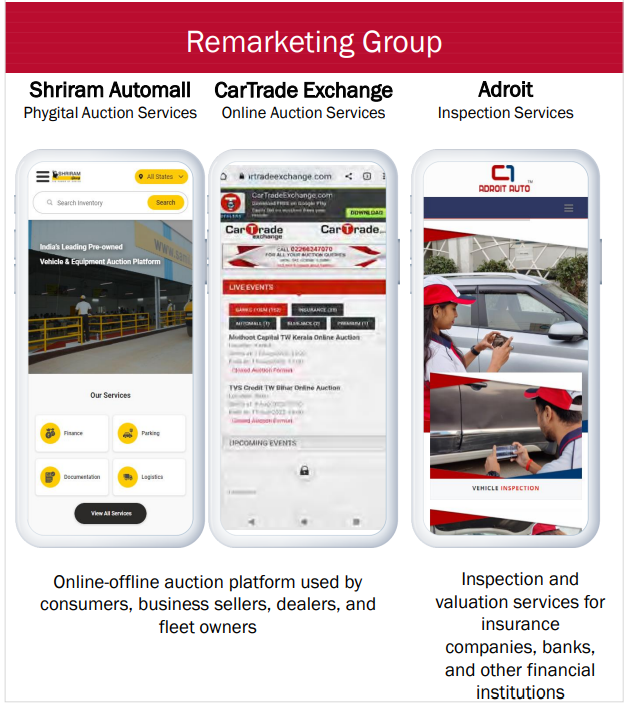

Before I get into what CTT does, let’s look at what went wrong with the stock that led to this significant fall in share price since the time of listing.

I think these are the Top 5 reasons why the stock has tanked in the last 18 months:

- Listed at obscene valuation (28 times Sales) during the height of euphoria of New Age Tech in the market ( more on valuation later)

- 100% OFS (Offer For Sale), the business got zero money from the IPO.

- Promoters and early investors made a killing at the IPO, generating good returns on their investments at the expense of the investors in the IPO.

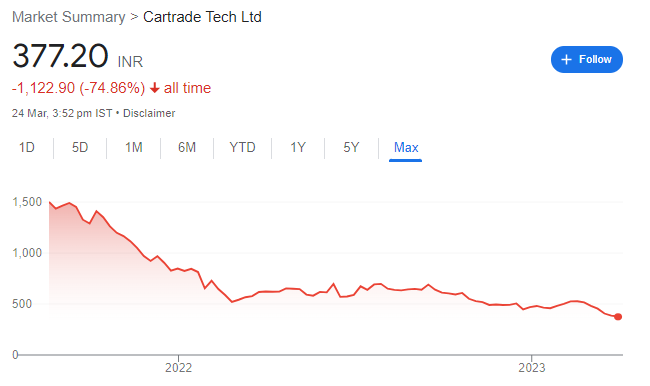

- A one-time Deferred Tax Asset (DTA) adjustment was done just before the IPO which inflated the profits for FY21 (Proof attached below)

- Huge one-time non-cash ESOP charge in FY22 that put them back into significant losses.

Valuation at the time of IPO

This is what their bankers said regarding valuations just before the IPO:

“Most internet companies are valued in a particular way by institutional investors. They look at the intrinsic value. They forecast future growth based on some metrics they apply. They clearly see CarTrade as a strong franchise in the space and the only profitable company. There is tremendous investor interest at this valuation, And there is enough money left on the table for all investors to make returns.”

Source: Pre-IPO Meet Q&A

No talk about earnings, book value, valuation multiples, or cash flow. Just that there is tremendous investor interest in the IPO and a promise that enough money is left on the table for others. This is not a personal attack on the banker. Just sharing this to make you understand what was the market pulse at the time of the IPO and contrast it with what investors think of CTT today after the market valuation has taken a hard 75% knockoff.

Just look at the highlighted numbers in the image below to get an idea of DTA, ESOPs, and profit swings.

More on DTA (figures in INR Millions):

Source: Page 224/338 of CTT’s RHP

If you do not understand the complexity of Deferred Tax Assets and their impact, just understand this simple thing.

