About the Company

Apcotex Industries Limited is one of the leading producers of Synthetic Lattices (VP Latex, Acrylic Latex, Nitrile Latex) and Synthetic Rubber (HSR, SBR) in India.

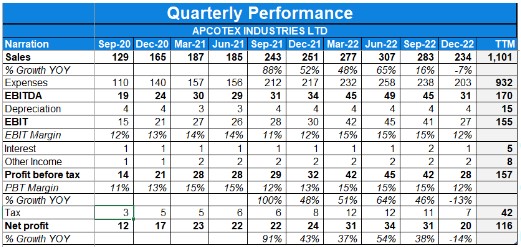

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a poor quarter with revenue and profits decreasing by -8% and -25% on a YoY basis respectively.

- FY23 Financials for the company were as follows :-

- Operational Revenue – INR 1080 Cr vs 956 Cr the previous year

- EBITDA – INR 158.5 Cr

- EBITDA margin – 14.7% vs 14.6% the previous year

- PAT – INR 107.9 Cr

- Net Profit Margin – 10%

- Q4FY23 Financials for the company were as follows :-

- Operational Revenue – INR 256 Cr

- EBITDA – INR 34.1 Cr

- EBITDA margin – 13.32%

- Net Profit – INR 23.2 Cr

- Net Profit margin – 9.06%

- The company crossed INR 1000 cr in Annual Revenue and INR 100 cr in PAT for the first time.

- Q4FY23 margins were impacted due to overall pressure on demand in Nitrile latex, while NBR margins returned to normalcy due to fall in import freight.

- CAPEX update as on 31st Mar’23 :-

- Multi-purpose Latex plant at Taloja commissioned with a capacity of 35,000 MTPA.

- Nitrile Latex plant at Valia commissioned with a capacity of 50,000 MTPA

- The company has declared a final dividend of Rs. 3.50 per share.

Investor Conference Call Highlights:

- The management states that for Q4, on a YoY basis the volumes are flat, while for FY23 the volumes are up 8% YoY.

- The management explains that Q4 EBITDA decline is also due to high cost raw materials and chemical inventory which is being carried on in the books. This is expected to be exhausted by April and May.

- Nitrile latex market continues to be extremely weak due 20%-30% lesser demand after covid, due to weak glove market. Nitrile margins are therefore lower than pre-covid levels.

- The management admits that being a new entrant it is difficult to get premium margins for the nitrile business. Overall, it is still bullish about the business for the long term.

- ApcoBuild has seen fantastic growth in the year. The management gives a guidance of 25%-30% for the growth of ApcoBuild for FY24.

- The management states there will not be much increase in the fixed costs due to the commissioning of the new plants.

- The company is not facing any competition intensity in the latex business due to it being mainly a regional business. Although, the company is facing issue in NBR due to lower freight rates.

- The company has seen a 28% growth in export volume in the fourth quarter and a 16% growth for the year FY23. They compete with European companies in some of the export markets.

- The management states that they can add up to 600-700 crore top line with the latex capacities that the company has added.

- The management states that the construction and waterproofing market in India has been growing significantly, with double-digit growth over the past 5-6 years. They expect this trend to continue over the next 5-10 years.

- The management states that they are predominantly an Asian company, manufacturing in India and catering to India and Asia. They are observing the growth in Asia and assessing where new capacities are coming up.

- The management states that they finished the year with strong numbers and are satisfied with their performance. However, they acknowledge that their projects were delayed by a few months.

- The management states that depreciation and interest will increase over the next two quarters due to the large CAPEX they have done in the last quarter. This will affect PBT numbers, but they will focus on EBITDA numbers.

- The management states that they have a treasury for potential non-organic acquisition growth or partnerships. They also want to have some liquidity for quick expansion decisions.

- The management states that they are looking at new products and are waiting to see if the current CAPEX cost will make sense in terms of returns. They will announce decisions about investments when the time is right.

- The management states that they have converted their 10,000-ton nitrile latex capacity in Taloja to a 35,000-ton multipurpose latex plant. This plant can make nitrile latex and other current products, and the demand for these is very strong.

- The management states that they expect to reach 100% plus capacity utilization for the new plant at some point in the following financial year.

- The management states that they have outsourced their treasury and wealth management to experts. They have invested about 70% in equity, which is broken up into equity mutual funds and some CMS.

- The management states that they are looking to grow both organically and inorganically. They are evaluating opportunities all the time and are looking to grow through a new product pipeline.

- The management states that they are mostly in South East Asia and the Middle East, with about 80-85% of their sales in this region. The rest is in Europe, China, America, and South America.

- The management states that they are growing quite well in the Southeast Asia and Middle East markets. Europe, North America, and Japan are not strategic markets for them due to the distance and time it takes to ship products.

- The management states that textiles, which was a very small part of their business 5 years ago, is now becoming a larger part of their business and a strong industry for them.

- The Taloja plant is expected to reach full utilization on a monthly basis in FY25.

- The management states that for NBR, the company continues to be the sole manufacturer in India, with capacity running at full. 15% to 20% capacity is expected to be freed up by March as nitrile latex is being made in the NBR reactor .

Analyst’s View:

Apcotex is a great small-cap company present in the latex and rubber area. It is a market leader for some of its products and has been in the industry for quite many years now. Its recent capacity expansion plans seem to be getting delayed, yet the plants that have been commissioned are expected to add greatly to the top-line. Seeing how well the market has placed the company in terms of its share price growth over the last few years, Apcotex definitely remains an important company to track with a huge future potential.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a poor quarter with revenue and profits decreasing by 6.7% and 14.3% on a YoY basis respectively.

- Quarterly Volumes grew by 1% as capacity was fully utilized.

- The EBITDA margins dropped to 13.07% due to

- Raw material and finished goods inventory losses in Q3-FY23 due to a sharp decline in prices • Lower margins mainly in some product categories due to weaker market demand and fall in ocean freight cost benefiting imported competition.

- PAT margins were 8.71%.

- Projects in Taloja and Valia are expected to be completed in Q4-FY23.

- The company have declared an interim dividend of Rs. 2 per equity share.

- Sales mix:

45% is our total solid rubber business which includes nitrile rubber, nitrile powder, nitrile PVC blend, and High Styrene Rubber

55% is latex, whereas out of 55%, 6-8% is nitrile latex. - Export contribution is 21-22% for the quarter.

Investor Conference Call Highlights

- The sudden fall in oil prices which is imported by the company coupled with high inventory days that the company keeps owing to geopolitical uncertainty led to inventory losses in the current quarter.

- The management indicates that in the last 2 years, it got a one-time benefit in the form of lower competition from imports due to high freight which has reduced in the current quarter & is expected to persist.

- The management expects some consolidation in the glove industry in the coming time.

- The company expects to reach 50,000-ton utilization in Nitrile latex capacity in a year Vs the previous guidance of 6 months as sales are directly related to relationship building.

- Although the glove industry is going through its deepest downturn, the management is quite bullish in the long term with the growth in healthcare requirements across the globe as well as a shift from natural latex gloves to Nitrile Latex gloves, it is well positioned in terms of geography, raw material pricing, and new plants at a reasonable CAPEX compared to most of its competitors.

- The company expects EBIDTA to improve from Q1.

- Sales decreased due to lower realizations Vs lower volumes.

- The delay in expansion was caused to a semiconductor shortage, which has now been resolved.

- The company faces difficulty in passing price hikes in Formula-based pricing contracts where total contribution stands at 25%.

- The company has been able to increase its margins in the past few years due to economies of scale & shift in product profile to specialty grades where margins are higher.

- In the Valia plant, the entire power comes from a captive power plant whereas, in Taloja, the company is dependent on MSCB.

