Compounding!

So much is spoken and written about compounding over decades that most people find it boring to discuss. But I will tell you about a lesser highlighted but more crucial part of compounding. And you may agree or disagree with me, but I promise, you won’t get bored.

First, a story.

A couple of weeks ago, I was teaching my eight-year-old about compounding. Using a basic excel tool. The conversation went like this:

I: I’ll give you 10 rupees every day for the next 10 years. You can give that money to your Mumma to keep it in Fixed Deposits (FDs). If you put 100 rupees in an FD today, after one year you get 105 rupees back.

SUBSCRIBE to our mailing list

I wanted to then play around with rates and time periods. And surprise him with the results. But he immediately stumped me with his observation.

8 y/o: Why you are giving me so less? 10 rupees is nothing. At least give me 100 and then see how it looks.

After looking at this nearly 5 lac figure, my 8 y/o just couldn’t stop his excitement and went running to my wife saying Papa will help me earn 5 lac rupees in the next 10 years.

And as always I could not finish my compounding class. I wanted to go on to the next step of how an increase in rates and time periods can dramatically change the outcome over the long run. Maybe, some other day.

But his question and observation got me thinking.

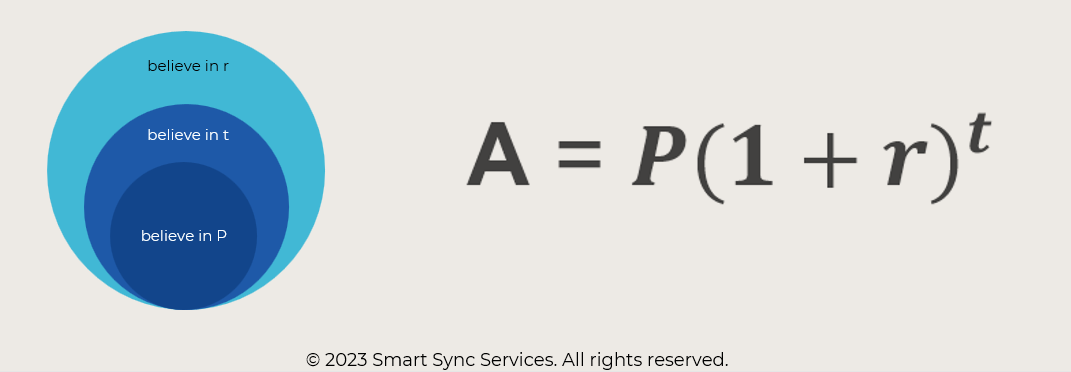

In the compounding equation, we all talk about either rate or time period. Because mathematically they have a far higher impact on the result. But today I will talk about that lesser-highlighted but more crucial part of compounding.

The principal.

Or the money invested.

And do you know that however exciting the r and t look in the above equation, the only variable where you have complete control is P?

Stories that get sold are of high CAGRs and extremely long periods. Nobody asks how many people can achieve that. And how much of that was luck? Stories that get lost are the ones that are not so exciting. And they start with a high principal amount to invest. I covered some real-life examples here, 3 years ago.

This is what I wrote in 2020. And I strongly believe that it is our best shot at making wealth.

Facing and surviving a lot of deliveries as a cricket batsman is cool. But scoring more runs makes all the difference.

Featuring in many movies for a long time is great. But giving spectacular performances make all the difference.

Living a long life with your partner is awesome. But those few special moments make all the difference.

Investing for the long term is necessary. But earning more, saving more, and investing more can make all the difference.

But investing in what?

An unpopular opinion.

Direct Equity Investing is not mandatory.

It’s just like you go to a barber and he says you don’t need a haircut. Someone who has been investing in direct equities for over a decade, tells you that you may not invest in direct equities. But if you don’t believe me, go to the Real-Time Billionaires list and check out the top ten names. Here they are:

None of them is an equity investor. They all compounded their capital at high rates of return for a long period of time. But the crucial point that you keep missing always is that they all had a constant stream of cashflows either in the form of investors’ money or banks’ money or the profits of their businesses. That is the P we discussed earlier. So, you tend to focus on r and t and often miss the P in your compounding equation.

Now you may show me the investors who have made big money by only investing in markets.

There are two problems with this.

First, Survivorship Bias. You only see the survivors, the dead bodies will not come out of their caves and share their painful stories.

And second and more importantly, this.

If you are convinced that you are not like them, you have only one resort. The option seminar guys, of course, will not agree to that. But I believe the wealth generation process is slow and gradual. And your best shot at increasing the speed is to either start with high capital or keep increasing your capital or earnings regularly. Higher earnings will then translate into higher savings and higher savings into higher investible amounts. So, against all the fancy stories you hear all around, I would suggest that ultimately it boils down to these 3 boring steps.

And if you pair the above message with the message of my 8 y/o at the start, you will now shift your focus on what you have the most control.

You don’t have any control over how much investment return you will earn over the long run. You don’t have any control over how long you will live. But you do have reasonable control over how much you can earn, how much you can save, and how much can invest.

Focus on this lesser-highlighted but more crucial part of compounding.

Thank you for reading.

Happy Investing 😊

P.S. Some of the images shared above are from the presentation slides we used in our 1st MissioN SMILE Physical Meet at Taj Vivanta, Whitefield, Bangalore on 22nd January 2023. To know more about MissioN SMILE, you may download our MissioN SMILE app on your Android phone. (iOS App coming soon ). Lots of free & premium sessions on investing for you to explore and learn. 🙂