Using book entries, CTT moved from paying 9Cr & 7Cr of income tax in FY19 & FY20 to getting a whooping 54 Cr Credit in FY21.

It is completely legal and they have not defied any rules of accounting or taxation here.

But the timing of the adjustment makes it clear that it was about getting the bride to look absolutely ready for the wedding.

Large ESOPs in FY22

Source: FY22 Annual Report

Source: FY22 Annual Report

The generous rollout of ESOPs to the top management and employees just after the IPO was also a big sentiment dampener for investors.

The background story and the origin of CarTrade Tech

Enough of negativity. Now you know why the stock has been battered over the last 18 months. So, let’s leave it there.

Let us now go back to the origins and the background story of CTT.

For that, you have to track the origins of Vinay Sanghi, who is the chairman and managing director of CTT.

Vinay was born into a business family. While he was doing his studies, he started taking an active part in his family business of car dealerships, ‘Sah and Sanghvi”. Post his education he started running the show. I am talking about the nineties era.

Then in 2000, M&M, Sah & Sanghvi, and HDFC formed a joint venture in Mahindra First Choice. Over the next 8 years, Vinay as CEO, helped it become the largest used car business in India.

Vinay then noticed that there was no marketplace to sell inventory at prices close to market prices specifically for financial institutions, for their reposed inventory. This was the reason for Vinay to leave Mahindra First Choice and start MotorExchange. MotorExchange was a trading platform, the first of its kind in August 2009, where vehicles got listed, and the winning bidder was then asked to fulfill the terms of the transaction, a model not very different from online retail giant eBay Inc. MotorExchange immediately acquired used car marketplace, CarTradeIndia.com in the same month.

His early years’ experiences, struggles, and victories are very well chronicled here in case you are interested.

This is how the journey of CarTrade Tech has been over the years:

Business

I often hear from some of my investor friends that they do not understand what CTT’s business is all about. Let’s decode the business right away.

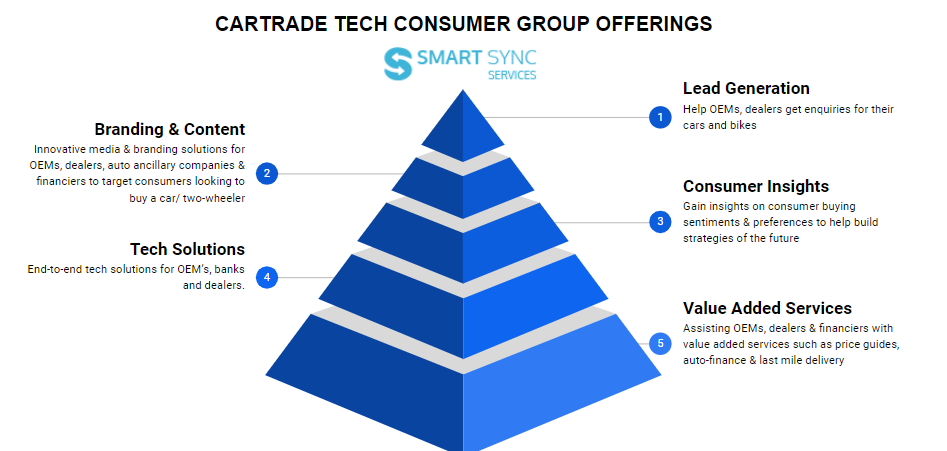

Simply speaking, CTT is a business that allows consumers like you and me, OEMs like Maruti, Tata, and Hyundai, etc, & auto dealers to buy and sell cars (new and used) online. They call this the consumer group of business. This is the core CarTrade Tech’s parent company business.