- The company doesn’t have any plan for a major capex other than maintenance capex of 15-18 Crs.

- Taloja is a swing plant that can produce different types of products on the basis of demand. The revenue potential of the new capex of 200 Crs is 600-700 Crs.

- The expected utilization of nitrile capacity for the whole year is 40% while full utilization will be achieved by the end of the year.

- The company can do another 300 Crs of revenue in its new capex by doing incremental spending of 30-35 Crs.

- The management explains that despite facing heavy competition from imports in 40-45% of its product category, it has been able to maintain volume share.

- The management is confident of maintaining 20-25% ROCE on 5 year basis in its new capex despite margins being on the lower end.

- The company expects the glove/nitrile latex market to grow by 12-15% in the coming period where the capacity of gloves is outpacing the capacity of latex.

- The management explains that the two primary raw materials for latex is Butadiene (which is available near the plant of the company) and acrylonitrile (which is imported in large quantity at competitive rates) leading to no major raw material costs disadvantage.

- The company’s Taloja plant is highly automated leading to very low fixed costs.

- The company has appealed for anti-dumping duty & expects a favorable judgment soon.

- 40% of capex will be met through internal accruals.

- The end user industry split stands as 15% to 20% would be paper and paper board, construction : 15%, carpet: 10%, carpet textile put together would be 10%- 12%, tyre would be another 10% and Nitrile Latex is 7-8% and the rest is all rubber products which includes footwear, automotive, hoses, all different kinds of application from agriculture to auto to all different kinds of industrial hoses. Thus no single industry has more than 20% contribution.

- The expected peak debt is 180 Crs.

- The management states that “as long as we are price competitive and we assure them that we would be we have a high amount of stickiness with our customers. “

- Exports have grown by 11% YoY & contribute 20% of total revenues.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company had a poor quarter with sales & PAT degrowth. The management is aiming to expand the export outlook for Apcotex mainly through nitrile latex which is expected to rise to 70-75% of revenues in the next 2 years. The company is facing problems due to the downturn in the gloves industry. It remains to be seen how the company will be able to preserve its margins if there is further RM inflation and what obstacles it will face in its export expansion. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 285.65 | 245.11 | 16.54% | 308.20 | -7.32% | 1,305 | 1,105 | 18.10% |

| PBT | 41.88 | 28.71 | 45.87% | 45.26 | -7.47% | 455 | 353 | 28.90% |

| PAT | 30.79 | 22.26 | 38.32% | 33.55 | -8.23% | 357 | 289 | 23.53% |

Detailed Results:

- The company had a good quarter with revenue and profits growing by 16% and 38% on YoY basis respectively. On a QoQ basis, the numbers have decreased for Q2.

- Quarterly Volumes grew by 5% over Q2-FY22 and 16% over H1-FY22

- The EBITDA margins were reported at 15.96% for H1FY22.

- PAT margins were 10.88%.

- 5-6% volume growth YoY, 16% of revenue growth i.e. value growth for the quarter.

- Sales mix:

45% is our total solid rubber business which includes nitrile rubber, nitrile powder, nitrile PVC blend, and High Styrene Rubber

55% is latex, whereas out of 55%, 6-8% is nitrile latex. - Export contribution is 21-22% for the quarter.

Investor Conference Call Highlights

- The company continues to run at nearly 100% capacity utilization.

- The management stated both projects Valia and Taloja will be successfully completed in Q3 of FY23.

- The project in Gujarat (Valia) facility is only for gloves and the project in the Taloja manufacturing unit is a swing, the company could make many other latexes.

- The current thinking of the management is that they would first utilize the Valia plant’s capacity for the glove industry. For the Taloja new plant, they will focus on other products that they already have for styrene butadiene, styrene-acrylic latex, for paper carpet construction.

- The company is going to focus on manufacturing styrene butadiene latex because the management believes in the next year the glove industry is going to go through a tough time, the silver lining is styrene butadiene latex market has been extremely strong, whether it is in construction, carpet, paper.

- Total capacity for both plants is 60,000. 50,000 is attributable to the Valia project only for gloves and 10,000 to Taloja will be converted to Styrene, butadiene latex. The management stated they will be focusing on Styrene, and butadiene latex for the next few quarters because the company is running at full capacity and this seems to be a higher demand for those products.

- Earlier envision for 10,000 tons of nitrile latex in the Taloja plant, instead, management stated they will do much more of styrene butadiene latex than 10,000 tons. The company is still working through the details because the styrene butadiene latex, the cycle times are lower, and it will be able to manufacture more products from our Taloja plant.

- The management stated the glove industry is going through the deepest downturn.

- The management stated they have the ability to go up to 80,000 tons at minimal investment in the Valia plant; In Taloja as well they have left some place for additional capacity with minimal investment.

- The management expected that the margins in the first year for latex capacity will be much lower than then what we had anticipated. It seems lower than pre-COVID margins as well.

- The management expects the 60,000 tonnes of the capacity of latex, which is used in gloves, is a very small capacity compared to the 2 million tonnes of world capacity, hence it is not a challenge to sell this capacity. Management expects volume to come in the next 3-6 months.

- The company always looks for a return on capital of 20-25%; in the current scenario it will be difficult to achieve but it is achievable in the long term.

- The management talked about issues the company will be facing:

- The company’s competition is import as for 40-45% of the company’s product, there is no Indian manufacturer, and the company is benefited there due to higher freight costs, but they are 50-60% lower from their highs, slowly returning to normalcy. So that sort of benefit that the company had for a few quarters may not be there going forward.

- The company has a stock of higher-cost inventory, has increased its inventory days, and now the prices of their RM are coming down, which is going to play out in the next few quarters.

- Demand has cool off due to the macroeconomic global recession in Europe and probably in America, high-interest rates, war, and China’s going down.

- Management stated the lower revenue growth is mostly attributable to the realization coming off. On the volume front, the company is operating almost on 100% utilization, but Q2 in general, for the company, is like this because of the monsoon season, a couple of the company’s customer industries like carpet, footwear, etc are a little slower.

- The company has to rely on imports for RM sourcing as styrene is a major RM for the company and there’s no Indian manufacturer providing the same. The company has been successful in quite a few raw materials of developing and working with suppliers to develop indigenous sources.

- The management stated while they expect a more challenging environment, they are going to focus on market share, improving quality, and consistency, introducing some new products, focusing on all the approvals, customer approvals, and most importantly, focus on a healthy balance sheet.

- The management stated if the gloves market stays under pressure for longer than expected, in this worst-case scenario they can use part of the latex manufacturing capacity at Valia towards captive NBR production, but for that, there is a reasonably sizeable investment required. NBR for the last many two-three years the company is running at full capacity.

- For NBR, the company has sort of started the process of detail engineering of the plan, updates will be given next few months.

- The company started selling specialty products to Asian paints, which they launched under the SmartCare brand of products and Apcotex is supplying to the construction chemical portfolio. There is no arrangement for getting any part of the distribution benefits from Asian paints.

- The company’s sweet spot for exports is the Middle East and Southeast Asia, where the freight cost is not a very large percentage of the total cost of the product.

- The Valia plant is a Brownfield project, so lower fixed cost, and it’s a highly automated plant, so management estimates the breakeven at the EBITDA level to come in a few months

- The management stated company’s competitors in Europe are facing a really tough and competing task, raw material prices in Europe for them are significantly higher than in Asia. Conversion or power and gas prices are currently significantly higher so the company has seen a lot of interest from not only European final customers but also customers in Asia, for specialty products, so the company has seen an opportunity to work with certain customers and developed certain specialty products that the company will not have in its range, within the same, styrene-butadiene, styrene acrylic, vinyl butadiene, VP latex range; the management also decided that current focus is at Taloja facility only on the company’s current products and focus on nitrile latex from Valia.

