About the Company

Acrysil Ltd is one the leading manufacturer and exporter of Composite Quartz Granite Kitchen Sinks in India. The company is engaged in the manufacture and sale of kitchen sinks in India. They offer granite kitchen sinks and stainless steel kitchen sinks. They market their sinks under the brand name ‘Carysil’.

Q4FY23 Updates

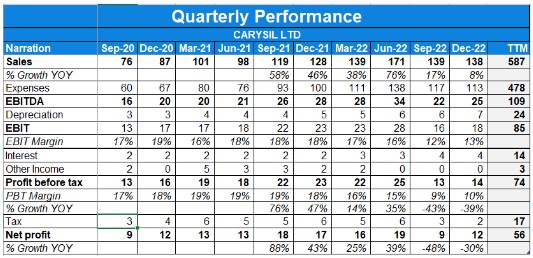

Financial Results & Highlights

Detailed Results:

- Sales increased by 5% YoY while PAT went down by -24%.

- EBITDA margins fell from 23.8% to 18.2%.

- PAT margins decreased from 13.4% to 8.54%.

- Domestic business has increased by 35.0% to Rs 131.6 cr for FY23 contributing 22.2% of revenue

- Acquired ‘The Tap Factory Ltd.’ which will allow it to leverage its expertise in tap design and marketing to better serve its customer’s needs in the kitchen and bathroom products offerings

- The company’s Demand revival in US & UK region, Europe is still lagging

- Increased dealer network in the domestic market from 1,500+ to 3,100+ in FY23

- Doubled orders from IKEA for the supply of quartz sinks

- Completed Quartz Sinks expansion by 1.6 lac units to 10 lac units P.A.

- Completed Steel sinks expansion by 90,000 units to 1,80,000 units P.A.

- Incorporated wholly owned subsidiary in Dubai for marketing of kitchen appliances and bath products, will be operational by Q2FY24.

- FY23 Product-Wise Revenue split was as follows:

- Quartz Sink – 52%

- Solid Surface Sinks – 25%

- Steel Sink – 13%

- Appliances & Others – 11%

- For FY23, Exports were at 78% while Imports were at 22%.

- The company has expanded to newer geographies – Australia, New Zealand, Gulf countries, Southeast Asia, China, Singapore, Turkey, Vietnam.

- The company’s dealer network crosses 3100+ and distributor network crossed 82.

Investor Conference Call Highlights:

- The management states that price pressures were easing among most of the global economies. Further the oceans freight have normalized and the supply chains have also reverted to its means.

- The management states that U.S. debt before remained a key threat to overall positive development witnessed over the last few months while India continues to be on the bright spot in the global economy.

- The management states that in FY ’23 the company surpassed its medium-term target of INR500 crores, which finally ended close to INR600 crores. The focused business approach and broadening of product offerings helps us to achieve the objectives.

- The management states that the company is witnessing an increase in the inflow of export orders, and a few economies are showing signs of a rebound in demand.

- The company recently renewed its contract with Karran USA for the supply of Quartz kitchen sinks worth $68 million, approximately INR550 crores over a 5-year period commencing from FY ’24.

- The management states that both Europe and U.K. are showing signs of recovery. However, the progress in Europe has been slow compared to the other markets.

- The company is undertaking product expansion, team expansion, and launching a range of new models domestically. In addition, it is strengthening the marketing team and increasing efforts to increase brand visibility in India.

- The company has doubled its capacity to manufacture steel sinks to 180,000. The additional capacity will be operational from June ’23 onwards. On full capacity, its expect to generate revenues in the range of INR80 crores to INR90 crores.

- The company recently made an agreement with IKEA for stainless steel sinks with the production to commence in the next 4 months’ time.

- In the built-in appliances and faucets division, greenfield project of capex in the appliances division, built-in appliances, kitchen hoods and hobs has been delayed by 3 to 4 months due to a high lead time of delivery of some critical machineries.

- In the built-in appliances and faucets division, the company expects to commercialize the first phase of 100,000 units by end of Sep 23 and second phase of 100,000 units is expected by Q4 ’24. In addition, the faucet assembly line of 10,000 units shall also be operational from Sep’23.