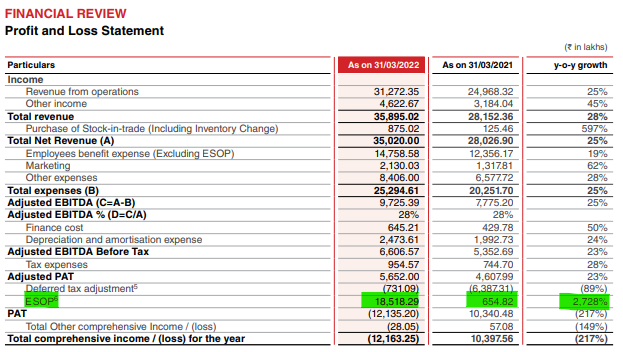

They also have an auction platform, both online and offline, that allows consumers, banks, financial institutions, & insurance companies to auction two-wheelers, three-wheelers, cars, CVs, farm equipment, construction equipment, etc. This is called the remarketing group of business. This business comes from the following three verticals:

- Shriram Automall India Ltd (SAMIL): The Physical Auction Platform (CTT owns 55.45% of SAMIL)

- CarTrade Exchange: Digital Auction Platform

- Adroit Auto: Valuation, inspection, and registration services to banks, insurance companies, financial institutions, and OEMs.

The images below may help you visualize the working of the two groups better.

Value Proposition

Now let us look at what CTT has to offer to all the stakeholders in these businesses.

Let us start with the consumer business first.

Now let’s move on to the remarketing business:

To further understand the scope of the remarketing business of CTT, I would recommend you to check out our research on Copart, the world’s largest online auction platform.

Organizational structure

This is what the organizational structure looks like.

Business Segments

I have broadly talked about the two business groups, the consumer and the remarketing. But if you drill down further, this is what their business segments look like.

The Ecosystem CTT is trying to Build

This is what CTT will look like in 3-5 years or maybe a bit more if they execute well.

Source: Company’s presentation

If you want to further break it down to what are the possible ways in which CTT can grow its business, then look at this detailed chart from their DRHP.

Does this ring any bell? No?

Can’t you see the network effects?

Ok, check the image below to understand more.

And that’s why RedSeer Strategy Consultants talk about this as a $14 Bn Revenue Pool Opportunity

Current Monetization Strategy

Now that we have covered the business fairly in detail, let’s move on to the monetization strategy of CTT.

As of now, CTT does not make any money directly from the consumers in their consumer group. They make money from OEMs, dealers, banks, insurance companies, and financial institutions. And in the remarketing group, their earnings are from auction commission & fees, tech-based services & allied services like inspections & valuations.

Financials

Now let’s move on to the financials. In Financials, let’s start with the Revenues first

| CTT Revenue Breakup (INR Cr) | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23* | CAGR |

| Consumer Business | 15 | 23 | 25 | 29 | 92 | 120 | 93 | 125 | 152 | 27% |

| Consolidated Revenue | N.A. | 33 | 78 | 124 | 243 | 298 | 250 | 313 | 357.3 | |

| Remarketing Business | 10 | 53 | 95 | 151 | 178 | 157 | 188 | 205.3 | 54% |

*FY23 numbers are just extrapolated from 9MFY23 numbers

If you ask me now what are the key variables I should be tracking to see the performance of both the business groups, I would not just fix my eyes on the final revenue numbers but also a few more variables. Let’s cover them here.

In the consumer group, their revenue is dependent on 3 variables:

- Number of users visiting their platforms

- The conversion rate ( % of people making a transaction like a buy or a sell)

- Unit price charged to OEMs & dealers

While CTT does not disclose the 2nd and 3rd variables, maybe due to confidentiality, they share the number of consumers’ details.

For CTT to grow its business, this number has to consistently increase going forward. So, if you see the numbers stagnating for a few quarters regularly, it should give you a good sense of the stress in the business.

Now, coming to the remarketing business, I believe the 3 variables we have to keep in mind are:

- Number of auto malls (Locational Advantage, a huge moat that is extremely difficult to replicate)

- Number of auction listings

- Auction volumes (sold Nos)

I have plotted all three of them here:

*FY23 numbers are just extrapolated from 9MFY23 numbers, N.A. means data not available, and CAGR is for the last 4 years.

You can notice the difference between the two verticals. While the consumer business is fast growing, the remarketing business is a steady compounder.

Another thing that works for the consumer business is the higher ranking on brand affinity as per google trends:

Just to be sure, I did not immediately believe the management’s version but checked out the google trends myself. The results below match the company’s presentation.