- Growth drivers according to the management:

- Nitrile latex will continue to be a growth driver, the issue is margin, not volumes.

- Taloja facility, the company could make more styrene butadiene latex and styrene acrylic latex and so that’s going to be another growth driver

- The company’s 8% to 10% of business is to the tyre industry and around 8% to 10% is to the auto industry.

- Key raw materials for the company are Acrylonitrile and Butadiene, Butadiene is manufactured in India and it’s very close to the company’s plant; Acrylonitrile is all imported into India.

- The management stated new capacities are expected to start contributing from Q4, but if CTO takes longer time, a major effect we will see in FY24.

- New capacities are expected to contribute more than 500 crores of revenue.

- Going forward, the management stated that exports will go higher; Because of nitrile latex for gloves which is largely for export, export should be much higher around 35 to 40% of total turnover.

- The management stated they supply latex to the tyre industry, and it is a very small portion of the whole cost of the tyre, hence tyre companies generally don’t move to other suppliers, even if they get the product at a 50% lower price.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company had a good quarter with handsome growth in revenue and profits YoY but muted growth on a QoQ basis. The management is aiming to expand the export outlook for Apcotex mainly through nitrile latex which is expected to rise to 70-75% of revenues in the next 2 years. The company is facing problems due to the downturn in the gloves industry. It remains to be seen how the company will be able to preserve its margins if there is further RM inflation and what obstacles it will face in its export expansion. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 279 | 189 | 47.6% | 253 | 10.3% | 965 | 546 | 76.7% |

| PBT | 42 | 28 | 50.0% | 32 | 31.3% | 130 | 57 | 128.1% |

| PAT | 31 | 22 | 40.9% | 24 | 29.2% | 99 | 44 | 125.0% |

Detailed Results:

- The company achieved its highest-ever quarterly revenue of Rs 279 Cr, up 47% YoY, on the back of strong volumes and an increase in realizations.

- Quarterly Volumes grew 24% YoY with Export contribution growing to 20% of overall revenues.

- The company earned EBIDTA of Rs.45.3 Cr at an EBIDTA margin of 16.32% growing 27 Bps YoY.

- The company’s expansion project is expected to get completed by Q3 FY23.

- The company has recommended final dividend of Rs.3 & total dividend of Rs.5 for FY22.

- EBIDTA margins for the FY22 stood at 14.6% while PAT margins stood at 10.3% & asset turnover ratio at 6.1 times.

Investor Conference Call Highlights:

- The company is currently running at 100% capacity utilization rates.

- The management believes the company’s performance should be judged through its EBIDTA per tonne or volumes rather than revenues.

- The management has grown Apcobuild by more than 130% in the current FY although it remains at a small part of the revenue mix.

- The company expects its Taloja plant to start revenue generation from Q3 and expects the demand to remain strong given the current inquiries.

- The company’s profit was positively impacted by 10-12% due to the higher price of its inventory of oils.

- The company endeavors to remain in the 13-17% EBIDTA margins bracket provided no major macroeconomic shocks.

- The management has incurred a cash outflow of 40% of the total project cost of Rs.190 Crs

- 60:40 was the latex: rubber revenue mix in Q4.

- 7 out of the 11% QoQ growth is derived from volume growth while the remaining 4% is due to realization increase.

- The management’s primary focus is currently on supply chain management due to high volumes of raw material import which risk has further increased due to high shipping rates and shortage of supply due to war.

- The company expects to get technological transfer benefits from its acquisition.

- The key drivers of EBIDTA per tonne growth is due to passing of price increase, tailwinds, high-capacity utilization & benefits of the price increase of its stock.

- The strong growth is due to import substitution in the domestic market coupled with several internal initiatives leading to the company being no.1 in almost all of its product categories.

- The company doesn’t opt for buyback due to the lower liquidity of the stock

Analyst’s View:

Apcotex is one of the very few synthetic rubber makers in India. The company continued its good momentum from Q3 and achieved its best-ever sales, volumes, and exports in Q4. The margin profile improved by 27 bps QoQ. The management is aiming to expand the export outlook for Apcotex mainly through nitrile latex which is expected to rise to 70-75% of revenues in the next 2 years. It remains to be seen how the company will be able to preserve its margins if there is further RM inflation and what obstacles will it face in its export expansion. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q3FY22 Updates

Financial Results & Highlights

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 253 | 166 | 52.4% | 245 | 3.3% | 686 | 358 | 91.6% |

| PBT | 32 | 21 | 52.4% | 29 | 10.3% | 88 | 29 | 203.4% |

| PAT | 24 | 17 | 41.2% | 22 | 9.1% | 68 | 22 | 209.1% |

Detailed Results:

- Across all financial parameters the company has reached historical highs in Q3-FY22.

- Quarterly Volumes grew YoY for both Q3 and 9M-FY22 due to:

- Full benefits of all debottlenecking projects achieved from November 2021 – almost maximized capacities.

- Broad-based volume growth was seen across most industries, customers, and geographies.

- Export sales contribution grew to 21% of overall sales to INR 53 Cr in Q3-FY22.

- Quarterly Operating EBITDA grew by 13.5% YoY to INR 33.90 Cr.

- Quarterly PAT grew by 41% YoY to INR 23.78 Cr.

- Work on new expansion projects is on schedule and is expected to be completed around Q2/Q3 of FY23.

- The company has declared an Interim Dividend @ Rs 2/- per equity share and the Board has fixed 11th February, 2022 as record date for the same.

Investor Conference Call Highlights:

- The company achieved its highest-ever quarterly sales volume including the exports.

- The Capex plan of INR 130 to 140 crores, which was started from 1st October 2020 would be completed by 31st December 2021.

- The XNBR project for manufacturing latex for the hand gloves is about INR 100 crores project.

- The detailed design for XNBR Project is completed and Company is currently working on the implementation of the plant which, is subject to permission and necessary approvals.

- Debottlenecking at Taloja is approximately INR 15 crores project help to increase the latex manufacturing facility by about 15% to 20%.

- Regarding the anti-dumping side of the Korean Sunset Review, the DGTR has recommended the extension of duty for another five years on 24th November 2020 however Company is still waiting for the final notification from the Department of Revenue, Ministry of Finance.

- Apcotex has filed a fresh petition against other countries like Russia, China, Japan, and European Union. The public hearing has been completed against the Petition and awaiting the final finding.

- A large chunk of the overall revenue growth has come from the volume growth and part of its from net realization and product mix according to the management.

- The company is making more latex with the product mix currently at about 55% latex and 45% synthetic rubber.

- Out of the rubber, around 30%-35% is coming from NBR and about 10% is coming from high styrene rubber.

- Out of the latex out of 55%, about 20% is for paper and paper board, 10% is for construction, 10% is for tires and now about 10% is for Nitrile Latex and the remaining 7%-8% is for carpet and textiles.

- The company is not back to the historic margins as far as the NBR portfolio is concerned.

- Compared to Q2, Q3 Capacity utilization was much better at almost 90%-95% utilization across the board.

- Debottlenecking at Taloja will become available for production by May or June.

- The next project lined up is to double the NBR capacity. The company is still waiting for one final permission to start XNB projects.

- Currently, about 8% to 10% of revenue is coming from XNB latex for gloves.

- The management expects the next five years to be quite strong for the glove market and therefore with the margins expected to be good, they expect a turnover of about 300 to 350 crores.

- The company will focus on the latex project first and thereafter on the rubber project. Only for NBR, 40%-50% of the industry imports are coming from Korea and about 40% of the imports are coming from these three or four regions Japan, China, Russia, and EU

- Issues on shipping are there but long-term contracts help Company however Company is paying higher rates in the last three months.