- The company has incorporated a subsidiary in the United Arab Emirates in the name of Carysil FZ-LLC to cater to GCC markets. The subsidiary will focus on the sale of kitchen appliances and bath products. The subsidiary will be operational from quarter 2 FY ’24

- The management states that the U.K. operating subsidiaries, Carysil Products Limited, erstwhile Homestyle Products Limited and Carysil Surfaces Limited, erstwhile Sylmar Technology Limited, have shown good growth in Q4 FY ’23 and expect it to grow further in FY ’24.

- The company successfully implemented SAP ERP system to integrate various functions for better efficiency and controls.

- The company went live on SAP from 3rd April 2023, and production and sales were operating at a lower scale compared to the normal capabilities in April 2023. This has led to a revenue shortfall in April 23.

- The management is confident to achieve 15% to 20% growth in FY ’24 irrespective of the rough patches in Q1 this year.

- Sales volume for quartz sinks stood at 5.14 lakh units. Standard steel sales stood at 1.08 lakh units, and the kitchen appliances stood at 28,895 units in FY ’23.

- The company has incurred a capex of INR60 crores in FY ’23. Gross debt of the company stood at INR220 crores.

- The company has been gaining market share in Europe, benefitting from the high inflation and difficult times there.

- In FY23, the company sold 513,280 Quartz sinks. Out of which, 20% were domestic sales.

- The company is implementing the one-stop solution for India due to the demand from the domestic market.

- The management states that out of the total revenue in the domestic market, 40% revenue is through the new product initiatives.

- The management states that Sternhagen is not its focus category. It is a luxury brand, which is being put in the market to test. It’s under making with less than 5% of resources and time being put in it.

- The management states that it has been successful in doing the built-in appliances due to trust in the brand and its German engineered technology.

- The management states that demand for Quartz has been reviving while big box retailers continue to de-stock. There is still a de-stocking problem present in the US and UK.

- The management observes that there is potential to improve EBITDA margins. If 15% to 20% growth in top line mix comes as expected, then it would land back to original margins of EBITDA at around 20%.

- The management states that it has gross margins in Quartz at around 48% to 49%. Steel sinks have a margin at around 35%. On the appliances side, it is at around 40% margin.

- On the cost reduction side, the company is putting up a solar plant reduce the energy cost and doing the Kaizen program on a continuous improvement in the company.

- The management states that the average price per sink, was between INR4,000 and INR4,500 between 2012 and 2017, and it has gone up to INR5,800 to INR6,000 on average currently.

- The management assures that the company is on track to reach the target of 1000 crores in revenue by FY26, with an endeavour to maintain 25%-30% contribution from domestic.

- The management states that the Indian markets are not fully matured for Quartz sinks, and it may take 5 to 10 years to mature.

Analyst’s View

Carysil is one of India’s leading manufacturers of quartz sinks and a leading exporter of this product. The company has witnessed substantial demand in the domestic market and going ahead, expects momentum to continue in the domestic market. With an uptick in demand and expectations of having healthy margins, the company will continue to witness healthy growth in the overall business. Due to weak macro conditions in Europe, the company’s export witnessed a slowdown coupled with a destocking trend affecting the volume growth. It is doubling its capacity for stainless steel & plans to expand further by acquiring new customers and penetrating new geographies.. Given the vast potential for the real estate sector and the company’s strong competitive positioning, Carysil remains an excellent real estate ancillary stock to watch out for.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- Sales increased by 8% YoY while PAT degrew by 30%.

- EBITDA margins fell from 23.8% to 18.3%.

- PAT margins decreased from 13.4% to 8.7%.

- The company expanded its capacity for Steel sinks by 90,000 units P.A, bringing its total capacity to 1,80,000 units P.A. commercial production to begin from March 23.

- The company proposed to incorporate a wholly-owned subsidiary in Dubai (UAE) to cater to the GCC market for the sale of Kitchen and Bath Products. Therefore, Carysil plans to open a showroom and warehouse in Dubai.

- Carysil has begun commercial production of green sinks made from organic materials such as charcoal, spinach, and beetroot & further introduced a super strength sink which is priced at a premium of 20% compared to quartz sinks.

- Increase dealer counts to 2800 as on December 31, 2022.

Investor Conference Call Highlights

- The management is receiving feedback from its major customers that the destocking happening is quite successful and gradually reaching the optimum levels. It has started to receive good orders for its quartz sinks in the U.S. and UK markets, etc.