Now back to financials

Coming to the Profit & loss account, let’s look at the consolidated numbers:

If you ignore the one-time DTA effect in FY21 that abnormally increased the profit and the one-time high ESOP cost that reduced the profit, the business is profitable and more than 50% of the cost is employee expenses. This establishes the fact that it is an asset-light business with a high operating leverage built into the model. Higher revenues will not increase the costs at the same rate thereby leaving enough scope to improve margins and ROE incrementally. We will verify the asset-light part again in the Balance Sheet.

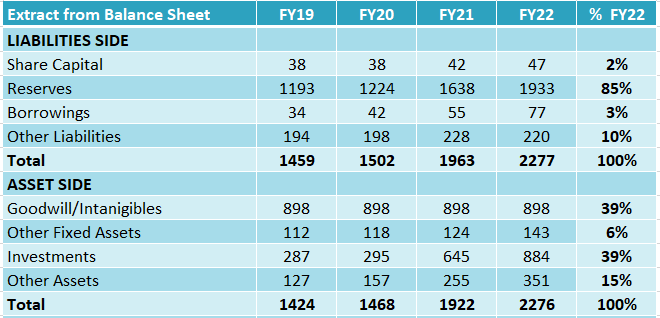

Now let us have a look at the Balance Sheet

Note that this is a Balance Sheet extract and not the actual Balance Sheet, which is why the Liability side and asset side are not matching exactly. But you may notice that on the Liability side, Share capital plus reserves form a majority part (87%). Similarly, on the Asset side, Goodwill plus Investments form 78% of the total. In fact, even in the other assets, which form 15%, there is no inventory, negligible debtors, and a significant amount of cash and investments.

That is why the company has 1000 Cr+ of cash or cash equivalents in its books.

It needs neither Capex nor working capital to make incremental sales. Wouldn’t you like to be the owner of such a business? 🙂

Goodwill on its books has come from acquisitions.

Key Acquisitions

Now let’s take stock of what we have covered till now.

- Top 5 Reasons for CTT’s stock to crash in the last 18 months

- The origin and evolution of CTT

- Business of CTT

- Value Proposition

- Organizational Structure

- Business Segments

- The Automotive Ecosystem CTT is trying to build

- Current Monetization Strategy

- Financials

- Key Acquisitions

Now it is time to check the competitive landscape.

Competition

The data I am sharing below is quite dated (FY20 numbers). FY21 numbers are not comparable due to the Covid impact. I was unable to fetch FY22 numbers for all the competitors as they are private companies. But the business model gives a lot of clarity

As you can see, it is a highly competitive industry. And if you observe closely, except CTT all other players are having a highly asset-heavy model. They also spend a huge amount of money on advertisement and promotional activities. They tie up with celebrities like Mahendra Singh Dhoni & Akshay Kumar and make them the brand ambassador. These strategies cost a bomb However, CTT has not followed that path. And if you are following this industry closely, you would have come across the news of these players laying off their employees and undergoing massive cost-cutting campaigns. The reason is simple, they are all loss-making, VC-backed start-ups and I do not need to share any proof of how the funding in the private market has dried up in the last 12-18 months.

In hindsight, CTT, or rather I should say CTT’s promoters and investors (as it was a 100% OFS) were lucky to do an IPO in August 2021. If they had delayed their plans by even 12 months, they might not have got even 50% of their 2021 IPO valuation.

However, coming back to the competition part, I believe, CTT has the advantage of asset-light model, strong Balance Sheet, zero-debt, and 1000 Cr+ cash which is enough for them to survive and thrive in this environment where their competitors are clearly on the back foot.

While others own the assets in their books, CTT has come up with a franchisee model through its Absure outlets around the country. As of date, they have 73 franchised outlets in 33 cities.

This is the biggest differentiator of CTT against all its competitors. Now, this is a debatable point. Proponents of the asset light model say that CTT has a big advantage over others as while they grow in this space they do not put any stress on their Balance Sheet. While there are others who feel that bringing the whole value chain inside the company gives you more control over the quality of service and enhances trust. So, time will tell whether it was a brilliant idea or a defensive strategy that did not work out. For the moment, it is too small and nascent in the overall scheme of things to pass any judgment.