Analyst’s View:

Apcotex is one of the very few synthetic rubber makers in India. The company continued its good momentum from H1 and achieved its best-ever sales, volumes, and exports in Q2. The margin profile remained subdued but mainly due to raw material price inflation and a rise in shipping costs. But operating EBITDA margin has risen to 13.5%. The debottlenecking efforts are expected to come online in Q1FY23. The management is aiming to work on a new capex program to double the capacity of the NBR for the company. It remains to be seen how the company will be able to bring back margins to previously high levels and what obstacles will it face in its export expansion. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q2FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Cr) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 245 | 130 | 88.36% | 188 | 30.63% | 433 | 191 | 126.50% |

| PBT | 29 | 14 | 100.07% | 28 | 4.21% | 56 | 7 | 666.6% |

| PAT | 22 | 12 | 91.40% | 22 | 1.83% | 44 | 5 | 789.52% |

Detailed Results:

- The company achieved its highest-ever quarterly revenue of Rs 245 Cr, up 88% YoY, on the back of strong volumes and an increase in realizations.

- It also saw the highest ever quarterly export sales of Rs 49 Cr, contributing to 20% of overall revenues.

- The company earned its highest-ever absolute EBITDA but EBITDA margin was lower by 141 bps YoY and 292 bps QoQ in Q2 due to:

- increase in shipping rates for both imports and exports,

- disruptions in certain raw materials,

- increase in the cost of manufacturing for some products due to an increase in Coal/Gas prices.

- Major debottlenecking projects completed between July and October 2021 have allowed for an additional 10-15% growth.

- Investments in the 2 projects in Taloja & Valia are expected to be Rs 180-190 Cr over the next 4 quarters.

- Escalation in capex costs expected on account of commodity price increases

- NBR anti-dumping appeal filed in CESTAT again.

Investor Conference Call Highlights:

- The company also saw its highest-ever volumes sold in a quarter in Q2.

- The management is satisfied with the current EBITDA margin profile which is under pressure on multiple fronts like RM costs and shipping container unavailability.

- The company is expanding Apcobuild to MP and rural regions in Gujarat and Maharashtra. The management is expecting 100%+ growth in the Apcobuild business.

- The company may take from 3-6 months to pass on any cost increases to customers.

- The management has stated that the demand outlook looks to be strong for the next 6 months.

- The management admits that raw material sourcing is the area with the biggest risk currently for Apcotex.

- The management expects to have volume growth of 10-15% in the next 1 year with additional capacity created by the debottlenecking.

- Given the current prices for the products, the management expects the revenue potential of the 2 new plants to be at Rs 600 Cr+.

- The company will be doing around Rs 220-230 Cr of capex in total in the next 12-15 months. This includes maintenance capex and a new zero liquid discharge plant in Valia.

- The management expects exports to account for 35-40% of sales after 2-3 years.

- The exports sales will be higher margin earning than domestic sales especially for nitrile latex for gloves which have only 5-6 global makers.

- Apcotex was running near full capacity utilization in the Taloja and Valia plants in Q2.

- The construction in Valia has started in the last 2-3 months and the Taaloja construction will start after Diwali.

- The management expects that 50-60% of sales from the new plant should be in the form of fixed contract sales to large customers.

- The growth for Apcotex will be driven by nitrile latex for gloves for the next 2 years at least according to the management.

- The company will wait and see how the situation in the NBR space pans out in the next 6-8 months before taking any action in this business segment.

- Both new facilities should come online by Q2FY23 according to the management.

- The management expects nitrile latex to rise in revenue share to almost 70-75% in the next 2 years.

- Although the company does have some form of low-cost advantage in exports, it is looking to differentiate itself by providing customized products for its customers. The company also provides technical services at the time of sales where its teams help its customers utilize its products at the lowest cost possible. This is another differentiating factor that the management hopes to develop for Apcotex in export markets.

- The management states that Apcotex is holding on to investments of Rs 110-120 Cr mainly as a cash buffer for sudden RM cost inflation or possible acquisition opportunities.

Analyst’s View:

Apcotex is one of the very few synthetic rubber makers in India. The company continued its good momentum from Q1 and achieved its best-ever sales, volumes, and exports in Q2. The margin profile suffered a drop of 292 bps QoQ mainly due to raw material price inflation and a rise in shipping costs. The debottlenecking efforts are expected to result in volume growth of 10-15% in the next 1 year before the new capacity comes online. The management is aiming to expand the export outlook for Apcotex mainly through nitrile latex which is expected to rise to 70-75% of revenues in the next 2 years. It remains to be seen how the company will be able to preserve its margins if there is further RM inflation and what obstacles will it face in its export expansion. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q1FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 188 | 62 | 203.23% | 189 | -0.53% |

| PBT | 28 | -7 | 500% | 28 | 0.00% |

| PAT | 22 | -7 | 414% | 23 | -4.35% |

Detailed Results:

- The revenues for the quarter were up 203% YoY. QoQ growth was almost flat showing good momentum for the company.

- PBT & PAT showed good improvement in Q1. They were up 5 times and 4.14 times YoY respectively.

- The company saw its highest ever export sales at 24% of overall revenues for the quarter.

- The operating EBITDA margin was at 15.82% in Q1.

- Volumes sold were a little lower than Q4 due to 2nd wave of COVID-19.

- Despite recommendation of DGTR, Ministry of Finance has not put up the anti-dumping duty on NBR imports to India.

- All debottlenecking projects will be completed in Q2, providing an extra revenue of Rs 60-70 CR per year.

- The company has announced a final dividend of Rs 2 per share.

Investor Conference Call Highlights:

- The company has obtained environmental clearance in Q1 to start the construction for 2 new brownfield projects, 1 each at Valia and Taloja plants. The total Capex for these new projects is expected to be around Rs 140-150 Cr which will be incurred in the next 4-5 quarters.

- The management has stated that it is confident of maintaining and improving the margin profile from current levels as the company continues to operate at a high capacity-utilization level and the product portfolio improves.

- The 2 capex projects approved are both for latex. The Valia project is expected to cost Rs 110 Cr while the Taloja project is expected to cost Rs 35-40 Cr.

- The company has applied for environmental clearance for the expansion in NBR and it has time till the clearance is passed to decide whether to go ahead or back out from it.

- The management has stated that exports should stay in the range of 20-25% of sales. Almost 80% of exports go to Southeast Asia and the Middle East.

- The Apcobuild business has expanded to Gujarat, Madhya Pradesh, and Goa now.

- Although raw material prices are going up, the management is confident of maintaining EBITDA/ton at current levels going forward.

- The Valia project is expected to add 50,000 MTPA capacity of XNB latex and has a revenue potential of Rs 400 Cr at current prices and Rs 500 Cr at full capacity. The Taloja project adds another 10,000 MTPA capacity of XNB latex and also provides flexibility to make other kinds of latex.

- The company has enough cash to fund the next 1 year of operations and the management is confident of funding the planned expansion using internal accruals.

- In FY21, the growth was led by volumes while in Q1, it was a combo of both volumes and value according to the management.

- The capacity added after debottlenecking should be sufficient for functioning till the new capacities get added in FY23 according to the management.

- Any new capacity will take around 6 months to 2 years to ramp up.

- The company will follow its policy to pass on any cost increases to the end customer.

- The major advantages for the company in the latex for gloves space are the increased demand due to focus on hygiene and the company’s decision to develop in this space 4-5 years ago. The early development allowed Apcotex 2-3 years to develop its product and build customer relationships.

- The XNB latex for gloves market is expected to grow at a CAGR of 10-12% for the next 5-7 years. The company will be aiming to reach 100,000 MTPA sales in this segment but it will hardly be able to cross 5-6% of the total market demand.