- The ongoing inflation energy crisis and cost escalation in Europe presented an opportunity to briefly supply gap, which will ultimately lead to an expansion of the customer base across the growth

- It is enhancing its focus on the growing demand in the domestic and emerging markets around the world and gradually ramping up its distribution and dealer networks.

- The company is seeing good demand for PVD sinks & since the price of the PVD is higher than the prices of the handmade and the quartz sink, they will be contributing to higher validation and revenue.

- The company’s faucet assembly line of 100,000 faucets is starting on a pilot basis, & will get full-fledged commercial products in quarter one of FY 23 onwards.

- The sales volume of Quartz, Stainless steel & kitchen appliances improved by 14%, 11% & 45% respectively.

- The company is confident of QoQ’s growth in volumes in Q4.

- The company expects margin improvement in Carysil surface due to lower freight costs while it also expects the better performance of subsidiaries Vs its guidance.

- The surfaces biz is unaffected by the destocking trend as production is based on actual orders only.

- The company in its kitchen appliances space will be focused on the kitchen hoods and hobs, & since its built-in appliances will be produced through in-house assembling and manufacturing, it will give the company a better competitive edge than the competitors.

- The company’s project sales are approximately 20% of its total sales & the management expects the Granite sink and steel sink quantity to double in the next three years.

- The destocking in the domestic market is over & inventory levels with dealers have again reached back to 2 months levels.

- The company’s price differential Vs its European peers is about 35% which makes it confident about closing in on major key players with whom, discussions are currently taking place.

- The company’s rationale behind getting into ceramics is higher realizations Vs quartz coupled with gross margins of around 80%. It intends to target the premium segment.

- Quartz sinks saw higher volumes decline due to destocking happening in the export market Vs stain steel sink which has a major presence in domestic only.

- The management believes that the price of the Quartz sink is the only issue behind its lower penetration & management expects this to change in the future.

- The entire revenue potential of all its capacity post capex stands as 600 Crs for Quartz, 80-90 Crs for stainless steel & 100 crs for kitchen appliances.

- The current capacity utilization for the Quartz sink stood at 65%

- The management, when asked about its rationale for diversifying in other areas, said “we want to have a one-stop solution to our customers because we have such a huge reach across India, pan-India, we just cannot afford the overhead by selling quartz.”

- The management is targeting to clock the 1000 Crs turnover mark in FY24.

Analyst’s View

Acrysil is one of India’s leading manufacturers of quartz sinks and a leading exporter of this product. The company has witnessed substantial demand in the domestic market and going ahead, expects momentum to continue in the domestic market. With an uptick in demand and expectations of having healthy margins, the company will continue to witness healthy growth in the overall business. Due to weak macro conditions in Europe, the company’s export witnessed a slowdown coupled with a destocking trend affecting the volume growth. It is doubling its capacity for stainless steel & plans to expand further by acquiring new customers and penetrating new geographies.. Given the vast potential for the real estate sector and the company’s strong competitive positioning, Acrysil remains an excellent real estate ancillary stock to watch out for.

Q2FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 83 | 97 | -15.01% | 109 | -23.85% | 402 | 255 | 57.65% |

| PBT | 6 | 16 | -60.93% | 17 | -61.45% | 67 | 39 | 71.79% |

| PAT | 5 | 13 | -62.52% | 12 | -61.36% | 51 | 26 | 96.15% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 139 | 122 | 14.03% | 171 | -18.65% | 494 | 318 | 55.35% |

| PBT | 13 | 24 | 48.00% | 25 | -48.96% | 86 | 54 | 59.26% |

| PAT | 9 | 18 | 47.22% | 19 | -49.97% | 65 | 39 | 66.67% |

Detailed Results:

- H1 FY2023, domestic revenues have increased by 58% Y-o-Y to Rs.71 Crores. The company aims to achieve a turnover of Rs.300 Crores in the domestic market in the next two to three years.

- Export sales is down by approximately 21% on a Y-on-Y basis. 20% growth in domestic market on Y-o-Y basis.

- Increase dealer count to 2200 as on September 30, 2022 with an aim to increase it to 3,000 by end of 2023.

- Sales volume for Quartz Sinks stood at 297,252 units, stainless steel sinks stood at 58,294 units, and kitchen appliances stood at 15,668 units.

- Appointed Vaani Kapoor as the brand ambassador.

- Current margins of appliances are 40%, which the management expect to go to 50%.

