Shadow Pilot on Market Coupling!

It was a routine Monday evening and I after successfully seeing through the Monday blues was getting ready for dinner.

Survive to Thrive Part 5

Famous investing author, blogger and partner at Collaborative Fund, Morgan Housel said it almost a year back. It is so profound-

Are You Ready for Emergencies?

It was a routine Monday evening and I after successfully seeing through the Monday blues was getting ready for dinner.

Journey of a Multibagger #1 Gujarat Themis Biosyn

Given the explosive growth in small-cap companies’ market capitalization in recent times, we are observing several radical calls like ‘Small-cap companies are in a bubble’ or “This is the start of the new capex cycle”, or “This is India’s decade”.

RE vs Other 2W Giants: A Bank Robbery or A Hare vs Hounds Run?

Rajiv Bajaj, the MD of Bajaj Auto, knows how to be in the news and how to get catchy headlines. If you have followed him just like me you will remember many of his previous stunts in the media

Insights Unveiled: The Top 5 Game-Changing Revelations from Concalls

Save time and unlock valuable insights with our free summarized notes on 95 tracked companies.

Watchlist-95: Insights from Q4FY23 Concalls

Investor conference calls following quarterly results have emerged as a treasure trove of knowledge in the dynamic Indian market.

Market Coupling: The Looming Threat to IEX’s Monopoly

One thing’s for clear: India’s power sector is in a state of flux. The proposed move to implement ‘market-coupling’ has casted a shadow over Indian Energy Exchange.

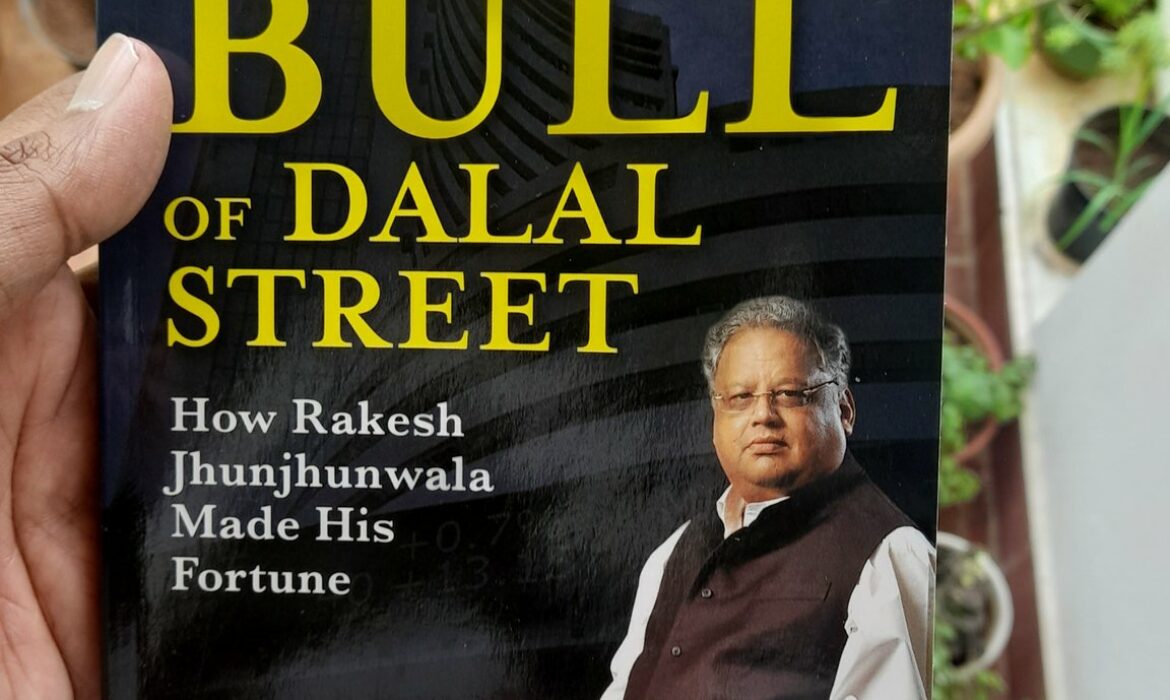

The Big Bull of Dalal Street: Book Review

The Big Bull of Dalal Street. Book Review. Top 10 learnings