- The development of downstream products in India especially styrene and acrylonitrile are especially good for the industry as it ensures the security of supply as compared to staying dependent on imports which may get disrupted due to several reasons. This will also enable local producers to become more price competitive.

- The company is still decided on doubling the NBR capacity because the higher capacity will help it become more competitive as economies of scale come into play. Another reason for persisting here is that a major competitor of Apcotex in NBR had announced recently that it will be shutting down its NBR business by December.

- The company has seen growth at all end-user industries for latex and it expects this demand momentum to persist.

- The market share in India of the exiting competitor in the NBR space is around 7-9%. The company is optimistic about the NBR growth as it already has a 25% market share and is running at full capacity and this new expansion will allow it to capture more market share.

- The management expects to maintain the margin levels at 13-16% in the next 4 quarters.

- The demand for NBR from the auto sector is agnostic of engine type and thus it will not be impacted negatively by the transition from ICE to electric vehicles in India in the future.

- The revenue breakup in FY21 was at 55% latex and 45% rubber. The latex share increased to 65% in Q1, and the management expects it to stay at 55-60% for FY22.

Analyst’s View:

Apcotex is one of the very few synthetic rubber makers in India. The company continued its good momentum from Q4 and posted almost similar numbers as its best-ever quarter of Q4FY21. The margins have stayed close to 16% for the company and the management expects it to stay in the range of 13-16% in the next 4 quarters. The company is now looking to start the capacity addition of the XNB latex at Walia and Taloja with construction starting in Sep. The antidumping petition by the company has not been implemented by the Ministry of Finance. Despite this, the management is confident about the NBR expansion as a competitor with a 7-9% market share has recently announced that it will be quitting the NBR business by Dec 2021. To cope with the delay in capacity expansion in XNB latex, Apcotex is looking to expand capacity by 10-15% through debottlenecking which will be over by Q2. It remains to be seen how the demand for the company’s products remains resilient and whether the current margins and demand profile remains sustainable. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q4FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 189 | 117 | 61.54% | 166 | 13.86% | 547 | 502 | 8.96% |

| PBT | 28 | 5 | 460% | 21 | 33.33% | 57 | 25 | 128.00% |

| PAT | 23 | 3 | 667% | 17 | 35.29% | 44 | 17 | 158.82% |

Detailed Results

- The revenues for the quarter were up 61.5% YoY.

- PBT & PAT showed tremendous improvement in Q4. They were up 4.6 times and 6.7 times YoY respectively.

- The company had its highest-ever revenues, export volumes, EBITDA, PBT & PAT in a quarter in Q4.

- The operating EBITDA margin improved to 16.05% in Q4 from 6.83% last year. Operating EBITDA for FY21 was at 12.67%.

- FY21 performance was good despite the poor performance in Q1 from the lockdown. Revenues were up 9% YoY while profits were up 159% YoY.

- The company has scaled up of production/sales of XNB latex for Gloves from existing plants with both plants running at near full capacity.

- The hearing on the anti-dumping petition is done and the company expects a result in Q1FY22.

- The company has announced a final dividend of Rs 2 per share.

Investor Conference Call Highlights

- The commissioning of the construction of new capacity for XNB latex for gloves was delayed due to a delay in obtaining the statutory clearances from the environmental department.

- The management expects some amount of debottlenecking to happen which will allow Apcotex to be able to deliver even higher volumes than at present and thus EBITDA/ton which is high right now will have even more room to rise.

- Since the Valia plant has not gotten clearance for XNB latex for gloves, the company is looking to increase capacity at the Taloja plant where it is being made currently. This expansion will be announced in Q1.

- The company can expect some indirect tailwinds in the tires industry due to the announcement of anti-dumping duty in the industry.

- Exports accounted for 20% of sales in Q4.

- Currently, NBR accounts for 30% of sales. The anti-dumping measure sought by Apcotex is for this segment only.

- The management has stated that with the addition of the planned capacities for XNB for latex, the annual sales figure can go up by Rs 350-500 Cr in the next 2 years.

- The company is looking at exports to help soften the impact on domestic sales from the 2nd wave of COVID.

- The export market share of Apcotex is very small right now and the management is optimistic about its growth prospects in the future 3- 5 years from now.

- The management is confident of sustaining current margins going forward and has stated that Apcotex is comfortably positioned to deliver an EBITDA margin of 14-15% a year.

- At current prices, the management is confident of delivering an asset turnover of 4+ from the XNB latex capacity.

- The management has stated that as it gets the environmental clearances, it will start construction of the Walia capacity and will complete it within 6-8 months. It is also confident of getting the required permissions for the Taloja expansion by Q1FY22.

- The company has a long-term debt of Rs 7-8 Cr and a cash position of 80-90 Cr.

- The management admits that there is uncertainty as to how demand will shape up for certain industries, but it remains confident that the packaging industry and gloves demand should remain strong.

- It also maintained that with the addition of the new pillar of gloves, the revenue stability has increased and should be much steadier now.

- The management admits that to be able to compete with international players in the NBR space, it will need to double its capacity and be able to cater to 50-60% of the domestic market. It is planning on using the breathing space from the anti-dumping duty to do exactly this and become competitive as soon as possible.

- The planned capex for FY22 is around Rs 100-150 Cr depending on the capacity expansion schedule. Thus, the revenues from the planned capacity additions are expected to come from FY23 onwards.

- The management has stated that the entire industry was affected by supply chain delays due to the Suez Canal blockage. It doesn’t expect any major issues arising from the raw material side in the foreseeable future.

- The debottlenecking operation should be done by Q1 and thus the additional capacity of 5-10% will become available. The capacity expansion for NBR, should it happen, will require 3-6 months to set up.

- Southeast Asia and the Middle East remain the main export markets for Apcotex.

- The management is confident of achieving >10% volume growth in FY22 as volumes for Q1FY21 drags lower the total for the year.

- Paper & paperboard accounts for 20% of sales with a large chunk of it in packaging. Tire and construction account for 10% each while footwear accounts for 10-12%. Auto accounts for 15% while other rubber applications account for 15-20%.

- The expected cost of the potential NBR expansion is expected to be around Rs 180 Cr.

- The management has stated that it will start looking for a 3rd plant location after all the currently planned expansions are completed.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company had its best-ever quarter again with its highest revenues, export volumes, EBITDA, and record profits. The margins have also risen above 16% for the company and the management expects it to stay in the range of 14-15% going forward. The company is now looking to start the capacity addition of the XNB latex at Walia as soon as it gets the required permits and the monsoons end. The antidumping petition by the company is still pending approval but is expected to get a decision by Q1FY22. This has caused the management to maintain its pause on its plans to expand NBR production lines. To cope with the delay in capacity expansion in XNB latex, Apcotex is looking to expand capacity by 5-10% through debottlenecking which should be over by Q1. It remains to be seen how the demand for the company’s products changes going forward and whether the current margins and demand profile remains sustainable given the uncertainty in the country from the 2nd wave of COVID-19. Nonetheless, given the company’s industry-leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on-track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q3FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 166 | 111 | 49.55% | 130 | 27.69% | 358 | 385 | -7.01% |

| PBT | 21 | -2 | 1150% | 14 | 50.00% | 29 | 19 | 52.63% |

| PAT | 17 | -1 | 1800% | 12 | 41.67% | 22 | 14 | 57.14% |

Detailed Results

- The revenues for the quarter were up 49.6% YoY.

- PBT & PAT showed tremendous improvement in Q3. They were up 50% and 42% QoQ respectively.

- The company had its highest-ever revenues, volumes sold, EBITDA, PBT & PAT in a quarter in Q3.

- The operating EBITDA margin improved 14.21% YoY to 14.76% in Q3.