- Sylmar Technology (the company merged with Sylmar technology in Q2)

- In Q2, achieved turnover of £3.6 million against last year, £3.19 million, growth of 14.8%.

- EBITDA is £588000 against last year, £505000, growth of 16.5%

- PBT £534000 against last year corresponding £440000, a growth of 21.3%

- PAT £433000 against last year £371000, a growth of 16.8%.

Investor Conference Call Highlights

- The export market is witnessing a periodic slowdown due to higher inventory levels maintained due to the COVID period by Carysil’s customers.

- The management stated the high inventory levels built up by the company’s sales channels are getting liquidated slowly hence, they expect ordering levels for Quartz Sinks to increase from Q4 FY2023 onwards.

- The management stated Indian market has high demand of quartz sinks. And the company has enough capacity to fulfill the demand.

- The company has doubled its supply to IKEA and sales to Grohe is increasing year-on-year basis.

- The management stated the company has started working on the faucet assembling line for 10,000 units and supply will start from Q4 FY2023 onwards. The company has witnessed good inquiries for procurement of faucets by export customers as well as premium customers like IKEA and Grohe.

- The company has received orders from France and other countries for new PVD sinks and other under mount sinks.

- Given the current global operating environment, the Board has decided to postpone the expansion of an additional 200,000 capacity of Quartz Sinks. The company has kept the infrastructure ready, and invested in the buildings and infra, and land. So the company has invested, around Rs 20 Crores. Now this infrastructure, the company will use for built-in appliances till it get the further boost in the Quartz Sink.

- The company has decided to utilize the resources for the manufacturing /assembling of approximately 200,000 built-in kitchen appliances. This expansion will take place in 2 phases i.e. 100,000 units in Q1 FY2024 and a balance of 100,000 units in Q3 FY2024.

- The company plan to do more assembling than manufacturing. So the total capex on the first phase for the 100,000 is expected to be around Rs 10 Crores. Revenue potential is approximately Rs 50 Crores to Rs 60 Crores from the first phase, the total will be about Rs 120 Crores with the Phase I, Phase II of 200,000 units.

- The management stated peak revenue will come in FY2025.

- The capacity expansion of Steel Sinks by an additional 90,000 sinks is expected to complete by December 2022.

- The company has filed a patent for green sinks technology, which will be manufactured from organic materials with Charcoal, spinach, and beetroot. The pigmentation is natural and sustainable and the company will soon launch in the Paris exhibition on November 19, 2022.

- The company is in process of developing a new type of sinks, which will have double the strength compared to the existing sinks without any further increase in manufacturing costs. The improved sink will result in reduced packaging costs. This will also lead to reduced packaging size which will allow shipping of more sinks per container, thereby reducing shipping costs. The management expects to complete this invention by the end of December 2022, and the supplies will start in January 2023.

- The company is launching the Carysil and Sternhagan brands in Dubai in December 2022.

- In order to strengthen its foothold in the export market the company acquired a separate Gulf head for export business.

- The company has also appointed, a chief of staff to oversee foreign operations and another business head for overseas institutional sales.

- The management stated the current ongoing geo-political tensions and energy crisis in Europe give a strong opportunity for Carysil on a medium to long-term basis. The Economies of Germany, Italy, and the rest of Europe, excluding France, continue to suffer from the energy crisis. As a result, their production costs have grown up to a very large level.

- Currently, 3 million to 4 million sinks are being manufactured in that area around Germany and Italy. The rise in cost and the inability to manufacture as compared to levels and to sustain escalating cost inflation levels will ultimately work to Carisil’s advantage. Carysil has tremendous potential to enter the market and bridge this supply gap, ultimately leading to an expansion of its customer base across the globe.

- The management stated the company is already talking to a few companies, and 1 or 2 customers have already moved to Carysil.

- Standalone sales were down by 12% primarily because of the lower export sales.

- Last quarter, the company had around Rs 2 Crores 85 lakh exchange gain, which in the current quarter is a loss of Rs 2.5 Crores exchange.

- The management stated the company is well equipped to expand to 1.5 million units capacity from 1 million of quartz sink within 6 months at any time.

- The management stated globally, about 5 million sinks of Quartz Sinks have been manufactured, and Schock technology has almost 80% market share.

- In India, which average price of quartz sink is to 5500 and steel sinks about 4000. So there is approximately about 20% – 25% difference between the steel sink and the granite sink.