Having said that, now I will move toward capital allocation.

Capital Allocation

Warren Buffett is arguably the best capital allocator in the world. And he has demonstrated his skills for a longer period than anyone in history. And he is not done yet. He puts a very simple method to prioritize capital allocation decisions. He suggests you to follow this order:

- Invest in your own business (Capex)

- Invest in other businesses (M&A)

- Pay Dividends if there is excess cash lying which you don’t need for your business

- Buyback if the share price has come to a very attractive level compared to intrinsic value.

We have already figured out that their core business doesn’t need capital for growth.

And we have also understood that CTT has grown and evolved over the years through acquisitions only. Carwale and SAMIL today contribute to almost 95% of their revenue. Both have been acquisitions of the past.

The dividend is an ineffective way to pay back cash in India as the tax on dividends is neither favourable for the company nor for the shareholders.

But Buyback, if done at an attractive price can be a win-win for both the company and its shareholders.

So, when CTT has 1000 Cr+ cash in books, they ideally have two choices. Either to utilize it for an acquisition or do a buyback.

For a new-age tech company, that has seen its market cap plummet in the last one and a half years, it is easy to give into the temptation of going for a big acquisition to grab the headlines and anchor the investors towards the possible future growth path. So, I am actually impressed by the CTT board that they are not rushing into an acquisition despite strong pressures all around, especially from the investing community.

However, large unutilized cash on the books of a public company is like a Tijori (Hindi term for a safety locker for storing valuables). Tijori was mentioned here by Prof Sanjay Bakshi. What it basically means is that the market tends to look at the management with suspicion if it carries a lot of cash for a long period of time.

When I asked the management in one of the quarterly results’ investor conference calls, their response was not direct.

Recently there was an article in The Morning Context, that had the following headline which got me interested:

But, CTT management quickly responded by a BSE press release that they have not entered into any such deal.

However, the management continues to maintain that they are actively evaluating several acquisition opportunities in the automotive ecosystem. Just that nothing has taken place as of date.

Ideally, before they close in on any acquisition I would have liked them to do a buyback of at least 50-100 Cr that can give a signal to the investing community that the management finds value in its share at this market price.

It’s easy to form an opinion as a desk analyst, but very tough to be on the other side and take the decision. So I would assume that management would be having some solid reason for the same. Maybe, we will get to know about it in the future.

Now that we have probably covered all the parts of the business, let’s turn our eye to the valuation.

Valuation

In his famous book, “The Most Important Thing”, legendary investor Howard Marks makes a good point of what are the 3 stages of the bull and the bear market. And here they are:

“the three stages of a bull market”: the first stage, when only a few unusually perceptive people believe things will get better, the second stage: when most investors realize that improvement is actually taking place, and the third stage: when everyone concludes things will get better forever.”

“the three stages of a bull market”: the first stage, when only a few unusually perceptive people believe things will get better, the second stage: when most investors realize that improvement is actually taking place and the third stage: when everyone concludes things will get better forever.”

I believe the CTT stock has already seen the bull phase and is probably in the 2nd or 3rd stage of the bear market.

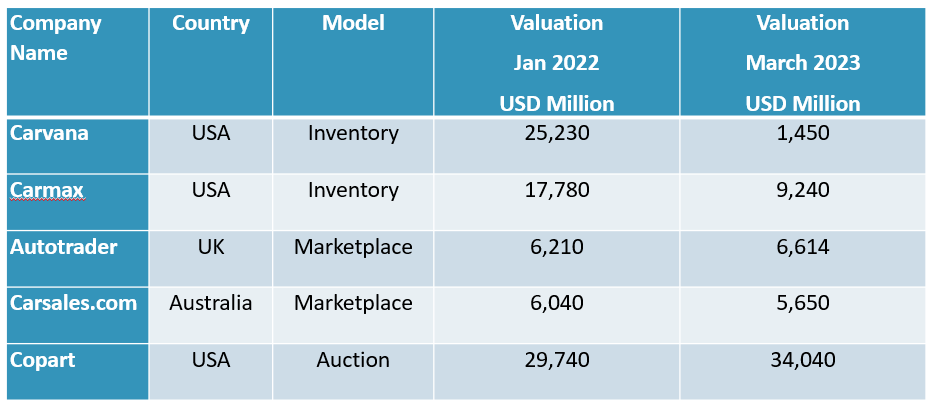

Here is the valuation of some of the international companies in the space.