- 9MFY21 performance was mixed from 9MFY20 due to the poor performance in Q1 from the lockdown. Revenues were down 7% YoY while profits were up 57% YoY.

- The design phase for XNBR Latex for Gloves in the Valia plant is done.

- Directorate General of Trade Remedies (DGTR) recommended extending duty for another 5 years on November 24, 2020 from South Korea. Apcotex has applied for similar duties against Russia, China, Japan & EU.

- The company has announced an interim dividend of Rs 1.5 per share.

Investor Conference Call Highlights

- The company is aiming at delivering ROCE of 20-25%.

- The management has stated that the company maintains its top 2 position in almost all operating categories. 80-85% of sales are domestic while 15-20% are from exports.

- Although the company had a good quarter, the management was cautious and admitted that the low base in Q3FY20 also helped make the YoY growth number more noticeable.

- The current revenue mix is around 55% latex and 45% synthetic rubber.

- Currently there still isn’t any anti-dumping duty on NBR in India.

- The management is confident that the govt will take steps to ensure the stability of local manufacturers and will crackdown on dumping in the industry.

- Almost all of the end industries that Apcotex caters to have bounced back well especially the auto industry with the resurgence of 2 wheelers & passenger vehicles.

- The high margins in Q3 were a result of many factors which include:

- Pent-up demand post reopening.

- Construction industry rising post monsoons.

- Low raw material prices.

- Better product mix with a shift towards latex.

- Q3 capacity utilization was at 90-95% across all lines for Apcotex.

- The debottlenecking project in Taloja is expected to be done by May or June 2021.

- The company has plans ready to double NBR capacity but the management decided to pause it till the situation regarding dumping gets better.

- During the year when the demand for construction and plastic products was low the company was able to repurpose the spare capacity to make XNB latex for gloves which has since grown tremendously in demand.

- Currently 8% to 10% comes from XNB latex for gloves. The company is planning to expand this steadily and also invest in developing adjacent products.

- Most projections show that the glove industry is going to do extremely well in the next 3 to 4 years. The full capacity sales from the XNB project is expected to be Rs 300-350 Cr per year.

- In Phase 1, the full capacity revenue generation is at Rs 100 Cr for XNB.

- In the 45% sales from synthetic rubber, 35% is from NBR and 10% is from high styrene rubber. In NBR, around half is from auto and the rest is from other applications.

- In the 55% sales from latex, 20% is from paper, 10% is from construction, 10% is from tires, 10% is from nitrile latex where 7-8% is from textiles.

- Volumes growth in Q3 was above 40% YoY.

- In NBR imports, 40-50% of imports come from South Korea and 40% come from Japan, China, Russia and EU combined.

- Apcobuild is still a small part of the overall sales for the company and although it has been growing, the company is looking to build it slowly and profitably due to high competition and the rigors of building up a portfolio and distribution network in the space. It is now operating in Maharashtra, Gujarat and Goa only.

- The management looks to maintain an asset turn of at least between 3% and 5% turnover ratio when there are new investments for expansion. This can rise to up to 7 times once the expansions are fully integrated.

- The current quarter was also the best on record in terms of EBITDA per ton for Apcotex.

- According to the management, the 2 main core competencies for Apcotex are:

- The wide range of products on offer with the capability to switch between products with the same machinery.

- The depth of knowledge about customer technology and processes enabling products to evolve with customer preferences.

- Raw material costs will continue to for at least 60-70% of costs for the company as it is a B2B business and it will stay so unless the company changes its business model.

- The company remains cash positive and has liquid reserves above Rs 20 Cr.

- The management has stated that the projected new capacities will come online in a step by step fashion and these steps have been planned to be able to meet expected demand at different points in the upcoming timeline. The only factor that can delay the demand expectations is customer approvals.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company had its best ever quarter with its highest revenues, sales volumes, EBITDA and profits on record. The margins have also risen above 14% for the company due to better product mix and low RM prices. The company is now focusing on capitalizing on the strong demand for gloves and is concentrating on expanding sales for XNB latex for gloves. The antidumping petition by the company is still pending approval and this has caused the management to maintain its pause on its plans to expand NBR production lines. It remains to be seen how the demand for the company’s products changes going forward and whether the current margins and demand profile remains sustainable. Nonetheless, given the company’s industry leading position in the domestic market, the prudent management of the company, and the management’s optimism from its on track Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q2FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 130 | 126 | 3.17% | 62 | 109.68% | 192 | 274 | -29.93% |

| PBT | 14 | 5 | 180.00% | -7 | 300.00% | 7 | 21 | -66.67% |

| PAT | 12 | 4 | 200.00% | -7 | 271.43% | 5 | 15 | -66.67% |

Detailed Results

- The revenues for the quarter were up 3% YoY.

- PBT & PAT showed tremendous improvement in Q2. They were up 180% and 200% YoY

- The company had its highest volumes sold in a quarter in Q2.

- The operating EBITDA margin improved 883 bps YoY to 12.31% in Q2.

- H1FY21 performance was still down from H1FY20 due to the poor performance in Q1 from the lockdown.

- The company has completed all Phase 1 projects- 3 years Capex Plan of Rs 100 Cr (FY18, FY19, and FY20). The benefits of cost reduction and enhanced capacity have started accruing.

- The new capex plan for the company is Rs 130-140 Cr starting Oct 1, 2020, to 31 Dec 2021. These funds are for XNBR Latex for Gloves in Valia and other de-bottlenecking, efficiency, and EHS projects across both plants.

Investor Conference Call Highlights

- The process for the anti-dumping petition from the company is still going on.

- Almost all of the company’s end-user industries have seen a good rebound post lockdown except for construction.

- The management has stated that a principal reason for the company’s growth and performance in Q2 is XNB Latex. Since demand for the product was very strong, the management decided to invest some money and make its existing facilities flexible to make XNB Latex which helped in the end.

- The volume growth for Q2 has been 18% YoY. The growth in value terms is much less as RM prices are subdued as compared to last year.

- Another good reason for the growth & margin expansion in Q2 was the pent-up demand. The launch of a few new products also helped expand the margins.

- The revenue mix between latex and XNBR is at 50-50 currently.

- The management expects volume growth to carry on in Q3 as well while realizations can also go up once RM prices come up.

- The new project of XNMB Latex for Gloves is expected to cost around Rs 100 Cr and is expected to yield Rs 300-325 Cr of revenue. As capacity rises, investment per tonne is expected to go lower and lower in the future.

- The capacity after the proposed expansion is at 40,000 tons for XNBR Latex for Gloves.

- The company also has plans for expansion of the core NBR line for Rs 150-180 Cr in the next 15 months.

- The maintenance capex for the company is at Rs 10-15 Cr per year.

- One big uncertainty that the company faces while executing any capex project is the environmental consent which may get delayed more than expected due to COVID-19.

- NBR remains a challenging space for the company due to the dumping by international players in the absence of any anti-dumping measures.

- NBR contributes to 30-35% of the company’s revenues. The company faces almost no local competition in this segment.

- High styrene rubber contributes to 12-15% of revenues. The company faces low competition locally but has a few international competitors in this space.

- Apcotex is the only maker of XNB Latex in India. Its main competition is international makers, most of which are based in Asia.

- The management has stated that the latex market is less commoditized due to demand for specialty products which increases the stickiness of customers.

- But for rubber products, the market is essentially commoditized where price a principal factor and customers may work with a product that is not the best quality if the prices are good. These are the segments where there is significant dumping by international players who may be selling at 15-30% lower prices than local sustainable levels.

- The debottlenecking of the NBR plant has increased its capacity from 15-16 thousand tons to 21-22 thousand tons.