- The management expect input cost and freight cost to go down, and gross margin to improve.

- The management stated Carysil was already around 20% to 25% cheaper than suppliers in Europe before this crisis hit, and now it should be more competitive by 35% to 40%.

- The management stated Sylmar Technology does not carry on inventory. It is on made to order business. So even with this crisis in UK, order book situation is still strong. It makes kitchen and the bathroom platforms, fabricated, based on orders at the site.

- The management stated in built-in appliances, margins could be better than the quartz sinks. Currently the company has only a trading margin. Now with the manufacturing margin coming, margin profile will also increase.

- The management stated about Built-in-appliances market

- Total built-in-appliances market in India is about Rs 3300 Crores

- Out of it, 50% of the market is shared between Elica, KAFF, Siemens, Bosch, Faber and Carysil.

- Carysil is into more of a premium segment, which is potential market of Rs 1500 Crores, given other is unorganized segment.

- The whole appliance industry is growing about 15% year-on-year

- There is about 8% to 10% decline in secondary sales.

- The management stated in the long-term, they see the India versus export revenue will be about 50%:50.

- The management stated they are appointing new team for India. They are expanding sales team organization across the board. They are planning to double our sales force in India.

- The management stated within the next 60 to 90 days, they plan to at least have a 50% increase in sales force, and by March, they plan to double the sales force right now. In the mid-term to long-term which is around 3 to 5 years, they plan to have a dealer network of about 5000 dealers across India.

- The management stated strategy for distributors will come into play by a quarter in January when they finalize AOP for next year because the strategy decision will have to come that the company will have to appoint direct dealers with the showrooms or have more distributors for displays. So that is a separate strategy for built-in appliances and sinks.

- The company has filed a patent for the SuperX technology, where the sink is going to have double the strength, the customers are going to prefer to have SuperX technology, which is going to be launched in France and Dubai in the next month’s time, the management stated.

- The management stated that Schock is not going to give technology rights into any other partner, Carysil has 90% market share in India in terms of quartz sinks, so that is the competitive advantage.

- As far as IKEA is concerned, the company has tied up with them for the stainless sink and will be starting there from Q4. The company has an opportunity for stainless steel sink for the UK market. Have tied up and also will be starting in Q4.

- The company is very confident of achieving Rs 1000 Crores in sales within the next 2 to 3 years.

Analyst’s View

Acrysil is one of the leading manufacturers of quartz sinks in India and a leading exporter of this product. Company has witnessed substantial demand in the domestic market and going ahead, expect momentum to continue in the domestic market. With an uptick in demand and expectations of having healthy margins, the company will continue to witness healthy growth in overall business. Due to weak macro conditions in Europe, the company’s export witness slowdown. The association of Vani Kapoor will help create a brand recall for lifestyle products among the youth in the domestic market. The Company has always emphasized on the importance of manufacturing high quality new age products which are targeted towards meeting the increasing demand of quality and aesthetics. Plan to expand further by acquiring new customers and penetrating in new geographies. The company has a vision to build global brands. Once revenge travel is over and people will be back to their home, inflation tapering off, geopolitical situation slightly improving and Christmas season would lead people to focus on their homes, thereby demand may improve by then. Given the vast potential for the real estate sector and the company’s strong competitive positioning, Acrysil remains a good real estate ancillary stock to watch out for.

Q1FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 108 | 80.4 | 35% | 112.9 | -4% | 402 | 255 | 57.6% |

| PBT | 16.6 | 20.1 | -10% | 16.9 | -2% | 67 | 39 | 71.8% |

| PAT | 12.3 | 14.2 | -14% | 12.5 | -2% | 51 | 26 | 96.2% |

| Consolidated Financials (in Crs) | ||||||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 171 | 99.3 | 73% | 141 | 22% | 494 | 318 | 55.3% |

| PBT | 34 | 23.5 | 35% | 22 | 13% | 86 | 54 | 59.3% |

| PAT | 18.7 | 13.5 | 39% | 16 | 14% | 65 | 39 | 66.7% |

Detailed Results:

- Acrysil exports increased by 25% Y-o-Y to Rs.100 Crores for Q1 FY2023 contributing 72% of the revenue.