There is a reason I have shared two valuation columns. In Jan 2022, we did a MissioN SMILE Webinar on CTT. It is prudent to compare today’s valuation with the Jan 2022 valuation

If you notice, except Carvana, which is dealing with controversy and high leverage, all the companies have been able to either hold on to their last year’s valuation or in the case of companies like Copart, they have even surpassed their last year’s valuation comfortably.

Now take these data points on your excel sheet.

- Volume growth of cars in India over 5-7 years: 10%+ CAGR

- Value growth of vehicles in 10 years due to inflation: 1.5x to 2x

- Buying cars online as a megatrend which has just started, should pick up going forward

- Current Market cap of CTT, a leading player in the space 1650 Cr

- You get the following:

- 1000 Cr Cash (Can be used for synergistic acquisitions)

- Profitable SAMIL business (Undisputed leader in Auction business)

- Consumer business is growing very fast

- 9MFY23 YoY growth 30%

- 40% market share in new online car business & nascent industry

- Sales have grown at a CAGR of 27% in the last 9 years

- All future growth will be yours

- At what valuation would you be interested?

I believe the valuation offers a lot a margin of safety at this point in time. Disclosure: I, my family, and my clients are invested and hence biased in favour of the business.

Investment Rationale

The top 5 reasons for buying CarTrade Tech are:

Add attractive valuation as the sixth and final reason.

Risks

And the final piece of this puzzle is here. The risks.

Of course, this is not a perfect business and has its own challenges and risks as mentioned above. Betting on a new wave is far more challenging than betting on an established trend. The level of uncertainty is far higher in the case of a new wave. This uncertainty about execution, timelines for growth and so many other factors often make the valuation work in your favour.

If you are still reading, pat yourself on the back. Hope this helped you in learning about CTT.

Now I want to leave you with these 3 thoughts

Thought no 1: How the market tricks us

Thought no 2: Investing as an arrogant act.

Thought no 3: Tech Platform’s Early Struggle & Eventual Success

The above snippet from the book, “Modern Monopolies”, explains the early struggles each tech platform has to deal with and Survive to Thrive.

So,

1. 1760 Cr Market Cap

2. Debt-Free Balance Sheet

3. Cash+ Liquid Funds: 1000 Cr+

4. Asset Light

5. Core business grew 30%+ in Q3FY23 & 9MFY23

6. Since the IPO, the stock fell by ~75% in 18 months

Of course, there are rumours about a big supply of large blocks of PEs and other institutional investors’ shares coming into the market. If that turns out to be true, you can see a further fall in price even from this level. And I have no idea what will be the price at which the slide will stop.

Remember, the market can remain irrational for longer than you can remain solvent.

We have a position sizing strategy at SSS, and we are going to stick to that.

However excited I am about CTT, it is just one of the 20 stocks in our SSS portfolio. Because I know that I have been wrong in the past and I can well be wrong again here. So don’t take it as a recommendation to buy CTT.

I now leave it to you to decide if CarTrade Tech is a Fallen Angel or a Value Trap. 🙂

Happy to take up questions and feedback in the comment section.

Thank you for reading.

Happy Investing 😊

P.S.: We did a deep dive into CarTrade Tech’s business in our 11th MissioN SMILE webinar in Jan 2022. If you like what you read above, you may like to watch the recording of the webinar here. To know more about MissioN SMILE. You may download our MissioN SMILE app on your Android phone. (iOS App coming soon ). Lots of free & premium sessions on investing for you to explore and learn. Subscribe to our free weekly newsletter here.🙂