- The debottlenecking of the 55,000-ton latex capacity is still going on and is expected to increase the current capacity by 20%. By the end of 2021, the company expects to have a capacity of above 70,000 tons in latex.

- XNB latex is currently at 10% of sales.

- The management has refrained from providing any margin guidance as it is still too early to tell whether the current demand is sustainable and how RM prices will fare in the future.

- The company is looking to target margins of near 15% for sustainable good growth.

- EBITDA per ton has also improved YoY along with EBITDA margins.

- Inventory levels have gone down in H1FY21 as compared to Q4FY20 as a lot of product dispatch was held up in March due to the lockdown which led to an inventory pileup.

- The management is not worried about the total dependency on imports for 2 of its raw materials as it has multiple international suppliers for each of them which can be supplied through multiple routes.

- The year so far has been challenging for Apcobuild as the whole construction industry has been very slow in the last 6 months. The company is currently focused on building the brand slowly and is even outsourcing some products to complete the set of product offerings under the brand.

- Although RIL has started making NBR, the management feels that the NBR market is not big enough for such big companies to get attracted.

- The company has reduced the number of grades in NBR and is focusing on customer approval and quality. It has also gotten more approvals than last year and has seen capacity utilization increase due to improvement in quality.

- The export contribution was at 16-17% of sales in H1.

- Exports in the gloves and carpet segments are expected to improve in the near future.

- There is still uncertainty about Q3 due to the announcement of lockdowns in major EU countries.

- The industry shift from natural latex to nitrile latex for gloves has been on the cards for a long time and the immediate surge in demand due to COVID-19 has only accelerated this shift. The demand for gloves and PPE has also increased a lot since COVID-19 and is expected to be sustainable as no one wants to face any critical shortage of protective equipment in the future as it happened at the start of COVID-19 in almost all countries.

- The company is looking to target 3-4% of the world market in gloves. The management expects XNB Latex for gloves to contribute to 50% of sales by FY23.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company had a very good quarter with an EBITDA margin expansion of more than 800 bps and its highest ever quarterly sales volumes. Exports were encouraging but the domestic demand has bounced back well for the company. The company is now focusing on capitalizing on the strong demand for gloves and is concentrating on establishing a direct facility for making latex for gloves in its Valia plant while servicing current demand with some of its machines that have been modified to make XNB latex for gloves. The antidumping petition by the company is still pending approval and this has caused the management to maintain its pause on its plans to expand NBR production lines. It remains to be seen how the demand for the company’s products changes going forward and whether the current margins and demand profile remains sustainable. Nonetheless, given the company’s industry position, the prudent management of the company, and the company’s optimism as deduced from its increased Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q1FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 62 | 148 | -58.11% | 117 | -47.01% |

| PBT | -7 | 16 | -143.75% | 5 | -240.00% |

| PAT | -7 | 11 | -163.64% | 3 | -333.33% |

Detailed Results

-

- The revenues for the quarter were down a lot with a fall of 58% YoY.

- Similarly, PBT & PAT fell into negative territory in Q1. This was because of lower volume sales coupled with high cost inventory

- Operating EBITDA fell to Rs (4.3) Cr.

- Both plants were closed since last week of March and resumed production from end of April. Current production in June was at 80-85% of pre-covid levels.

- The Rs 100 Cr for Capex phase 1 was completed. Capacity enhancement in Valia is expected from Q2.

- The new project for XNBR gloves is in design phase and construction should start in Q3 once environmental consents are obtained.

Investor Conference Call Highlights

- Dumping of NBR in India continues and South Korea accounts for 50% of these imports. Fresh antidumping petition has been filed in Q4 FY20 against Russia, China, Japan and European Union. The case was initiated by the designated authorities in Q1 FY21.

- The capex for the XSB latex has gone up from Rs 70 Cr to Rs 100 Cr to be spent in FY21 and FY22.

- The company has currently put on hold the plans for the second NBR line and it will revisit this once the antidumping petition has been resolved.

- By Q3FY21, the management expects the company to be making around 4 times NB latex for gloves as it did pre-covid.

- The churn in equity investments has been high recently as the company has shifted advisors and has reduced its equity exposure.

- The management has stated that the demand for nitrile latex for gloves is even higher than demand for natural latex for gloves.

- With the capex in the latex for gloves, the company is targeting 3% of global demand which is 45,000 tons per year.

- The revenue at full capacity for this volumes is at Rs 300-350 Cr at current prices.

- The breakup in Q1 was at 70% latex and 30% NBR in value terms.

- Packaging and paperboard has come back to pre-covid levels while water proofing is expected to come back post monsoons with pent up demand. Auto industry however remains subdued.

- The margin improvement from the debottlenecking and new power plant is expected to be around 1-2%.

- The company saw losses from high cost inventory as these finished goods were made in March when oil prices were up as compared to post lockdown. Thus the company had to sell this inventory at 30-35% lower prices in Q1.

- Volume decline in Q1 was only 14% YoY as compared to value decline of 69% YoY.

- The company will keep maintaining R&D at current levels and it is looking to introduce new grades in existing products in the next 1-2 years.

- The company did not have any pending orders from Q4 in Q1.

- Exports were at almost 19% of total sales in Q1 vs 13-14% of sales in the previous year.

- The debt to equity for the company has risen as the company took out a loan in FY20 for coal power plant and working capital due to COVID-19. All of these borrowings are short term in nature and the company remains net debt free after accounting for the net cash position.

- The company may take on new debt to finance new projects.

- The management thinks that EBITDA/ton will come back to FY19 levels from Q2 onwards.

- The management has stated that the main advantages that the dumpers are having in contrast to Apcotex are raw material price advantage and scale.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company has seen a dismal quarter in Q1 with EBITDA loss and volume decline. Exports were encouraging but the company did lose a few orders due to the lockdown. The company is now focussing on capitalizing on the strong demand for gloves and is concentrating on establishing a direct facility for making latex for gloves in its Valia plant. The antidumping petition by the company is still not accepted and this has caused the management to pause on its plans to expand NBR production lines. It remains to be seen how the demand for the company’s products changes going forward and how the company will be navigating the issues brought up from the continued dumping by international makers. Nonetheless, given the company’s industry position, the prudent management of the company, and the company’s optimism as deduced from its increased Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q4FY20 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 117 | 155 | -24.52% | 111 | 5.41% | 502 | 633 | -20.70% |

| PBT | 5.2 | 13.6 | -61.76% | -1.8 | -388.89% | 24.6 | 61.7 | -60.13% |

| PAT | 3.1 | 15.3 | -79.74% | -1.4 | -321.43% | 16.6 | 46.6 | -64.38% |

Detailed Results

-

- The revenues for the quarter were down a lot with a fall of 24.5% YoY.

- Similarly, the PBT fell even further at 62% YoY while PAT was down 80% YoY indicating a very difficult quarter for the company.

- The operating EBITDA margin declined 233 bps to 6.83% in Q4, but it was up significantly from Q3 which was at 0.55%. Overall operating EBITDA margin for FY20 was at 6.73% vs 10.8% in FY19.

- The company had its best-ever quarter in terms of exports but couldn’t fulfill all orders due to lockdown.

- Out of the Rs 100 Cr for Capex phase 1, Rs 95 Cr has been invested by 31st March 2020.

- The Taloja plant saw its best-ever quarter in terms of volumes but some orders remained unfulfilled due to the lockdown.

- The debottlenecking project is completed shortly which is expected to increase production capacity to 20,000 MTPA in the nitrile latex division and reduce operational costs per ton.

- The company has been designing and applying for consent applications for 2 major projects:

- XNBR Latex (Rs 60 Cr)

- 2ndPolymerization Line (Rs 180 Cr)

- The company is looking to add latex capacity in Taloja of 20% in FY21 at a cost of Rs 12-15 Cr.