- The company has maintained decent EBITDA margins in the 20%+ range with a strong profitability growth of 39% on a Y-o-Y basis. Slightly suppressed due to consolidation of Sylmar Technology Limited.

- Debt level Rs.180 Crores on sanctioned basis and Rs.150 crores on utilized basis.

- Domestic business has increased by 117% YoY to Rs. 38 crores for Q1 FY23 contributing 22.2% of the revenue.

- Quartz Sink Volumes have touched 650,000 units in volume.

- Company has maintained an EBIT Margin (%) of 16.3% vs 20.5% in Q1 FY22 and PAT After Tax Margin (%) 11.0% vs 13.6% in Q1 FY22.

- In Q1 FY23, the dealer network stood at 1,880 and plans to increase by ~3,000 by the end of FY23.

Investor Conference Call Highlights

1) The Board of Directors have approved the change of the name of the company to “CARYSIL Limited” or “CARYSIL Technik Limited” or “CARYSIL Products Limited.

2) The total manufacturing capacity now stands at 10,00,000 units p.a.

3) Company has strengthened its presence in newer geographies of Australia, New Zealand, Singapore, Vietnam, Gulf countries and other Southeast Asian countries.

4) Company’s order to IKEA for supply of Quartz kitchen sinks has been doubled.

5) The management believes owing to stabilization of freight costs and softening of input costs, the company expects to maintain healthy margins and profitability going forward.

6) On a full year basis, the company will continue to witness healthy growth in overall business.

7) The Company is doubling production capacity of stainless steel sink from 90,000 units p.a to 180,000 units p.a with capex of Rs.11 crores. Commercial production for which is expected to commence by the end of September, 2022.

8) The company is observing strong demand for faucets and hence the company is starting an assembly line for kitchen faucets manufacturing with the capex of Rs.5 Crores with the capacity of 100,000 pieces per year. This project is expected to be completed by the end of December, 2022.

9) Capacity Expansion of Quartz Kitchen Sinks production capacity by an additional 200,000 units p.a at Bhavnagar with capex of ~Rs. 30 crores which is likely to be completed by Q3 FY23.

10) Brand promotion on TV and in print, along with exposure through sponsorship of events like Times Food and MasterChef Australia.

11) The board of directors have approved a 3MW (Three Megawatt) solar power plant to be set up with Bhavnagar, Gujarat for captive use in addition to the existing 0.44 megawatt solar power plant. Management expects to save around Rs.4 per unit in energy cost.

12) Introduced a new top-of-the-line brand titled ‘Tek Carysil’, featuring kitchen sinks, faucets and appliances that represent a revolution in design, style and quality.

13) Acrysil has signed Bollywood celebrity ‘Vaani Kapoor’ for new marketing campaign #TheHeartofMyHome for its ‘Carysil’ Brand.

14) Offers a wide range of cutting edge technology products to customers based on their needs.

15) Company has stated long term goal of achieving Rs 1000 crores in sales and has appointed Deloitte while company has achieved short term goal of Rs 300 crores.

16) Management believes once revenge travel is over internationally, this would help in demand coming back as people would focus more on homes.

17) Management commented that overall on the customer side, the company is not dependent on any particular customer.

18) Management stated that purely marketing spends is about 5% of domestic sales.

19) As a part of green initiative, Green sinks patent has been filed and this is getting some recognition by Grohe, Ikea and the large customers.

20) Management guided that India is the new country to quartz so it is growing quite rapidly and has more than 90% market share in India, people are saying Carysil means quartz.

Analyst’s View:

Acrysil is one of the leading manufacturers of quartz sinks in India and a leading exporter of this product. Company has witnessed substantial demand in the domestic market and going ahead, expect momentum to continue in the domestic market. With an uptick in demand and expectations of having healthy margins, the company will continue to witness healthy growth in overall business. The association of Vani Kapoor will help create a brand recall for lifestyle products among the youth in the domestic market. The Company has always emphasized on the importance of manufacturing high quality new age products which are targeted towards meeting the increasing demand of quality and aesthetics. Plan to expand further by acquiring new customers and penetrating in new geographies. The company has a vision to build global brands. Once revenge travel is over and people will be back to their home, inflation tapering off, geopolitical situation slightly improving and Christmas season would lead people to focus on their homes, thereby demand may improve by then. Given the vast potential for the real estate sector and the company’s strong competitive positioning, Acrysil remains a good real estate ancillary stock to watch out for.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 113 | 84 | 34.5% | 106 | 6.6% | 402 | 255 | 57.6% |