- Post lockdown, both plants resumed operations from 20th

- The company is modifying both plants for manufacturing XNBR latex for gloves due to strong demand. This is expected to be completed in the next few weeks.

Investor Conference Call Highlights

- The management has stated that the dumping from South Korea and Europe is still going on though it has improved since Q3. The management has also mentioned that the company has applied for anti-dumping duty applications in a few countries and the investigation for the application in India has been initiated.

- The management has stated that the long term Capex plans are now on hold and the company is focusing on immediate latex capacity expansion as it saw very good demand in Q4 where the plants were running at almost 100% utilization.

- The management has clarified that the 20% capacity expansion is for overall latex capacity in Taloja for existing products and the latex gloves project will be done in Valia. This expansion is expected to be completed in 6-8 months.

- The management has stated that the company now has a 20-25% market share in the NBR market in India with the rest being imported. Thus there is a big opportunity from import substitution for the company especially given that even China has instituted anti-dumping in this industry and the shift away from imports due to COVID-19.

- The management has stated that the major industries that the Taloja plant catered to pre-COVID were paper, paperboard, construction, carpet, tires and textiles. Pre-COVID, the company saw very strong demand from construction, paper, paperboard and carpets which also was responsible for the rise in volumes in Q4.

- In Q4, the utilization for latex was 100%, 90% and 95% in January, February and March respectively.

- The management has stated that some of the company’s footwear customers are bullish post-COVID as the company mainly caters to the cheap footwear segment which is expected to grow much faster than the premium segment in the short term.

- The utilization level in HSR is 60-70% in Q4.

- The management clarified that although demand from the tire industry is slowly coming back, it expects this demand to remain subdued for the next few quarters.

- The price arbitrage opportunity for European rivals has gone down and is expected to go away soon. The management has stated that this phenomenon is cyclical in nature and not sustainable and thus it shouldn’t be a big matter for concern going forward.

- The management has stated that Q4 volumes were almost flat YoY but were up a lot QoQ. Overall net realizable value of products has gone down YoY mainly due to a drop in raw material prices.

- Another reason for the fall in net realizable value is the shift in product mix sold towards latex which is generally sold at a cost price of 50-60% of rubber prices.

- The company is seeing prices of key raw materials like styrene, butadiene, etc at decade-low prices.

- The management has stated that the company will be investing Rs 60 Cr for the new NBR latex gloves project in Valia and is looking to make another Capex of Rs 90 Cr in the next 12 to 15 months.

- The company had planned to fund the Capex plans with internal accruals but due to the fall in internal accruals, it may raise debt in the future if required. The management has stated that the company can easily raise Rs 200-300 Cr to fund the Capex plans for the next 3 years if required.

- The effective tax rate for FY21 is expected to be around 22%.

- Exports were only 12-13% in terms of value in FY20. The export % for Q4 is much higher.

- The addition of 5000-ton capacity in the NBR line as part of the Capex phase 1 is almost 99% complete and just got delayed due to delay in shipment form out of state vendors in the time of lockdown.

- The realization for NBR is around Rs 100 per kg and the realization for latex gloves is expected to be better than this figure.

- The management has stated that the working capital days have gotten stretched due to logistical issues from the lockdown and it is expected to come down to normalized levels soon.

- The management has stated that the company will indeed be stuck with some stock losses due to high-cost inventory being stuck and not sold due to lockdown.

- The management has stated that around 40% of sales prices are based on a formula for customers while 60% is based on spot prices. NBR is mostly spot priced while latex is largely formula priced.

- The management has also stated that the margins in latex for gloves will not be very high as it is not a finished product and will mostly be spot priced.

- The company was expecting a good Q1 before COVID came in and now it expects to make sales of around 60% of January in the month of May. The company is also facing uncertainty on logistics, raw material supply and labour. But overall it is optimistic of the opportunity from the demand for latex for gloves.

- The net cash position for the company is at Rs 35-40 Cr at the moment.

- The power plant was commissioned before the lockdown but was shut down as the lockdown came into effect.

- The work on the gloves project is also expected to start post monsoons like the Taloja expansion.

- The management has stated that there are no XNBR latex makers in India and the primary destination for this product is expected to be Malaysia which makes for 70% of the global demand for gloves. There are few competitors for this product in Asia.

- The management has clarified that it tries to keep EBITDA per ton as stable as possible.

- The management has stated that it prefers for prices to stay low as with a stable EBITDA per ton, the EBITDA margin is higher and the working capital requirement is lower. So when prices go up, working capital requirement rises along with EBITDA per ton.

- The management has maintained that it is engaged with all of the top 5 glove makers in Malaysia.

- The management has stated that despite the fall in the auto industry in India, it does not expect the industry to go to 0. Even if the industry may remain subdued in India, the company can easily try and source other industry players in nearby geographies like South Asia, South East Asia, and the Middle East.

- The management has also stated that it is better positioned currently in the NBR market as only half of NBR for the company is used in the auto industry while for many rivals in the EU, this number is greater than 70%.

Analyst’s View

Apcotex is one of the very few synthetic rubber makers in India. The company has seen a good comeback in Q4 after suffering from its worst-ever quarter in years in Q3. Exports were particularly encouraging for the company before the COVID disruption brought everything to a halt. The company is now focussing on capitalizing on the strong demand for gloves and is concentrating on establishing a direct facility for making latex for gloves in its Valia plant. The company has done well to concentrate on volumes and preserving its EBITDA per ton while commodity price falls are pushing down prices for its products. It remains to be seen how the demand for the company’s products changes going forward and how the company will be navigating the issues brought up for the COVID-19 disruption. Nonetheless, given the company’s industry position, the prudent management of the company, and the company’s optimism going forward as deduced from its increased Capex plans, Apcotex seems to be a good chemical stock to watch out for.

Q3FY20 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 109.6 | 164.1 | -33.21% | 124.1 | -11.68% | 380.4 | 473.9 | -19.73% |

| PBT | -1.8 | 15.8 | -111.39% | 5.4 | -133.33% | 19.4 | 48 | -59.58% |

| PAT | -1.4 | 10 | -114.00% | 3.6 | -138.89% | 13.6 | 31.3 | -56.55% |

Detailed Results

-

- The revenues for the quarter were down a lot with a fall of 33% YoY.

- Similarly, the PBT fell even further 111% YoY while PAT was down 114% YoY indicating a very difficult quarter for the company.

- The operating EBITDA margin declined 975 bps to 0.55% in Q3, mainly due to a drastic fall in finished good prices globally while RM prices remained firm during the period.

- Exports were adversely affected due to low key raw material prices in Europe compared to Asia. This is expected to get correct in Q4.

- The Capex spend for the first phase post-acquisition was planned for Rs 100 Cr (for FY18, FY19 and FY20) out of which is Rs 85 Cr has been invested till December 2019. The remaining amount will be spent in Q4.

- The captive power plant will be commissioned soon with savings in the Valia plant coming in from Q1FY20 onwards.

- The debottlenecking project will be completed in Q1 which is expected to increase production capacity to 20,000 MTPA in the nitrile latex division and reduce operational costs per ton.

- The company has been designing and applying for consent applications for 2 major projects:

- XNBR Latex (Rs 60 Cr)

- 2nd Polymerization Line (Rs 180 Cr)

Investor Conference Call Highlights

- The slowdown in the auto industry has been hard for the company. The overall slowdown in the Indian economy has also affected the company’s performance in the Paper, Carpet, and Construction industries.

- The company was looking to fund the XNBR project using internal accruals and debt and the company may have to delay this project due to slowdown in internal accruals in recent quarters.

- The net cash position of the company is around Rs 50 Cr.