| PBT | 17 | 13 | 30.8% | 16 | 6.3% | 67 | 39 | 71.8% |

| PAT | 12 | 7 | 71.4% | 12 | 0.0% | 51 | 26 | 96.2% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 141 | 105 | 34.3% | 130 | 8.5% | 494 | 318 | 55.3% |

| PBT | 22 | 19 | 15.8% | 23 | -4.3% | 86 | 54 | 59.3% |

| PAT | 16 | 13 | 23.1% | 17 | -5.9% | 65 | 39 | 66.7% |

Detailed Results:

- The company saw a decent quarter with revenue growth of 34% while PAT growth of 23% YoY.

- EBIDTA margins stood at 22.2% for Q4.

- Product wise revenue mix for FY22 –

- Quartz sink – 77%

- Steel sink – 14%

- Appliances & others – 9%

- The domestic business increased by 53.0% YoY to Rs. 97.5 crores for FY22 contributing 20% of the revenue.

- The exports business increased by 61.4% YoY to Rs.381.8 crores for FY22 contributing 80% of the revenue.

- The board of directors have recommended a final dividend of Rs. 1.2 per equity share in addition to an interim dividend of 1.2 per equity share declared in February 2022. Thus the total dividend of FY2021-FY2022 amounts to Rs.2.4 per equity share.

Investor Conference Call Highlights

- The company’s wholly owned subsidiary Acrysil U.K. Limited acquired 100% shares of Tickford Orange Limited, the U.K. holding company of its operating subsidiary Sylmar Technology Limited on 1st April 2022 for a total consideration of GBP 11 million which was funded through a mix of debt and internal accruals.

- The company signed Bollywood celebrity ‘Vaani Kapoor’ for the new marketing campaign #TheHeartofMyHome for its ‘Carysil’ Brand.

- The management states that due to a sharp increase in steel prices, the price differential has narrowed between quartz and steel globally which led to a significant shift towards quartz sinks.

- The company’s expansion plan of 160,000 quartz sinks is expected to be completed in the current quarter.

- The company’s capacity expansion of stainless steel is expected to finish by Q1FY23 from 90,000 units to 118,000 units per annum.

- The share of quartz sink to total revenues stood at 77%.

- The company incorporated Acrysil Ceramictech – a wholly owned subsidiary on April 12, 2022, with the objective of manufacturing and selling Hi-Tech Ceramic kitchen sinks and bath products.

- The company expects its supply to IKEA to double in FY23.

- The management states that it is the lowest cost producer in the industry with the company being cheaper by 15-20% despite quality being at par with others.

- The management expects to continue to grow at 30-40% with a target revenue run rate of $100 million.

- The geographical revenue mix constitutes of US @ 25% to 30%, UK and Europe @ 30%, India @ 20% to 25% and Asia and Gulf @ 15% to 20%.

- The management is confident about turning around its new acquisition & increasing its EBIDTA margins from current levels of 14-15% to 15-16% & then to 18-20%.

- The company’s A&P spend is 2% of total sales & 5% of the domestic sales.

- The management believes that the sector is in a sweet spot because all the major companies in home improvements in the U.S.A have been able to pass on inflationary costs to consumers leading to stable margins.

- The company’s debt level for FY23 can go up to Rs.200 Cr.

- The management states that 30% of the raw material goes into the manufacturing of one sink.

- The company’s margin for exports is around 24% and around 18% to 19% in domestic for the quartz sink.

- The company enabled a resolution a few quarters back for equity raise & the company is currently in the process of that resolution. This equity fundraise will be used for the new expansion in the ceramic, faucet and built-in appliances segment.

Analyst’s View:

Acrysil is one of the leading manufacturers of quartz sinks in India and a leading exporter of this product. It has seen good growth in Q4 & FY22 which saw a 61% YoY rise in exports. The company is doing well with good expansion in the quartz sink segment due to the rise in prices of steel sinks. The company has also been in expansionary mode and it remains committed to staying as the lowest cost producer of quartz sinks. It remains to be seen how their expansion plans pan out and what impact will the rising inflation around the world will have on their growth trajectory. Given the vast potential for the real estate sector and the company’s strong competitive positioning, Acrysil remains a good real estate ancillary stock to watch out for.